Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 March, 2024

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Despite Stumbles, Decarbonization of Transportation Accelerates

According to the US Environmental Protection Agency, a typical passenger vehicle emits about 4.6 metric tons of carbon dioxide every year. While this makes any single car’s contribution to global climate change negligible, in aggregate, decarbonizing transportation is necessary to achieving global climate goals. While different regions commit to the decarbonization of transportation with varying intensity, the global picture is one of reduced oil demand and greater electrification, with hydrogen potentially providing a low-carbon fuel for long-haul trucking. As part of S&P Global’s latest Look Forward report on the Multidimensional Transition, Kurt Barrow, head of oil markets, midstream and downstream research at S&P Global Commodity Insights, offers insight and analysis of transportation in “Decarbonizing road transportation: When will we get there?”

For consumers in Europe and China, the impending decarbonization of the transportation sector is a settled issue. Europe and China have made substantial investments in public charging infrastructure. Over a third of new cars sold in China are electric, and the EU has a de facto ban on new light internal combustion engine vehicle sales beginning in 2035. As the US and Japan lag in electric vehicle infrastructure and adoption, they risk falling out of step with the global passenger vehicle market. While Ford and GM have scaled back investments in EV production capacity, European and Asian car manufacturers such as Hyundai, Kia and BMW are accelerating their electrification efforts.

Although the transition to electric passenger vehicles is advancing, trucks remain a more intractable problem. Medium and heavy trucks consume an average of 10 times more fuel than cars. The electrification of long-haul trucking calls for remote or public charging infrastructure, with considerable electrical load and transformer requirements. S&P Global Commodity Insights projects that hydrogen-powered heavy trucks will outpace electric trucks by 2050 because of infrastructure and range challenges with EVs on this scale. The electrification of medium-duty trucks for urban and rural delivery looks to be more immediately attainable, given centralized hubs with range-appropriate charging facilities. One reason for optimism in the decarbonization of trucking is that truck buyers are more responsive to changes in the total cost of ownership than buyers of personal passenger vehicles. Established savings in fuel costs and reduced repairs can overcome higher initial costs for such buyers.

The electrification of transportation will have substantial impacts on global oil demand. Road transportation has accounted for 62% of oil demand over the past decade. Already, higher fuel efficiency standards and the adoption of hybrid and electric vehicles has led to a decline in oil demand for countries of the Organisation for Economic Co-operation and Development. S&P Global Commodity Insights also believes that oil demand in China will peak in 2024 before beginning a gradual decline. Global oil demand is forecast to peak in 2026, although demand in markets outside OECD countries and China will continue to grow for the foreseeable future.

Today is Monday, March 18, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

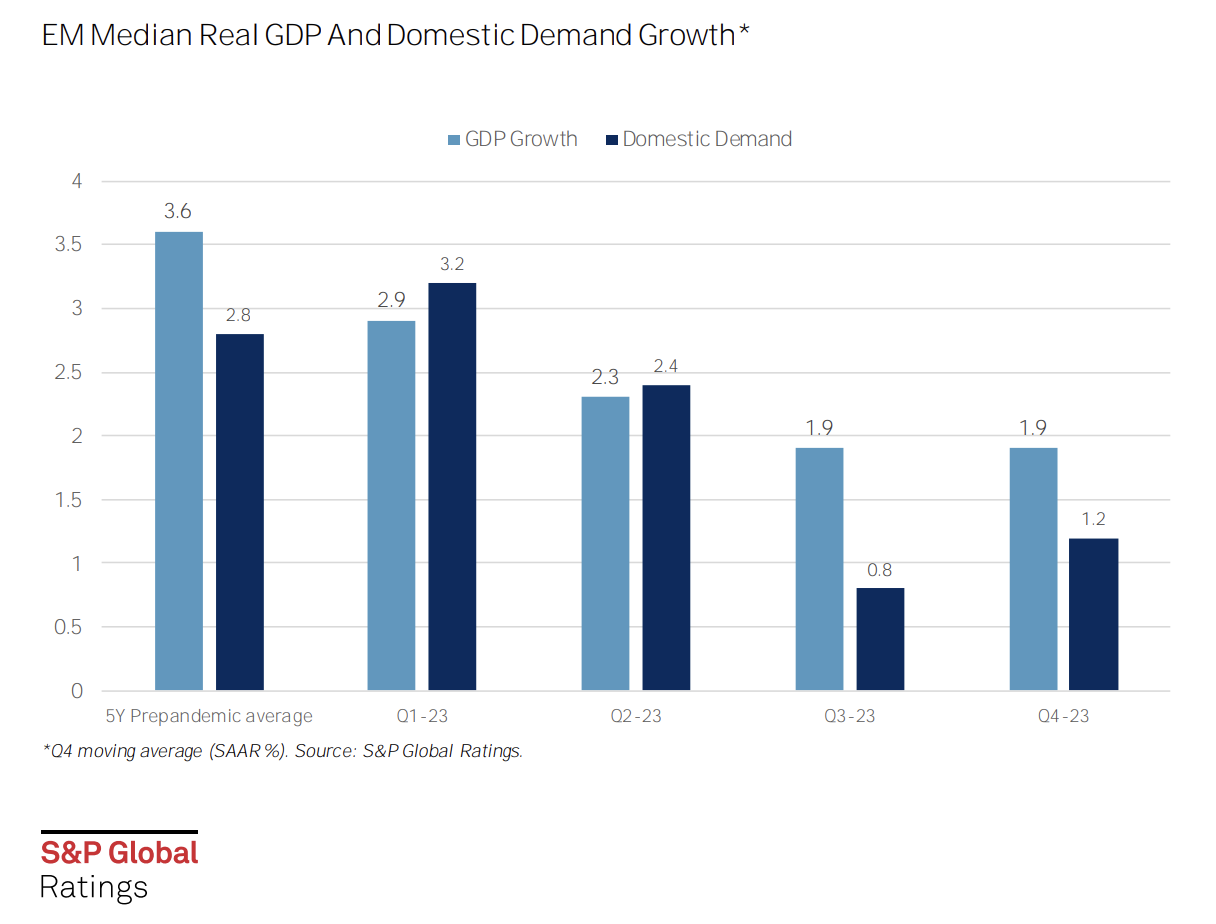

Emerging Markets Monthly Highlights: Strong Domestic Demand, Diverging Trajectories

Recent Q4 GDP data point to continuing resilience across most emerging markets (EMs), mostly because of solid — albeit, in some cases decelerating — domestic demand, helped by ongoing fiscal stimulus. However, growth in EMs with high trade exposure to Developed Europe continues to underperform.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

Eurozone Banks: ECB's Operational Framework Review Backs The Status Quo

The European Central Bank (ECB) has finalized the review of its operational framework, which determines how it steers its monetary policy stance and therefore how it provides liquidity to the banking system. S&P Global Ratings believes that the ECB's announcement on March 13, 2024 will cement ample liquidity provision for eurozone banks for the foreseeable future, with positive impacts on banks' liquidity and funding conditions, and their profitability.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

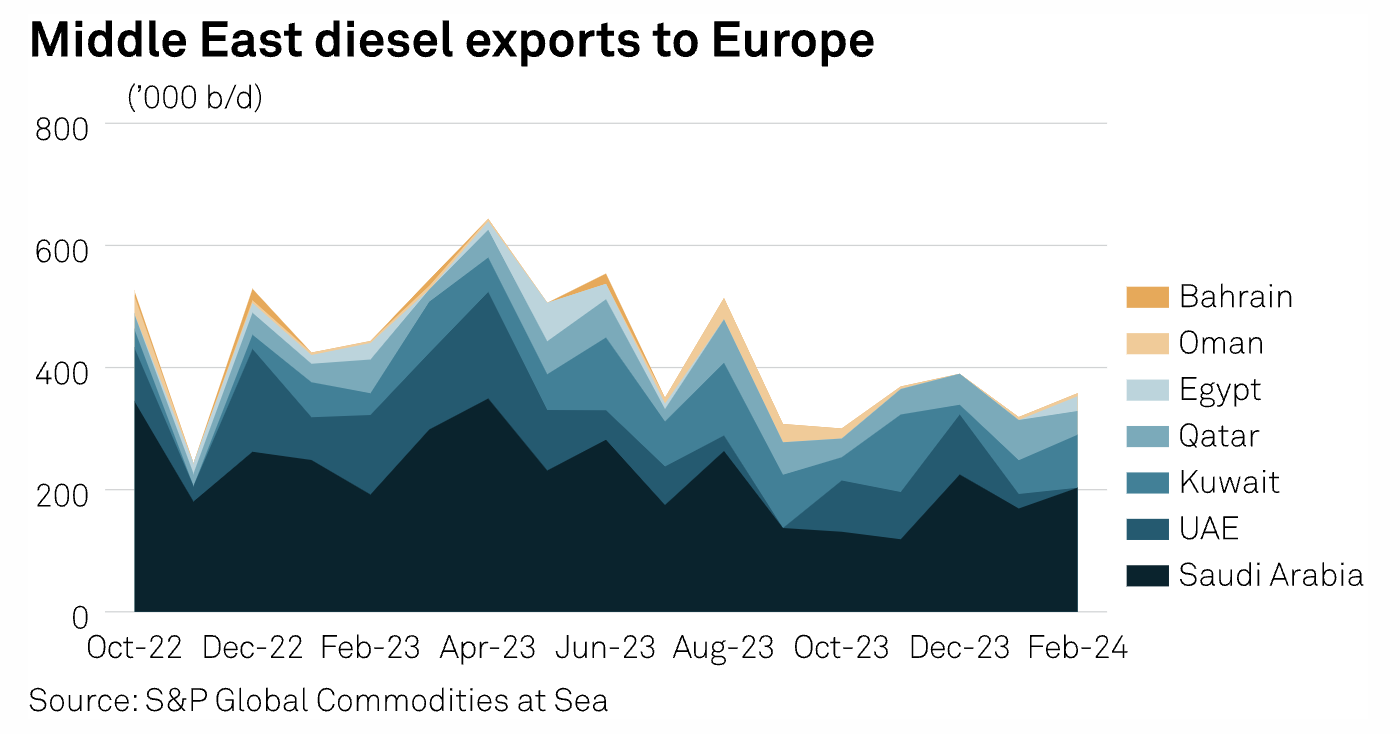

Middle East Diesel Exports To Europe Seen Rising In March As Refinery Output Climbs

Middle East diesel exports to Europe are expected to push higher in March after rebounding in February, with Saudi Arabia and Kuwait leading the way, as the production from Middle East refineries is seen rising, according to analysts and latest ship-tracking data. Diesel shipments from the Middle East to Europe averaged 374,000 b/d in February, the highest in two months, and up from 318,000 b/d in January, S&P Global Commodities at Sea data showed.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

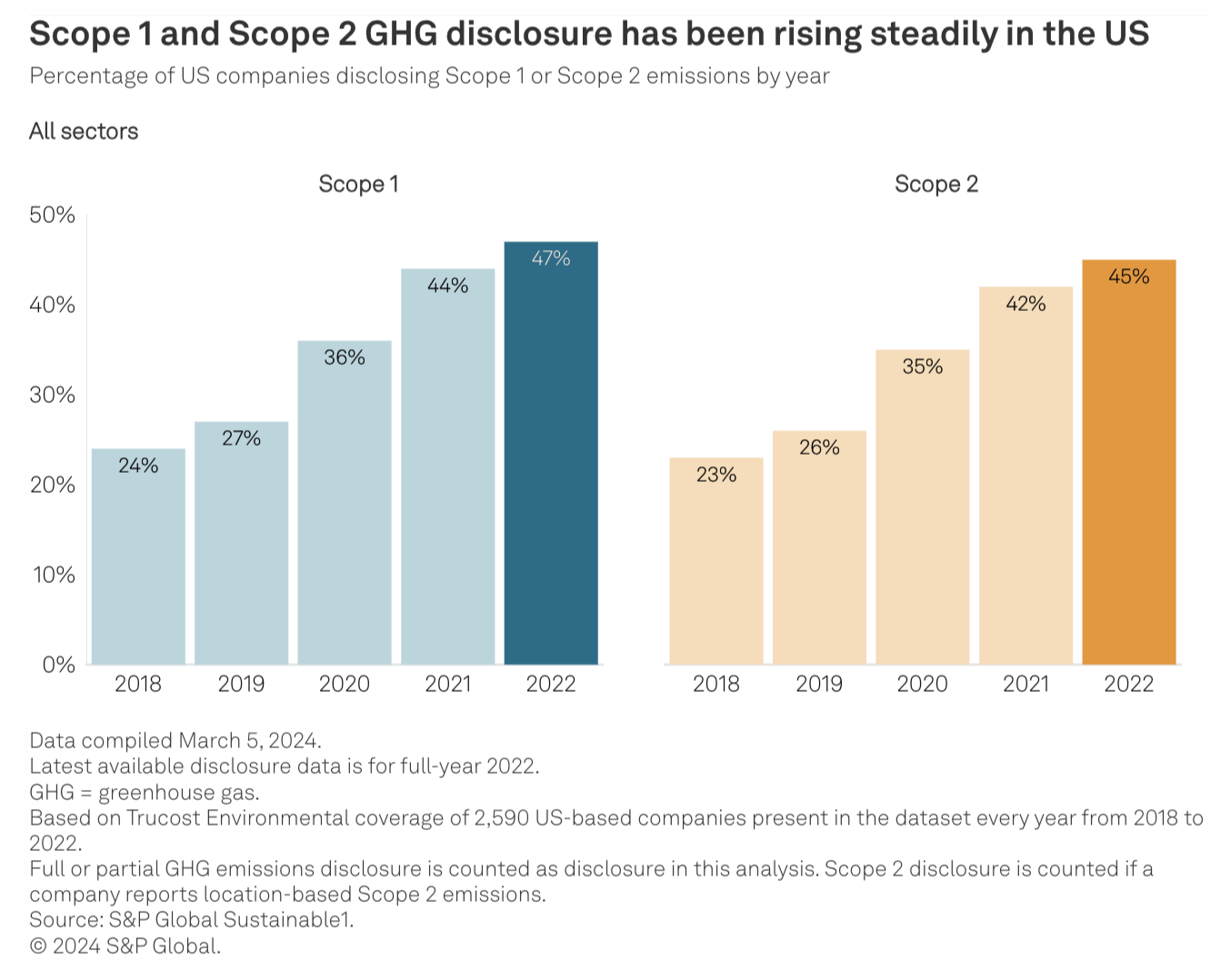

After SEC Rulemaking, Assessing The US Climate Disclosure Landscape

The new US Securities and Exchange Commission (SEC) rule requires companies registered under its mandate to disclose at least some material climate-related information, such as risk management practices and risks to its strategy or financial performance. Certain larger companies that view greenhouse gas (GHG) emissions as material will need to disclose them under the rule. Utilities, energy and materials were the top sectors identifying climate transition and physical risks as material in the 2023 S&P Global Corporate Sustainability Assessment.

—Read the article from S&P Global Sustainable1

Access more insights on sustainability >

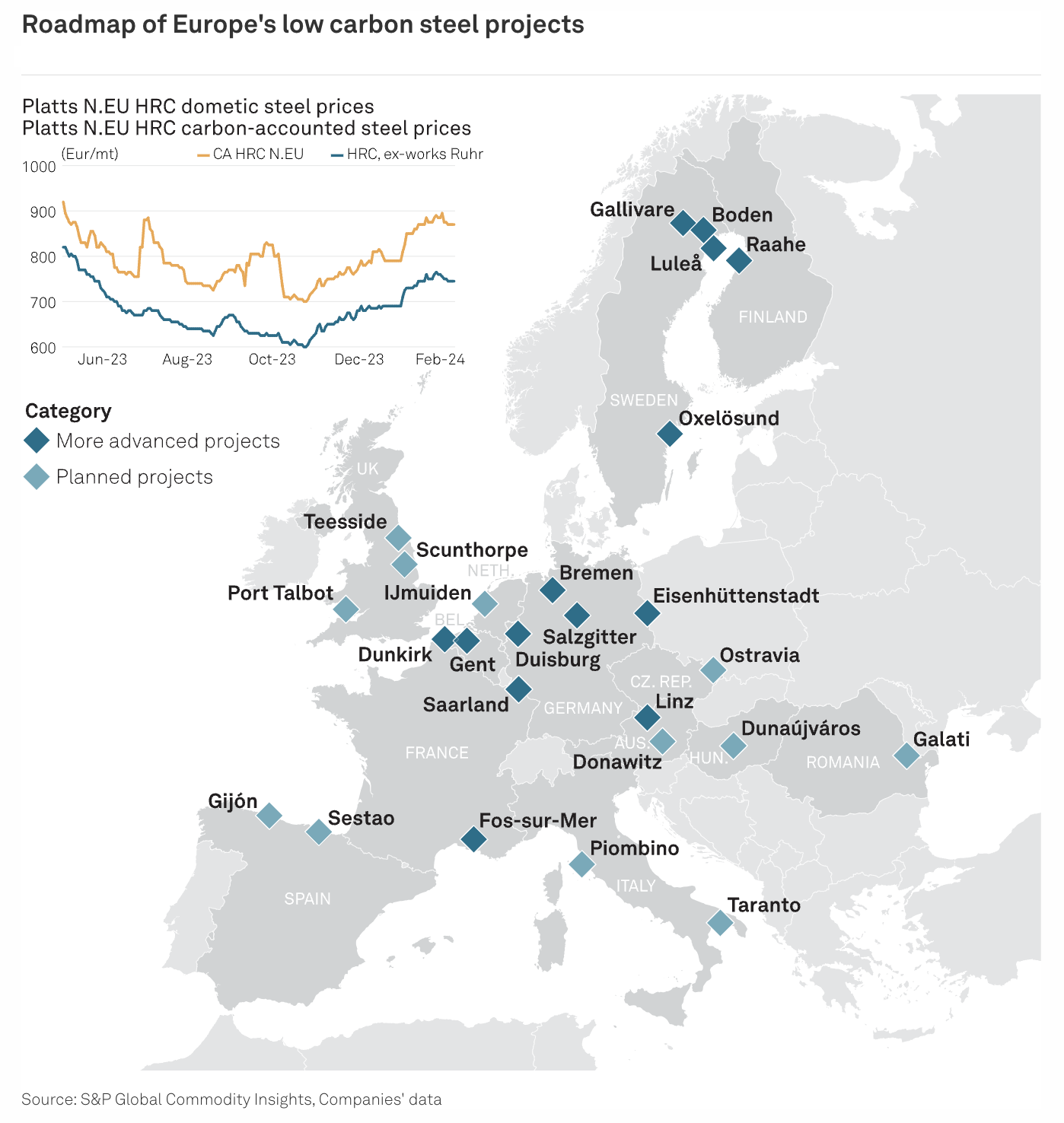

Roadmap Of Europe's Low-Carbon Steel Production Projects

Europe is expected to cut carbon emissions by 55% compared with 1990 levels by 2030 and to achieve climate neutrality by 2050. With around its 200 million mt/year of CO2 emissions, the steel industry is responsible for 5% of global emissions and is working towards a target of zero emissions. To achieve this, European steelmakers are switching technologies; there are around 60 projects that have the potential to reducing CO2 emissions by 81.5 million mt/year by 2030, according to Eurofer, the European steel association.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: MediaTalk | Season 2 Ep.4: Could 2024 Set A New Political Ad Spending Record?

MediaTalk Host Mike Reynolds speaks to S&P Global Market Intelligence Kagan Analyst Peter Leitzinger, who specializes in the broadcast industry with expertise in political advertising. Peter shares his thoughts on the 2024 election cycle, including the rematch for the White House, battles for control of the House and Senate and a number of ballot issues that are expected to raise interest and dollars. Together, Mike and Peter go through projections for seven swing states, including those where races in 2020 were decided by a single percentage point or less.

—Listen and subscribe to MediaTalk, a podcast from S&P Global Market Intelligence