Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 6 Jul, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

What Steel Means

On a superficial level, steel looks like just another commodity. Steel can move across borders, and rebar is rebar from Brazil to China. However, trade and environmental restrictions in the US and Europe are reinforcing national champions in the steel industry. The strength of a country’s steel industry appears to have macroeconomic implications. Low demand for Chinese steel points to low growth in China. Higher steel prices in Europe and the US point to anticipated growth, particularly for low-carbon steel. Steel prices indicate growth, monetary and fiscal stimulus, and political priorities. In a changing trade environment, steel means something.

China’s steel prices have been trending lower as sluggish demand has not kept up with rising production. Some market observers said a heat wave in northern China and heavy rainfall in eastern and southern China have affected work at construction sites. Construction has slowed, but it isn’t clear if that is due to the weather or ongoing issues in the property sector. China’s steel producers seem to expect that a monetary and fiscal stimulus package aimed at supporting the property and infrastructure sectors will reinvigorate demand for their products, according to S&P Global Commodity Insights. China’s Politburo is due to meet in July and a discussion of stimulus is believed to be on the agenda, according to market chatter.

In Europe, steel volumes are low, but that is expected to change when the EU's impending Carbon Border Adjustment Mechanism scheme takes effect. European steelmakers are investing heavily in new equipment and less carbon-intensive production routes to cut emissions, anticipating that the so-called carbon tax will make their steel cost competitive with cheaper imports. Demand for European steel is expected to pick up sharply as buyers overcome their resistance to premium prices for green steel. Many large European steelmakers have begun developing low-carbon steel processing facilities and electrolyzers and signing contracts to supply low-carbon steel.

North America may be looking at substantial growth for regional steelmakers due to infrastructure spending, demand from green-intensified factors and a global reduction in carbon emissions. Demand for low-emissions steel is expected to increase prices as soon as the fourth quarter of 2023, driven by offshore wind facilities and the automotive sector. North American companies looking to meet their sustainability targets have been pressuring steel manufacturers to reduce their carbon emissions.

"We believe the North American market is about to hit a once-in-a-century growth spurt resulting from a combination of factors," Philipp Englin, CEO of World Steel Dynamics, said at the June 27 Global Steel Dynamics Forum in New York.

Today is Thursday, July 6, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

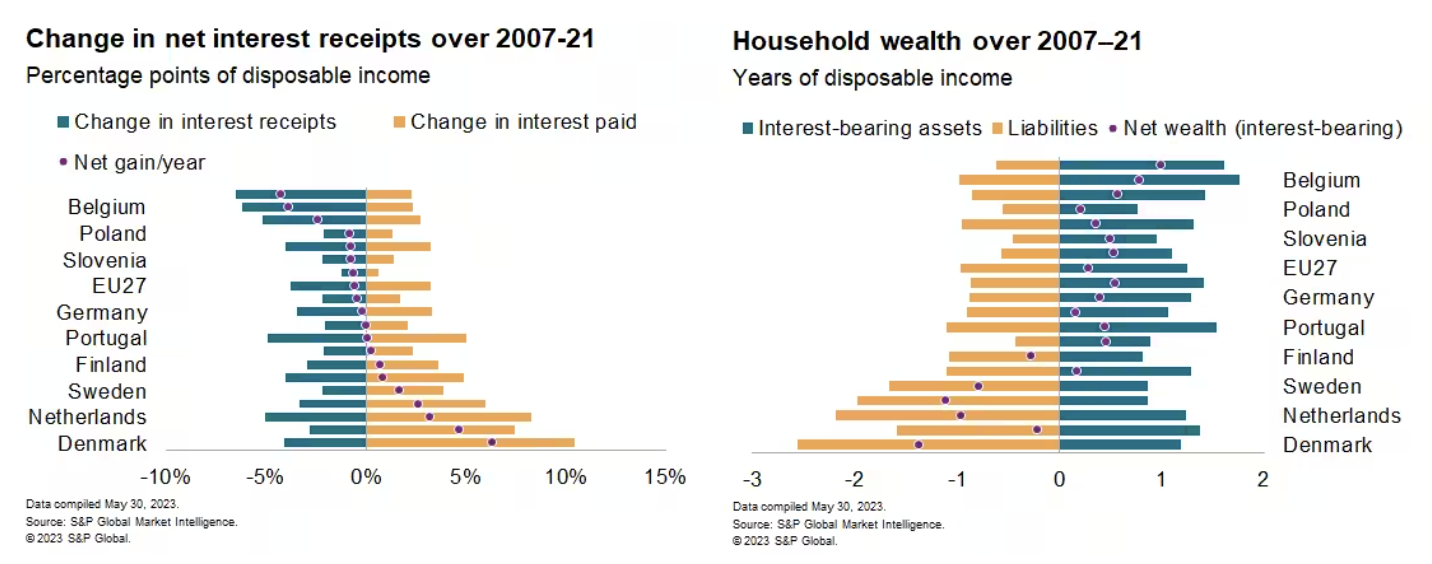

High Interest Rates And The Euro Area Economy

The eurozone has yet to experience the full impact of high interest rates on economic activity and demand. These rates will likely lead to a contraction in investment while private consumption remains relatively resilient — at least until the second-round effects on credit availability and job market dynamics fully manifest in the economy.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Listen: Street Talk | Episode 113: Bank Investors Can Find Diamonds In The Rough Amid Funding Pressures

The liquidity crunch that erupted in March made deposits more precious, but performance has diverged between institutions of different sizes and regions, according to Josh Siegel, chairman and CEO of StoneCastle Partners. In this episode, Siegel discussed the liquidity pressures facing the industry and how they far more acute for regional banks than the nation’s largest and smallest banks; strategies institutions are employing to compete for deposits; potential regulatory changes and the outlook for capital raising activity and the risk posed by commercial real estate.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

Access more insights on capital markets >

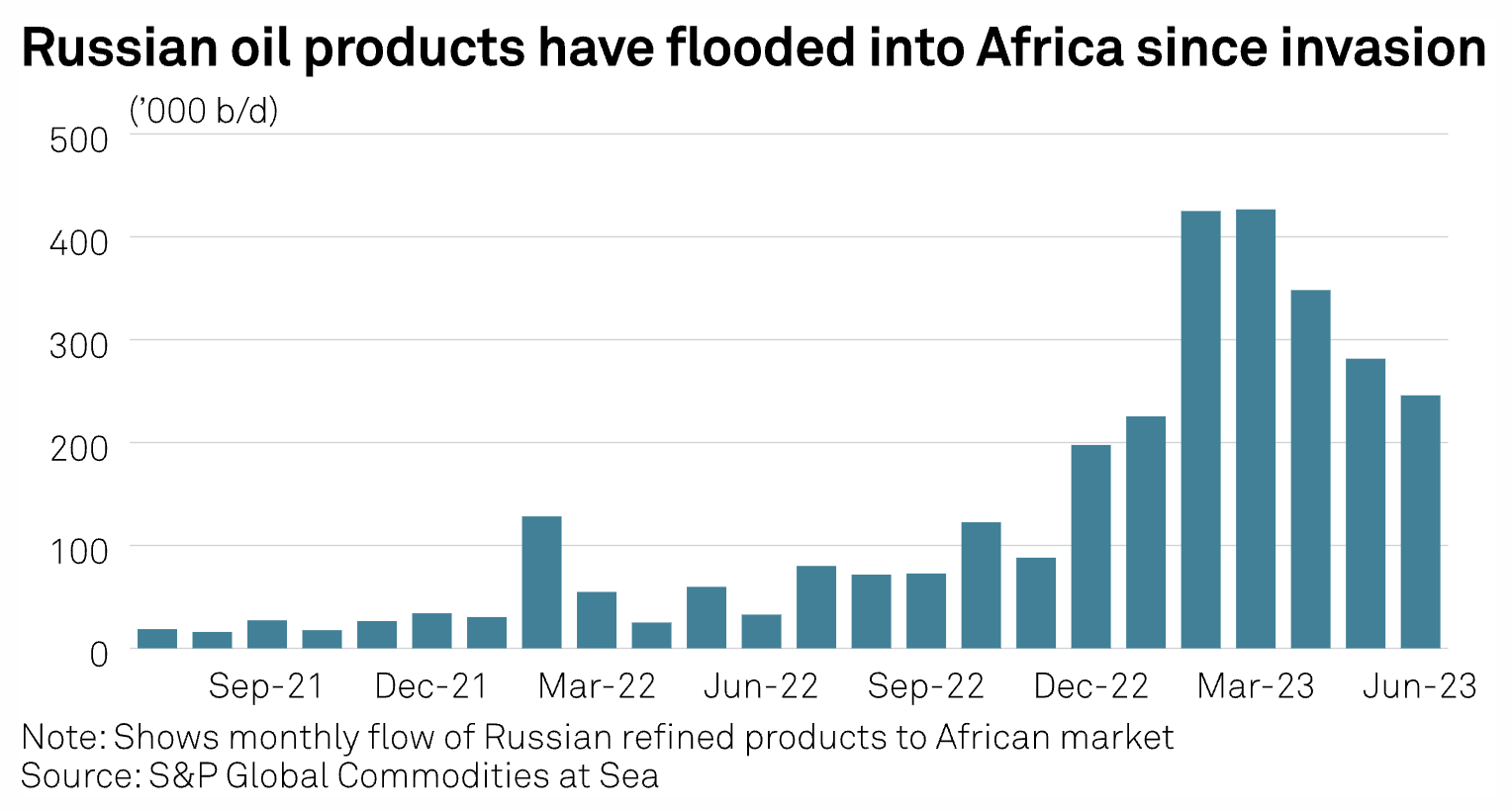

Russian Oil Product Flows To Africa Jump Following Western Sanctions

Sanction-hit Russia's refined product exports to Africa have skyrocketed since the invasion of Ukraine, increasing 14-fold in just over a year, following a diplomatic onslaught on the continent by Russian officials. Prior to the war, Russia exported 33,000 b/d of refined products to Africa, much of it gasoline. By March 2023, that had soared to 420,000 b/d. Illustrating the geopolitics at play, shipments to countries such as Nigeria, Tunisia and Libya jumped sharply in February, when the European Union placed an embargo on Russian products.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: TNFD Executive Director Talks New Nature Disclosure Framework

Biodiversity and nature are gaining attention from companies, investors and governments. At the same time, many stakeholders are in the early stages of measuring and understanding nature-related risks. In this episode of ESG Insider, sit down at the GreenFin conference with Tony Goldner, Executive Director of the Taskforce on Nature-related Financial Disclosures (TNFD). He explains how TNFD’s soon-to-be-finalized set of disclosure recommendations could help companies understand their nature-related risks and increase investment in nature-related climate solutions.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

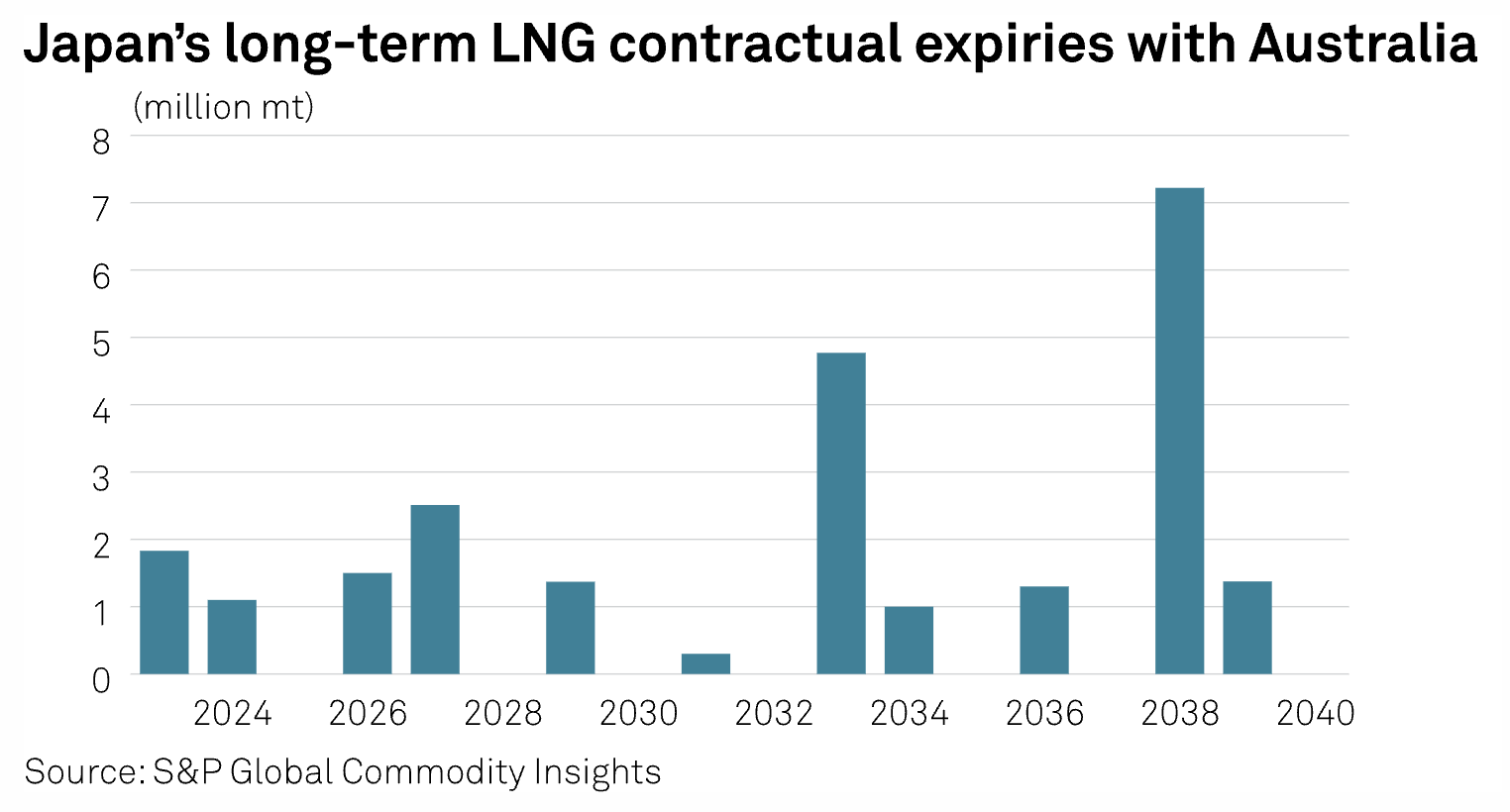

Japan Mulls Greater LNG Supply Diversification As Australian Policy Shifts

Reforms to Australia's Safeguard Mechanism that took effect July 1 will have a significant impact on LNG business and import costs for Japan and are accelerating the import-dependent country's efforts to diversify supply sources, with a renewed focus on Middle East prospects. The reforms, the latest in a series of Australian policy changes that could have impact on LNG supply, have shaken Japan's confidence in Australia's role as a stable long-term LNG supplier, sources and analysts told S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 122: Cloud Delivered Quantum

Quantum computing can seem exotic, but there are a growing number of offerings from cloud and colocation providers that provide ready access for those that aren’t quite ready to step up to one of their own. Analyst Gabriella Brown returns to discuss the services and technologies that are available with host Eric Hanselman. It’s getting easier to use and now generative AI tools can translate natural language prompts into quantum circuits. Onramps for quantum experimentation are ready for all.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Content Type

Location

Segment

Language