Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Jul, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Increased Migration Is On The Horizon

A plethora of economic and geopolitical factors point to an increase in both official and irregular labor migration to Europe and the U.S. in the next five years.

The Russian invasion of Ukraine has created sizable refugee movements in Central and Eastern Europe in recent months. But long-term factors like sluggish economic development in West Africa and Central America, the increasing importance of remittances as a percentage of GDP for some countries like Mexico, and the increasing implications of climate change on agriculture in Central America and the Caribbean are likely to be the key drivers of increased migration in the years ahead, according to a recent report by S&P Global Market Intelligence’s Economic & Country Risk team.

Because many emerging market economies are more vulnerable to higher food and energy prices due to their dependence on imports, the increased inflationary environment in global energy prices is putting outsized pressure on their growth as macroeconomic and credit conditions worsen, according to S&P Global Ratings. The Economic & Country Risk research showed that sluggish recovery and slowing growth in emerging markets, combined with the lifting of pandemic-related travel restrictions to Europe, is likely to cause a spike in irregular labor migration to Europe from sub-Saharan Africa. And an increase in inflation in many African countries caused in part by the war in Ukraine, along with a weakening of many African currencies against the dollar, may further contribute to migration, according to S&P Global Market Intelligence.

Political instability and higher food prices in Central America, West Africa, and other regions can create destabilizing conditions that leads to increased migration flows. While economies across Africa and Latin America started this year strong, recent data appears to indicate that growth is, at best, stalling, according to S&P Global Ratings. Risks remain firmly on the downside for emerging markets.

As the physical risks of climate change worsen, the implications of global warming are particularly affecting agriculture in Central America and the Caribbean—contributing to existing country risks and exacerbating the risk of migration, according to the Economic & Country Risk research. Droughts and other extreme weather events risk damaging agricultural crops and infrastructure and forcing larger populations to migrate north. Worldwide, the imminent and growing threat of droughts, floods, hurricanes, and tornadoes makes agriculture production and yield forecasts murkier than ever, according to S&P Global Commodity Insights.

“Alongside longstanding drivers of migration, emerging push factors including climate risks and environmental stressors are likely to account for an ever-growing proportion of international migration.” Lindsay Newman, director of Economic & Country Risk at S&P Global Market Intelligence, told the Daily Update. “We see water scarcity, which exacerbates food security and economic shocks, as becoming a leading driver of migration in Latin America, particularly acutely in Central America’s Northern Triangle.”

Today is Thursday, July 14, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

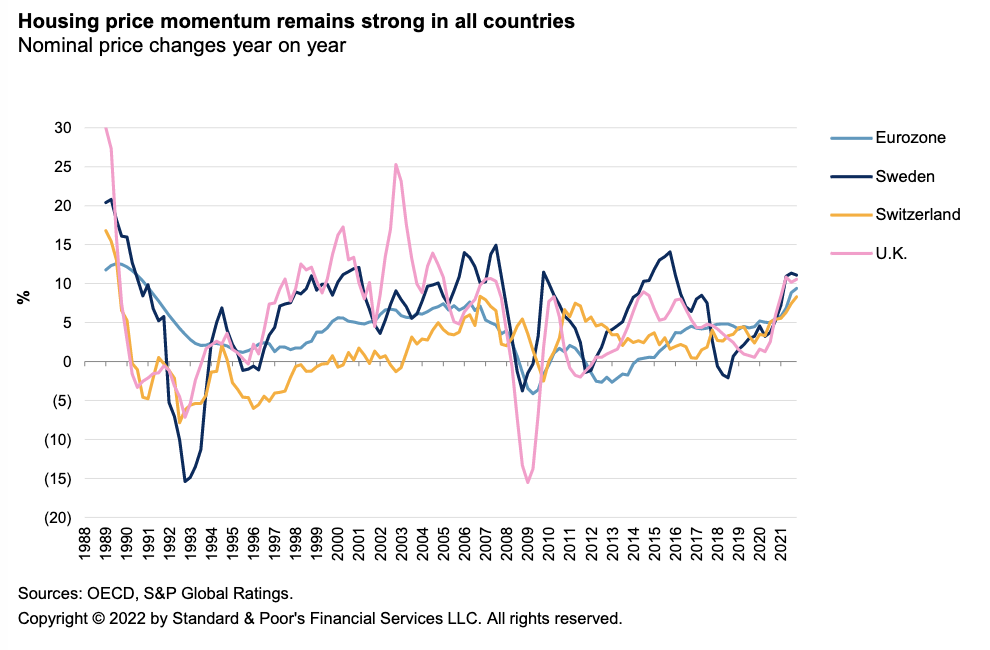

Economic Research: European Housing Markets: Soft Landing Ahead

The strong price momentum in major European housing markets is likely to cool over the next few years amid declining affordability, rising interest rates, and high inflation. However, strong household balance sheets accumulated during the COVID-19-related lockdowns, as well as an influx of refugees from Ukraine, should sustain housing demand and continued, but slower, price growth.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Regulating Crypto: The Bid To Frame, Tame, Or Game The Ecosystem

Regulation is shaping up to be a defining feature of the crypto ecosystem over the next two years. The current market downturn and related collapse of some projects and crypto assets have prompted significant losses, exposed idiosyncratic risks and vulnerabilities within protocols, highlighted systemic concerns within the crypto landscape, and sharpened policymakers' awareness of the need to regulate the crypto and decentralized finance ecosystem.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

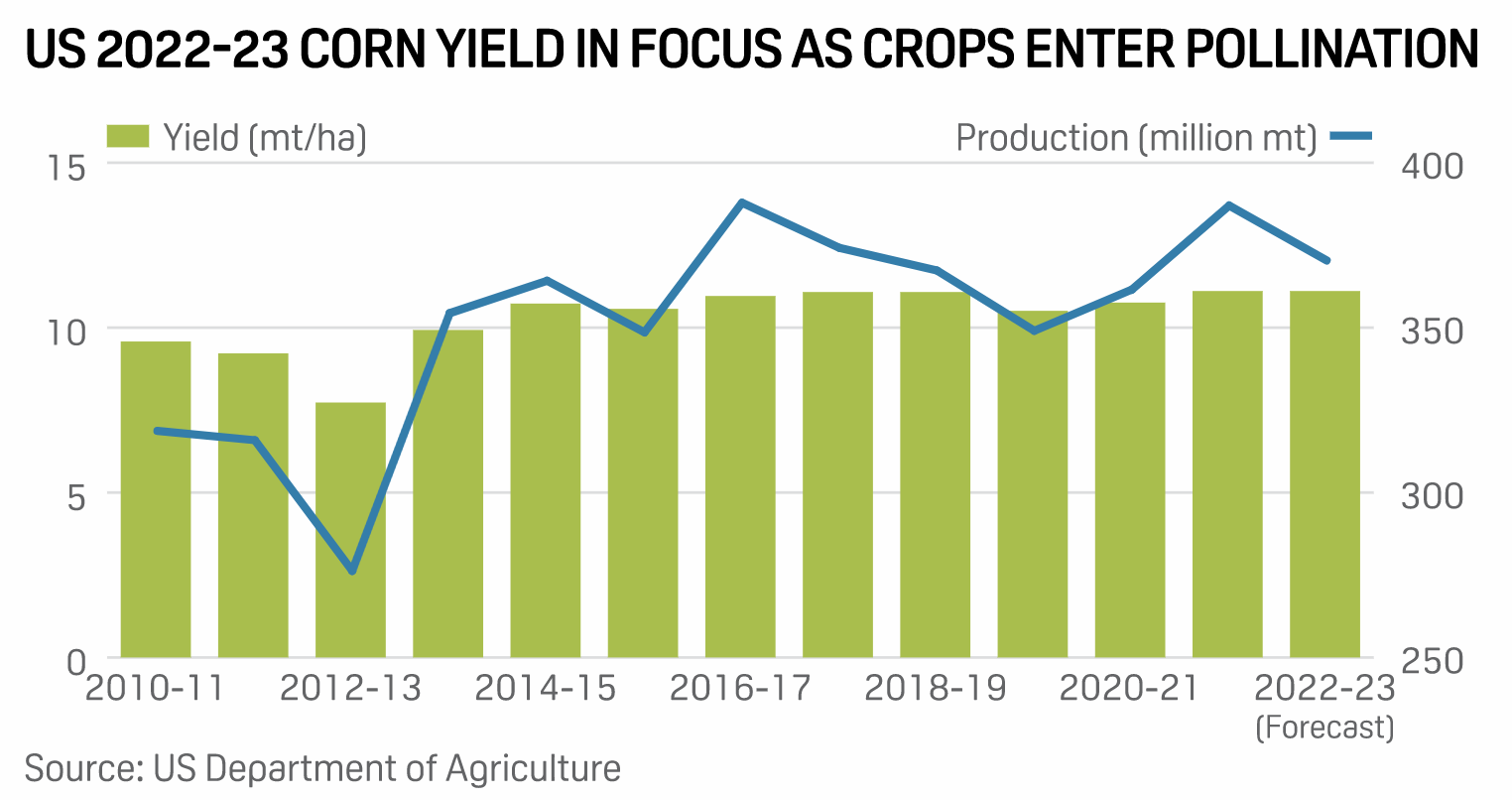

Dry Weather Concerns For U.S. Corn Yield, But Repeat Of 2012 Unlikely: Maxar

Weather conditions are likely to remain unfavorable for corn crops in the key producing states of the U.S. as they enter the crucial stage of pollination in the next few days, which could hurt yields, but any dramatic decline in yields is unlikely at this point, according to Kyle Tapley, senior agricultural meteorologist with Colorado-based private weather service Maxar.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

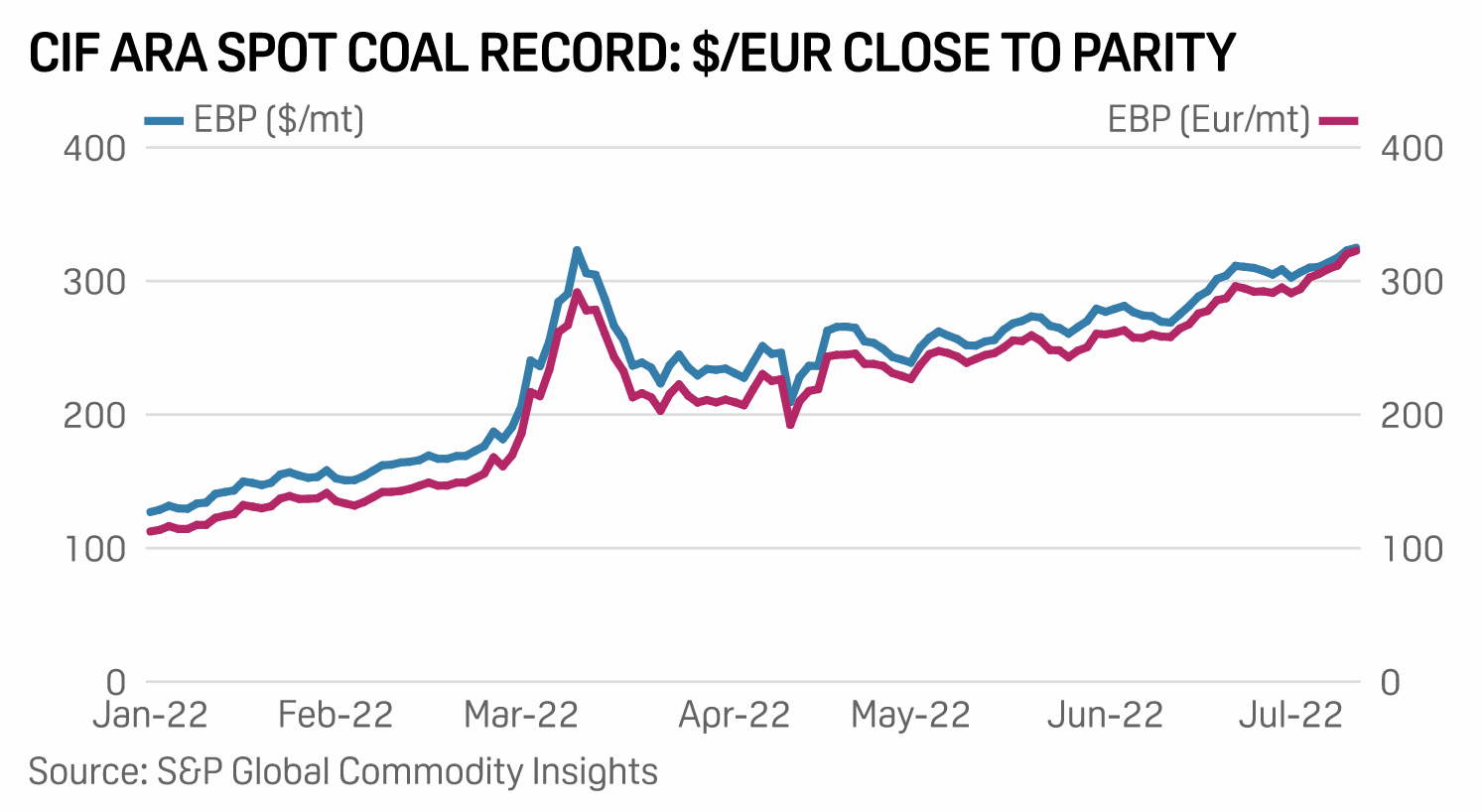

Europe's Emergency Coal Standby Plans 'Have Limited Climate Impact'

European plans to place coal plants on temporary standby would only add 1.3% to EU emissions annually even if run hard, according to energy think tank Ember. Germany, Austria, France, and the Netherlands have announced plans to enable increased coal power generation in the event that Russian gas supplies are halted.

—Read the article from S&P Global Commodity Insights

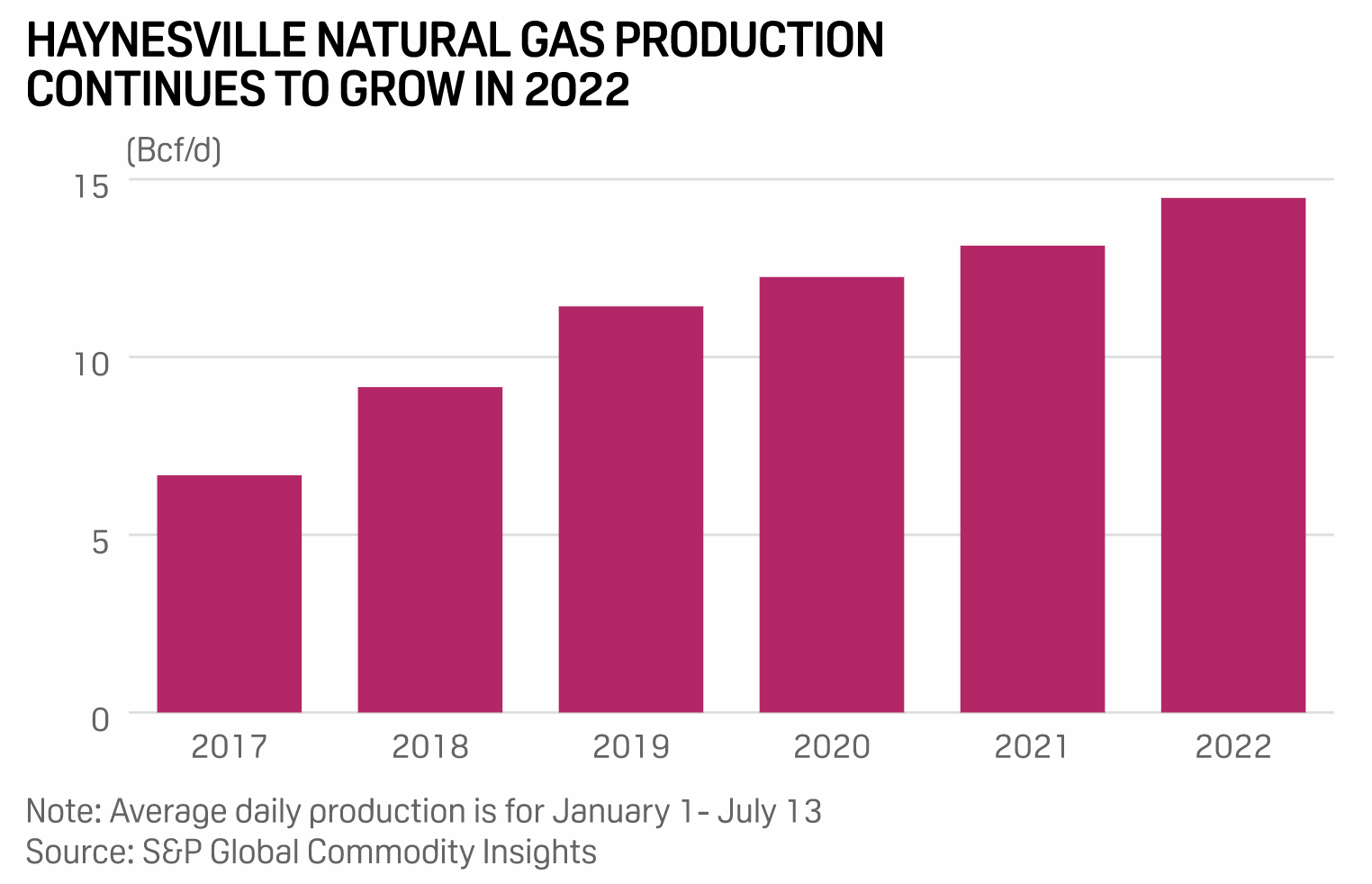

Tellurian Expands Gas Production Assets With Haynesville Acquisition

Tellurian's production unit agreed July 13 to buy Haynesville Shale natural gas producing assets from Ensight IV Energy Partners and EnSight Haynesville Partners for $125 million, growing its upstream footprint in support of its proposed Driftwood LNG export terminal. The assets include around 5,000 net acres in DeSoto, Bossier, Caddo, and Webster parishes in Louisiana, which will bring Tellurian's total acreage in the Haynesville up to 20,000 net acres at close, Tellurian said in a a statement.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 73: Interesting Times In Insurance Technology

AI and ML can help insurers, but the InsurTech world has a lot more going on. Automation is delivering faster quotes and improving customer experience. Senior analyst Thomas Mason joins host Eric Hanselman to look at the impacts of market opinion and interest rate increases. Market worries about tech are hitting stock prices, but investment portfolios could be helped by higher rates. There’s promise integrating insurance into consumer purchasing, similar to what’s happening with financing.

—Read the article from S&P Global Market Intelligence