Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Jan, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Since the onset of the coronavirus pandemic, economists, policymakers, and market participants have measured the health of the global economy based on the health of the global population. In turn, the economic recovery depends, in large part, on the success of the vaccine rollout—which has started with shortages and setbacks.

The International Monetary Fund (IMF) now projects the global economy to expand 5.5% this year and 4.2% next year due to "additional policy support in a few large economies and expectations of a vaccine-powered strengthening of activity later in the year, which outweigh the drag on near-term momentum due to rising infections." In its updated outlook on Jan. 26, the organization projected that the U.S. economy will grow 5.1%, the euro area 4.2%, and China 8.1% this year. But “inequitable distribution of vaccines risks exacerbating financial vulnerabilities, especially for frontier market economies,” the IMF said.

Leaving unchanged its near-zero benchmark federal funds rate—and ongoing monthly purchases of $80 billion in Treasury securities and $40 billion in mortgage-backed securities—the U.S. Federal Reserve said following its first policy meeting under the Biden Administration that “the path of the economy will depend significantly on the course of the virus, including progress on vaccinations.”

In a press conference after the meeting, Fed Chair Jerome Powell acknowledged that “the pandemic still provides considerable downside risks to the economy,” and that “we think it’s going to be a struggle” to combat the slow vaccine rollout in the U.S.

If equitable access to inoculations isn’t prioritized, vaccine nationalism in advanced economies could cost the global economy $9.2 trillion in lost output this year alone, according to a study published Jan. 25 by the International Chamber of Commerce. This would equate to more than 7% of global GDP prior to the pandemic.

“The arrival of effective vaccines can be a major game changer in mitigating the economic, social, and health consequences of the virus in the year ahead,” the global business organization , which represents more than 45 companies across 100 countries, said in its report. “However, evidence to date suggests that access to these vaccines is likely to be highly uneven across countries.”

“Advanced economies have in recent months pursued a policy of securing the global supply of frontrunner vaccines—as a result severely limiting their availability in emerging markets,” the report continued. “Advanced economies that can vaccinate all of their citizens are shown to remain at risk of a sluggish recovery with a drag on GDP if infection continues to spread unabated in emerging markets and developing economies.”

In the face of uneven vaccine distribution, investors have advocated for institutional changes at top pharmaceutical companies to ensure equitable access to medicines in lower-income countries, according to S&P Global Market Intelligence.

Meanwhile, the EU is embroiled in a dispute with AstraZeneca, as the 27-country bloc remains slow to inoculate its populations with limited supplies after the biopharmaceutical giant slashed its deliveries and prioritized providing vaccines to the U.K. In the U.S., President Joe Biden described on Jan. 26 the state of the vaccine distribution program started by his predecessor as being in "worse shape than we anticipated” and that “the brutal truth is it's going to take months before we can get the majority of Americans vaccinated.” The U.S. Centers for Disease Control and Prevention adjusted its guidance on Jan. 27 to allow for individuals to receive the second dose of coronavirus vaccines in as many as six weeks after the first inoculation, up from three to four weeks previously.

In advanced economies, roughly 7% of Americans, 11% of Britons, and 2% of EU citizens have been vaccinated as of this week, according to figures tracked by Our World in Data. Emerging economies such as India and Mexico have vaccinated just 0.1% and 0.5%, respectively, of their populations.

Today is Thursday, January 28, 2021, and here is today’s essential intelligence.

Credit Trends: 'BBB' Pulse: Potential Fallen Angels Continue to Decrease Even as Risks Remain

Two new fallen angels in December raised the total count for 2020 to 49. Meanwhile, global fallen angel default rates ended the year at 1.4%, slightly down from the decade-high of 1.8% in September and far below those seen during 2008-2009 (at 6.5%).

—Read the full report from S&P Global Ratings

Leadership Change That Matters: A Value and Momentum Story

The volatility associated with momentum began to climb in June 2020, peaked in November, and has declined since. Value outperformed momentum over the same time. Volatility remains at elevated levels, indicating that the rotation may continue until momentum again resumes its leadership. Investors should monitor how the volatility of momentum evolves as value stocks have historically led until the volatility of returns to momentum returns to normal. Current volatility remains at high levels, not seen since the Great Financial Crisis.

—Read the full article from S&P Global Market Intelligence

Southeast Asia E-Money Market Report Shows Tech Firms Disrupting Banks

Despite the economic contraction amid COVID-19, electronic money payments are growing in at least three large Southeast Asian markets due to the popularity of reloadable wallets offered by popular e-commerce and ride-hailing firms. Technology firms that combine commerce with payments will seek to extend their dominance from e-money into electronic banking.

—Read the full article from S&P Global Market Intelligence

Street Talk Episode 72: Desire to Compete with Megabanks Driving More U.S. Regional Bank M&A – KBW CEO

The current environment is highlighting the value of scale and should encourage more bank M&A activity, including larger transactions, according to KBW CEO Tom Michaud.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

Sustainable Debt Markets Surge as Social and Transition Financing Take Root

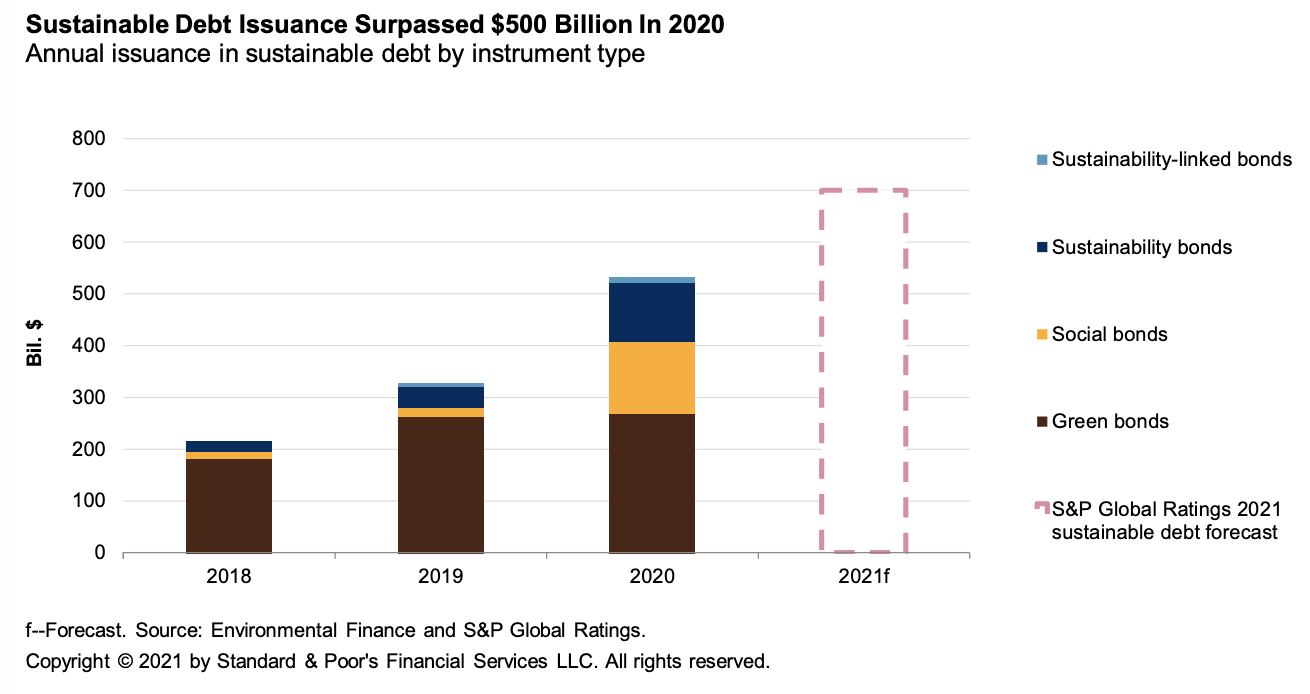

S&P Global Ratings expects issuance of sustainable debt--including green, social, sustainability, and sustainability-linked bonds--will surpass $700 billion in 2021. This would take cumulative issuance past the $2 trillion milestone, from $1.3 trillion as of year-end 2020.

—Read the full report from S&P Global Ratings

Stakeholder Capitalism Gains Traction as Companies Commit to New ESG Metrics

Dozens of the world's largest companies representing trillions of dollars in market capitalization pledged to use a uniform set of "Stakeholder Capitalism Metrics" in their mainstream disclosures amid broader global efforts to streamline and standardize reporting on environmental, social, and governance topics.

—Read the full article from S&P Global Market Intelligence

Transmission Seen as Pivotal to Biden Administration's Climate, Environmental Justice Goals

Ambitious climate goals and a renewed emphasis on environmental justice envisioned by the Biden administration will require a greater focus on overcoming obstacles to getting much needed transmission expansions and upgrades built, the head of the WIRES trade group said.

—Read the full article from S&P Global Platts

U.S. Envoy Kerry Takes Aim at China Over Unclear 2060 Climate Pledge

China's plans to achieve carbon neutrality by 2060 lack clarity and appear to be undermined by the country's financing of coal-fired power station construction around the world, the US' new presidential envoy for climate, John Kerry, told the online version of the Davos World Economic Forum Jan. 27.

—Read the full article from S&P Global Platts

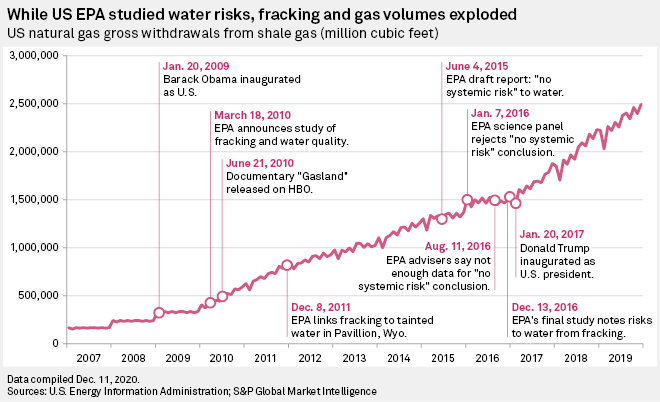

Like Fracking Under Obama, Mining Poised to Grow During Biden Years

Much like the last time Democrats took control of the White House, President Joe Biden may find himself needing to support increased access to a controversial resource to achieve key policy goals.

—Read the full article from S&P Global Market Intelligence

Stable Oil Market Will Enable Smoother Energy Transition: OPEC Secretary General

Stability in the oil market will be critical to the energy transition, OPEC Secretary General Mohammed Barkindo said Jan. 27, arguing that volatile prices would harm the global economy and dampen investment needed to meet future demand across all sources.

—Read the full article from S&P Global Platts

Insight Conversation: Sadan Kaptanoglu, BIMCO

The president of BIMCO, the world's largest shipping industry organization, and managing director of Turkey-based Kaptanoglu Shipping, spoke to S&P Global Platts shipping associate editor, Charlotte Bucchioni, about the lessons of 2020 and the challenges facing the industry.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language