Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global — 16 Apr, 2020

By S&P Global

Experts have differing opinions on how the economic ecosystem will regenerate after the coronavirus crisis ends, but what is certain is that the economic effects of the pandemic will be longer and more intense than previously anticipated. S&P Global Ratings today slashed its global economic outlook and now forecasts GDP falling 2.4% this year—followed by a growth rebound of 5.9% in 2021 and 3.9% in 2022. This revision reflects extended social restrictions, expectations for gradual re-emergence, and sharper slowdowns in each region of the world.

For the U.S., S&P Global Ratings foresees GDP growth contracting 5.2% this year, dramatically worse than March’s forecast of a 1.3% decline. This includes a historic annualized decline of almost 35% in the second quarter. According to U.S. Chief Economist Beth Ann Bovino, headline unemployment could reach 19% in May—closer to the reported 1930s Depression-era peak of 25% than the 10% high during the 2008-2009 global financial crisis.

The Federal Reserve last week put forward two credit facilities that will enable nearly $600 billion in loans to flow to small and medium-sized businesses under the Main Street Lending Program, but rules that cap maximum leverage for firms that borrow under the program will prevent large numbers of leveraged loan issuers from participating, according to S&P Global Market Intelligence.

The Eurozone may contract 7.3% this year, says S&P Global Ratings EMEA Chief Economist Sylvain Broyer. Europe’s economic activity is unlikely to stabilize by the end of the second quarter, and external EU borders might not fully reopen by summertime.

European Commission President Ursula von der Leyen said today that European Green Deal investments will remain a priority as part of the EU's efforts to kickstart its economy post-crisis. Having proposed a European Green Deal Investment Plan in January before the lockdowns hit, the commission hopes to mobilize at least 1 trillion euros ($1.1 trillion) of sustainable investments in the next 10 years to help the bloc become climate-neutral by 2050. This would remove unabated fossil fuels from the EU's energy mix and increase demand for renewable electricity and low carbon gases.

For now, the projected GDP declines in the U.S. and Eurozone will shock emerging markets. S&P Global Ratings Emerging Markets Lead Economist Tatiana Lysenko expects India and Indonesia to both grow 1.8% this year, but projects Mexico to be particularly at risk. Virus-prevention and -containment measures may have an outsized effect on demand across emerging-market economies.

The new forecast predicts China’s GDP to grow 1.2% this year, down from S&P Global Ratings’ first-quarter outlook that the economy would gain 2.9%. As the Asia-Pacific region slowly starts to reignite its economic engine, having endured the first wave of the coronavirus pandemic, S&P Global Ratings Chief APAC Economist Shaun Roache sees China’s GDP rebounding with 7.4% growth next year and 4.7% in 2022.

The International Monetary Fund projected that growth in Asia will “stall at zero percent in 2020,” marking the region’s worst year in almost six decades. The IMF sees China’s growth declining to 1.2%, from 6.1% in 2019.

Europe and Asia appear to be more successful in keeping firms in business and workers on payrolls, although with reduced hours. In the U.S., jobless claims have skyrocketed to 22 million unemployed Americans seeking insurance in just four weeks.

Acknowledging that the very near term looks bleak, S&P Global Ratings highlighted that as infection curves are flattening and the focus turns to the recovery, the downturn’s length and pace will depend on the combination of health and economic policies, people’s and firms’ responses, and the conditions of labor markets and small and medium enterprises. S&P Global Ratings’ economists, led by Global Chief Economist Paul Gruenwald, believe the balance of risks remains on the downside. Much can go wrong with their baseline path on the health, economic, and policy fronts.

IMF Managing-Director Kristalina Georgieva told G20 finance ministers and central bank governors yesterday that the global lender is prepared to deploy its “full toolbox and $1 trillion firepower,” as more than 100 countries have asked for emergency aid. She noted that “everything is on the table in terms of measures we can take” and urged countries to “keep the receipts … we don't want accountability and transparency to take a back seat in this crisis."

Oil markets are still hurt by diminished demand from coronavirus even after the historic OPEC+ oil production agreement. The sheer weakness of the physical oil market can be best explained by the state of the Nigerian crude market, according to S&P Global Platts, which analyzed how the once coveted light sweet Nigerian barrel is facing one of its toughest trading cycles. Refiners are shunning these crudes even as they are trading at record-lows.

Today is Thursday, April 16, 2020, and here’s an overview of today’s essential intelligence.

Economic Research: COVID-19 Deals A Larger, Longer Hit To Global GDP

The economic impact of COVID-19 is longer and more intense than S&P Global Ratings thought, and the Economists have again lowered their macro forecasts. S&P Global Ratings now sees global GDP falling 2.4% this year, with the U.S. and eurozone contracting 5.2% and 7.3%, respectively. S&P Global Ratings’ Economists expect global growth to rebound to 5.9% in 2021. While the very near term looks bleak, infection curves are flattening and the focus has turned to the recovery. Its length and pace will depend on the combination of health and economic policy, the response of people and firms, and the condition of the labor market and small and medium enterprises. The balance of risks remains on the downside, as much can go wrong with our baseline path on the health, economic, and policy fronts.

—Read the full report from S&P Global Ratings

Economic Research: An Already Historic U.S. Downturn Now Looks Even Worse

With over 90% of the population under "stay-at-home" guidelines, up from three-fifths in late March, U.S. economic activity has effectively stopped. S&P Global Ratings now forecasts U.S. GDP will contract 5.2% in 2020—substantially worse than the March forecast for a 1.3% decline. The current recession has likely reduced economic activity by 11.8% peak to trough, which is roughly three times the decline seen during the Great Recession in one-third of the time. Headline unemployment could reach 19% in May. Recovery will be gradual as fears linger and social distancing endures, but S&P Global Ratings expects the economy will at least partly reopen in the third quarter.

—Read the full report from S&P Global Ratings

COVID-fueled supply chain disruption a crunch point for insurance claims

A lack of parts, materials and labor to repair cars and buildings is hampering the ability of the insurance industry's claims apparatus to adapt to new working conditions amid the coronavirus pandemic. The outbreak has thrown a number of challenges at the insurance claims community, such as handling claims when most staff are working from home, and assessing damage when there are restrictions on movement and travel.

—Read the full article from S&P Global Market Intelligence

Pharma M&A on track to surge again once pandemic concerns subside – experts

The drop in market value for biopharmaceutical companies and a need to diversify portfolios have set the stage for a surge in M&A in 2020 even as the coronavirus pandemic and market volatility stall near-term deal-making, experts said. The number of deals in the pharmaceutical space is likely to rebound when markets and financial institutions stabilize in the wake of the crisis, Moody's Senior Vice President and pharmaceutical analyst Michael Levesque told S&P Global Market Intelligence in an interview.

—Read the full article from S&P Global Market Intelligence

OPEC sees 10 mil b/d demand recovery by Q4 as market remains in 'extreme' shock

OPEC is banking on global oil demand recovering by more than 10 million b/d from the second quarter to the fourth quarter of 2020 as it embarks on a global supply pact along with allies and rivals to provide relief for a coronavirus-stricken oil market. OPEC's analysis arm, like many other agencies, severely cut back its demand forecast for 2020 as the COVID-19 pandemic has spread fast globally, jolting an oil market with a historic shock described as "abrupt" and "extreme."

The producer group now expects global oil demand to plunge by 6.8 million b/d year on year in 2020 to 92.82 million b/d, with April witnessing the biggest contraction at about 20 million b/d, according to its latest monthly oil market report. But data showed that demand in Q4 is expected to rebound to 97.30 million b/d from a low of 86.70 million b/d in Q2. The report warned of further adjustments and downward risks due to the large uncertainties, as large scale containment measure remain in place to combat the COVID-19 coronavirus.

—Read the full article from S&P Global Platts

PODCAST OF THE DAY

The Essential Podcast, Episode 4: "It's All Demand" – Making Sense of Oil Markets

In conversation before the historic OPEC+ oil production cut agreement was announced, host Nathan Hunt and S&P Global Platts' Global Director of Analytics Chris Midgley try to make sense of unprecedented low oil prices caused in part by coronavirus and the role of OPEC on the global stage.

Listen and subscribe to this podcast on Spotify, Apple Podcasts, Google Play, Google Podcasts, Deezer, and our podcast page.

—Share the Essential Podcast from S&P Global

WTI holds at 18-year low as market weighs US output cuts, weak economic data

Crude futures were little changed following a range-bound session as the market balanced tightened supply picture against weakening demand outlooks. ICE June Brent settled up 13 cents at $27.82/b while NYMEX May WTI settled unchanged on the day at $19.78/b. Indications of a contraction in US crude supply placed a floor under prices Thursday.

—Read the full article from S&P Global Platts

How to Counter the COVID-19 Perfect Storm: Asia’s Case Study

On April 8, 2020, the European Risk Management Council hosted a RiskVirtual meeting for European and APAC risk executives. The theme was How to Counter the COVID-19 Perfect Storm: Asia’s Case Study. European countries and the U.S. have become the epicentre of the coronavirus. Unlike the global financial meltdown of 2008-2009, however, the current crisis started in Asia, with China and other APAC countries being hit by the virus before the western world. Discussions at the meeting considered what risk management professionals at APAC financial institutions have learned during this outbreak when it comes to credit, market, and operational risks. This article is a summary of the key themes and issues that were covered.

—Read the full report from S&P Global Market Intelligence

Bank of China's aircraft leasing unit sees growth opportunities amid downturn

BOC Aviation Ltd., the Hong Kong-listed aircraft leasing unit of Bank of China Ltd., plans to spend US$5 billion on buying planes from airlines. The Bank of China unit plans to grow its portfolio and support its cash-strapped airline customers during the industry downturn. Half of BOC Aviation's customers may be allowed to defer part of their monthly lease payments; company may take back a handful of aircraft from airlines that may fail.

Bank of China, like several other global lenders that have expanded into aircraft leasing and financing in recent years, is caught in the sudden downturn in the aviation industry as COVID-19 becomes a global pandemic and countries enforce travel restrictions. The International Air Transport Association, a global body of the airline industry, said April 14 that it expects airline passenger revenues to drop by 55% this year. As of early April, global passenger flights were down 80%. There was a day in April when Hong Kong's Cathay Pacific Airways Ltd. flew 582 passengers, down from its pre-pandemic daily average of about 100,000 passengers.

Even after the outbreak is brought under control and global air travel resumes, most analysts believe demand will take several months to return to pre-outbreak levels. Bank of China's Hong Kong-listed aircraft leasing unit, BOC Aviation, has activated its "downturn" plan and aims to spend US$5 billion on buying planes from cash-strapped airlines. The strategy is to support its long-term customers and grow its portfolio, CEO Robert Martin tells S&P Global Market Intelligence in an interview. The company currently owns 323 jets and has another 204 on order.

—Read the full article from S&P Global Market Intelligence

Fund managers push brakes on European real asset deals in early 2020

Fund managers made fewer real asset acquisitions in Europe between Jan. 1 and March 23, 2020, than a year earlier, amid the onset of the coronavirus pandemic. Listed and unlisted fund managers announced a combined 247 deals worth an aggregate disclosed transaction value of €12.74 billion during the period, down from 315 deals worth a combined €13.86 billion a year earlier, according to S&P Global Market Intelligence data. The dip also follows a quarter high during the final three months of 2019, when 359 deals valued at a combined €23.73 billion were announced.

—Read the full article from S&P Global Market Intelligence

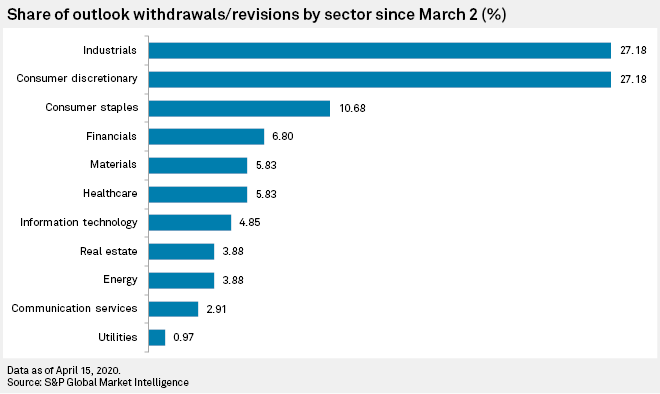

CHART OF THE DAY

Consumer, industrial sectors top European coronavirus profit warnings – tracker

With much of Europe ordered to stay at home, the consumer discretionary and industrial sectors are at the forefront of companies voiding their earnings forecasts because of the COVID-19 outbreak. S&P Global Market Intelligence tracked 103 Europe Stoxx 600 companies that have withdrawn or negatively revised earnings guidance since the beginning of March, with a marked uptick of disclosures observed since March 23. The tally is based on earnings guidance announcements in news releases, regulatory filings, financial results and conference speech transcripts by companies in the STOXX Europe 600 index, which covers large, medium and small capped companies, through April 9.

—Read the full article from S&P Global Market Intelligence

Barclays faces earnings hit just as investment bank arm moves up a gear

Barclays PLC is forecast to see earnings fall by more than a third this year as the coronavirus crisis unfolds, just as CEO Jes Staley's determination to focus on its investment banking arm looked like paying off. Virus-inspired interest rate cuts and lower market activity will take £1 billion off the British bank's income this year, said analysts at Jefferies, with about £500 million coming off investment banking revenue. The result would be a fall in expected 2020 earnings of 37%, with a sharp rise in impairments in the first half of this year. Nor would the pain end in 2020, said Jefferies, which also forecast a 14% downgrade in earnings in 2021.

—Read the full article from S&P Global Market Intelligence

Coronavirus could derail Greek banks' bad-debt reduction plans

Greek banks can expect the novel coronavirus outbreak to deal a blow to their ongoing efforts to reduce portfolios of toxic assets, analysts say. Only just a few months ago, the signs of an economic recovery were encouraging as was a new government scheme to encourage bad-debt securitizations. Greek banks had good reason to be hopeful that 2020 would be the year that they would at long last make deep reductions to the bad debts that piled up on their balance sheets during the financial crisis of 2008-2009. But that was before the pandemic hit.

Greece, which imposed a social lockdown March 22 to combat the virus, has reported relatively few COVID-19 fatalities, at 101 as of April 14. But the prospect of a prolonged economic downturn is leaving the country bracing for another period of financial pain. For Greek banks, a prolonged period of coronavirus fallout could be a double whammy as not only would their soured-asset reduction plans come under pressure, but they also could be faced with a new wave of defaults.

—Read the full article from S&P Global Market Intelligence

EU green energy spend key to economic recovery: EC's von der Leyen

European Green Deal investments will remain a priority as part of the EU's efforts to jump-start its economy after the coronavirus pandemic lockdowns, European Commission President Ursula von der Leyen said Thursday. The EC proposed a European Green Deal Investment Plan in January, before the lockdowns hit, to mobilize at least Eur1 trillion ($1.1 trillion) of sustainable investments over the next 10 years to help the EU become climate-neutral by 2050.

The EC's proposed investment plan included Eur503 billion to come from the EU's 2021-2027 budget, which EU national governments have yet to agree. The EU budget needed to be the re-imagined in light of the pandemic to "unlock massive public and private investment" to create a "more resilient, green and digital Europe," von der Leyen told the European Parliament.

—Read the full article from S&P Global Platts

European jet fuel forward cracks point to need for further refinery run cuts

European jet fuel cracks have plummeted to such an extent that European refinery run cuts look insufficient to offset lost demand given the high levels of arrivals expected from East of Suez markets in April, market sources said. Forward jet cracks, meanwhile, were below the physical crack in negative territory.

"It makes sense," a trader said. "If you believe that demand is going to be very low and that refineries, which are reducing throughput now, will still produce more than the market demands", then one would expect to see future jet crack spreads trading at a discount to the cash crack.

—Read the full article from S&P Global Platts

Norway oil cuts could impact gas, but likely trumped by gas market dynamics

Norway's pledge to consider oil production cuts -- if realized -- could impact associated gas output in the country, but gas market dynamics are more likely to dictate Norwegian gas production behavior in the near term. Oslo has said it would consider a unilateral cut in oil production, provided that the agreement between the OPEC+ countries on output cuts is implemented, as part of a global effort to offset the demand destruction caused by the coronavirus outbreak.

It has said it would return to how a possible production cut would be implemented and the size of it in due course, though S&P Global Platts Analytics estimates a cut could be as big as 300,000 b/d. Reduced Norwegian oil output could exert some pressure on associated Norwegian gas output, but could also see less emphasis on gas re-injection, making more gas available for exports, Platts Analytics believes.

—Read the full article from S&P Global Platts

INTERVIEW: North Sea producers look to absorb crisis with delays, not decommissioning: RockRose CEO

North Sea oil and gas producers should be able to weather the current crisis by delaying new investment rather than abandoning fields, with an eye to future demand recovery, Andrew Austin, CEO of London-listed RockRose Energy, said in an interview. RockRose, which listed in London in 2016, is one of a number of independents that have bought assets in the North Sea and West of Shetland area from legacy producers, helping extend the life of fields and revive production levels. It bought the assets of Japan's Idemitsu in 2017 and US upstream company Marathon Oil last year.

UK oil production, which includes flagship crudes such as Brent and Forties, has been running at over 1 million b/d, but the region's crudes have been hit hard in the recent crisis, trading at a steep discount to front-month futures. The country, however, is not joining output cuts agreed by OPEC+ countries, and there are signs of buying among Asian refiners. RockRose's production amounted to some 19,000 b/d of oil equivalent last year, including the Marathon assets. Austin said the company's current focus was on the "actual challenges" of ensuring safe operations and protecting workers from coronavirus.

—Read the full article from S&P Global Platts

Low UK demand outlook presents summer balancing challenges: Grid

The coronavirus lockdown could push UK electricity demand down to between 96% and 80% of usual daytime levels this summer, making it challenging to balance the system, National Grid said Thursday in its annual Summer Outlook. Lower summer demand would increase the amount of work needed to manage high voltage levels on the power transmission network, National Grid said.

—Read the full article from S&P Global Platts

Nigerian crude in dire straits, gasping for buyers

Trading sources said more than 50 million barrels of Nigerian crude for late-April and May loading has still not been sold to end-users. Sellers are resorting to holding some of this oil on inland or floating storage, to hope to sell at a later date, when demand recovers. Nigerian crudes, which are largely low in sulfur and yield a generous amount of diesel, jet fuel and gasoline, are finding it very difficult to attract interest from refiners in a market where demand has been battered due to the coronavirus pandemic.

—Read the full article from S&P Global Platts

S&P and Dow Jones Islamic Indices Continue Outperformance in Q1 2020

Amid losses, Shariah-compliant benchmarks beat conventional counterparts by substantial margins. Global equities fell 22.3% during Q1 2020, as measured by the S&P Global BMI, with COVID-19 taking center stage and cases growing worldwide. The S&P Global BMI Shariah—which fell 17.2%—markedly outperformed its conventional benchmark by more than 500 bps, marking its greatest quarterly outperformance since inception. The trend played out across all major regions as the S&P 500® Shariah outperformed its conventional counterpart by 2.7%, while the Dow Jones Islamic Market (DJIM) Europe and DJIM Emerging Markets each outperformed their conventional benchmarks by more than 8.0%.

Amid the tough backdrop, broad-based Islamic indices outperformed their conventional counterparts by a substantial margin, as Information Technology and Health Care—which tend to be overweight in Islamic indices—outperformed among sectors, while Financials—which is underrepresented in Islamic indices—heavily underperformed the broader market.

—Read the full article from S&P Dow Jones Indices

Performance of Latin American Markets in Q1 2020

U.S. equities, which serve as a guidepost for the global economy, surpassed prior all-time highs in volatility. VIX®, also known as the “fear gauge,” has not reached similar highs since the global financial crisis (GFC) in 2008. The higher the uncertainty, the higher the option prices that are used to calculate VIX. The precipitous drop in oil prices following a price war between Russia and Saudi Arabia threatened a collapse of the Energy sector, adding to the uncertainty in the U.S. and globally. Unemployment in the U.S. continued to rise—in the last two weeks of the quarter, nearly 10 million Americans applied for unemployment benefits following the shutdown of thousands of businesses. It’s expected that this number is only a sign of further job losses to come and that unemployment filings will double in the coming weeks. Many impacted businesses are in the travel, entertainment, restaurant, retail, and real estate industries.

What about Latin America? Like a tsunami that started in Asia and then ravaged Europe, COVID-19 and its effects are now flooding the Americas. Despite the closing of borders and quarantines, the pandemic continues to sweep the continent. Governments have started to institute policies to minimize the public health and the economic impact. Similar to the U.S., which has approved a USD 2 trillion stimulus package to help mitigate the effects of the pandemic, Brazil has approved around USD 30 billion. Peru is also reviewing a similar package. In Chile, the president approved a USD 12 billion package. In Argentina, the World Bank will lend USD 300 million in emergency funds. Colombia and Mexico have not yet announced any major economic measures at this time. The question many ask is, will all this be enough? In the midst of uncertainty, the answer depends on how quickly the pandemic recedes and life goes back to normal.

—Read the full article from S&P Dow Jones Indices

Trade War Return Risk Rises With Tariff Cuts, Commitments Undelivered

While the world's focus in global supply chains has been on the impact of the spread of coronavirus, it appears that the prior preoccupation — the U.S.-China trade war — may be facing worsening statistics. U.S bilateral trade with China fell by 28.8% year over year in February, Panjiva's analysis of official data shows. That marked the 16th straight downturn and was led in dollar terms by a 31.3% slump in imports.

The main driver of the decline in imports has been the use of section 301 duties by the U.S. against Chinese imports. During February, there was a cut in the rate of tariffs on imports of list 4A products — principally consumer goods — to 15% from 7.5% resulting from the phase 1 trade deal between the two countries. There have also been subsequent exemptions for medical-related products, as outlined in Panjiva's research of April 1, as the U.S. attempts to cut the barriers to vital imports during the coronavirus crisis. Despite the drop in tariffs, however, the import of list 4A products dropped by 38.4% year over year in February, Panjiva's analysis shows, marking the fastest rate of decline for the product groups.

—Read the full article from Panjiva, part of S&P Global Market Intelligence

Bad, With Worse To Come — Coronavirus' Toll On US Imports In March

The toll of the new coronavirus disruptions to global trade were clearly visible in U.S. seaborne imports in March, though not perhaps by as much as midmonth data suggested. Panjiva's data shows shipments from all origins fell by 10.1% year over year in March, compared to 15.0% at midmonth as discussed in Panjiva's March 25 research. Nonetheless, March still saw the fewest number of shipments for a month since 2016. Containerized imports did slightly better with a 9.2% decline and reached their lowest level since February 2017.

The intramonth reduction in the rate of decline in imports was largely down to shipments from China, which fell by a still considerable 34.0% year over year to their lowest level since at least 2007 as the full impact of the industrial lockdown made itself felt.

—Read the full article from Panjiva, part of S&P Global Market Intelligence

Credit FAQ: U.S. CLOs In The Time Of Coronavirus - Webinar Follow Up

On Friday, March 27, 2020, S&P Global Ratings held its "U.S. CLOs In The Time Of Coronavirus" webinar to provide investors and others with S&P Global Ratings' views on U.S. leveraged finance and collateralized loan obligations (CLOs) in the current market environment. S&P Global Ratings held two live sessions covering the same topics: one during local business hours in Asia and the other during U.S. business hours. Each webinar began with an overview of the U.S. macroeconomic outlook before moving on to S&P Global Ratings' forecast for speculative-grade non-financial corporate defaults, an overview of trends in the leveraged loan market, and the potential implications for U.S. CLO transactions.

—Listen to a replay of the webinar from S&P Global Ratings

Leveraged loan issuers see little love from Fed's Main Street lending program

The Federal Reserve last week put forward two credit facilities that will enable nearly $600 billion in loans to flow to small and medium-sized businesses under the Main Street Lending Program. But a number of rules that cap maximum leverage for firms that borrow under the program will bar large numbers of leveraged loan issuers from participating, an LCD review has found. Together with a $75 billion equity investment from the Department of the Treasury, the Federal Reserve is committing up to $600 billion through the Main Street New Loan and Main Street Existing Loan Facilities. Under the new loan facility, a borrower can take a maximum of $25 million, and under the extension facility, an existing borrower can take a maximum of $150 million.

However, the new loan facility stipulates a borrower cannot take out any amount that would raise its debt/EBITDA ratio above 4:1, taken in combination with outstanding and committed but undrawn debt. The same rules apply for the existing loan facility, which is targeted at existing loan issuers looking to upsize their deals, except the new debt/EBITDA ratio cannot be above 6:1.

—Read the full article from S&P Global Market Intelligence

Office landlords and their lenders brace for more unknowns

The coronavirus pandemic and the many business closures that have attended it may accelerate ongoing structural changes in the office real estate market, with unknown consequences for landlords and their lenders, industry observers said.

Well before COVID-19 evolved into a crisis, the commercial office space was undergoing rapid change that put stress on landlords. Across the country, office tenants were downsizing and owners moved to redevelop office floor space to better meet contemporary requirements, assigning less square footage per worker and carving out more shared spaces to encourage collaboration. Now, social distancing and remote work may upend the market dynamic again. More workers may request to telecommute, while those that return to offices may require more space as a health precaution.

—Read the full article from S&P Global Market Intelligence

US auto sales dropped 12.7% YOY in Q1 as coronavirus hit production, demand

U.S. auto sales declined 12.7% in the first quarter of 2020 as the coronavirus pandemic weighed on consumer demand, according to an S&P Global Market Intelligence analysis. The crisis has shut down production sites and dealerships across the U.S. as government officials have ordered people to stay at home. Overall nonseasonally adjusted U.S. vehicle sales for the period dropped to 3.48 million units from 3.98 million vehicles in the first quarter of 2019.

—Read the full article from S&P Global Market Intelligence

FOX News Opinions May Resonate With Viewers, But Not With Some Advertisers

Recent opinionating by influential news anchors at FOX News Channel (US), some via Twitter Inc., may have backfired, with a number of major advertisers potentially abandoning the channel. This risk has contributed to a reduction in our estimates for advertising on the channel in 2020. We now expect FOX News ad revenue to be off by more than 15% this year to $1.07 billion. This decline includes a previous downgrade for issues associated with the COVID-19 pandemic. Kagan estimates FOX News margins to compress by about 180 basis points as a reduction in programming costs offsets some of the impacts of the revenue downturn.

—Read the full article from S&P Global Market Intelligence

Despite OPEC+ pledge to cut output, oil import tariffs still possible

The Trump administration is considering using tariffs on imported oil as a means to help the beleaguered U.S. shale industry, a move that some policy analysts have questioned and called "extreme." Francis Fannon, U.S. assistant secretary of state for the bureau of energy resources, on April 15 said oil tariffs are still a tool the U.S. could use in its toolbox to try to limit oil oversupply, Reuters reported. While tariffs could provide a boost to some in the industry, their potential use has drawn mixed reviews from energy sector experts.

"It's an extreme policy for extreme circumstances, and you run the risk if you go to that well too often, then it loses credibility as a threat," Benjamin Salisbury, who leads Height Capital Markets' energy and utilities team, said in an April 13 interview. Tariffs, he said, are "not just a regular tool of U.S. energy policy.

—Read the full article from S&P Global Market Intelligence

Five oil-refining states ask US EPA to waive biofuel mandate amid plunging fuel demand

The governors of five oil-refining states have asked the US Environmental Protection Agency to waive biofuel blending mandates while refiners confront plunging fuel demand as a result of the coronavirus pandemic. The governors of Louisiana, Texas, Oklahoma, Utah and Wyoming said refiners in their states need hardship waivers to the Renewable Fuel Standard to weather the financial turmoil.

"The current [blending obligations] made assumptions regarding the ability of the US refining sector to blend renewable fuels that simply no longer obtain," the governors said in the letter. "As our country comes to grips with this national emergency, continuing to implement the current [mandate] imposes an added obligation that would 'severely' harm the sector, and consequently harm the economy of the states and the nation."

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language