Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 5 Jul, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Businesses Awaken to Biodiversity Loss

For most companies, biodiversity commitments are lagging carbon goals, even though the two are interrelated and the biodiversity crisis has become acute. The challenge is that many companies don’t perceive biodiversity loss as a threat to their business in the same way as physical impacts from climate change. The passage of a new global biodiversity framework at the UN’s Biodiversity Conference in Montreal has raised hopes that biodiversity loss can be slowed.

According to the World Wildlife Fund, there has been a 69% decrease in the populations of mammals, birds, reptiles, amphibians and fish since 1970. When businesses think about biodiversity loss, they are often thinking about these charismatic fauna. However, the real economic impact of biodiversity loss can be felt from forests, grasslands, soil microorganisms, seagrasses and mangroves.

According to a recent study by S&P Global Sustainable1, 85% of the world’s largest companies have a significant dependency on nature across their direct operations. An April 2023 study by PwC estimated that 55% of global GDP, or approximately $58 trillion, is moderately or highly dependent on nature. This dependency takes several forms, including wood for timber; ground water or fresh water for drinking, cooling power plants or irrigation; and animal or plant fibers for fabrics or fertilizer. In addition, mixed prairies of native plants provide significantly improved soil stabilization and erosion control, which has become critically important in food-growing regions. Swamps and coastal ecosystems provide superior flood and storm protection. Finally, reversing the physical asset risk arising from climate change is critically dependent on the ability of natural ecosystems to absorb excess carbon.

Forests, which cover 31% of the earth, absorb about 7.6 billion metric tons of CO2 from the atmosphere every year. But even this capacity is small compared with that of the earth’s oceans, according to the UN. Ocean habitats such as seagrasses and mangroves, along with their associated food webs, can capture atmospheric CO2 at rates up to four times higher than terrestrial forests. Oceans generate 50% of the world's oxygen, absorb 25% of all CO2 emissions and capture 90% of the excess heat generated by these emissions.

S&P Global Sustainable1 launched a new Nature & Biodiversity Risk dataset that covers more than 17,000 companies and more than 1.6 million assets. It shows that even financial institutions and institutional investors that have made carbon commitments struggle to make similar commitments to prevent biodiversity loss. Only about one-third of Europe's biggest companies have set biodiversity targets, and those rates are even lower among the largest companies in Asia-Pacific and the US.

Under the new global biodiversity framework, governments pledged to achieve "effective conservation and management of at least 30% of the world’s lands, inland waters, coastal areas and oceans" by 2030. It seems many countries are awakening to the interrelationship of their climate goals and biodiversity.

Today is Wednesday, July 5, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week Of 3 July 2023

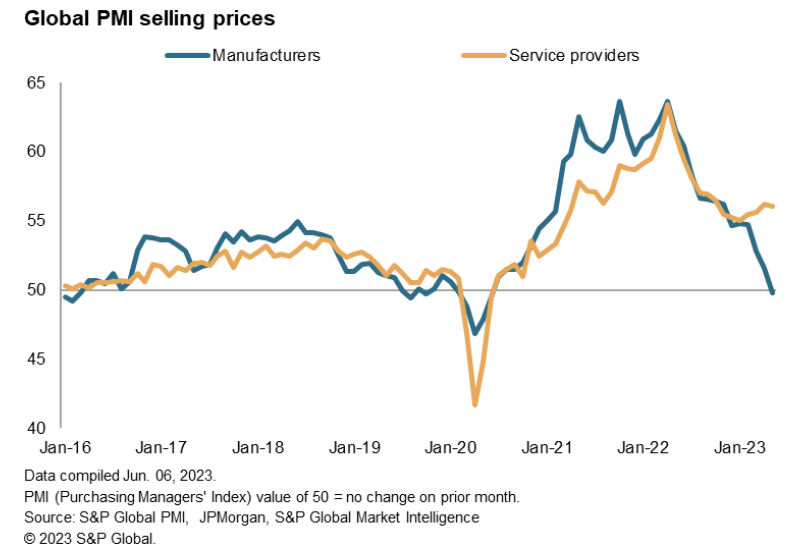

The opening week for the second half of 2023 packs a multitude of economic data highlights including worldwide PMI figures plus US ISM data and monthly jobs report. On the central bank front, Fed minutes from the June meeting will be released and monetary policy meetings will be held in Australia and Malaysia. A series of inflation updates across the world will also be due while Japan's Tankan survey will be scrutinized for second quarter business conditions.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Global Credit Conditions Q3 2023: Higher For Longer Will Fuel Ratings Divergence

S&P Global Ratings expects slowing growth ahead and diverging credit performance. Investment-grade entities should remain resilient and more financially flexible while higher rates will continue to challenge those at the lowest end of the rating spectrum. This divergence is reflected in our negative bias, at 9.2% for investment grade and 35.4% for 'B-' and lower ratings. The full impact of sharply higher interest rates has yet to unfold.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

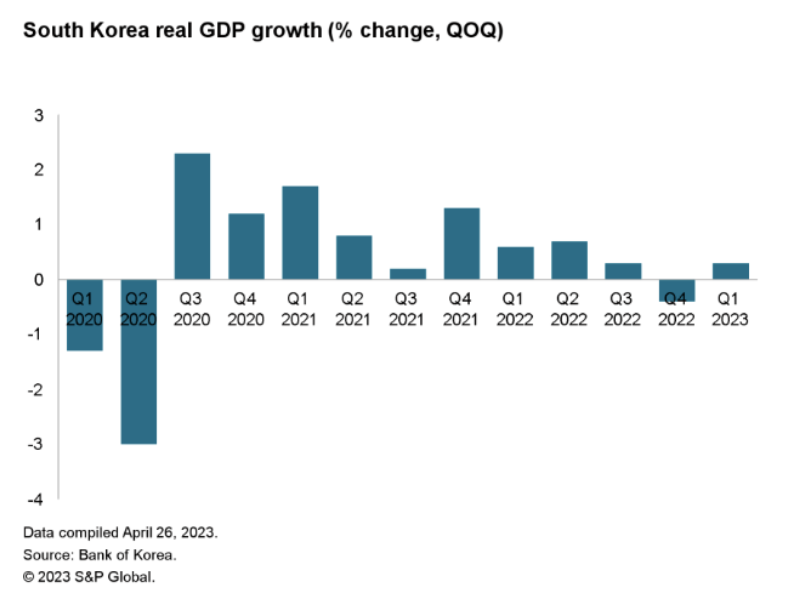

South Korea Continues To Face Headwinds From Weak Exports

South Korea has faced continuing economic headwinds during the first half of 2023, due to the impact of weak exports and the cumulative transmission effects of monetary policy tightening by the Bank of Korea during 2022. Weak economic growth in the US and the European Union remain a key downside risk for South Korea's manufacturing export sector in the second half of 2023 and into 2024. Despite improving economic growth in mainland China during the first half of 2023, South Korean exports to this key market have remained weak due to declining exports of semiconductors and mobile phones.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Carbon-Negative Bioenergy Technologies Gain Traction As A Climate Solution

Bioenergy with carbon capture and storage, BECCS, is gaining traction as a technological solution for reducing carbon emissions while adding to the global energy supply, but experts are arguing that it needs more clearly defined policy incentives to play a role in midcentury climate targets. BECCS is among a suite of carbon dioxide removal technologies necessary to limit global warming to 1.5-2 degrees Celsius, yet it is one that has received less attention over the years relative to other CO2 removal solutions, such as direct air capture, afforestation and biochar production.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: What's In Store For US Refined Products And Distillates This Summer?

Summer travel season is upon us, so what's the outlook for fuel demand in the Americas for the coming months? Naphtha, a key component in gasoline, was recently in short supply but now appears to be in ample supply, and recent S&P Global analyst reports show an anticipated rebound in diesel demand in the second half of 2023. S&P Global Commodity Insights' Sarah Hernandez, Americas light ends manager, discusses recent trends in gasoline, aromatics and distillates with petrochemicals editor Wendy Dulaney and Americas distillates manager Jordan Daniel.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

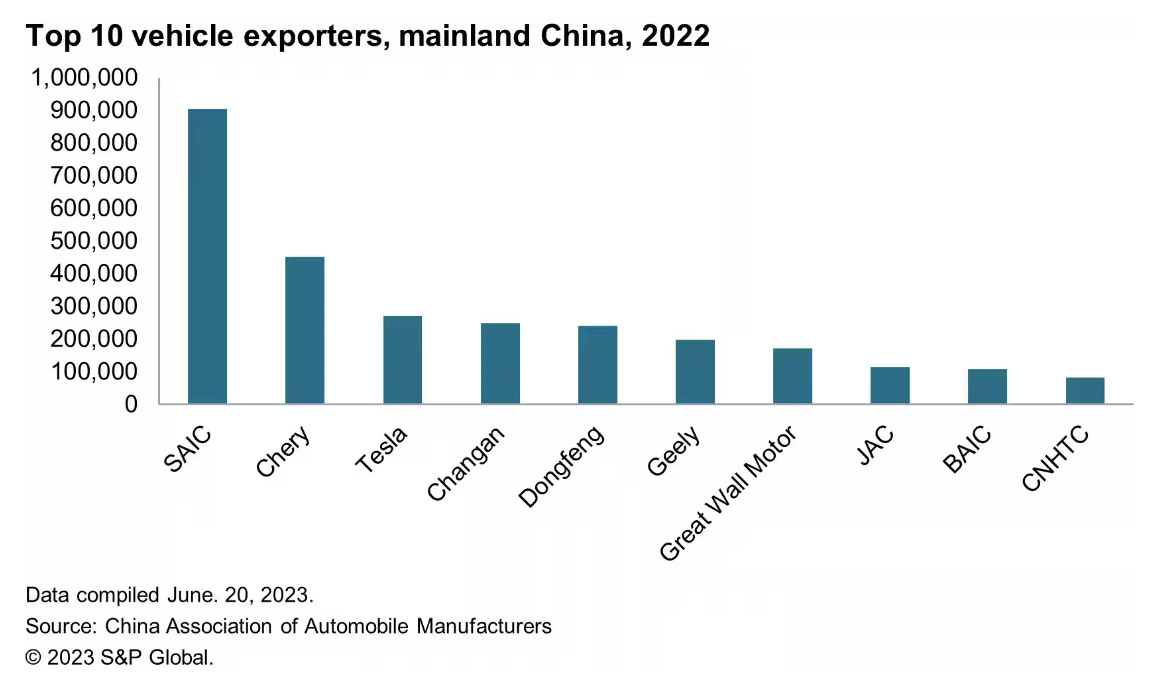

China Exported More Than 3 Million Vehicles In ‘22 … And Is Soaring Even Higher This Year

Mainland China's automotive industry is rapidly expanding into export markets and could disrupt the leadership positions of traditional global legacy automakers. In 2022, it passed long-time No. 2 exporter Germany, and through the first quarter of 2023 surpassed Japan as the world's leading vehicle exporter. Can it maintain that lead for the rest of the year? Chinese automakers are improving their technology, design and manufacturing processes, gaining market share in new regions and addressing brand recognition issues to continue their growth in the European market. However, political risks and regulatory challenges remain a concern for Chinese manufacturers as they navigate different markets worldwide.

—Read the article from S&P Global Mobility

Content Type

Theme

Location

Segment

Language