Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 9 Apr, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The calamity that ensued when the Ever Given got stuck sideways across one of the world’s busiest and most important trade channels for six days has reminded the world of the fragility of supply chains.

“Global trade in April is likely to be focused on the recovery from the Suez Canal blockage,” Panjiva, part of S&P Global Market Intelligence, said in a recent report. “The pressure on shipping through the canal has waned, but the disruptions to shipping schedules and downstream supply chain operations could last for months.”

The 422 ships log-jammed on the north and south ends of the Suez Canal completed their transit by April 3, another six days after the massive container ship was refloated on March 29, according to the Suez Canal Authority. However, disruption in shipping schedules from South and Southeast Asia to the U.S. East Coast could continue as surges of ships successfully reach their destinations weeks after their intended timings.

"Due to the rapid clearing of the Suez backlog, you will now get peaks of ships arriving in 1-2 weeks and some will need to wait," Andy Lane, CEO of the Port of Belize, told S&P Global Platts. "Then you will get another small lull, before those ships which diverted around Africa arrive and a second peak. Some say that this will go on for months, but in reality April and May for terminals on the main east-west trade lanes will suffer peaks and troughs."

The uncertainty surrounding whether shipments will be successful, delayed, or ultimately cancelled could further frenzy container freight rates. Steel and other metals may also experience price pressures.

"Shippers will be extremely anxious to secure capacity—vessel space as well as equipment—for their own shipments, and hence this pressure could serve to either drive rates up or to maintain rates which are still at historically high levels," Lars Jensen, CEO of container shipping strategic advisory firm SeaIntelligence Consulting, told S&P Global Platts.

The silver lining of the situation is apparent in the low insurance claim that resulted from the rapid response to freeing the 224,000-ton mega cargo ship. Industry experts told S&P Global Market Intelligence that resulting claim will likely be in the low hundreds of millions of dollars.

"It could have been an awful lot worse,” Martin Hall, head of marine casualty at the law firm Clyde & Co, told S&P Global Market Intelligence. He expects the biggest claim will be from the Suez Canal Authority, which may bill the ship's owner, Japanese company Shoei Kisen Kaisha, for the damage caused to the canal itself, assistance in the salvage, and loss of revenue.

Today is Friday, April 9, 2021, and here is today’s essential intelligence.

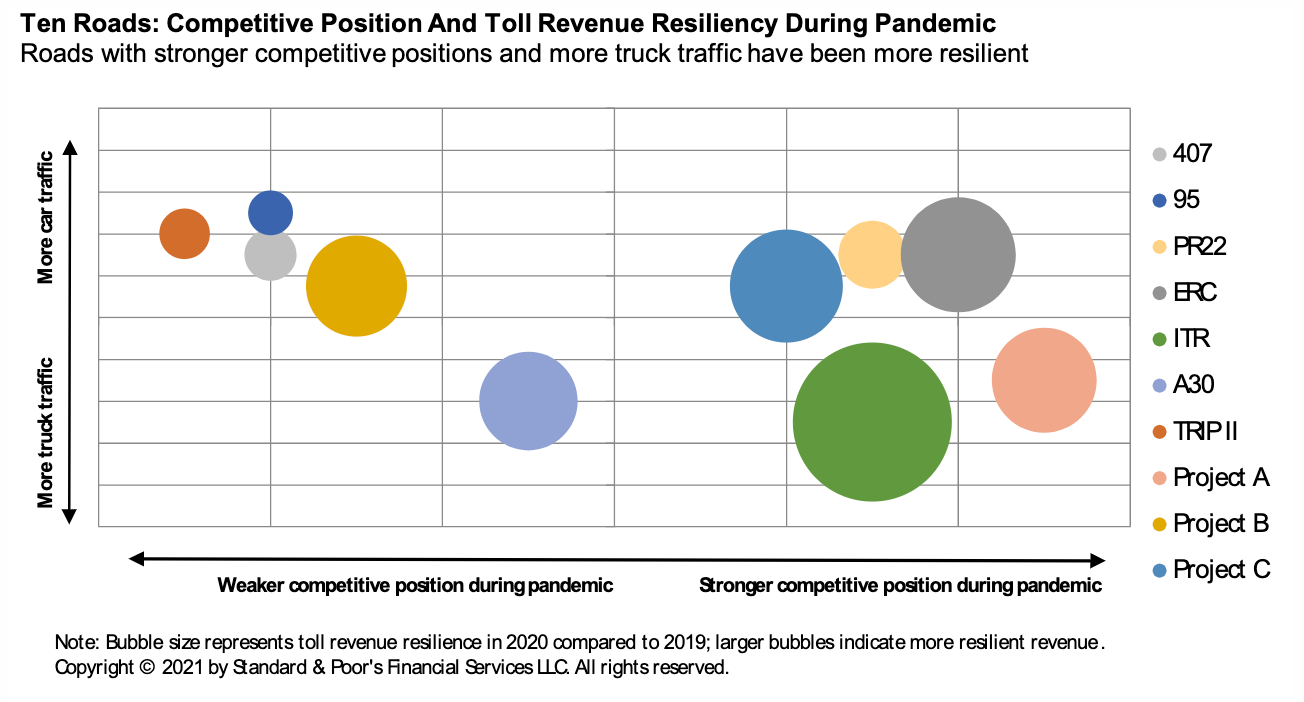

Infrastructure: Ten Roads, Ten Routes Ahead

Although the ongoing vaccine rollout is facilitating the return to normalcy and the economy might have turned a corner, the road ahead is different for each of S&P Global Ratings’ rated U.S. and Canada P3 toll roads.

—Read the full report from S&P Global Ratings

Infrastructure: Ten Roads, Ten Different Stories

The COVID-19 pandemic caused unprecedented declines in traffic volume, including on the 10 U.S. and Canadian P3 volume-exposed toll roads we rate.

—Read the full report from S&P Global Ratings

Citizens' Continued Growth A Sign Of Trouble In Fla. P&C Market

Citizens Property Insurance Corp.'s burden of insuring Florida homeowners is increasing, an indication that the market is in significant trouble, industry observers say.

—Read the full article from S&P Global Market Intelligence

Brent/Dubai Spread An Indicator To Watch Amid Shifting Crude Oil Flows

Middle East crude oil has been a mainstay of the Asian refining sector for many decades. More recently, regional producers have benefited from the demand surge in the fast-growing economies of China and India. But in a market that is increasingly globally interlinked, competing supplies from the West and Africa constantly vie for market share.

—Read the full article from S&P Global Platts

SPACs Drive March M&A Record, But Other Infotech Players Are Still Buying

The economy is finally lapping the coronavirus closures from March 2020, and in doing so, some areas of interest are showing strong growth. U.S. information technology M&A, for instance, spiked in March this year, up 66.4% over last year by deal volume, with 243 deals for the month.

—Read the full article from S&P Global Market Intelligence

Wall Street's Fear Gauge Dips to Pre-Pandemic, Subdued Levels as Stocks Run Up

The S&P 500's "fear gauge" has dipped to levels last seen before the COVID-19 pandemic took root in early 2020, an indication that volatility may be calming even as U.S. stock markets are seeing fresh record highs.

—Read the full article from S&P Global Market Intelligence

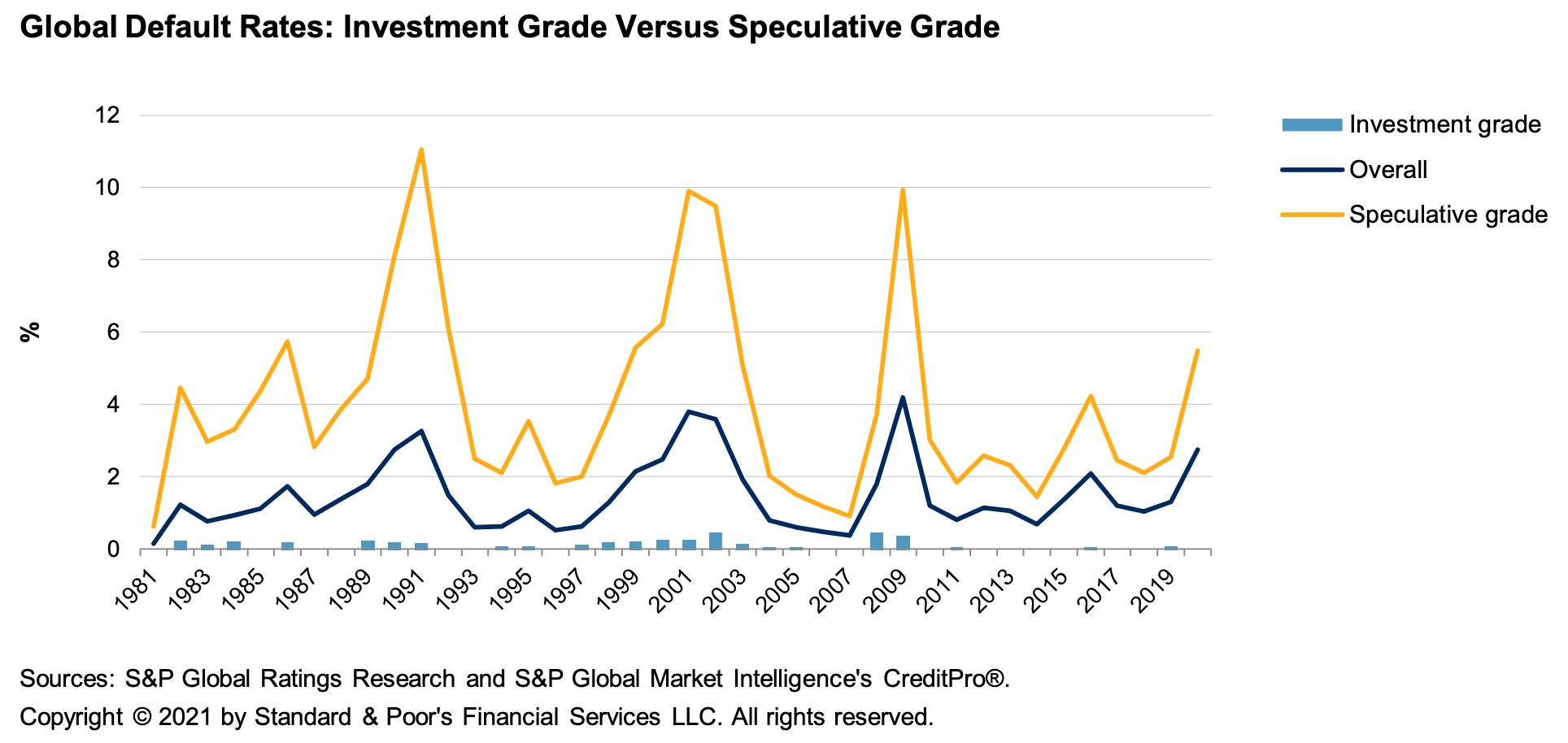

2020 Annual Global Corporate Default And Rating Transition Study

In a year marked by the worst economic contraction since the Great Depression, S&P Global Ratings’ ratings performed well, with all rated defaults in 2020 beginning the year with speculative-grade ratings.

—Read the full report from S&P Global Ratings

Remote Working Not Lights Out For Asia-Pacific Office Players

Working from home as the norm once seemed a remote possibility, globally and in the Asia-Pacific region. Not anymore. The global pandemic has triggered adoption of working from home at an unprecedented pace. The shift is likely to reduce demand for office real estate over the next few years.

—Read the full report from S&P Global Ratings

U.K. Pubs, Shaken And Stirred, Look To Recover After A Cocktail Of Headwinds

With good progress on vaccinations and a roadmap for easing of lockdown and restrictions, pubs and restaurants in the U.K. can open their doors over the next few weeks. The reopening is set to be gradual and staggered, with venues in England allowed to have outdoor operations from April 12 and indoors from May 17; rules and dates vary across Scotland, Wales, and Northern Ireland.

—Read the full report from S&P Global Ratings

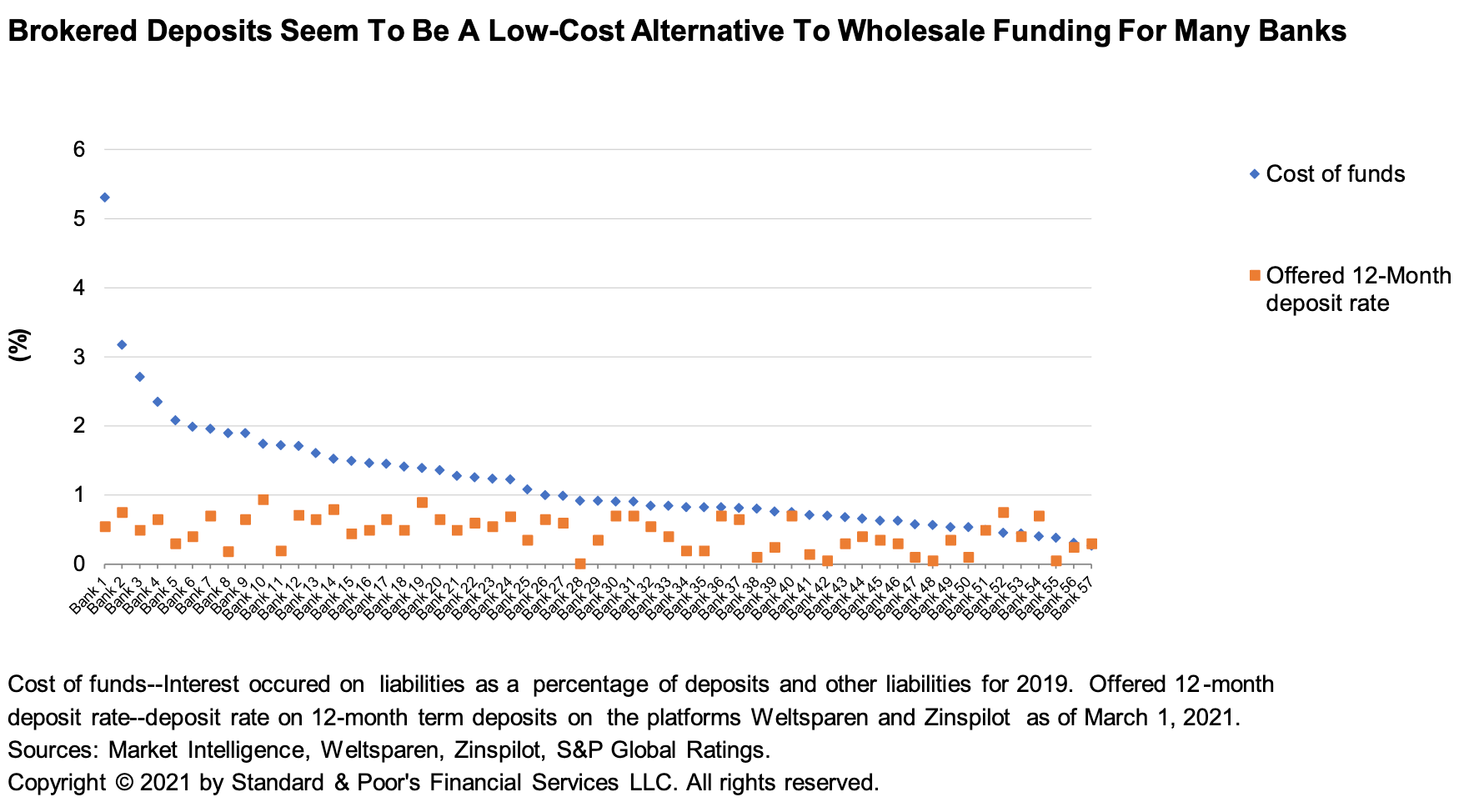

The Future Of Banking: One-Click Deposits (Risks Included)

Traditional banks and online savings platforms are seeing record levels of household deposits during the pandemic. Digital deposit platforms are an efficient funding alternative for banks that lack direct access to domestic or international retail deposits and a way to reduce excess deposits for others.

—Read the full report from S&P Global Ratings

The Future Of Banking: Research By S&P Global Ratings

Traditional banks and online savings platforms are seeing record inflows of household deposits during the pandemic. Digital deposit platforms are an efficient funding alternative for banks that lack direct access to domestic or international retail deposits and a way to reduce excess deposits for others.

—Read the full report from S&P Global Ratings

As Margins Fall, Mortgage Refinancing Dynamics Favor UAE, Saudi Banks

Onerous early settlement clauses and long fixed-rate periods deter borrowers from refinancing mortgages in the United Arab Emirates and Saudi Arabia, respectively, helping ease the impact of historic low interest rates on banks' dwindling margins.

—Read the full article from S&P Global Market Intelligence

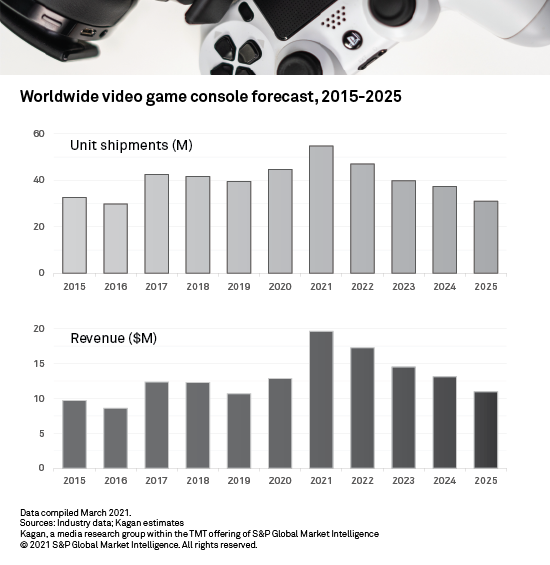

New Nintendo Switch Rumors: The Pros, The Cons, The Profits

Nintendo Co. Ltd. could soon turn on a new Switch video game console, in a move that analysts say would expand the device's target audience to include the rising number of consumers interested in purchasing more powerful gaming hardware. But there are some risks to the move.

—Read the full article from S&P Global Market Intelligence

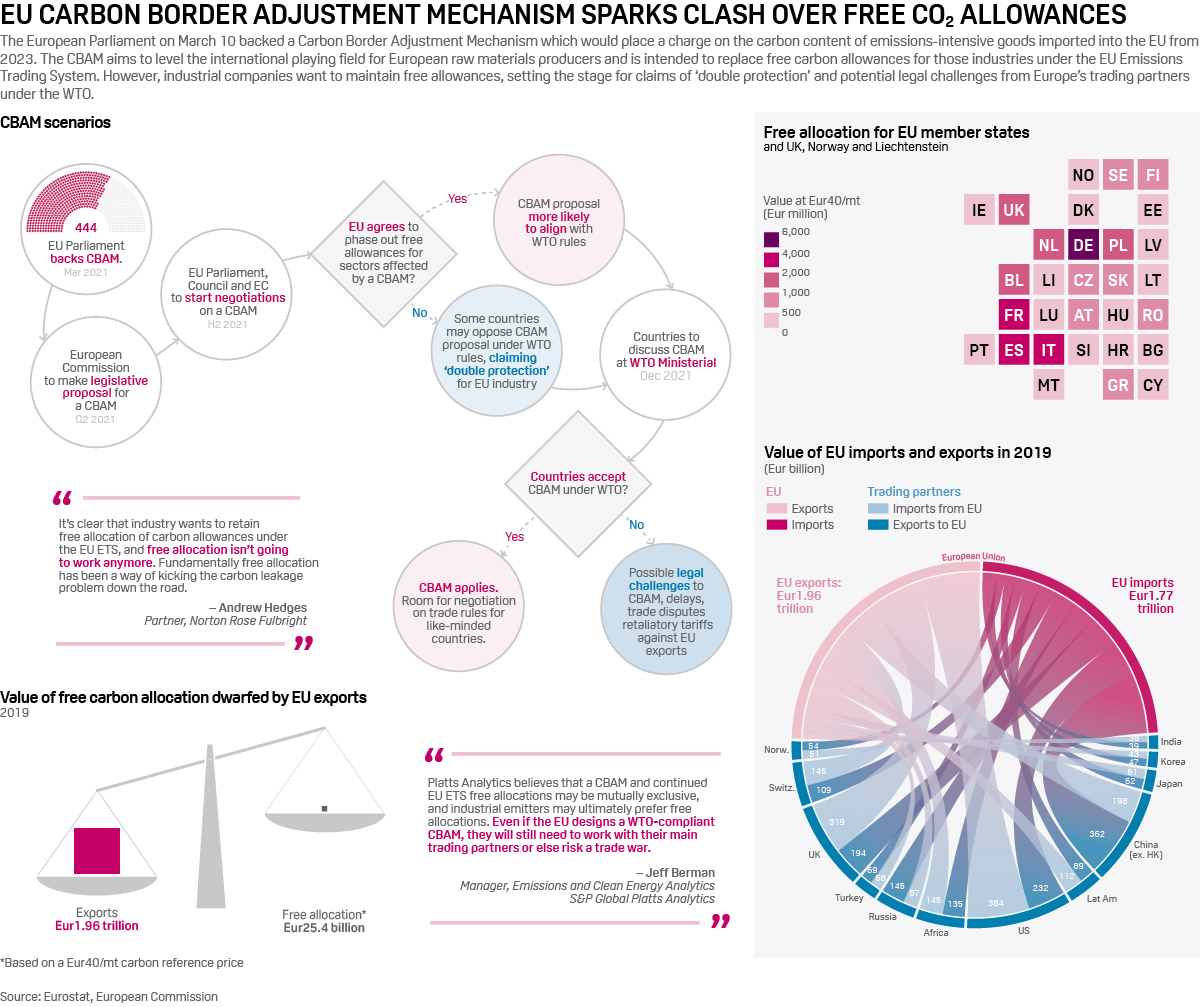

EU Carbon Border Adjustment Mechanism Sparks Clash Over Free CO₂ Allowances

The European Parliament on March 10 backed a Carbon Border Adjustment Mechanism which would place a charge on the carbon content of emissions-intensive goods imported into the EU from 2023.

—Read the full article from S&P Global Platts

Japan Insurers Under Rising Pressure To Push Portfolio Companies To Go Greener

More institutional investors in Japan will likely join Nippon Life Insurance Co. in dialing up pressure on their portfolio companies to go greener more aggressively, experts say, after the nation's largest life insurer went as far as threatening to off-load investments that are not tackling emissions adequately.

—Read the full article from S&P Global Market Intelligence

Meet The Regulator Helping Shape The Next Era Of US Corporate Disclosures

Born in the U.K. and raised in Oklahoma, Khanna, the son of Indian immigrants to the U.S., always saw finance as an "east coast mystery." He attended Washington University in St. Louis with the goal of heading to medical school, before switching course in favor of a legal and policymaking career, the specifics of which remained undecided.

—Read the full article from S&P Global Market Intelligence

In SPP, Preparation, Proper Valuing Of Resilience Seen As Key To Energy Transition

Grid owners and planners in Southwest Power Pool, during an April 7 webinar, emphasized preparedness and the growing need to put a value on the resilience provided by the grid as the power industry embarks on transitioning to a clean energy economy.

—Read the full article from S&P Global Platts

Renewable Diesel Feedstock - An Alternative Clean Energy Investment Part 1

Renewable diesel1 is one of the newer clean energy fuels on the market. It has become popular because it reduces emissions and has up to 85% less sulfur than ultra-low sulfur diesel. As clean air regulations and sustainability goals become more common, renewable diesel could continue growing in popularity.

—Read the full article from S&P Dow Jones Indices

Fossil Fuel Financing Falls In 2020 Amid COVID-19, Environmental Groups Find

Fossil fuel financing fell by 9% in 2020 as the COVID-19 pandemic halted demand and production, but overall bank funding of the fossil fuel industry in 2020 remained higher than in 2016, the year after the 2015 Paris agreement on climate change was signed, according to a new report from a group of environmental advocacy organizations.

—Read the full article from S&P Global Market Intelligence

China's Downstream Gas Market Competition Heats Up With Arrival Of Western Participant

The competition in China's downstream gas sector is expected to heat up with the entry of more foreign participants vying for a greater presence in the increasingly open and growing market, sources and analysts said.

—Read the full article from S&P Global Platts

Texas Regulator To Revise ERCOT Scarcity Pricing To Avoid 'Absurd Results'

The Public Utility Commission of Texas on April 7 initiated a revision to the Electric Reliability Council of Texas' scarcity pricing rule to ensure that a "circuit breaker" change in the systemwide offer cap, designed avoid harming consumers, does not create what the chairman called "absurd results."

—Read the full article from S&P Global Platts

Brazil's Bolsonaro Warns Of Potential Changes To Petrobras' Fuel-Price Policy

Brazilian President Jair Bolsonaro once again warned of changes at state-led Petrobras in a move that raised the specter of renewed government interference at the company that could lead to changes in its policy for pricing transportation fuels "We could change the pricing policy there," Bolsonaro said April 7.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language