Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 May, 2022

By Taylor Kuykendall and Susan Dlin

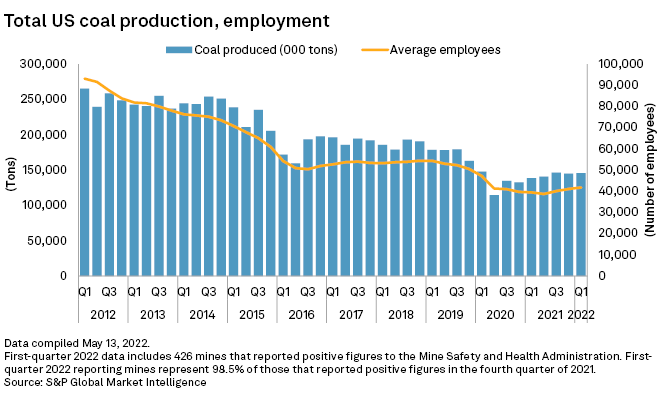

U.S. coal employment swelled alongside higher demand since the summer of 2021, but total production volumes were flat for the past three quarters as producers struggle to make coal shipments.

Production has been climbing along with an increase in demand amid higher natural gas prices, leading to an uptick in hiring.

The average number of employees in the U.S. coal sector has grown over the past three quarters, rising 3.5% between the second and third quarter of 2021 alone, according to S&P Global Market Intelligence data. However, in the first quarter of 2022, coal employment was up just 1.8% over the prior period as coal production volumes stabilized nationally and hovered near the same level through the past three quarters.

U.S. coal employment reached an average of 41,797 employees in the first quarter, according to an analysis of available U.S. Mine Safety and Health Administration data. That is 8.0% higher than in the second quarter of 2021, but remains down by 55.1% compared to the first quarter of 2012.

"We along with the rest of the coal industry are finding it difficult to attract new workers simply by paying higher wages," Alliance Resource Partners LP Chairman, President and CEO Joseph Craft said during the company's May 2 earnings call.

At the same time, U.S. coal producers say they are struggling to meet higher demand for coal due to problems with railroad service, a longer-term deficiency of capital going into new projects and other issues that have stymied producers' efforts to increase production.

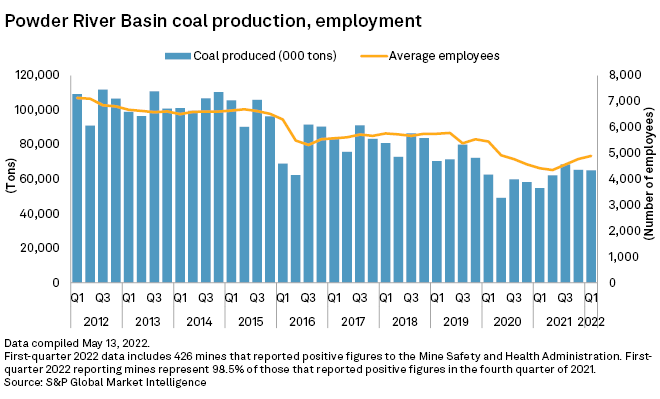

In the Powder River Basin, the United States' largest coal basin by production volume, production has recently drifted lower while employment has climbed. Between the second quarter and third quarter of 2021, employment jumped 4.9% before growing another 4.7% and 2.5% quarter to quarter in the next two periods.

Peabody Energy Corp. President and CEO James Grech said on its first-quarter earnings call the company plans to ship more coal from its Powder River Basin mines in 2022 as it recruits and trains employees. Arch Resources Inc., which has been sharpening its focus on metallurgical coal sold into steel markets, noted that due to higher demand it committed 3.5 million tons of thermal coal to export markets, including shipments from its Black Thunder mine in the Powder River Basin.

Coal production from eastern U.S. coal operations — which can generally be sold at higher margins but requires more labor to produce — has fluctuated but has generally risen across the three largest basins east of the Mississippi. Average employment in Northern Appalachia and the Illinois Basin held steady since mid-2020. As of the first quarter, Central Appalachia coal mine employment climbed about 13.6% over the low seen in the second quarter of 2020 as international demand for the region's metallurgical-grade coal has been higher in recent quarters.

Ramaco Resources Inc. executives noted on the company earnings call that the Central Appalachia producer was hiring workers in anticipation of ramping up production throughout the year. Ramaco Senior Vice President and COO Christopher Blanchard said the company already increased headcount by over 15% in the first quarter.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.