Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 Feb, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

LNG Market Provides a Lesson in Unintended Consequences

It started with the Fukushima nuclear disaster in 2011. Responding to public outrage, Japanese authorities shut down Japan’s remaining nuclear energy facilities. Looking for an alternative energy source, Japan turned to coal and natural gas. With few domestic sources, liquefied natural gas needed to be imported in massive quantities, which helped the Asian LNG market to develop. By 2020, four Asian countries (including Japan) accounted for 60% of global LNG demand. In 2022, Russian President Vladimir Putin decided to invade neighboring Ukraine. In the aftermath, the trade in natural gas between Russia and Europe collapsed. By helping to bridge the gap, the US became the world’s largest exporter of LNG. As a result, US energy exports have reached unprecedented heights under an administration publicly committed to reducing fossil fuel usage.

In the early days of Russia’s invasion of Ukraine, the Biden administration worked with the energy industry to boost LNG supplies, concerned an energy shortage could hit during the European winter. However, as natural gas markets have realigned and reserves in Europe have remained healthy through several winters, the US government is reexamining its support of LNG exports.

On Jan. 26, the Biden administration said it will "pause" issuing new LNG export permits pending additional guidance from the US Energy Department on the likely economic, environmental and national security impacts of further exports. The review centers on new LNG exports to countries that do not have a free trade agreement with the US, affecting most of the global LNG market. The move was criticized by the energy industry, prominent trading partners and Republican lawmakers. On Feb. 1, Republicans in the US House of Representatives introduced legislation to strip authority for LNG export reviews from the DOE.

German gas industry group Zukunft Gas criticized the pause on new permits. The US has been the leading LNG supplier to Germany, providing 82% of total imports, according to S&P Global Commodity Insights. Japanese Minister of Economy, Trade and Industry Ken Saitō also criticized the decision and its potential impact on global LNG trade. On the other hand, a spokesperson for the European Commission insisted that the new policy would not have any short- or medium-term impacts on the EU's security of supply.

Despite the pause in approvals, US LNG exports in January approached record highs, climbing to 8.56 million metric tons as of Jan. 31. This capacity is poised to double over the next five years. But sector experts worry that the policy could create uncertainty in LNG markets and threaten the longer-term market share of US LNG. Trade partners may reassess supply risks if LNG trade becomes a political issue in Washington’s partisan political environment.

Today is Thursday, February 8, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

Global PMI Signals Lowest Inflation Rate Since October 2020

Average prices charged for goods and services rose globally at the slowest rate since October 2020, according to the January worldwide PMI surveys, signaling a cooling of worldwide inflation. Service sector price increases slowed, though some stickiness was observed for goods prices, the latter linked in part to higher shipping costs amid supply chain delays. However, the overall rate of inflation also remains somewhat elevated by historical standards due to wage pressures continuing to run above pre-pandemic levels.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

A Primer On Spain's RMBS Market

In this Spanish residential mortgage-backed securities (RMBS) primer, S&P Global Ratings provides a comprehensive guide to the fundamentals of both the Spanish housing and mortgage markets. It also describes the key features and risks of loan origination, and summarizes the Spanish securitization legal framework. Finally, S&P Global Ratings compares the features of prime and reperforming RMBS transactions and compares the RMBS market with the Spanish covered bond market.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Listen: Will US Confront Iran? Analyst Says It Must To Stop Houthi Attacks On Major Oil Shipping Route

Threats to the flow of crude supplies have worsened in recent weeks with oil and petroleum products tankers among targets struck by Yemen's Iran-backed Houthi rebels. Foreign policy and international energy specialist Brenda Shaffer, a professor at the US Naval Postgraduate School, joined the podcast to discuss not only the latest developments in the Red Sea but how we got here. She spoke about the Houthi rebels’ origins, their impact on global oil supplies and prices and the US posture towards their sponsor — Iran.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

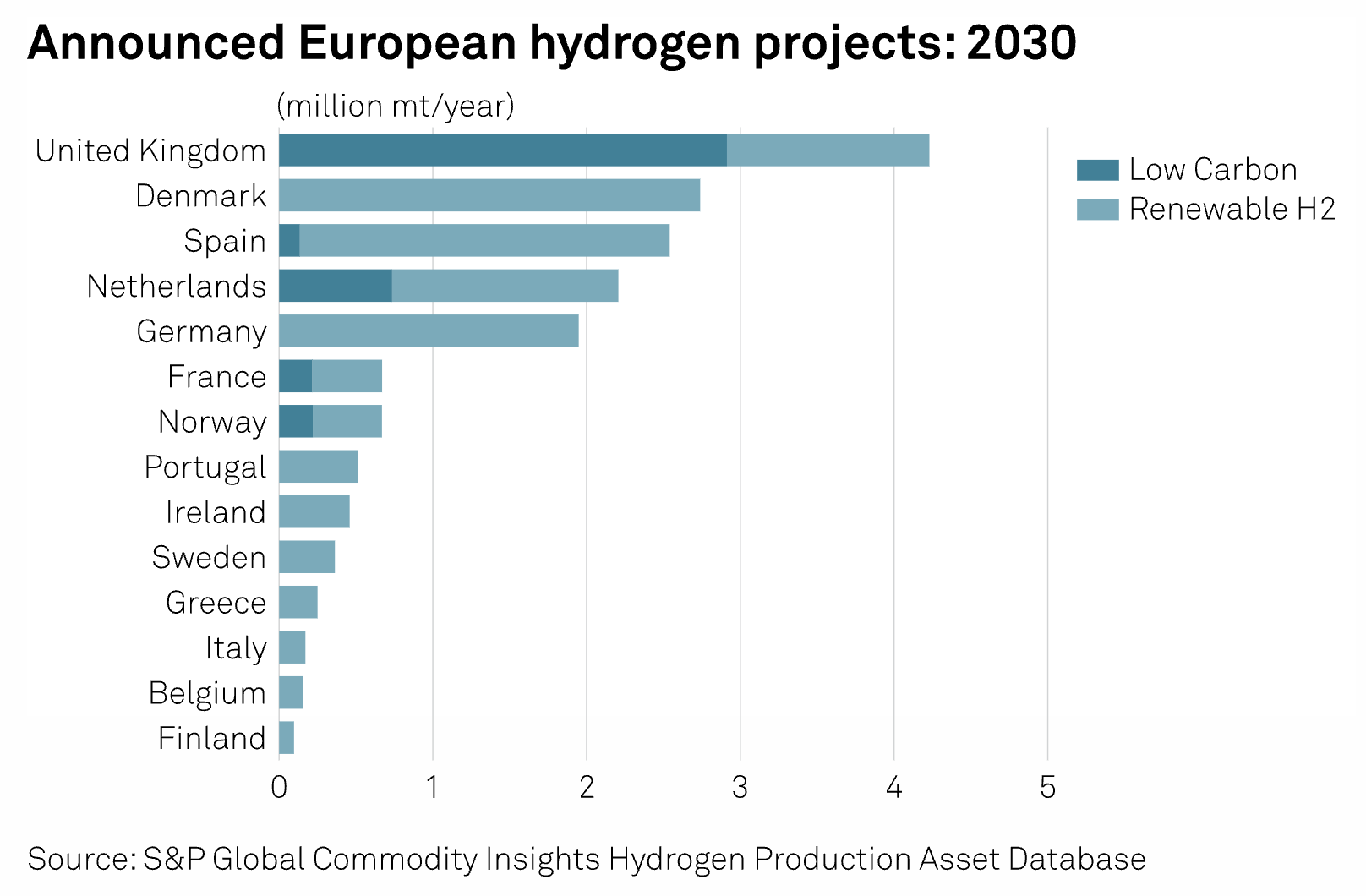

Pipeline Network Crucial To Europe's Bold 2030 Hydrogen Plans

The planned European Hydrogen Backbone pipeline system is becoming increasingly critical to the success of the continent's nascent clean hydrogen economy, with major production project developers orienting plans around the network and offtakers opening tenders seeking pipeline deliveries. The Hydrogen Backbone is expected to reach 31,500 km by 2030, with 40 concrete projects managed by the EHB's transmission system operator members set to be commissioned this decade.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

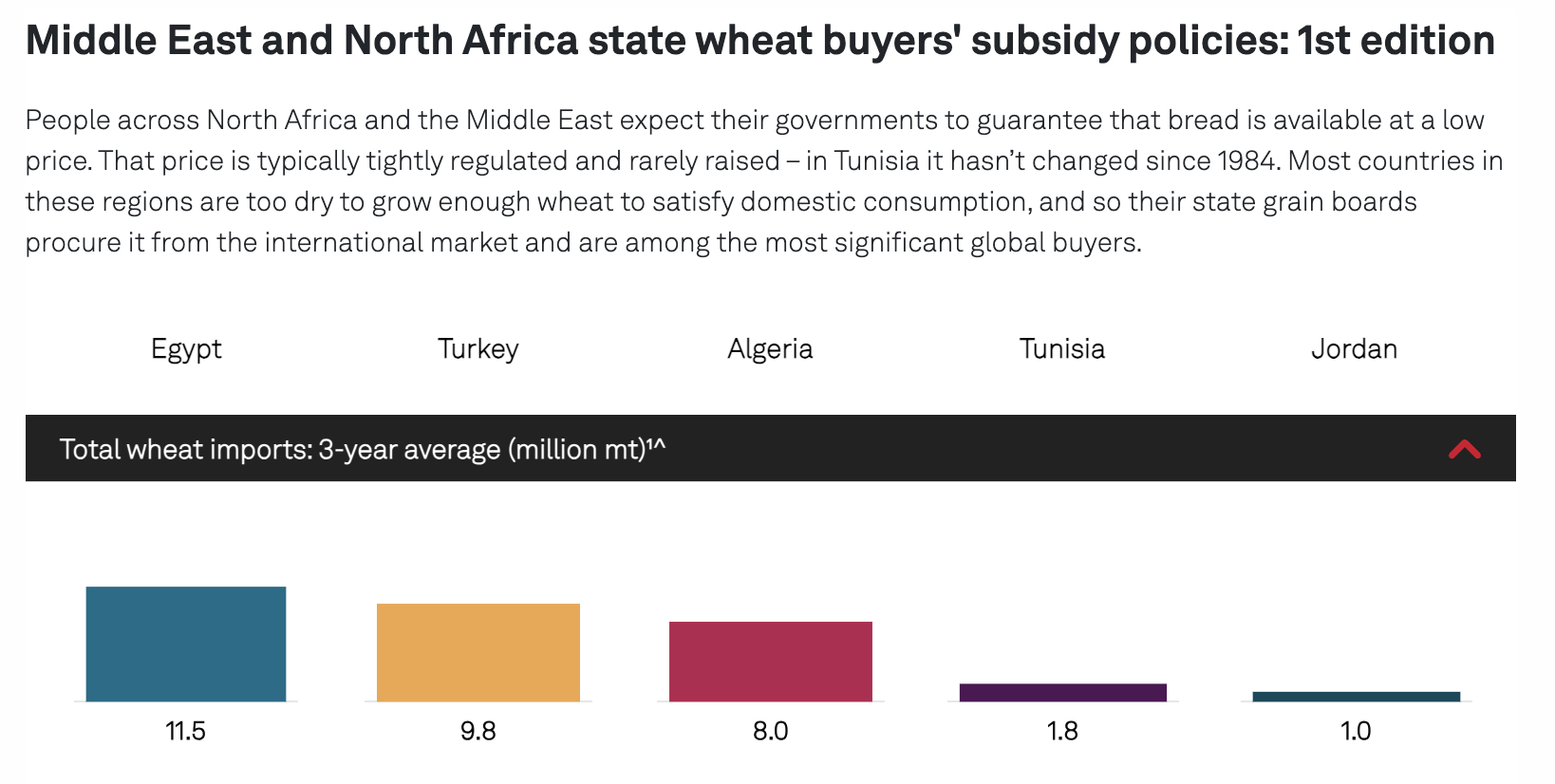

Middle East And North Africa State Wheat Buyers' Subsidy Policies: Edition 1

People across North Africa and the Middle East expect their governments to guarantee that bread is available at a low price. That price is typically tightly regulated and rarely raised — in Tunisia it hasn’t changed since 1984. Most countries in these regions are too dry to grow enough wheat to satisfy domestic consumption, and so their state grain boards procure it from the international market and are among the most significant global buyers.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Open Data Portals For Community-Driven AI Apps, Sustainability Validation

As the era of generative AI permeates industry, the public sector could benefit from the use of their data portals to support a range of city-specific AI applications, especially to help validate critical green initiatives. Open data portals can have meaningful impact across city operations, from enhancing transparency to validating initiatives around sustainability and emissions.

—Read the article from S&P Global Market Intelligence