Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 Mar, 2024

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Commercial Real Estate Under Stress

The commercial real estate sector continues to navigate a challenging post-COVID landscape, weighed down by employees working from home. From struggles in refinancing rates to declining asset quality, the sector's stress points are having a ripple effect on financial institutions and the global economy.

According to Ana Lai, managing director for US real estate investment trusts with S&P Global Ratings, slowing economic growth and the cooling labor market will reduce demand for commercial real estate (CRE), lower occupancy rates and cap rent increases.

Commercial mortgage-backed securities delinquencies climbed 173 basis points year over year to 4.3% in January 2024. At just over 6%, the office sector experienced the highest late payment rate, ahead of retail, lodging, multifamily and industrial delinquencies. Office tenant retention rates are still 10% below pre-pandemic levels.

Banks provide about half of all debt funding for CRE, with US banks holding $2.48 trillion in outstanding loans. In an S&P Global Ratings bank stress test, firms with a high ratio of CRE loans were shown to experience a 28% decline in Tier 1 capital when their loan values dropped 10%. In these hypothetical scenarios, poor CRE loan performance can drive down a bank’s capital, which in turn leads to deposit outflows and customer attrition.

US community banks have recently increased their reserves against CRE portfolios as delinquencies rise from historically low levels. New York Community Bancorp, for example, reported an elevated provision for loan losses from weakness in the office sector and risk posed by borrowers in the multifamily sector struggling with higher interest rates. The institution reportedly has assets surpassing $100 billion, 60% of which are tied to commercial properties in Manhattan.

A similar picture is unfolding across Europe and Asia. Deutsche Pfandbriefbank in Germany saw its share price fall after making substantial risk provisions to address "persistent weakness of the real estate markets." In Japan, Aozora Bank recorded its first loss in 15 years due to US commercial property investments.

In 2022, the CRE loan delinquency ratio for nonowner-occupied properties surpassed the ratio for owner-occupied properties for the first time in 10 years. For banks with more than $100 billion in assets, the delinquency ratio for nonowner-occupied loans was far worse than the ratio for owner-occupied loans, increasing by 101 basis points sequentially to 3.64%. This shift better fits conventional wisdom that property owners using their own space are more likely to stay current on their loans than those relying on tenants to pay rent.

These challenges may be with us for a while as 63% of leases held by office real estate investment trusts do not expire until after 2027. Fortunately, financial markets are expecting policy rate cuts this year, which should ease the pressure on CRE debt refinancing, and as more US companies adopt office-centric attendance policies, delinquency rates should also decline.

Today is Tuesday, March 12, 2024, and here is today's essential intelligence.

Written by Ken Fredman.

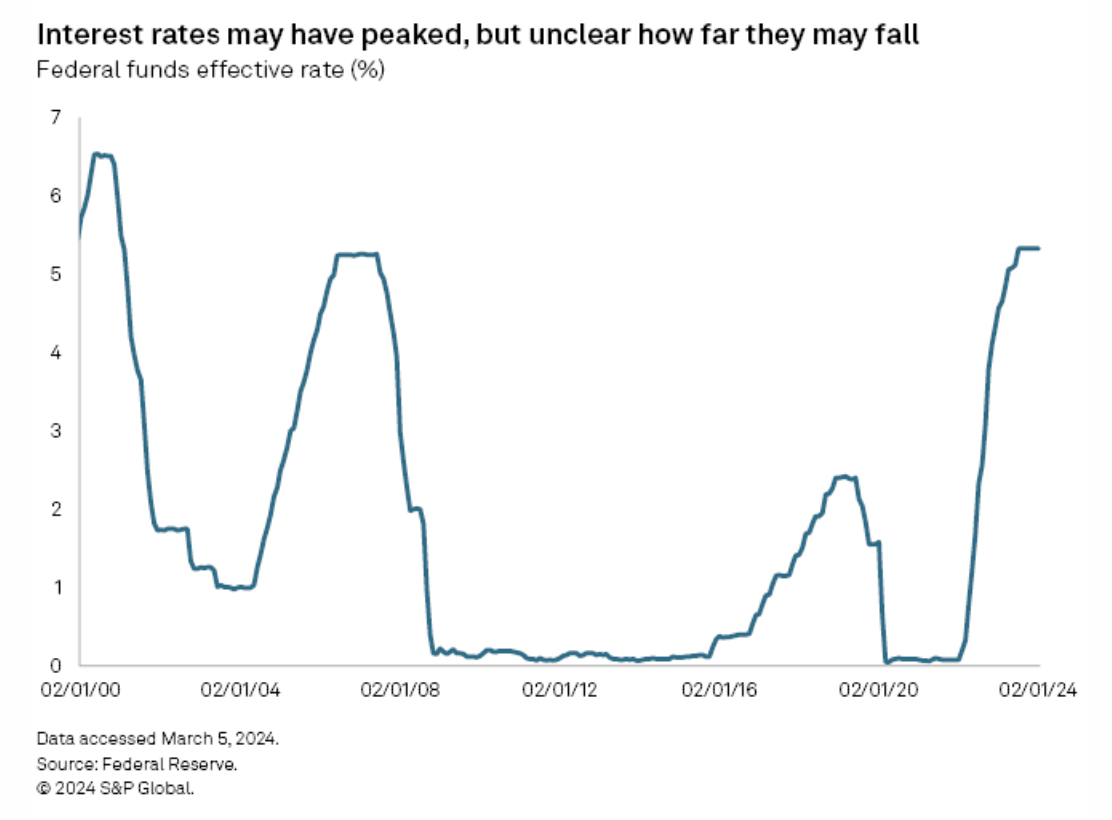

Market Waits On Fed Cuts As Doubts Rise About Return To Low Rates

As financial markets face uncertainty over when the US Federal Reserve will begin cutting interest rates, an even bigger question may be when and where central bankers plan to stop. After rapidly hiking rates 525 basis points between March 2022 and July 2023, the Fed is now weighing its first cuts since March 2020, when it lowered its benchmark federal funds rate to near zero as the COVID-19 pandemic began. A majority of the futures market now expects the Fed to start with a 25 basis-point rate cut at its June meeting, according to the CME FedWatch Tool, which measures investor sentiment in the Fed funds futures market.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Insurtech Stocks Maintain Momentum, Among Top Performers So Far In 2024

Insurance technology companies have been some of the best-performing US insurance stocks thus far in 2024, according to an S&P Global Market Intelligence analysis. Through March 5, Root Inc. has had the strongest rally among publicly traded insurance companies in 2023, surging 273.1%, thanks in part to announcing its best-ever quarterly results on Feb. 21. Another insurance technology (insurtech) company, Hippo Holdings Inc., has posted the second-largest rise, at 58.6%.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

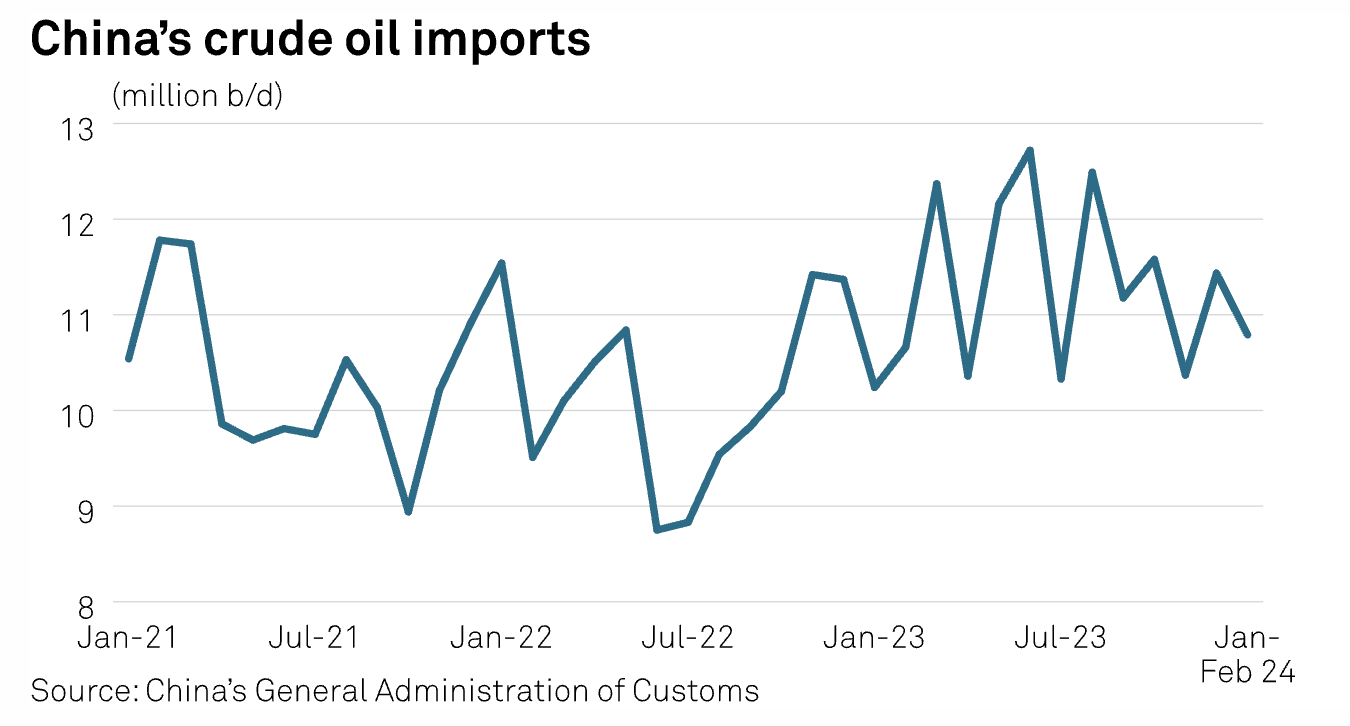

Jan-Feb Crude Imports Gain 3% On Year To 10.8 Mil B/D

China's crude imports fell 5.7% to 10.79 million b/d in January-February from the 11.44 million b/d in December, showed data from the General Administration of Customs March 7. This indicated destocking activity as Chinese refiners raised their crude throughput during the two months to meet healthy transportation fuel demand during the Lunar New Year holiday.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

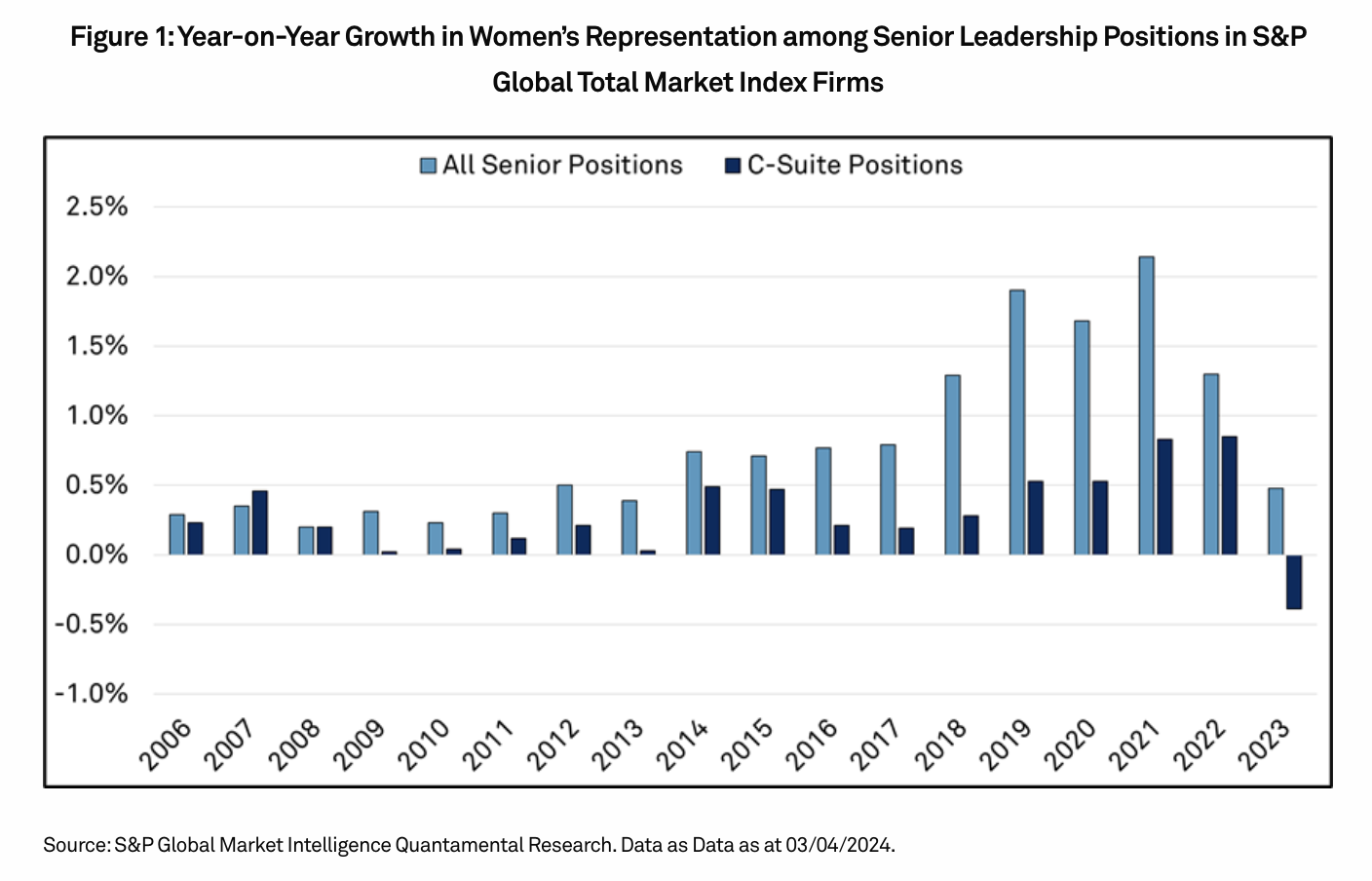

Elusive Parity: Key Gender Parity Metric Falls For First Time In 2 Decades

The growth in women’s representation among senior corporate positions, once a bright spot for gender parity, potentially faces an alarming turning point. Exponential growth over a decade is showing signs of losing momentum. Growth no longer appears exponential. A waning focus on diversity initiatives suggests a potential inflection point and calls our previous gender parity estimates into question.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

Listen: Lithium Producers Pump Brakes On North American Projects Amid Low Prices

Lithium producers are pushing timelines out for project development in North America as global lithium prices sit near a three-year low after plunging from record levels in 2022. The change in sentiment has cooled off a red-hot market and cast doubt on the future of domestic lithium supply for North America’s electric vehicles and other energy transition applications. S&P Global Commodity Insights metals editor Nick Lazzaro speaks with Viral Shah, managing editor for low carbon and base metals in EMEA, and Adriana Carvalho, senior managing editor for Americas metals markets, about the changing dynamics in global lithium markets this year, new pricing trends in the US and the future prospects for North American lithium supply.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

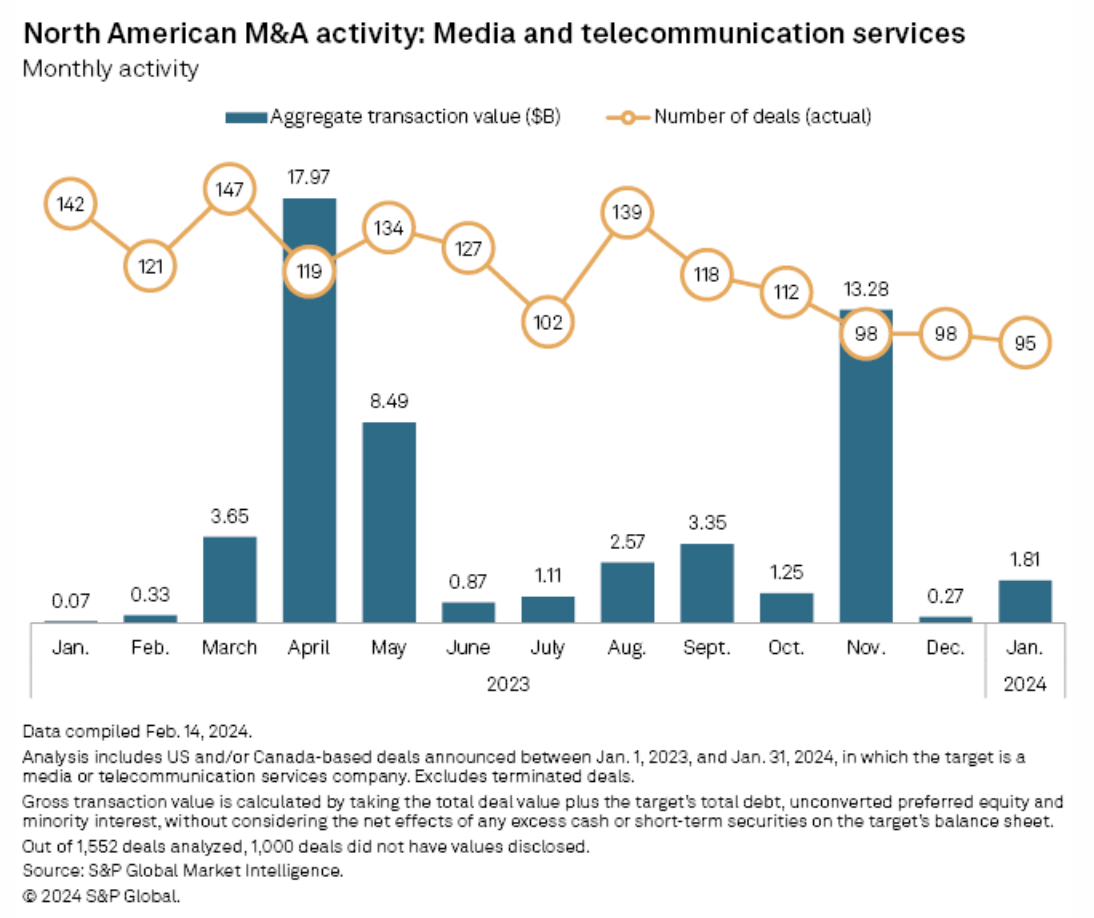

Deal Tracker: Sports Drives Media And Telecom M&A Activity

America's pastime was a major driver of North American media and telecommunications M&A activity in the first month of 2024. In January, Carlyle Group Inc. co-founder David Rubenstein led a group of investors in agreeing to acquire a Major League Baseball team, the Baltimore Orioles, in a transaction worth $1.73 billion. The deal was not only the sector's largest transaction in January by far, but it also ranked among the largest deals since the start of 2023.

—Read the article from S&P Global Market Intelligence