Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 9 Feb, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

While Asia was first to go into lockdown and now has managed to largely gain control of the crisis, it isn’t the first region to experience a recovery.

“The popular narrative is Asia is leading the recovery and digging the world out of a big hole. This is not quite right,” S&P Global Ratings’ Chief Asia-Pacific Economist Shaun Roache said in a recent report. “Demand from the rest of the world is helping Asia out of the hole. This is mainly due to cautious Asian consumers despite the resilience of labor markets,” which have benefited from policies that spurred hiring rebounds following short-but-strict lockdowns in Asian countries.

China’s economy grew 2.3% last year, according to government figures released last month—making the Asian country the only economy in the world to grow during the throes of the coronavirus crisis. China was the first country to suffer from the pandemic and the demand destruction brought about by restrictions on economic activity and mobility.

Growth in China has slowed largely due to consumers’ caution, according to Mr. Roache. More than one year after the first case of COVID-19 was confirmed in the country, consumer spending is rising more slowly than activity before the pandemic without strong evidence of pent-up demand. Chinese consumers waiting for the economy to recover to start spending is prompting an unbalanced recovery. While infrastructure investment, property sales, and manufacturing exports are swelling, retail sales and travel remain weak.

“The good news is that the government appears to be a little bit more tolerant of slower growth going forward. The growth target seems to be politically less important than it used to be,” Mr. Roache told S&P Global’s Essential Podcast this week.

“There is a tradeoff between growth and these other very important factors,” Mr. Roache said on the podcast. Over the long-term, the country may “focus on what really matters for the Chinese economy, which is making sure that risks in the financial system are managed and controlled, that the energy transition continues, and that consumer welfare continues to improve in a broad and expansive way, including things like health and education services—rather than this singular focus on real GDP growth, which frankly hasn't served China too well, at least over the last 10 years.”

Prior to the pandemic, China appeared to be growing comfortable with its new leadership status on the international stage. This was both exacerbated and tested by the crisis that gripped the global economy for most of 2020, just as an increasingly isolationist America retreated. Chinese President Xi Jinping aided the World Health Organization and set a 2060 net-zero carbon emissions target—extraordinary actions that would have perhaps been unheard of in more precedented times.

“We are now seeing this transition towards this more balanced perspective on Chinese development. And that for me, I think is a very positive development—but it's not only positive for China. I think this is also positive for the world,” Mr. Roache told the Essential Podcast. “It means that we're going to have a more stable Chinese economy and perhaps most important of all, we're going to have a greener Chinese economy.”

Risks across Asia remain. If the region fails to meaningfully contribute to the global demand recovery, S&P Global Economics foresees that the global economy’s overall recovery will overly dependent on the U.S. and Europe to maintain steam. If that happens, Asia could experience international issues, including continuing trade tensions with the U.S., and domestically be stuck with both low economic growth and inflation over the long-term.

Today is Tuesday, February 9, 2021, and here is today’s essential intelligence.

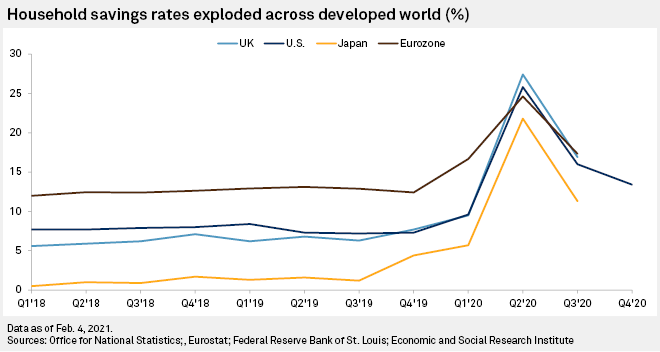

Consumers to Unleash Trillions of Dollars in Excess Savings When Pandemic Ends

Developed economies have been hit particularly hard by the coronavirus pandemic partially because they are so dependent on consumer spending. But elevated household savings rates and accelerating vaccination programs suggest a deluge of spending power that was stored up during the pandemic in those economies will be unleashed in 2021 and 2022.

—Read the full report from S&P Global Market Intelligence

Cannabis Company Valuations Rise as U.S. Reform Efforts Accelerate

With greater momentum behind reform efforts, shares of cannabis companies are on the rise. The median price change for shares of constituents in the North American Marijuana Index was a 102.2% increase for the year ended Feb. 3.

—Read the full report from S&P Global Market Intelligence

SocGen, to Preserve Franchise, Must Walk Cost-Cut Tightrope

Société Générale SA's retail and trading revamps will cut costs, helping offset revenue pressure from long-term ultralow interest rates, but the French bank needs to ensure it does not lose its competitive edge against peers, according to analysts.

—Read the full report from S&P Global Market Intelligence

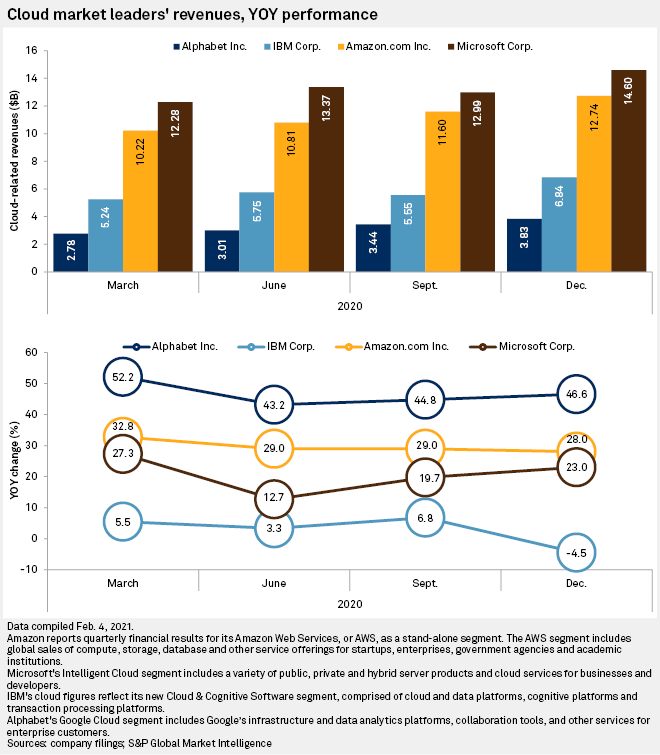

COVID-19 Continues to Drive Demand for Cloud Platforms in Q4'20

Major cloud providers in the U.S. saw year-over-year revenue growth in the fourth quarter of 2020, as pandemic-driven restrictions accelerated demand for the cloud to support essential digital solutions such as remote work and e-commerce, as well as entertainment platforms such as video streaming and online gaming

—Read the full report from S&P Global Market Intelligence

Internet Outages During Business Hours Decline in Early February

Although global internet outages in the first week of February were relatively unchanged compared to the prior week, there was a notable reduction in outages during local business hours, according to data from ThousandEyes, a network-monitoring service owned by Cisco Systems Inc.

—Read the full article from S&P Global Market Intelligence

Infotech M&A Themes Shift in 2021, but Advisers Keep Busy in January

A run of public-market transactions will keep the information technology deal table greased in the first month of 2021, with advisers from Goldman Sachs Group Inc. set to cash another check for their consultation in the industry.

—Read the full article from S&P Global Market Intelligence

'Stakeholder Capitalism,' The Buzzword At Davos

The latest episode of ESG Insider dives into stakeholder capitalism—what it means and what people were saying at the World Economic Forum's annual Davos conference. You'll also hear an interview with the World Economic Forum's Project Lead for ESG, Emily Bayley. She describes the story behind a set of new stakeholder capitalism metrics that more than 60 major companies just agreed to use in their mainstream reporting, such as annual reports and proxy statements.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Market Intelligence

Amazon Workers' Union Vote in Alabama Could Spark More Organized Labor Efforts

Thousands of Amazon.com Inc. employees who work at an Alabama fulfillment center will vote in the coming weeks on whether to establish a union, an effort labor experts say could spark more organized labor initiatives among the e-commerce company's U.S. employees.

—Read the full article from S&P Global Market Intelligence

Mandatory Climate-Risk Disclosure to Pose Challenges for Hong Kong Fund Managers

Uneven proficiency in assessing climate-related risks and transparency of portfolio companies will pose challenges for many fund managers in Hong Kong as the city is about to make environmental disclosures mandatory, experts say.

—Read the full article from S&P Global Market Intelligence

How Russian Companies Are Responding to Growing ESG Pressures

Many large rated Russian companies are well placed to tackle immediate ESG challenges. Indeed, they are feeling pressure from international investors and are going well beyond the nascent and unambitious domestic ESG regulations.

—Read the full article from S&P Global Ratings

Biden's Decision to Rejoin Paris Agreement Complicates U.S.-Mexico Relationship on Energy

U.S. President Joe Biden make good on his campaign promises and rejoined the Paris Agreement upon taking office, a move that has huge implications for Mexico in particular, given the current energy strategy of the government, which focuses on fossil fuels.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

How COVID-19 Affected Transport Fuel and Refineries in Europe

The coronavirus pandemic has had an unprecedented impact on the European transport sector. Millions were confined to their homes, airplanes were grounded and motor traffic came to a standstill. Product stocks rose as refineries ramped up processing of cheap crude at the start of the year.

—Read the full report from S&P Global Platts

Russia's Turkstream Link Continues to Redraw SE European Gas Map

The startup in 2020 of the 31.5 Bcm/year TurkStream pipeline triggered an unprecedented reshuffle in the way Russian gas reaches southeast Europe, and now with the start of flows via TurkStream's onshore expansion, the picture is shifting once again.

—Read the full article from S&P Global Platts

Market Movers Asia Feb 8-12: Myanmar Energy Investments in the Spotlight Amid Coup

The highlights on S&P Global Platts Market Movers in Asia, with Senior Oil News Editor Surabhi Sahu: Myanmar coup threatens energy investments, U.S. LPG flows to Asia to fall as arbitrage narrows, U.S. LNG cargoes diverted to Europe with arb closed, metals markets subdued ahead of Lunar New Year holidays, spotlight on China's corn imports ahead of WASDE report.

—Watch and share this Market Movers video from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Language