Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Apr, 2022

By Sanne Wass

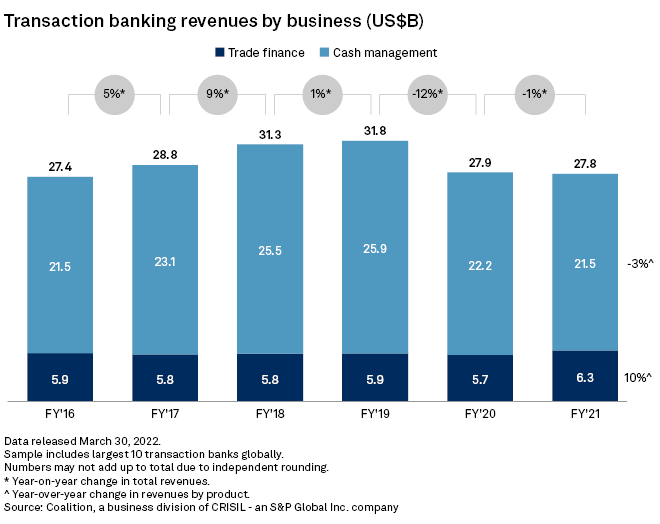

Trade finance revenues for the world's top transaction banks were up by 10% in 2021 and are set to grow further this year, after almost a decade of decline or stagnation, according to figures from research company Coalition Greenwich.

Revenues stand to receive a boost in 2022 from record-high commodity prices and higher interest rates.

"The trade finance market is still doing great, financing volumes are great and revenue is growing," Eric Li, research director at Coalition Greenwich, said about year-to-date activity, emphasizing that only a small part of global trade is linked to Russia.

While some banks may feel the pinch from Russian sanctions due to higher trade exposure to the nation, the outlook for the trade finance industry as a whole is "relatively positive," Li said. Commodity trade finance will be a key driver of growth this year, he said.

Russia accounted for 1.89% of total world exports and 1.35% of global imports in 2020, according to data from the World Trade Organization.

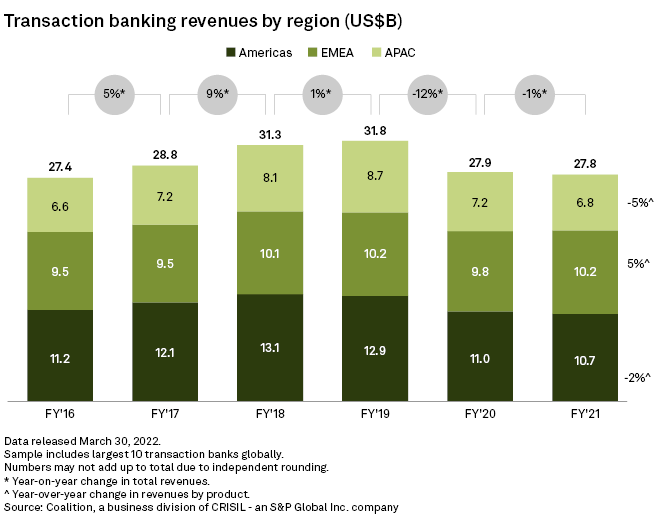

The world's 10 largest transaction banks posted a combined revenue of $6.3 billion from trade finance in 2021, up from $5.7 billion in 2020, surpassing pre-pandemic levels, according to new Coalition Greenwich data.

S&P Global-owned Coalition Greenwich tracks transaction banking revenues at Bank of America Corp., Barclays PLC, BNP Paribas SA, Citigroup Inc., Deutsche Bank AG, HSBC Holdings PLC, JPMorgan Chase & Co., Société Générale SA, Standard Chartered PLC and Wells Fargo & Co.

|

In the second half of 2021 alone, banks' trade finance revenues grew by 13% year on year, according to the research, driven in part by higher trade volumes amid a post-pandemic economic recovery as well as by banks' efforts to finance more international trade, including that conducted by small and medium-sized enterprises, said Li.

The value of global trade reached a record level of $28.5 trillion in 2021, an increase of 25% from 2020 and 13% higher than in 2019, according to UNCTAD's Global Trade Update, published in February. UNCTAD is part of the United National Secretariat.

Commodity trade finance boost

Material price increases for "all key commodities" including oil and gas but also soft commodities such as wheat are creating a larger revenue opportunity for trade finance banks, said Sukand Ramachandran, senior partner at Boston Consulting Group, in an interview.

Top European commodity trade finance banks including Société Générale, ING Groep NV, Rabobank, Crédit Agricole SA, Groupe BPCE and UBS Group AG already appear to be growing their lending to commodity trading firms amid unprecedented liquidity needs, Fitch Ratings said in a March 29 note. Its research was based on data relating to syndicated loans extended to large trading firms such as Trafigura, Glencore, Gunvor, Vitol and Mercuria Energy.

Record-high commodity prices have triggered increased margin requirements from central clearing counterparties and, in turn, have led to higher demand for financing among commodity traders, the rating agency said.

ING, one of the leading banks in financing the trade of commodities, said it would consider increasing support to strong performing clients on a selective basis in a high-price environment.

"Higher limits and higher utilization under existing limits will increase the asset base for the bank and will generate more fees and margin income," Maarten Koning, the Dutch bank's global head of trade and commodity finance, said by email.

Transaction banking revenues, which include both trade finance and cash management, will also benefit from higher interest rates, said Coalition Greenwich's Li. Banks' cash management business has in particular felt the burden of a low interest rate environment, with revenues down 14% in 2020 and 3% in 2021, in part due to lower net interest income, according to Coalition Greenwich data.

But the outlook for this business in 2022 is positive too, thanks to the prospect of higher interest rates, Li said. The Fed, which raised rates in March for the first time since 2018, signaled six additional rate hikes this year.

Trade volumes may take a hit

Global trade volumes will likely take a hit from supply chain disruptions, a more fragmented global payments system and a slowdown in economies as a result of the war in Ukraine, which will factor into banks' trade finance business, said Gianluca Romeo, a director in Fitch Ratings' banks division, in an interview.

The World Trade Organization in October projected a 4.7% growth in global merchandise trade volume in 2022, which Romeo expects to be reviewed downward. Fitch Ratings in March cut its world GDP growth forecast for the year by 0.7 percentage points to 3.5% and is expecting a negative impact on trade, he said.

Ramachandran agreed the conflict will affect trade volumes but expects the pricing benefits this year to outweigh any volume decline.

The worst impact from the war is likely to be felt by those banks with significant direct exposure to Russia, said Li. French bank Société Générale and Austria's Raiffeisen Bank International AG have some of the largest exposures to the nation among nondomestic lenders.

The "big caveat" to Coalition Greenwich's positive outlook for trade finance is whether economies will fall into a recession as a result of the conflict, said Li. This would have much more significant implications for trade and make it impossible to forecast trade finance revenues, he said.

Coalition Greenwich is owned by CRISIL. CRISIL and S&P Global Market Intelligence are owned by S&P Global Inc.