Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Aug, 2020

By S&P Global

Pre-existing economic, political, and social issues are intensifying under the spotlight of the coronavirus pandemic—and governments around the globe are addressing the tensions in different ways.

The entirety of Lebanon’s government stepped down Monday following an enormous explosion in Beirut on Aug. 4 caused by more than 2,000 metric tones of ammonium nitrate reportedly improperly stored in the city’s port. The blast ravaged the country’s capital and drew thousands of Lebanese residents into the streets to protest for a regime change. Many Lebanese viewed the blast—which killed at least 200 people—as a symbol of the government’s fecklessness.

“I discovered that corruption is bigger than the state,” Lebanese Prime Minister Hassan Diab said in an Aug. 10 press conference announcing his and his cabinet’s resignations after eight months of leadership. The replacement of governmental leaders is unlikely to lead to a resolution of the devastating economic crisis that has long challenged the fragile state.

Protests calling for political change also erupted in Belarus over the weekend, after five-term President Alexander Lukashenko claimed a landslide victory in the eastern European country’s election. Polls had projected a victory of the 37-year-old opposition candidate Svetlana Tikhanovskaya, who decided to run after her husband, a popular YouTube personality, was arrested on charges of inciting unrest. Ms. Tikhanovskaya rejected the official results awarding 80% of the vote to the incumbent. Thousands of protesters who took to the streets in Minsk, Belarus’s capital, and other cities on Sunday and Monday were met with violence from riot police. At least 3,000 civilians were arrested, according to the Belarusian Interior Ministry, and one protester was reported to have died.

"The authorities aren't listening to us; they are completely detached from the people," Ms. Tikhanovskaya told reporters on Aug. 10. "We are for peaceful change, and the authorities should think about how to transfer power peacefully."

“We won't let the country be torn apart,” Mr. Lukashenko said during an Aug. 10 public appearance, during which he called the protesters “sheep.”

One month after U.S. anti-racism protests across the country clashed with police using force, U.S. Secretary of State Mike Pompeo said in a statement that "we urge the Belarusian government to respect the rights of all Belarusians to participate in peaceful assembly, refrain from use of force, and release those wrongfully detained. We strongly condemn ongoing violence against protesters and the detention of opposition supporters."

In the U.S., the total number of coronavirus cases topped 5 million, according to Johns Hopkins University data. President Donald Trump said in an Aug. 10 press conference that “in 1917 … the Great Pandemic, as it certainly was a terrible thing, they lost anywhere from 50 to 100 million people, probably ended [in] the second World War [and] all the soldiers were infected.” While the Spanish Influenza did kill roughly 50 million people worldwide, according to the U.S. Centers for Disease Control, that pandemic began in 1918 and ended the year after, in 1919, shortly after the conclusion of the First World War.

Today is Tuesday, August 11, 2020, and here is today’s essential intelligence.

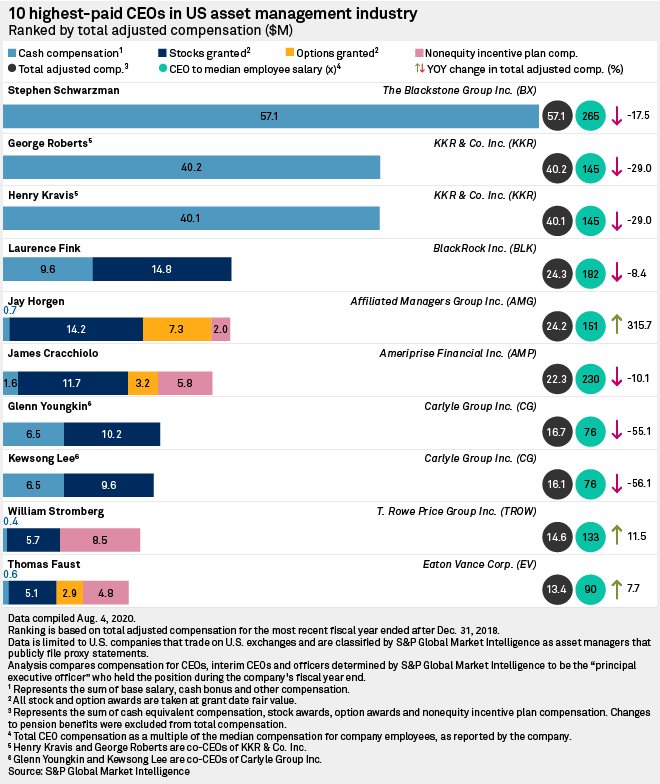

Compensation Drops For Majority of Highest-Paid US Asset Manager CEOs in 2019

Blackstone Group Inc. Chairman, CEO and co-founder Stephen Schwarzman remained the highest-paid CEO among U.S. asset managers and other financial services firms in 2019, even after his compensation fell for the second consecutive year. Schwarzman's $57.1 million in all-cash compensation was well ahead of the roughly $40 million that KKR & Co. co-CEOs George Roberts and Henry Kravis received. Seven of the 10 top-paid asset manager CEOs saw a drop in total compensation in 2019.

— Read the full article from S&P Global Market Intelligence

Corporate and Municipal CUSIP Requests Drop in July

CUSIP request volumes for corporate and municipal issuers slowed in July, reversing the significant gains realized over the previous month. North American corporate requests totaled 4,086 in July 2020, down 19.4% from June. On a year-over-year basis, corporate CUSIP requests are up 15.3%. The July 2020 decrease was driven by an 18.9% monthly decline in requests for corporate debt identifiers and a 20.6% monthly decrease in requests for identifiers for certificates of deposit with maturities longer than one year.

— Read the full article from S&P Global Market Intelligence

Next-gen Chip Delays Plague Intel's Past, Future

Investors are starting to lose patience with Intel Corp.'s inability to keep up with contract chip manufacturers like Taiwan Semiconductor Manufacturing Co. Ltd. While Intel's revenue, sales and dominant market share keep it at the top of any list of competitors, rivals including NVIDIA Corp. and Advanced Micro Devices Inc. — both of which design chips but outsource production — have shown much faster growth in share price and market capitalization in recent years.

— Read the full article from S&P Global Market Intelligence

Analysis: Iraq-US Energy Ties, Once Seen as Oil Deal Bonanza, Mired in Geopolitics

Iraq's energy ties with the US, which were supposed to yield oil deals following the 2003 invasion, have been whittled down to waivers to OPEC's second biggest producer to import Iranian electricity and gas, and avoid a political meltdown of the fragile Baghdad government, according to analysts.

— Read the full article from S&P Global Platts

Watch: Market Movers Europe, Aug 10-14: Key oil reports and state of German steel market eyed

In this week's highlights: Russia's largest oil company Rosneft will publish its results; German largest steel maker Thyssenkrupp will give an update on its steel unit; and the UK government ends a consultation on biofuel regulations.

— Watch and share this Market Movers video from S&P Global Platts

OPEC+ Oil Cut Compliance Dips In July, Ahead of Quota Easing: Platts Survey

OPEC+ production discipline slipped in July, as Gulf members led by Saudi Arabia ended their voluntary extra output cuts, while some countries that have struggled to adhere to their quotas continued to pump above their caps, the latest S&P Global Platts survey found. Quota compliance by the 22-country alliance fell to 96% for the month, from 106% in July, with its collective production increasing by 1.10 million b/d, according to the survey.

— Read the full article from S&P Global Platts

FEATURE: Dominion South Rally Unlikely To Fuel Appalachian Production Growth In 2020

Rallying forward gas prices at Dominion South are making for a bullish market outlook in Appalachia this winter – a scenario that's often fueled regional production growth in the past. Following pivotal changes to the industry this year, though, most producers are likely to keep output flat heading into 2021.

— Read the full article from S&P Global Platts

Zinc Surplus Expected To Continue Amid Price's Return To Pre-Pandemic Level

Analysts expect zinc to remain oversupplied after it recently became the second of the S&P Goldman Sachs Commodity Index industrial metals to have prices return to pre-pandemic levels, after copper. Zinc's rise in the past two weeks prompted special analyses from Australia's Eden Asset Management and London's Capital Economics, and the price rose further to US$2,398.50 per tonne on Aug. 6, its highest point since January, before retreating to US$2,234.75/t the next day.

— Read the full article from S&P Global Market Intelligence

Listen: A New President For Guyana, The Next Non-OPEC Oil Giant

Guyana is one of the most promising new sources for non-OPEC oil production growth, and the country just emerged from a chaotic five-month election drama. Opposition leader Mohamed Irfaan Ali was sworn into office as the country's new president last week.

— Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language