Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Jan, 2021

By Chris Rogers

Soaring rates, better margins

The mismatch between demand for global container shipping services and available capacity was a defining characteristic of the fourth quarter of 2020. As of Dec. 18, 2020, S&P Global Platts' global benchmark reached $3,561 per forty-foot equivalent unit, or FEU, compared to $1,660 per FEU on Sept. 30, 2020, and a trough of $985 per FEU on Feb. 28, 2020. That in turn has led to a bunker excluded rate, a rough proxy for the profitability of the container lines for the fourth quarter of 2020, at over $3,600 per FEU on North Asia to U.S. West Coast routes, nearly four times the level of a year earlier.

The sustainability of those rates will be challenged in 2021 by a mixture of market fundamentals and potential government regulations.

The fundamental picture will take most of the first half of the year to become clear. In the very near term, clearing existing congestion at major ports heading into the off-peak season may keep a lid on equipment availability. Indeed, DHL Express (USA) Inc. has stated it could take until the second half of the year to return to normality. Additionally, supply chains operating through the U.K.-EU border face disruptions from the move to post-Brexit trading arrangements.

The Lunar New Year comes later than last year and so may not act as a coolant for global shipping until late February into early March. In prior years, the average China-outbound container rate has risen by an average 11.7% in the six weeks running up to Lunar New Year over the past five years, based on Shanghai Shipping Exchange data. There has historically then been an average 11.8% drop in the following six weeks. With the Lunar New Year in 2021 scheduled for Feb. 12 (week seven), it is likely to only be later in the first quarter of 2021 that rates will begin to decline.

Looking further ahead, the spread of vaccines for SARS-CoV-2 and associated return of consumer spending on services rather than goods and resulting sustained decline in shipments of consumer goods may take longer to deliver.

Re-regulation — the price of the bounty

The surge in rates has drawn the attention of government authorities in the latter part of 2020. If rates stay high during 2021, and particularly if companies start flagging higher logistics costs during the earnings reports, then action to control rates will become more likely.

The latter will be particularly relevant for container-lines domiciled in Taiwan, mainland China and South Korea, though the governments of both India and the U.S. are also investigating recent rate practices, as outlined in Panjiva's research of Dec. 21, 2020.

While price regulation in the utility sense or renationalization of ownership are unlikely, there is room for intervention in some of the industry's price-setting mechanisms. One option is an adaptation to rate setting transparency along the lines of rules in the EU and those proposed in India's new Merchant Shipping Bill.

Another would be for one or more governments to outlaw the operation of the container shipping alliances. While Panjiva Research has been raising concerns about their future since 2017, they have proven remarkably resilient. Rearrangements of offerings, including the shifting alliance of HMM Co.Ltd. and ZIM Integrated Shipping Services Ltd., and even cross-alliance services, have characterized much of the past year.

Unwinding the alliances does not necessarily address pricing directly. Indeed, the loss of efficiency may lead to higher rates in the longer term. The threat alone, however, may be enough to push the big shipping companies to shift their service offerings and make commitments to invest in new capacity (see more below).

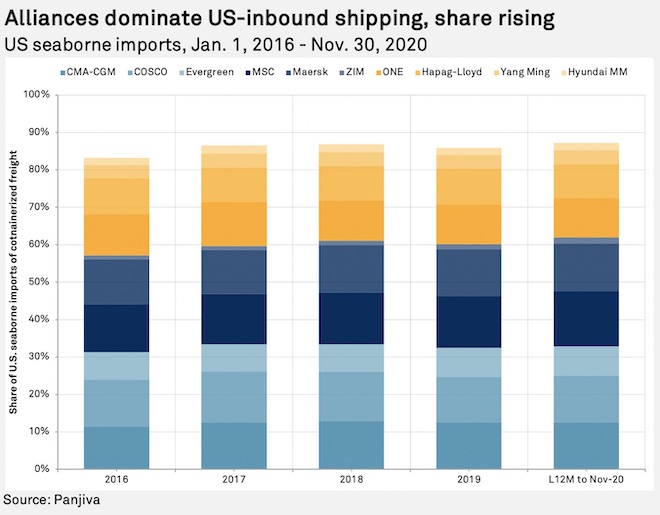

Panjiva's data shows that the three alliances combined accounted for 83.5% of U.S. seaborne imports in the 12 months to Nov. 30, up from 79.5% in 2016 (based on current memberships). The Ocean Alliance group (CMA CGM SA, Cosco Shipping Holdings Co. Ltd. including Orient Overseas and Evergreen Marine Corp. (Taiwan) Ltd.) was the largest of the three with a 32.9% share of shipments in the past 12 months. The 2M alliance (MSC Mediterranean Shipping Co. SA and A.P. Møller - Mærsk A/S) held a 27.4% share and also has ZIM Shipping as an affiliate, adding a further 1.7%. THE Alliance (Hapag-Lloyd AG, Ocean Network Express Pte. Ltd. and Yang Ming Marine Transport Corp.) held a 23.2% share with HMM adding a further 2.0% as an affiliate.

More profits may mean more boats, eventually

One reason for the rise in container-rates in 2020 was the capacity discipline shown by the container lines in terms of being willing to blank sailings. That new capacity cannot be brought online in a timely manner will also have helped. Indeed, one legacy of the 2016 financial crash in the container-line sector was a reduced willingness to order new vessels.

Panjiva's analysis of Alphaliner data shows total orders among the top 100 liners reached 1.69 million twenty-foot equivalent units, or TEUs, as of December 2020 compared to an installed base of 23.61 million TEUs owned/chartered. That is equivalent to a 7.1% increase in capacity with nearly two-thirds of the increase accounted for by the Ocean Alliance members COSCO, CMA CGM and Evergreen.

A central challenge for the container lines is that uncertain environmental regulations (see below) are clouding what choices of equipment to order. Indeed, Maersk CEO Soren Skou stated on the company's third-quarter 2020 earnings call that "buying ships today that you get delivered two years from now and that last for 25 years is a risk when we do not know exactly what fuels that we'll be using from 2030."

There are some signs of new orders arriving, with Korea Shipbuilding receiving four major container vessel orders worth an aggregate $409 million according to Marine Energy while Hapag-Lloyd has committed $1 billion for six 23,000+ TEU, LNG-powered vessels. Notably, though, delivery for those vessels is not scheduled until 2023. Ocean Network Express and MSC, via Bocomm, have reportedly placed similar orders.

The shipbuilding industry globally, including tankers, bulkers and service vessels as well as continue ships, had a lackluster 2020. Panjiva's analysis of government trade data shows exports from China, Japan and South Korea combined fell by 7.4% year over year in the 12 months to Nov. 30, 2020, to reach $78.7 billion, the lowest since 2008. China's shipyards did better than average with a decline of just 2.4% while Japan's have done the worst with a 22.4% drop.

ZIM IPO finally ready to set sail

ZIM Integrated Shipping has responded to the continued improvement in container shipping industry fundamentals with a filing for an IPO of its shares on the NYSE. That represents the fourth attempt at a listing with prior events postponed due to prevailing market conditions.

As the 10th largest container line by capacity, the company has chosen to tie up with the 2M shipping alliance of Maersk and MSC in order to be able to provide a wider shipping offering to its customers.

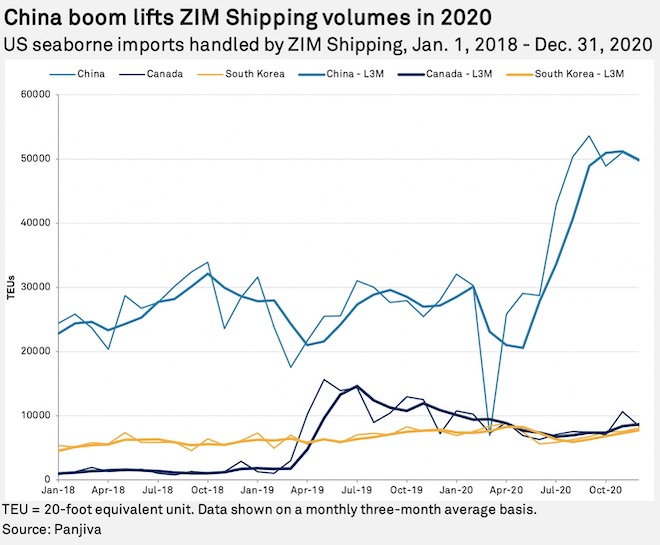

That tie-up has yielded benefits for the company in the form of increased shipping on U.S.-inbound routes. Panjiva's data shows that shipments linked to ZIM surged 30.7% higher year over year in the fourth quarter, including an 83.7% increase in imports from ports in mainland China and offset in part by lower shipments from Canada and South Korea.

Greening the ocean — Spending on environmental measures for container ships

The U.S. may return to the Paris Agreement on climate change under President-elect Joe Biden, raising the profile of long-term greenhouse gas policies in 2021.

The European Commission has already approved a new set of greenhouse gas emission targets that will see a 55% cut in emissions in 2030 versus 2009 levels compared to a prior target of a 40% reduction. The targets include a set of strategies including the Sustainable & Smart Mobility Strategy that includes 8% to 13% fuel mix for maritime from alternative fuels by 2030, rising to 85% to 90% in 2050.

The shipping industry will also enter the EU Emissions Trade Scheme from June 2021 and pressure will likely increase on the IMO to put greenhouse gas regulations in place that are similar to those applied for desulfurization.

The container lines have a wide range of short- and long-term options for alternative fuels, ranging from reduced emissions using LNG or ammonia instead of oil as a fuel in the near term through hybrid-electric systems with near-zero emissions but using unproven technology. Most will require replacing the fleet and so may be more expensive than the desulfurization process that was completed in January 2020.

In the very near-term the container lines could try and use purchases of carbon emission permits, or EUAs, while seeking longer-term solutions. Indeed, the tighter EU rules have led to a surge in carbon emission permit prices, Reuters reports. Panjiva's analysis of S&P Global Market Intelligence data shows prices reached 31 euros per ton by mid December 2020, up from an average of 25 euros per ton in 2019 on average.

If the experiences of desulfurization in shipping and carbon pricing in European power markets hold, then the extra costs will be passed through to consumers.

The level of pricing needed to meet commitments is not yet clear, though the NHH Center for Shipping & Logistics has indicated bunker fuel oil prices would need to reach $800 to $1,000 per ton for long-term solutions such as ammonia as a fuel to be viable.

That compares to $450 per ton for low-sulfur fuel oil currently, according to S&P Global Platts, with the additional costs equivalent to around $210 per 40-foot equivalent unit, or FEU, to $330 per FEU on North Asia to North America's west coast. Container rates on those lanes averaged around $2,500 per FEU in 2020.

No shortage of ways to cut port congestion; funding needed

While spending on new vessels may be minimal, there is a clear need for investment elsewhere in the logistics sector including infrastructure, digitalization and environmental measures.

The deluge of shipping to west coast ports shows that supply chains can break down among intermodal boundaries, as discussed in Panjiva research of Dec. 10, 2020.

Inland ports (also known as dry ports) provide an option that could alleviate space issues at crowded seafronts. An inland port, in concept, is a hub facility that allows imported goods to move further inland, often closer to main transportation arteries, for processing and sorting. This alleviates traffic from rail and road to ports directly, which often do not have sufficient space to expand these services to provide for peak demand.

Investing in larger ship handling and deeper channels can also help alleviate congestion. Instead of many smaller ships, each requiring a quay with the necessary equipment, ports can achieve their volume goals through fewer larger ships. The port of Boston is going down this route — dredging finished in late 2020 to allow post-panamax ships into the harbor at low tide.

Finally, ports across the U.S. could benefit from a coordinated federal infrastructure program to clear bottlenecks across the intermodal journey. Investments in existing infrastructure, from converting rail bridges to allow double stacked containers through to investing in road trains and highway improvements can add up to overall increased throughput. Federal spending on transportation and roadways increased by 7.7% and 2.9% year over year in 2019, and if that trend continues could help alleviate some of the congestion.

Internet of more things

The coronavirus pandemic has brought into focus some of the benefits of technology for shippers. The ability to process paperwork remotely, track containers and optimize networks on the fly provide numerous benefits for shippers, forwarders and operators.

One area where internet of things investments could help is in the shipment of eagerly awaited COVID-19 vaccines, of which some need to be kept at temperatures below what a normal refrigerated container can provide, as noted in Panjiva research of Nov. 25, 2020. Pharmaceutical companies are also signing deals with carriers to guarantee availability of these cold chain networks. IoT technologies may give carriers an advantage in securing those deals. Maersk claims that the majority of their 380,000 refrigerated containers are IoT-enabled, theoretically letting pharma companies track their drugs in real time.

IoT investments not only build resilience and confidence in shipping infrastructure, but they also provide a way to meet other commitments such as climate pledges. Fuel costs are often also one of the highest expenses for a carrier, and with the U.S. Energy Information Administration projecting a 7% increase in consumption in 2021, carriers are likely looking for ways to mitigate that and stay in compliance with IMO sulfur regulations.

IoT devices provide the data for algorithms to solve complex optimization problems — also known as "traveling salesman" challenges that can lead to greater efficiencies. Predictive analytics and ubiquitous data can also improve the lifecycle of ship engines and equipment alongside other benefits.

The up-front cost and technology expertise required to run a successful IoT program may keep some carriers away in the short term. One solution could be to join a technology alliance, mostly made up of blockchain networks. While adopting blockchain is somewhat "on-trend" the capabilities required to integrate with a blockchain are the same requirements to utilize IoT, giving companies the opportunity to kill two birds with one stone.

The adoption of blockchain networks also promises to solve some of these problems, with the key selling point continuing to be traceability and network trust. These platforms have continued to grow, with MSC and CMA CGM joining Tradelens, along with Canadian Pacific Railway Ltd. and the Port of Los Angeles. Another blockchain group, BiTA, has also seen growth with companies such as Oneledger (Uk) Limited, Open Text Corporation and KPMG International Co-op signing on to help the development of blockchain alongside companies including DSV Panalpina A/S and United Parcel Service Inc.

Blockchain programs are very likely nearing the point where network effects start to take over, and it is important to note that they are generally not mutually exclusive, with CMA CGM holding membership with Tradelens and the Global Shipping Business Network, another blockchain program.

One notable facet of the development of technology in logistics is that it does not yet appear to have risen to the level of relevance to stockholders. Panjiva's analysis of S&P Global Market Intelligence transcript data shows just eight company conference calls discussed blockchain in 2020 while seven discussed Internet of Things.

(Not) altogether now as prospects for consolidation remain low

One of our mistaken expectations for 2020 was that the freight forwarding sector would need to consolidate to cut costs and improve profitability. In the end, most of the forwarders have improved their profitability per unit during the pandemic while the process of consolidation that saw CMA CGM buy Ceva and DSV merge with Panalpina has remained frozen.

Many forwarders are instead investing in technology and smaller, bolt-on deals to improve future efficiency levels. Panjiva's analysis of S&P Global Market Intelligence data shows that 2020 saw 1,060 deals announced in the marine and air freight/logistics sectors compared to 1,470 in 2019 and 1,640 in 2018.

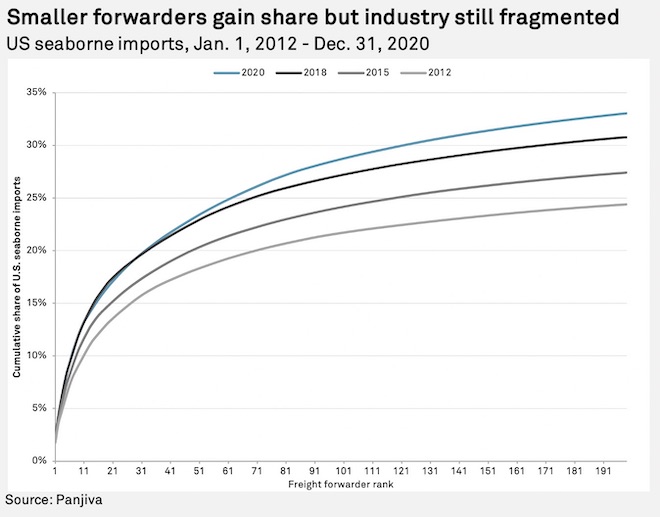

What is unchanged is the challenge from new entrants including digital natives such as Flexport Inc. and Amazon.com Inc. and a degree of vertical integration by the container lines, shown by Maersk's actions. Nonetheless, the high level of fragmentation in the freight forwarding sector is unlikely to change without a series of consolidative deals.

Panjiva's data shows that the top 25 freight forwarders accounted for 14.5% of U.S. seaborne imports in 2012, a ratio that had increased to 18.4% by 2018 but dipped slightly to 18.3% in 2020. There has been a modest shakeout among smaller operators with the top 100 forwarders' share rising to 28.7% in 2020 from 27.2% in 2018, potentially as a result of smaller operators having excited the market.

Safety first

Safety has been on the minds of many in 2020, and will likely continue to be in 2021. One of the most pressing issues is containership fires, with MarineLink noting that there is a containership fire on average every week. Despite the thankful improvements in survivability, fires often sideline a ship for repairs and remediation, disrupting service.

Two factors to keep an eye on in the next year are container lines cracking down on the reporting of dangerous cargoes — including lithium ion batteries, cars and chemicals — and regulations to provide for firefighting systems that can manage the types of fires that those cargoes could produce. While new ships largely fall into line with advanced firefighting techniques, if fires persist expect additional scrutiny on the container fleet.

The most dramatic case of shipping losses in 2020 was the ONE Apus, which lost 1,900 containers in a storm as detailed in Panjiva research of Dec 4, 2020. This reminds us that shipping is still inherently dangerous — even in the age of megaships, GPS and satellite weather. Panjiva analysis of IMO incident reports shows that these events are rarer than fires, however, with only incidents matching the keyword "storm" in 2020, compared to 6 instances of "fire."

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.