Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Jul, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Fragility of Black Sea Grain Deal Demonstrates Geopolitical Challenges

At present, it is unclear if the Black Sea grain deal will be renewed. The deal, which allows for agricultural exports from Ukraine to pass through the Black Sea, was first brokered by the UN and Turkey on July 22, 2022. The deal was renewed May 18 for 60 days but is due to expire today — July 17. If the deal is not renewed or extended, Ukraine may be unable to export its agricultural output of grains and oils if Russia proceeds with a blockade of Ukrainian ports. Ukrainian grains and oils are imported by Egypt, Bangladesh, Turkey and many other countries. Global food prices are likely to increase, particularly in some of the poorer countries of Africa, if the deal is allowed to lapse. Even if the Black Sea grain deal is extended at the deadline, uncertainty due to geopolitical tensions may keep food prices high and undermine confidence in global trade.

Ukraine and Russia have accused each other of failing to meet obligations under the existing deal. Ukraine claimed that Russia has been slow in registering grain ships departing from the Pivdennyi port — the deepest port on the Black Sea coast — leading to a slowdown in Ukrainian agricultural exports. The Russian government accused Ukraine of failing to live up to its obligation to allow the safe export of ammonia via a pipeline across Ukraine, which has been idle since 2022, to the Black Sea port of Odesa. Ammonia is a crucial ingredient in most chemical fertilizers used globally to boost crop yields.

"There were clauses of this agreement with the UN, according to which it was necessary to take into account Russian interests. Nothing, I want to emphasize this, nothing was done at all," Russian President Vladimir Putin said July 13 in an interview on Russian state television. "We will think about what to do. We have a few more days."

UN Secretary-General António Guterres and Turkish President Recep Tayyip Erdoğan have been actively engaged in talks with Russia to address Russian concerns over grain and fertilizer exports through the Black Sea to allow the existing deal to continue.

"Negotiations continue for the extension of the Black Sea Initiative” Erdoğan said in a July 12 statement. “We will continue to use our close dialogue with both our neighbors to extend the initiative and resolve the crises."

Since August 2022, about 32.9 million metric tons of farm products have been exported through the grain corridor, data from the Black Sea Grain Initiative’s Joint Coordination Centre showed. Russia is expected to export 42 MMt of wheat in marketing year 2023-24, while Ukraine is expected to produce 18.1 MMt of wheat in the same period, according to S&P Global Commodity Insights. Ukraine and Russia, together, are expected to account for nearly 27% of global wheat trade, according to the US Agriculture Department. Disruption of exports may impact global supplies of wheat and corn, which could drive up prices.

Today is Monday, July 17, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

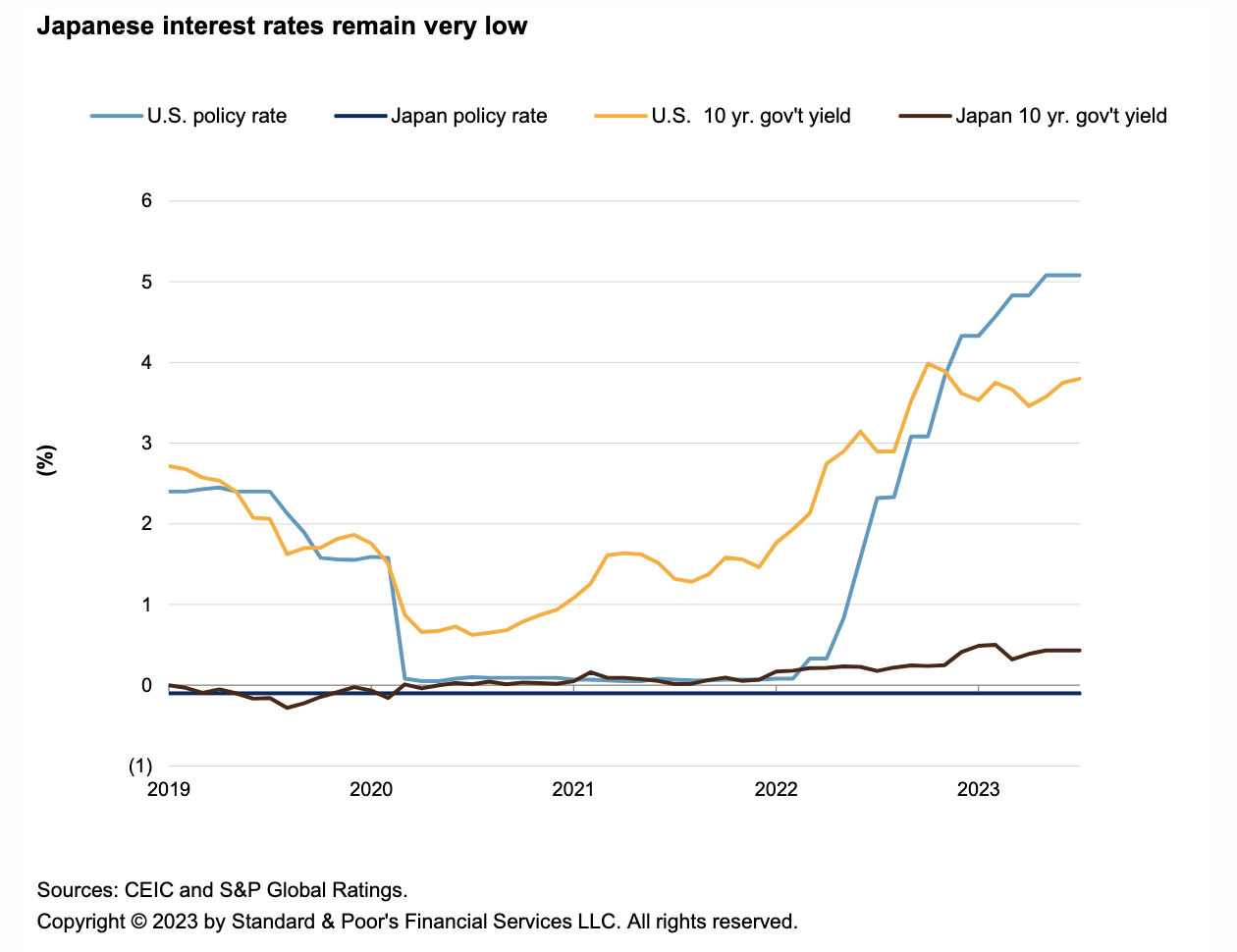

Economic Research: Japan Will Tread Carefully In Its Likely Tightening

After a long period of very low interest rates in Japan, market expectations of monetary policy normalization are rising. Higher inflation and global interest rates are putting pressure on the Bank of Japan (BOJ) to abandon its ultra-accommodative monetary stance. The BOJ's policy rate has been close to zero since 2008, and less than zero (-0.1%) since 2016. The bank has also pursued a yield curve control (YCC) policy, under which it commits to buying government bonds to maintain 10-year government bond yields at "around 0%." With the BOJ having become an increasingly large holder of this paper, financial markets tested its commitment at end-2022.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Global Private Equity Exit Activity Slumps In Q2 2023

The total number of global private equity exits in the second quarter was 391, down 9.7% from the same period in 2022, according to data from Preqin Pro. The valuation gap between buyers and sellers and the rising cost of credit are among the headwinds slowing such exit routes as IPOs, trade sales and secondary sales, which were all down year over year. Secondary sales made up 37.9% of total private equity exits, with 148 transactions during the second quarter. Trade sales and other exits numbered 200 and 37, respectively. Only six IPOs were completed during the second quarter compared to 14 in the same period a year prior.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

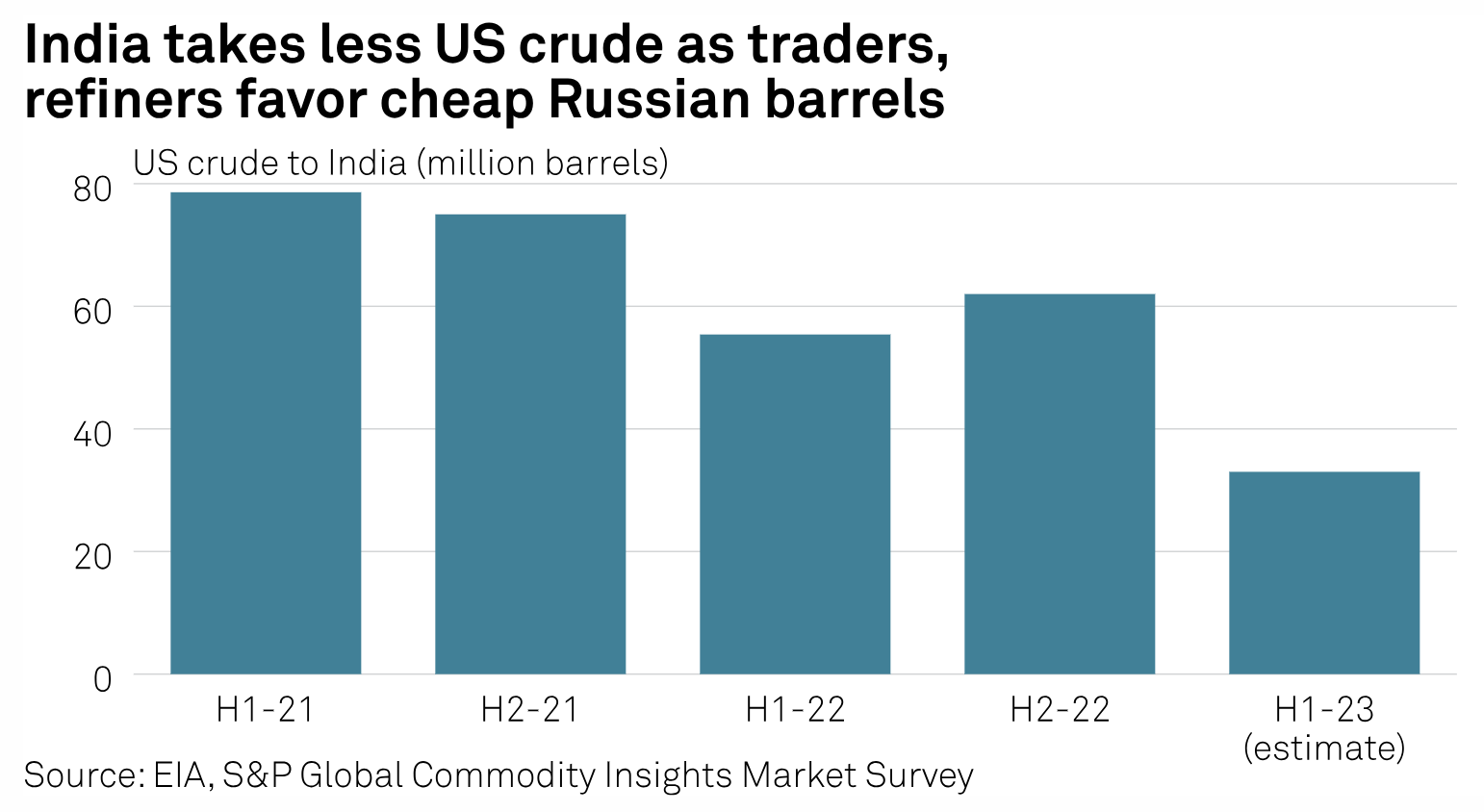

US Crude Share Intact In Asia But Flows Witness Dramatic Shifts

The Russia-Ukraine conflict has not only shifted Asia's Russian sweet and sour crude flows, but also changed US crude trade dynamics in the region, with Taiwan displacing India as one of the region's top three North American light sweet crude customers. The market share of US crude oil in Asia reached a record high of 7% in Q2 this year compared with the average of 5.8% last year. China, South Korea and Taiwan emerged as the top three US crude importers in Asia in that quarter, with volumes rising by 201%, 50% and 92% on the year, respectively, according to S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Why Europe Is Warming At A Faster Rate Than The Rest Of The World

Europe has been warming twice as much as the global average since the 1980s, and in 2022 warmed about 2.3 degrees C above preindustrial levels, according to the State of the Climate in Europe 2022 report, published in June 2023 by the World Meteorological Organization and the EU's Copernicus Climate Change Service, which provides information about the climate in Europe and the rest of the world. In this episode of the ESG Insider podcast, hear from Carlo Buontempo, director of the EU’s Copernicus Climate Change Service. He shares that many parts of Europe are experiencing extreme heat, wildfires and melting glaciers.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

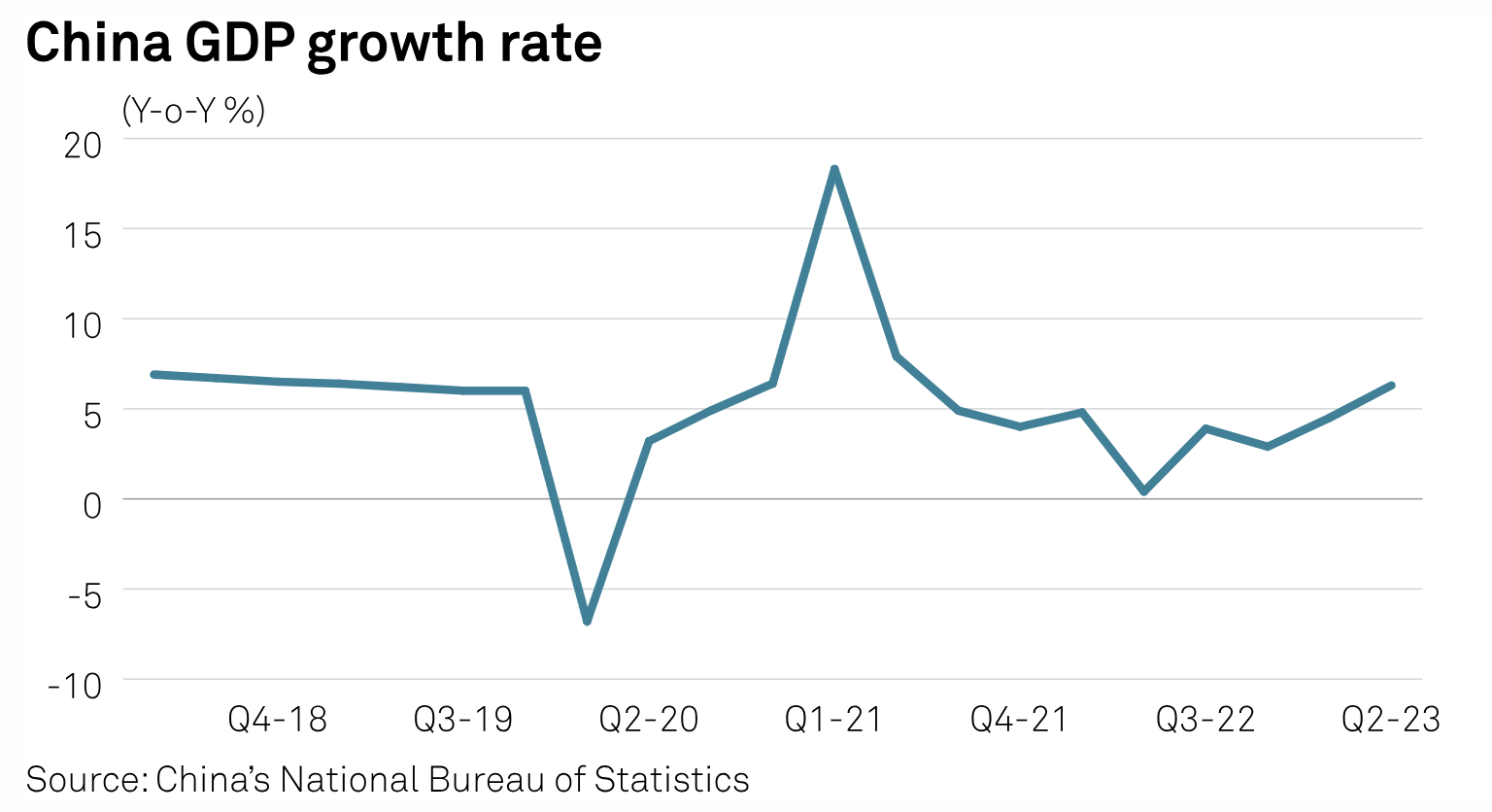

H1 Crude Oil Throughput Jumps 10% On Year Amid 5.5% GDP Growth

China's crude oil throughput jumped 9.9% from a year ago to 14.72 million b/d in the first half of 2023, stronger than its GDP growth of 5.5% in the same period, National Bureau of Statistics data showed July 17. To boost the economic growth, which has been slower than expected, Chinese refineries may be required to further increase throughput in H2 to lift oil product exports in addition to meeting domestic demand, analysts said. The country's GDP growth stood at 6.3% in the second quarter, the NBS data showed, lower than the market estimate of 7.3% despite a low base over April-June 2022 amid countrywide COVID-19 lockdowns.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 124: Getting FAST

The growth in Free, Ad-Supported Television (FAST) is impacting media markets as consumers blend new forms of consumption. FAST has become a notable player, generating billions in ad revenue and improving and increasing the content available. It’s still a small percentage of the Streaming Video On-Demand (SVOD) revenues, particularly in Europe, but the relatively low cost to spin up new channels is letting it address new and niche media content. It’s not all Baywatch and Bob Ross anymore.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Content Type

Segment

Language