Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 7 Feb, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Economic Diversification Buoys Saudi Banks as Oil Prices Stagnate

In the past, a prolonged period of lower crude production and moderate oil prices might have spelled problems for Saudi banks. However, economic diversification away from the energy sector and government support for Vision 2030 projects mean that many banks in Saudi Arabia appear set for another year of credit growth. On the horizon, tighter liquidity conditions, energy transition risk and ongoing geopolitical tensions in the region may create challenges. At present, all Saudi banks have stable credit outlooks, according to S&P Global Ratings.

GDP growth is expected to accelerate in Saudi Arabia in 2024, although higher interest rates and OPEC oil production cuts will constrain near-term growth. Economic growth in non-oil sectors and credit growth in Saudi Arabia will remain dynamic due to the continued implementation of Vision 2030 — the Saudi government’s initiative to support increasing economic, social and cultural diversification. Oil prices are expected to stay largely stable during 2024, with some volatility related to supply-demand dynamics. This will continue to support government expenditures, a not-insignificant driver of growth in Saudi Arabia. Vision 2030 initiatives will create opportunities for corporate lending since large investment projects are breaking ground.

According to S&P Global Ratings, credit growth will support the profitability of Saudi banks. Return on assets for the banks should remain steady at 2.2%, although some margin compression is possible later in the year if interest rates decline. Almost half of Saudi banks' lending books are corporate loans with floating rates. The Saudi government is projected to continue to support credit growth by injecting deposits into the banking system. In 2023, the government and related entities were responsible for 30% of deposits. That is a sharp increase from 2020, when the government was responsible for 20% of deposits.

Challenges persist for the Saudi banking sector. Rapid credit growth has reduced the availability of liquidity. Over the past few years, liquid assets have declined as a share of total assets. S&P Global Ratings projects this trend to continue as growth remains brisk. The larger share of deposits coming from the Saudi government and related entities should maintain liquidity in the near term.

The energy transition remains a risk for all oil-exporting nations. S&P Global Ratings estimates the risk for Saudi banks based on their exposures to sectors including manufacturing, oil and gas, quarrying and mining, power generation, and 30%-40% of banks' government lending. While the Saudi government has made efforts to diversify the country's economic base beyond fossil fuel production, the indirect exposure of Saudi banks to the energy transition is high. Many other sectors, like the fast-growing chemicals industry, are correlated with the oil sector's performance, either directly through the supply chain or indirectly through government and consumer spending.

S&P Global Ratings views geopolitical tensions in the area around Saudi Arabia as complex and worsening. The Israel-Hamas conflict and associated proxy conflicts appear to be escalating. This could negatively impact Saudi banks through deposit outflows, although the banks’ strong net external positions can offset this risk.

Today is Wednesday, February 7, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

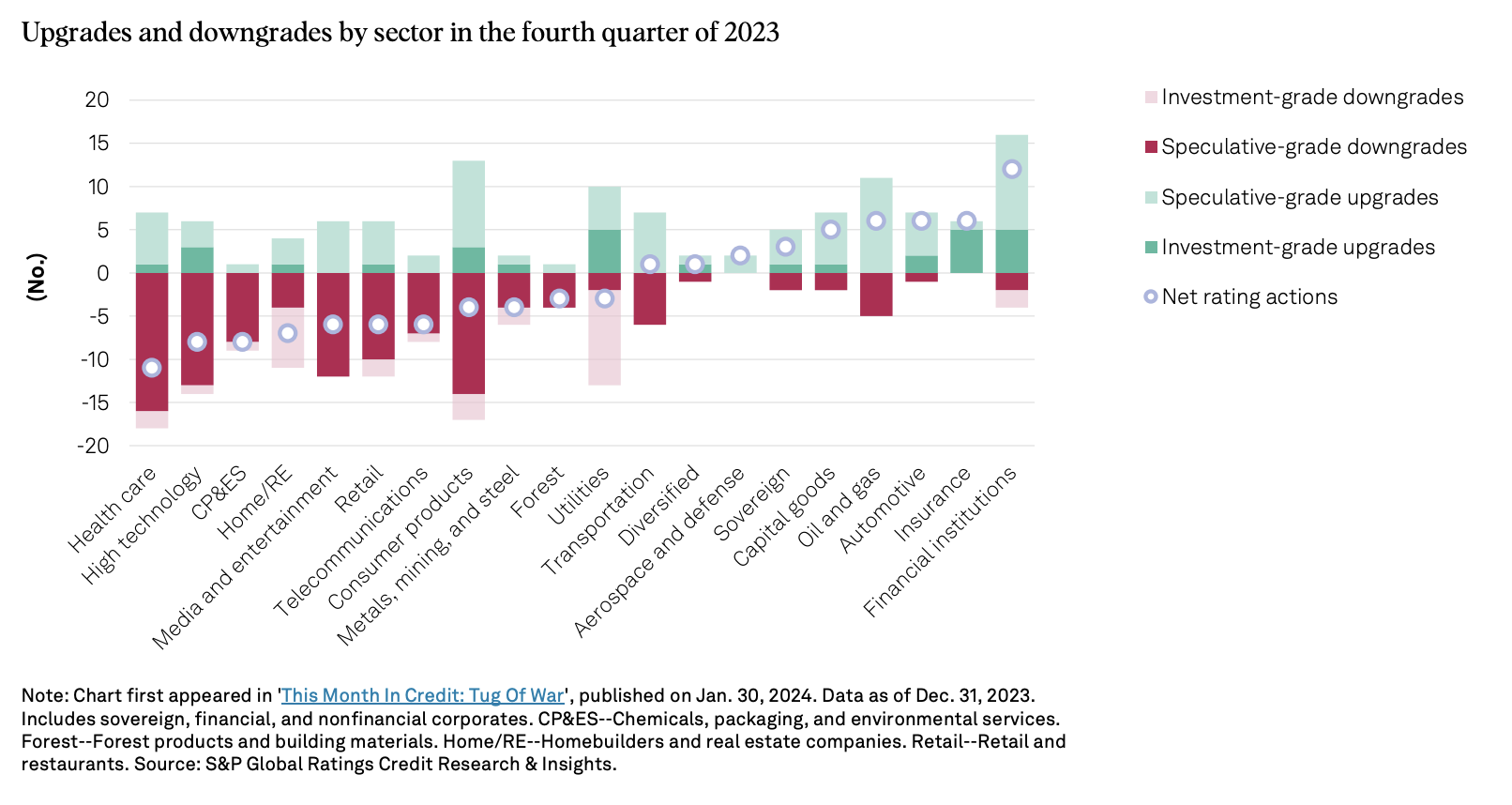

This Week In Credit: Earnings Reports To Upstage Economic Releases

Rating performance trends were mixed last week and credit pricing moved wider. Increased defaults and downgrades were countered by positive outlook and CreditWatch trends. This week's focus will be on the ongoing earnings season and in particular results from some high-profile tech companies.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Credit FAQ: How Will Saudi Banks Fare In 2024?

High interest rates and tight liquidity conditions have weighed on credit growth in Saudi Arabia's banking sector, although it remained robust at 10% in 2023. Also, after strong growth over the past few years, new mortgage lending has slowed somewhat. At the same time, deposits have been lagging lending growth.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

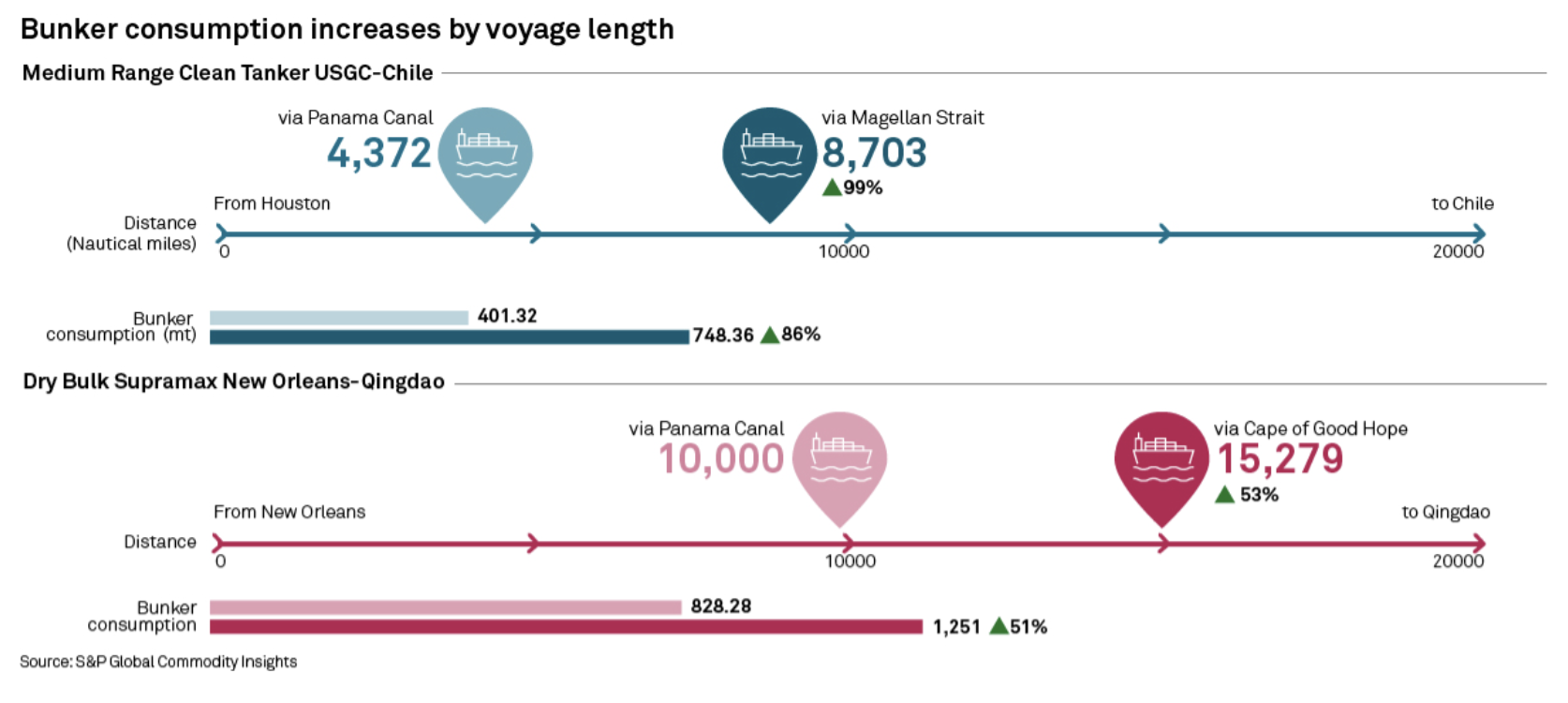

Taking The Long Way Around: Ships Divert From The Panama Canal

Freight costs are rising globally due to tightened logistics at key chokepoints like the Panama Canal and Red Sea. Recent transit restrictions at the Panama Canal sparked by drought have pushed shipowners to opt for longer voyages, resulting in tighter supply, increased costs and delayed deliveries. Follow along in the report to see the impacts of these shifts and the decisions ship operators must make when facing weeks-long delays or war-torn regions.

—Read the report from S&P Global Commodity Insights

Access more insights on global trade >

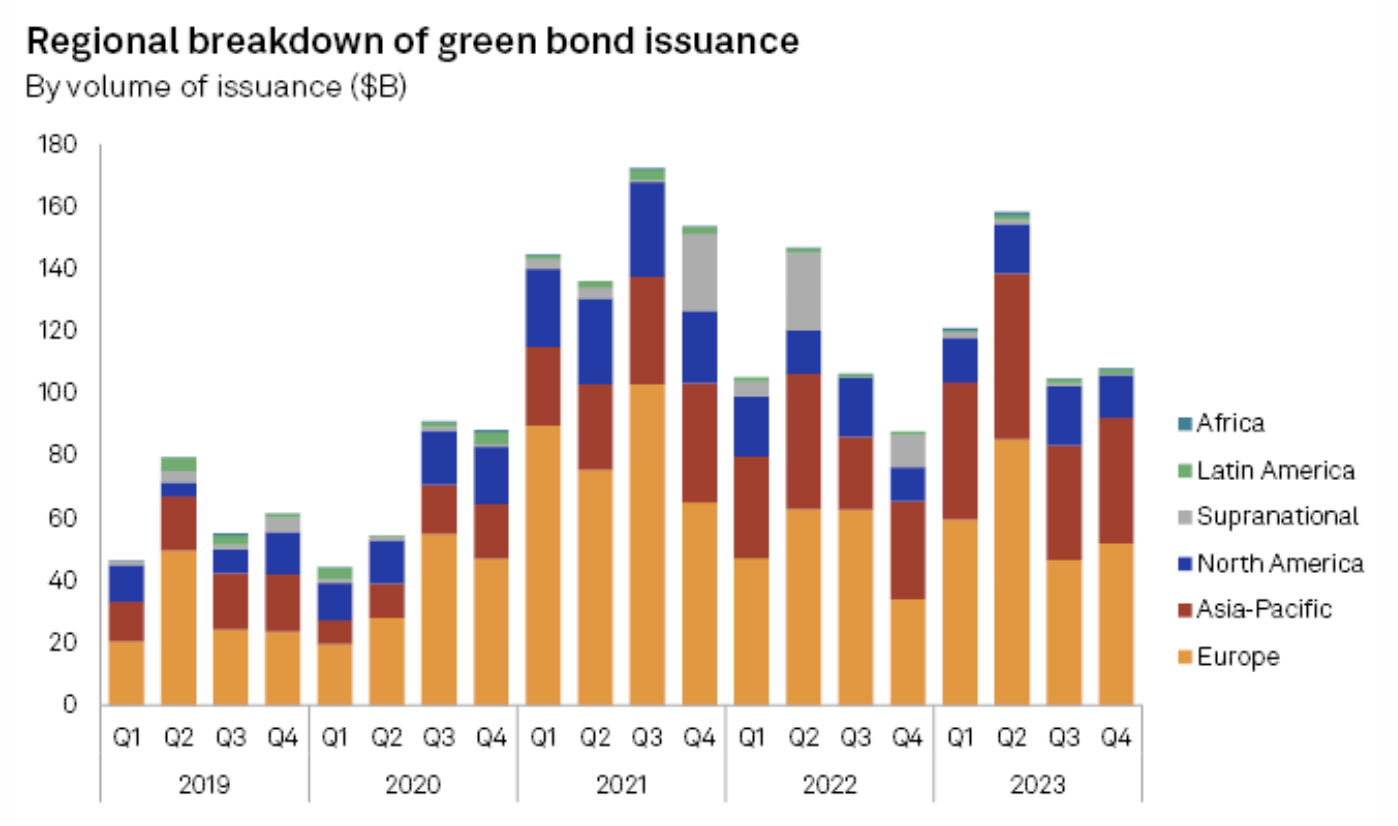

Global Green Bond Sales To Get Boost In 2024 As Interest Rates May Fall

Global green bond issuance will likely gain further momentum in 2024, with interest rates in the US and Europe expected to fall, creating favorable debt market conditions for investors and issuers alike. 2023 green debt sales grew to $492.30 billion in 2023 from $446.18 billion the previous year, led by Europe, which made up nearly half of the global market, according to Climate Bonds Initiative data. The increase came even as most global central banks tightened monetary policy.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

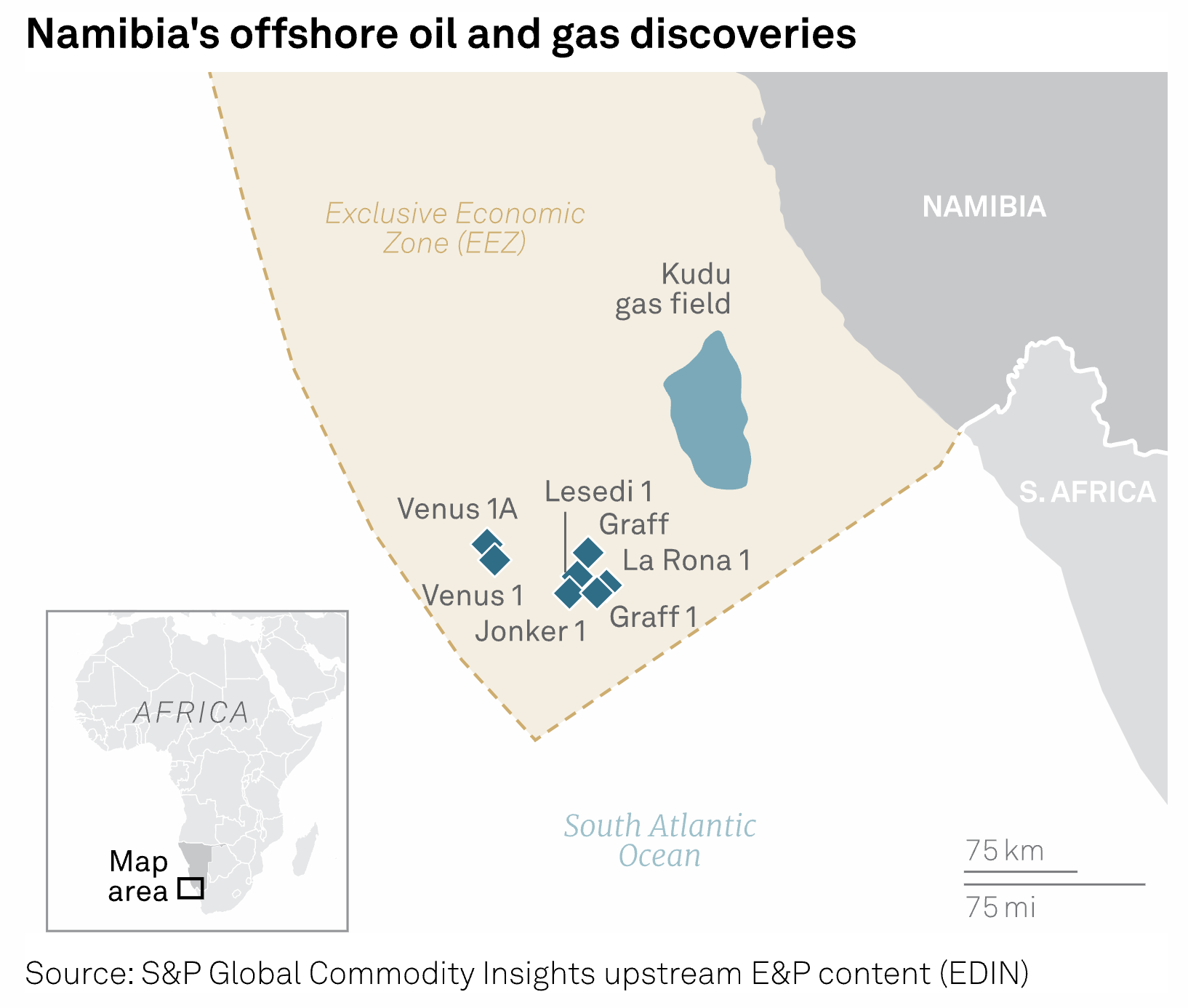

Business As Usual For Namibia Oil Sector After President's Death: Analysts

The death of Namibian president Hage Geingob in office will not affect the country's rapidly emerging oil and gas sector, analysts told S&P Global Commodity Insights, with the ruling party expected to maintain a business-friendly approach to facilitate development of recent discoveries and further exploration. Geingob died in the early hours of Feb. 4 aged 82, weeks after announcing a cancer diagnosis. Nangolo Mbumba, the vice president, takes over the oil, diamonds and lithium-rich country until elections can be held later this year.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: How A Rural Co-Op Is Using Artificial Intelligence To Get The Most Out Of Renewables

In the Energy Evolution podcast, Dan Testa and Taylor Kuykendall interview Jonathan Martell, COO of Mohave Electric Co-Op, and Larsh Johnson, CTO of Stem, to discuss rural power generators using artificial intelligence to help transition to clean energy. The guests discuss the challenges and solutions for increasing the share of renewables in the co-op retail energy mix, and a new solar-plus-storage project recently announced by Mohave.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Commodity Insights