Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 30 Aug, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

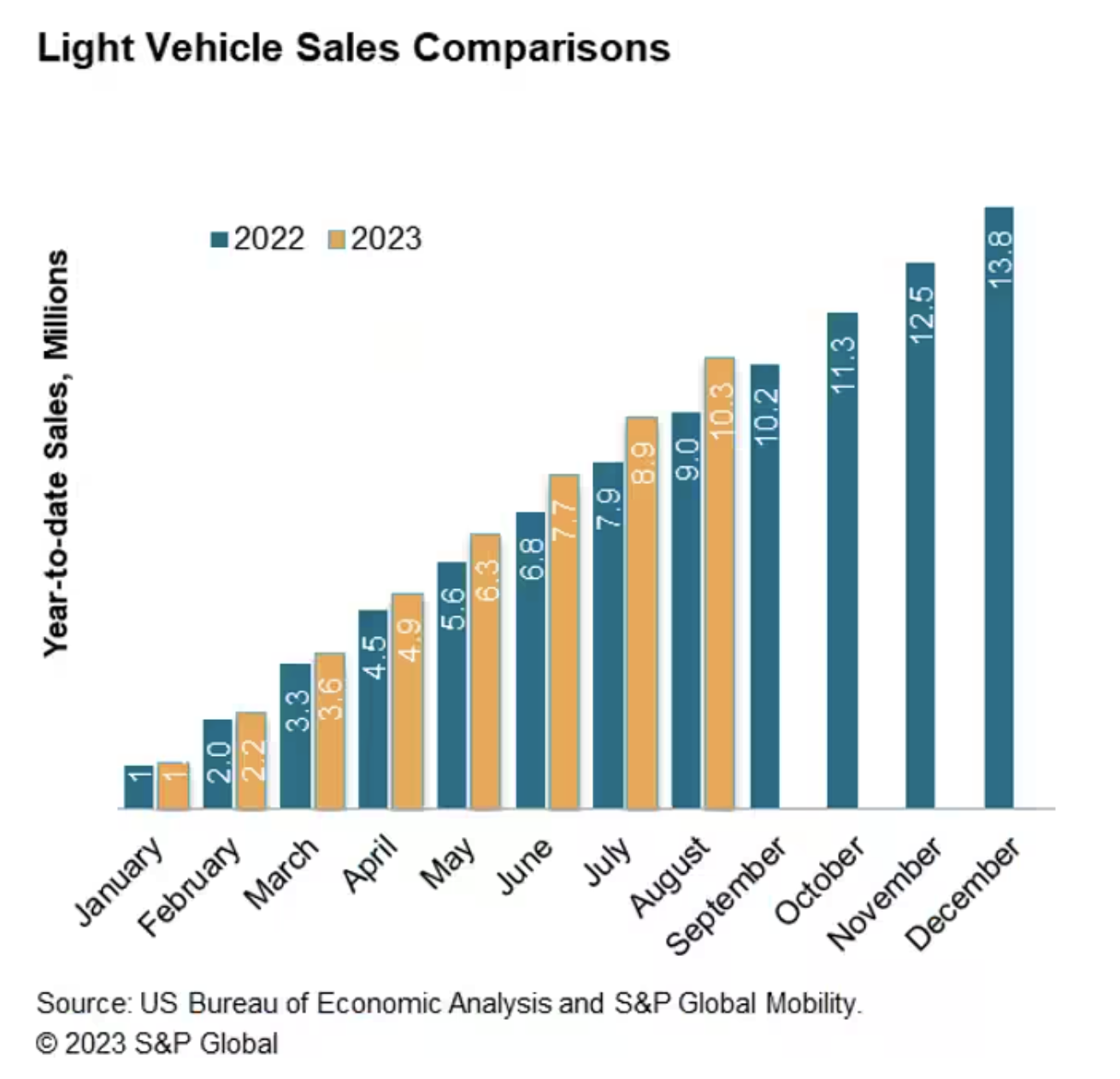

US Auto Sector Confronts Lingering Pandemic Effects

Year-over-year growth in the US auto sector looks strong in 2023. In the first half, light vehicle sales reached about 7.7 million units, representing a 12.4% improvement over the last year. However, those numbers disguise deeper challenges. This year looks good compared to the previous, but last year was unusually grim. In 2022, COVID-19 restrictions and the tight supply of semiconductor chips and automotive parts depressed sales. Now, a recovering auto sector finds itself confronting the residual effects of the pandemic, including an aging fleet that will require more repair and maintenance work.

S&P Global Mobility upgraded its full-year 2023 forecast for US light vehicle sales to 15.4 million units, due to robust demand and the unexpected resilience of the US economy. Electric vehicle adoption continues to grow across many parts of the US fleet and advertised inventories for EVs are expanding across the country in response to anticipated demand. In California, EV inventories for May surpassed hybrid inventories for the first time. Trends around EV adoption continue to track upward, despite the impacts of the pandemic. Sole EV registrations in the US surged 67% year over year to about 341,500 units from January through April. The biggest challenge to further EV adoption continues to be infrastructure. The US Joint Office of Energy and Transportation estimated in June that $31 billion to $55 billion would be required in new infrastructure to support the 33 million passenger EVs that are projected to be on the road by 2030.

During the pandemic, many US consumers chose to hold on to older cars or buy used cars. New vehicles were in short supply due to chip shortages and other supply chain problems, while higher prices drove some buyers to look at older vehicles. With higher interest rates affecting the cost of car loans, the real cost of buying a new vehicle remains challenging for some consumers. The average age of cars and light trucks in the US has risen again this year to a new record of 12.5 years, up by more than three months from 2022, according to S&P Global Mobility.

An older car fleet means that more money will be spent on the US vehicle aftermarket of repairs and maintenance in the coming years. In 2022, the US light duty aftermarket grew 8.5% to $356.5 billion. This year, aftermarket revenue is forecast to increase by 5% or more.

"Traditionally, the 'sweet spot' for aftermarket repair was considered 6-11 years of age, but with average age at 12.5 years, the sweet spot for aftermarket repair is growing," said Todd Campau, associate director of aftermarket solutions at S&P Global Mobility. "There are almost 122 million vehicles in operation over 12 years old."

Lingering inflation and high interest rates may weaken consumer demand for new cars, just as the supply constraints of the pandemic are starting to ease. During the pandemic, many auto manufacturers shifted their production mix to high-ticket, high-margin vehicles. The question now is whether those manufacturers will shift production back to economy or midpriced vehicles to draw middle- and lower-income families out of the used car market.

Today is Wednesday, August 30, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

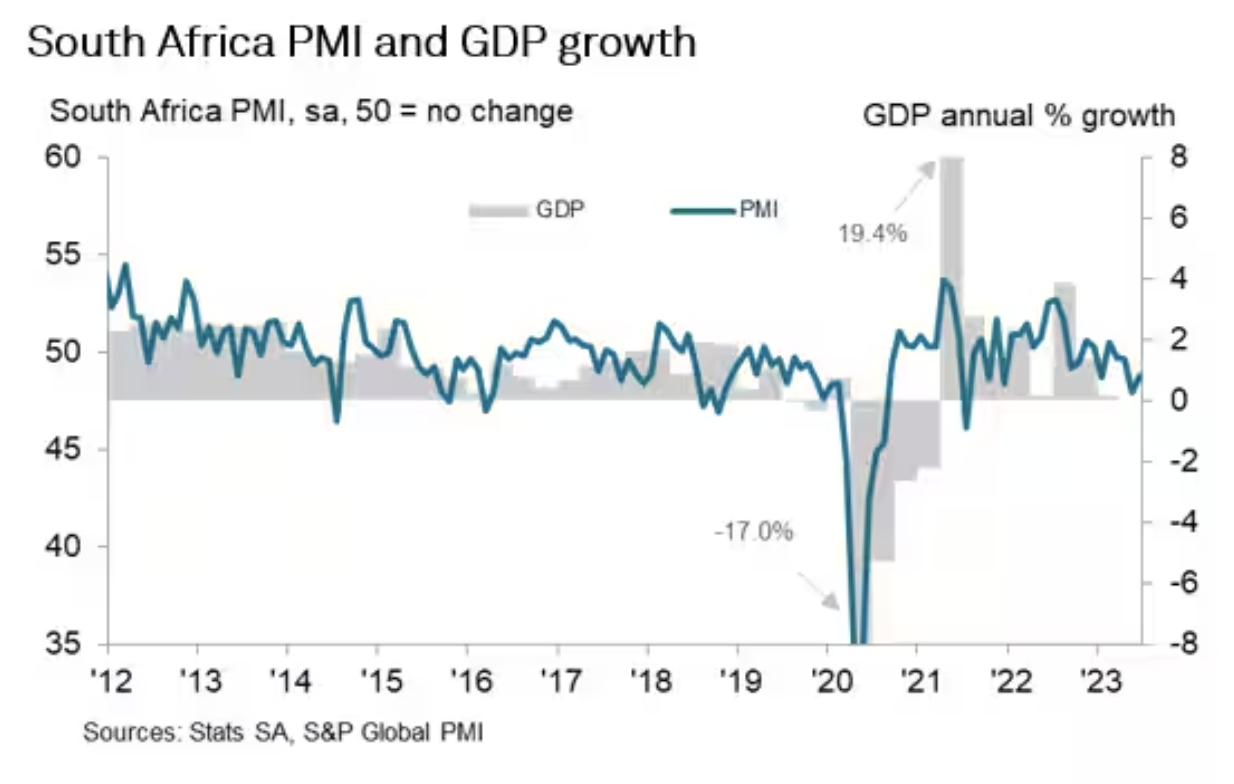

Nowcasting South Africa: Utilizing PMI And Official Data To Provide Early Estimates Of GDP

In this piece, S&P Global Market Intelligence builds on its previous nowcasting work with Purchasing Managers' Index (PMI) data by introducing a new model to provide early estimates of gross domestic product in South Africa. The nowcast model draws on both PMI and non-PMI data sources, taking advantage of the timely release of PMI survey data to provide GDP nowcasts well in advance of official numbers.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

China Developer Probes Expose Governance Risk

The wraps are coming off China developers' books. Shimao Group Holdings Ltd. in late July disclosed the findings of an independent investigation, revealing arrangements that sharply raised its total debt obligations, particularly its short-term debt. S&P Global Ratings believes Shimao's practices are not an isolated case. Recent disclosures have raised questions about the lax controls and aggressive accounting practices of developers during the boom years.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

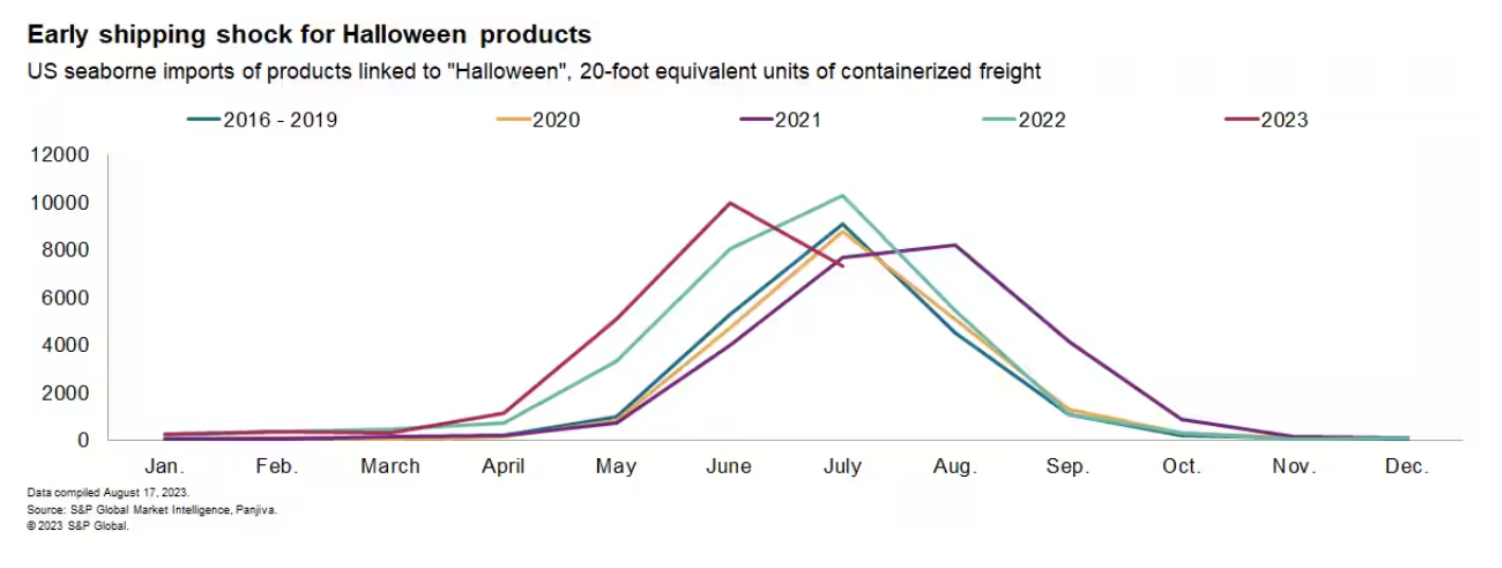

Halloween Creeps A Little Closer: Seasonal Supply Chains Accelerate

Retailers are preparing for Halloween sales earlier than ever, in part due to concerns about a downturn in consumer spending. That's led to earlier shipments of Halloween products than prior years, with decorations outstripping outfits. (Worryingly, clown costumes are doing better than others). At least two large retailers have had Halloween merchandise available since July. The earlier arrival of seasonal shopping comes as US back-to-school spending is expected to improve but at a slow rate.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Listen: Renewable Natural Gas Is Headed For The Moon

Renewable Natural Gas — also known as RNG or biomethane — has gained attention in recent years as a lower-carbon replacement for conventional fossil natural gas. Rising demand for RNG has helped push prices for the associated environmental attributes up to anywhere from five to forty times the price of physical natural gas. As the market has grown, so has the need for transparent pricing. In response, S&P Global Commodity Insights launched first-of-kind pricing for landfill gas RNG for the California and outside-of-California markets in May. What supports those premiums for RNG and how does S&P Global see demand for this low-carbon gas alternative developing in the future?

—Listen and subscribe to Platts Future Energy, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

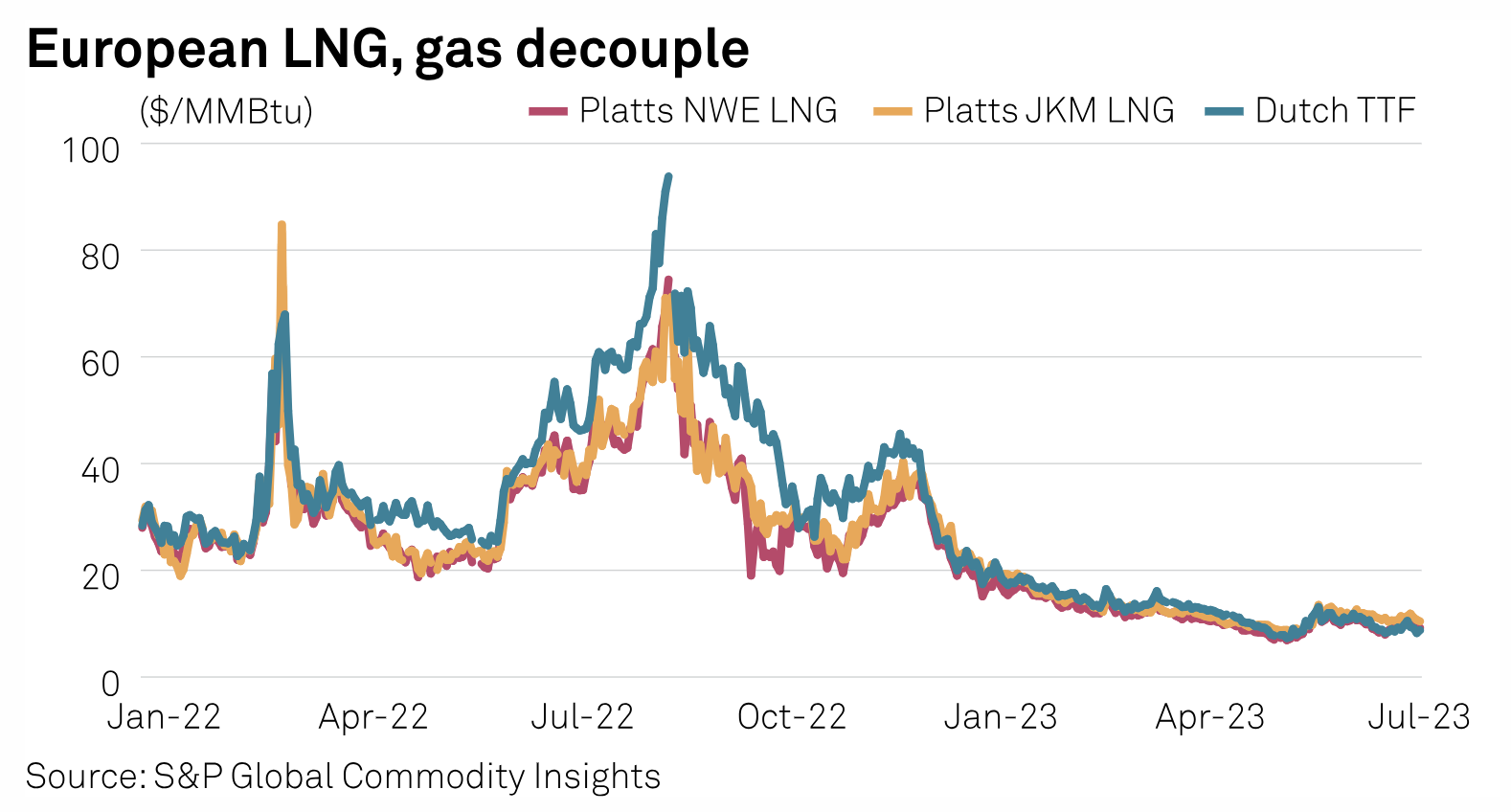

Greater Options To Manage LNG Price Risk Emerge After Natural Gas Market Turmoil

The LNG industry is finding new solutions to manage risk following last year's price surge where unhedged exposure into Europe ballooned to tens of millions of dollars per cargo. The yawning gap between European LNG delivered-ex-ship and European pipeline gas in 2022 made clear the tangible basis risk between them and provoked industry clamor for more risk management tools.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

August US Auto Sales Trends Remain Familiar

S&P Global Mobility expects US light vehicle sales in August to remain steadfast in a challenging environment, with a volume estimate of 1.34 million units. The projected August result would be up 18% year over year, however compared to the month-prior result, growth would be a milder 3% even with two more selling days. This translates to a seasonally adjusted annual rate (SAAR) of 15.2 million units, down from a July 2023 reading of 15.7 million units.

—Read the article from S&P Global Mobility

Content Type

Language