Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Oct, 2023

Short sellers are increasing their bets that the economic headwinds facing the real estate industry are far from over.

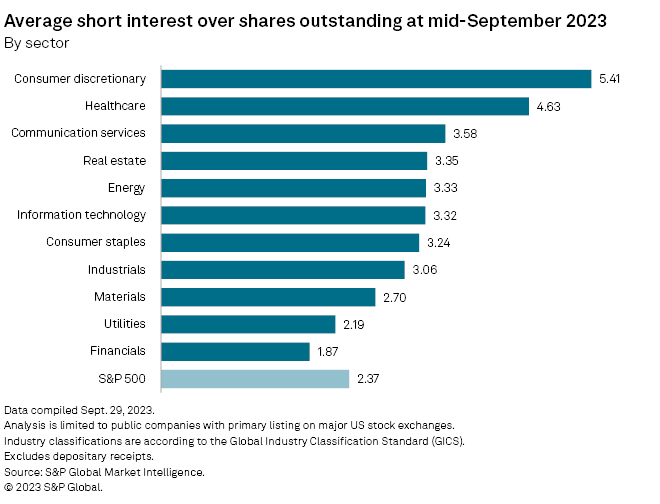

Short interest in the real estate sector was at 3.35% as of mid-September, up 8 basis points since mid-July and the highest level of short interest in the sector since mid-June, according to the latest data from S&P Global Market Intelligence. Average short interest in the S&P 500 was at 2.37% as of mid-September.

Bets against real estate grew in September as the sector continued to struggle with the effects of remote work and relatively high interest rates. The S&P 500 real estate sector has fallen 36.43% from its peak at the end of 2021 through Oct. 3, compared to the overall S&P 500, which fell 11.49% over that stretch. For 2023, the S&P 500 real estate sector has fallen 11.59%, compared to the 10.6% gain in the overall index.

Short interest measures the percentage of outstanding shares of a given company or industry held by short sellers, who seek to profit from a stock's decline by borrowing shares to sell at a high price, then repurchasing them after a drop and pocketing the difference.

Short interest continues to thrive in the consumer discretionary sector, as sellers still believe that persistently high inflation will impede consumer demand. Short interest in the consumer discretionary sector was 5.41% in mid-September, up from 4.98% in mid-August.

Real estate in focus

Short sellers in the real estate sector focused the most on office real estate investment trusts, which had short interest of 6.64% at mid-September, up from 6.49% at the end of August.

Healthcare REITs and hotel and resort REITS had the second- and third-most short interest within the sector, at 5.15% and 5.06%, respectively, as of mid-September.

SL Green Realty Corp. was the most shorted real estate stock as of mid-September, with 24.31% short interest. Short interest in the company has averaged 22.39% throughout 2023.

SL Green is Manhattan, NY's, largest office landlord and, as of late June, held interests in 60 buildings totaling 33.1 million square feet.

Overall picture

Novavax Inc. remained the most shorted stock in mid-September with 47.1% short interest, up from 42.5% at the end of August.

Short interest in Helius Medical Technologies Inc., a neurotechnology company, also soared to 32.9% in mid-September from 5.4% at the end of August, putting it among the top five most shorted stocks. In August, the company enacted a 1-for-50 reverse stock split.