Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Jan, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

As tensions between Russia and Ukraine intensify, the world’s diplomatic balance may soon be thrown off kilter—destabilizing trade, energy, and geopolitical relationships.

Russia’s aggression toward Ukraine, and the NATO reaction, are sending energy risks surging. If Russian President Vladimir Putin orders the 100,000 troops already mobilized around Ukraine to attack the country, the U.S. may impose stringent sanctions on Russia’s economy. Europe could lose critical energy supplies and global oil markets could see crude prices surge.

Russia is a big exporter of oil and petroleum products to the U.S., creating complex considerations for the Biden Administration. Because Europe depends on Russia for the majority of its crude oil, natural gas, and solid fossil fuel supplies, the Russia-Ukraine tensions have stirred anxiety within Europe over potential outcomes—if financial sanctions are imposed on Russia or Nord Stream 2 or if Russia slashes Europe’s energy supplies or cuts capacity through Ukraine. Some market participants see Germany’s strategic energy partnership with Russia over the Nord Stream 2 pipeline as a conflict of interest in diplomatic dealings involving Ukraine. Global oil market participants are watching how Russia’s actions will affect its output as a major oil producer within the OPEC+ alliance. An S&P Global Platts analysis found that European oil markets and refiners are the most exposed to potential tougher Western financial sanctions or pipeline interruptions that would follow Russia’s possible invasion of Ukraine.

"Commodity prices could soar if the Russia-Ukraine crisis escalates … As tensions between Russia and Ukraine grow, so does the risk that it spills over into global commodity markets. Russia is a commodities powerhouse, with it being a key supplier of energy, metals, and agri[culture],” Warren Patterson, head of commodities strategy at ING Economics, told S&P Global Platts on Jan. 21. "Tough sanctions would rattle commodity markets. It appears that a number of commodity markets are starting to at least price in some geopolitical risk around the growing tension.”

While the U.S. has warned Russia that it will face “massive consequences” if it continues on its path, the world’s most powerful economy hasn’t yet levied any sanctions. The U.S. Treasury Department sanctioned four Ukrainian officials for helping Russia to destabilize Ukraine on Jan 20. The U.S.’s previous sanctions against Russia, announced on April 15, 2021—which prevented American institutions from purchasing primary, ruble-denominated sovereign debt after June 14—marked the first of more-restrictive economic or energy sector sanctions to come, according to S&P Global Platts Analytics. In opposition to Nord Stream 2, a 764-mile (1,230-kilometer) pipeline that would carry gas to Germany and central Europe, the Trump Administration threated sanctions in July 2020 against investors funding the project. Now that the pipeline is completed but not yet certified nor in operation, the Biden Administration warned in December that the U.S. would impose harsh economic sanctions to block the startup of Nord Stream 2 if Russia invades Ukraine.

"Nord Stream 2 is a geopolitical project," Yuriy Vitrenko, the CEO of Ukraine’s largest oil and gas company Naftogaz Ukrainiy, told delegates at the S&P Global Platts European gas and LNG conference in November. “Russia wants to essentially punish Ukraine for its European choice, and that is why they are building pipelines: just to bypass Ukraine."

Despite Russia asserting that it remains a "reliable guarantor of European energy security,” the European Commission announced yesterday that it is exploring increasing gas deliveries from other supply partners, according to S&P Global Platts. Tensions between the EU and Russia have already simmered over Europe’s claim that Russia has contributed to the energy crisis that has sent European and U.K. power prices soaring by booking only minimal gas supply capacity to supply greater amounts of gas to Europe during the crunch.

"We do not anticipate Russia voluntarily cutting off large energy supplies to Europe given the lack of a major disruption in 2014-15 [when Russia previously invaded Ukraine], its desire to remain a dependable supplier, and the fact that such a move could unite the U.S. and Europe," Paul Sheldon, chief geopolitical adviser at S&P Global Platts Analytics, said in a special political risk report published on Jan. 18.

Military escalation could affect 250,000 barrels per day of oil through the Southern Druzhba pipeline in Ukraine, but export capacity at alternate ports and pipelines could provide a sufficient offset, according to S&P Global Platts Analytics.

"There's an obvious fear premium in the [crude] complex especially on account of the latest escalation of tensions between the U.S. and Russia, on account of Ukraine … U.S. sanctions on Russia are currently being ruled out and a military conflict is not our base case, but the oil complex is currently ultra-sensitive to even the slightest hints of a supply disruption," Vandana Hari, the founder and CEO of the global energy market research firm Vanda Insights, told S&P Global Platts yesterday. "The underlying supply concerns are also strong, as OPEC+ have been falling sizably short of their monthly targets and the global spare capacity and inventory cushion is also thin.”

Today is Tuesday, January 25, 2022, and here is today’s essential intelligence.

Economic Research: Limited Supply Poses A Barrier To The U.S. Homebuying Dream

U.S. homebuying activity took a breather in December amid the holiday buying season. After existing home sales climbed higher over the prior three months, in December they declined by 4.6% from the previous month to a seasonally adjusted annualized rate of 6.18 million—below consensus expectations of 6.43 million. Actual existing home sales rose to 6.12 million in 2021 from 5.64 million in 2020, reaching their highest annual level since 2006, helped by low interest rates, a strong jobs market, and high stock prices that supported healthy household balance sheets.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

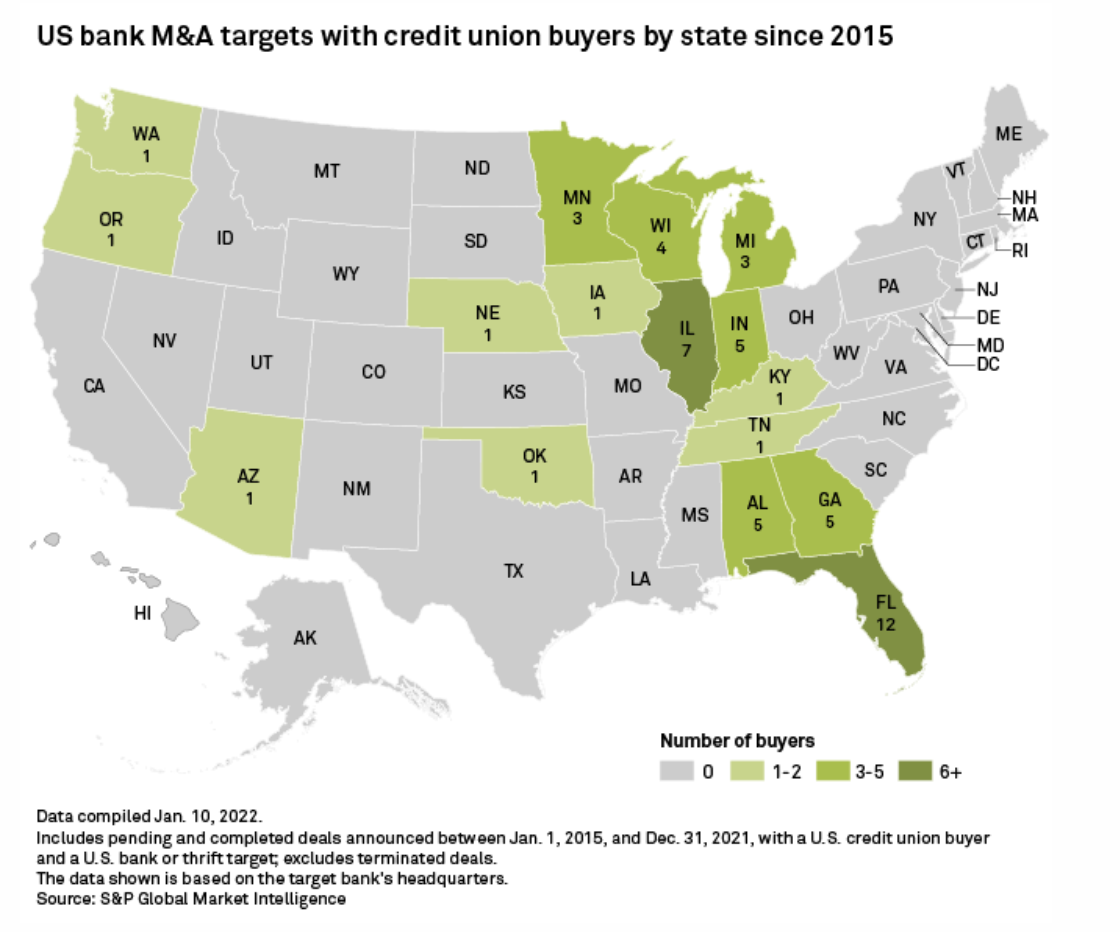

Record Credit Union-Bank M&A Foreseen For '22; MassMutual Reinsurance Deal

Thirteen credit union purchases of banks were announced in 2021 for a total of $5.89 billion in total assets among the targets. Two deal advisers that work on credit union acquisitions of banks anticipate around 20 such announcements in 2022. U.S. bank M&A activity is expected to remain strong in 2022. Texas remains a likely hotbed of activity with its growth profile and large number of community banks. Banks have reduced their reliance on certificates of deposits and borrowings to minuscule levels and the balances seem unlikely to rebound soon despite the prospect of higher interest rates on the horizon.

—Read the full article from S&P Global Market Intelligence

Access more insights on the capital markets >

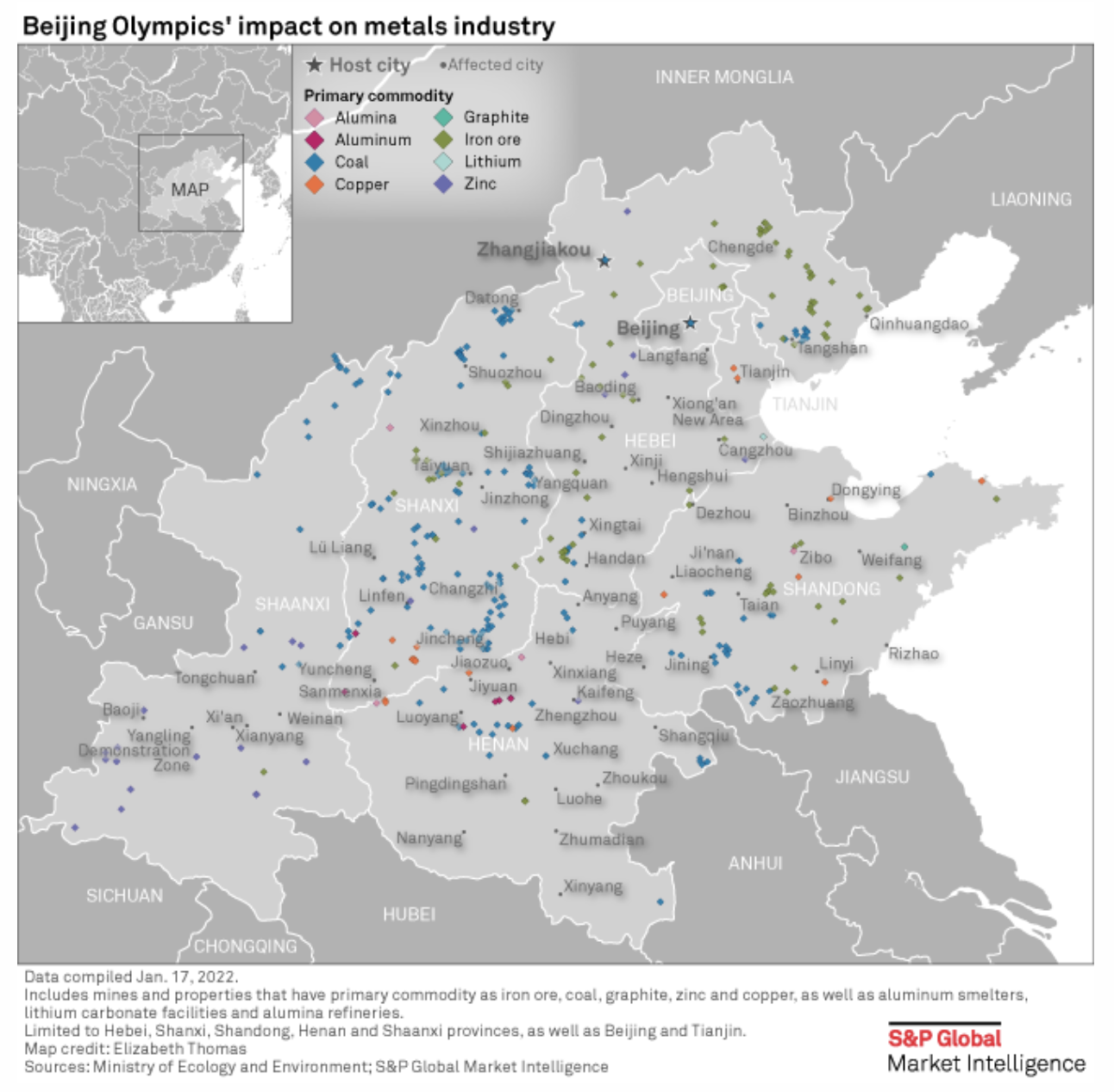

China's Goal For 'Green' Olympics Squeezes Short-Term Metal Supplies

To improve air quality during the Beijing Winter Olympic and Paralympic Games, scheduled for Feb. 4 to March 13, China's Ministry of Ecology and Environment included more cities in its annual winter antipollution campaign in September 2021. A total of 64 cities near Beijing and co-host city Zhangjiakou are subject to stringent environmental regulations from Oct. 1, 2021, to Mar. 31, 2022, up from 28 cities in the past few years. The affected provinces include Hebei, China's biggest steel producer, as well as coal mining hub Shanxi, and key aluminum producers Shandong and Henan.

—Read the full article from S&P Global Market Intelligence

Access more insights on global trade >

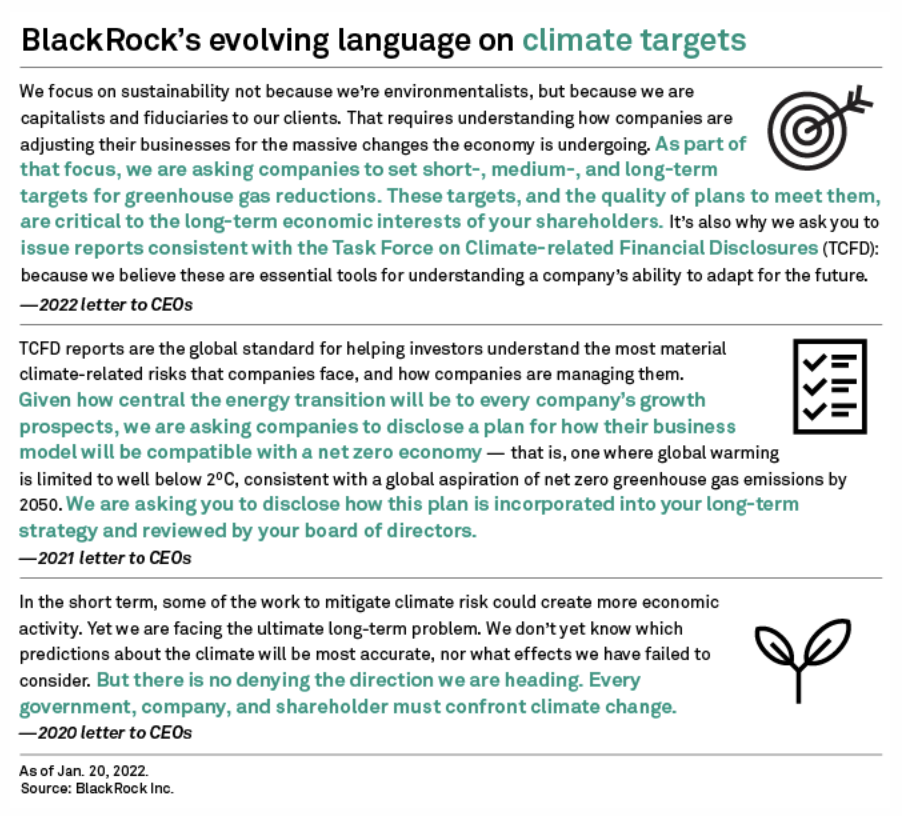

How Blackrock CEO’s Latest Letter To Execs Will Shape The ESG Conversation

Larry Fink, influential financier and head of the investment firm BlackRock Inc., has just raised the corporate stakes on climate change—and chief executives across a wide swath of sectors are likely to pay heed. BlackRock is the world’s largest asset manager with a staggering $10 trillion in assets under management. As a major shareholder in companies ranging from Apple Inc. and Microsoft Corp. to Proctor & Gamble Co. and The Walt Disney Co., BlackRock’s macroeconomic views command attention in boardrooms across the world.

—Read the full article from S&P Global

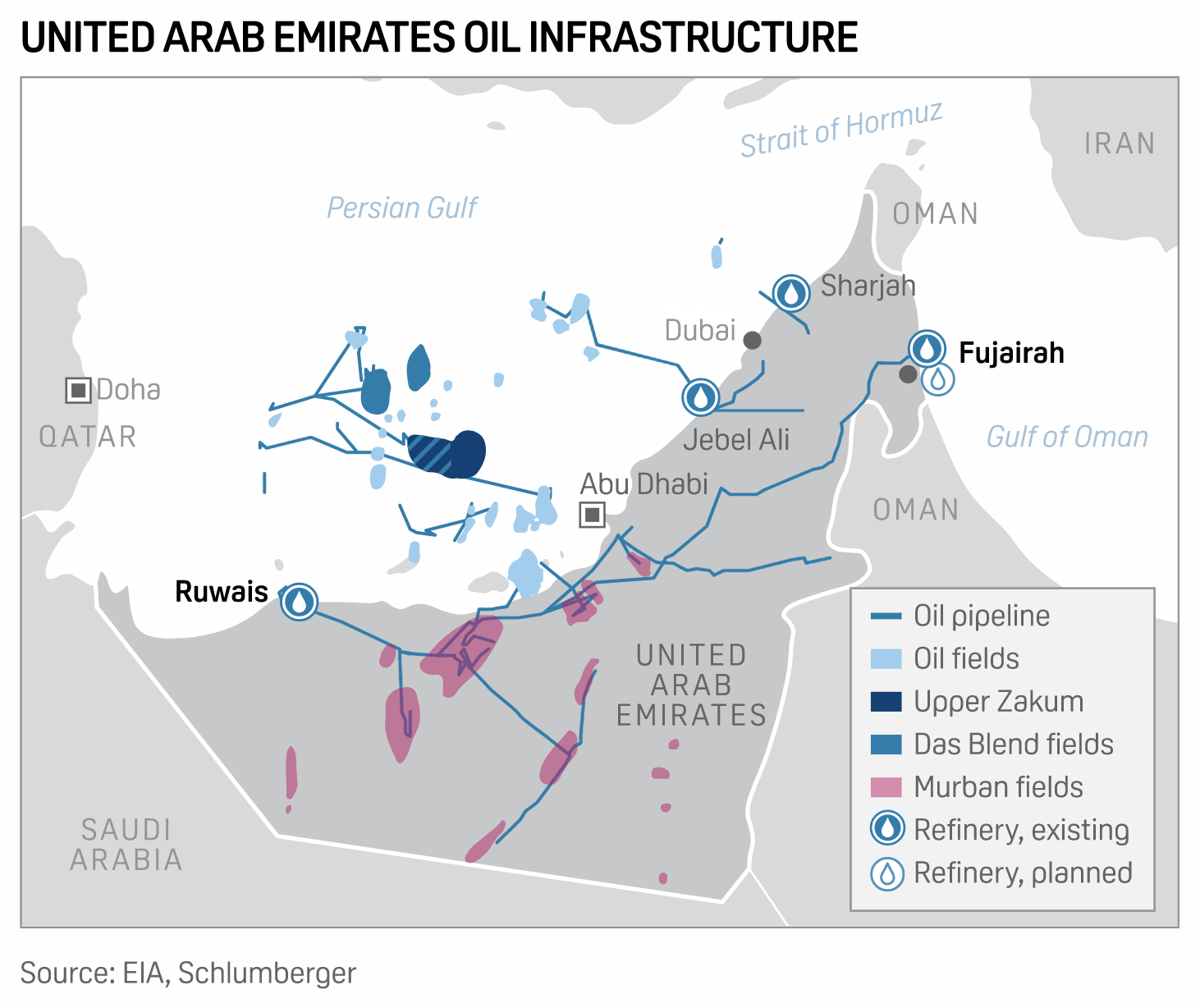

Factbox: Abu Dhabi Missile Attack A Reminder Of Risks To UAE Energy Infrastructure

A foiled Houthi missile attack on Jan. 24 directed at OPEC's third-largest oil producer, the UAE, has highlighted the ongoing geopolitical risks to the oil market. The intercepted attack followed a Jan. 17 drone and missile strike on an Abu Dhabi National Oil Co. fuel depot in the industrial zone of Musaffah, which killed three people. The incidents were "a reminder that Iran's regional proxies will continue to act aggressively, with or without direct guidance from Tehran, while also demonstrating a clear ability to strike sensitive targets in the GCC," said Paul Sheldon, chief geopolitical adviser for S&P Global Platts Analytics.

—Read the full article from S&P Global Platts

Access more insights on energy and commodities >

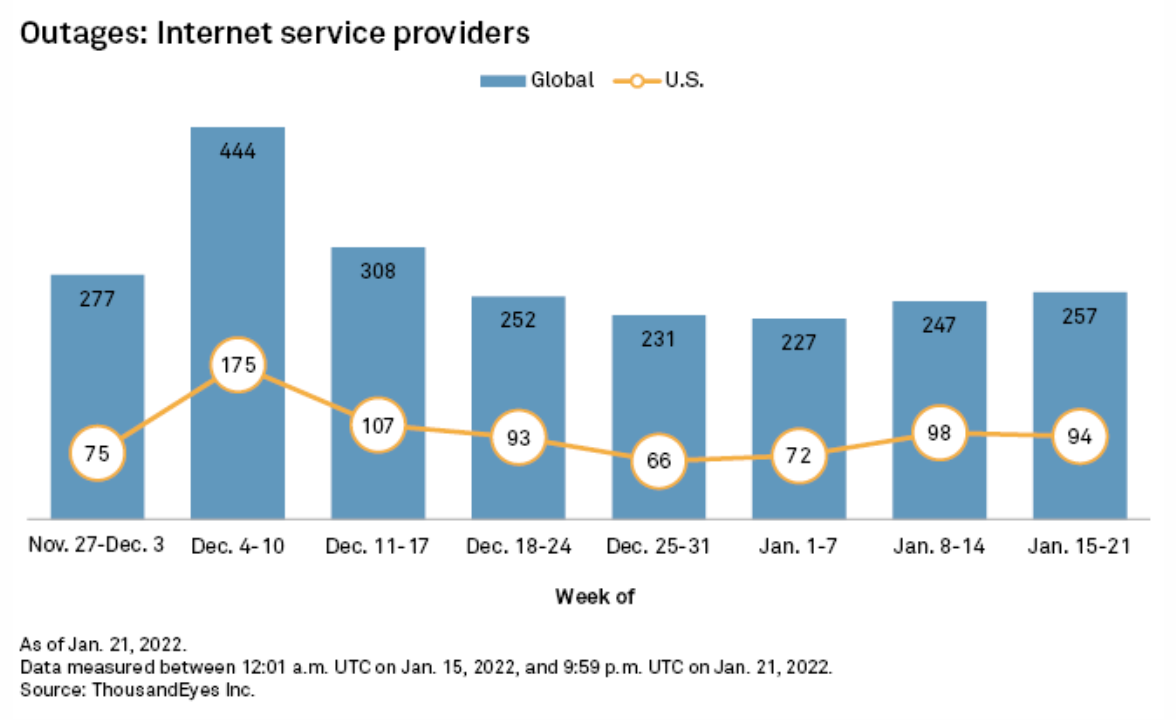

Global Internet Outages Increase 4%, U.S. Disruptions Down 4% In Mid-January

Global internet outages nudged up 4% to 257 in the week of Jan. 15, marking the second consecutive weekly increase since the preceding week, according to data from ThousandEyes, a network-monitoring service owned by Cisco Systems Inc. U.S. outages, meanwhile, dipped 4% to 94 from 98 in the prior week. The current total comprised 36% of all global disruptions, down from 40% in the week of Jan. 8. ThousandEyes detected two notable interruptions last week.

—Read the full article from S&P Global Market Intelligence

Access more insights on technology and media >

Written by Molly Mintz.