Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Aug, 2021

By Brian Scheid

Short sellers are continuing to grow their bets against consumer discretionary stocks after their wagers hit a low earlier this year.

The renewed focus on the sector — which largely comprises businesses that sell goods and services viewed as non-essential like apparel, vehicles and restaurants — comes as companies continue to grapple with lingering effects of the pandemic, a surge in delta variant cases and related impacts on consumer sentiment.

"Short sellers are betting against consumer spending as stimulus checks wane, required vaccinations across some states, demand normalizes, and both retail sales and sentiment data softens," said Edward Moya, a senior market analyst at OANDA, in an interview.

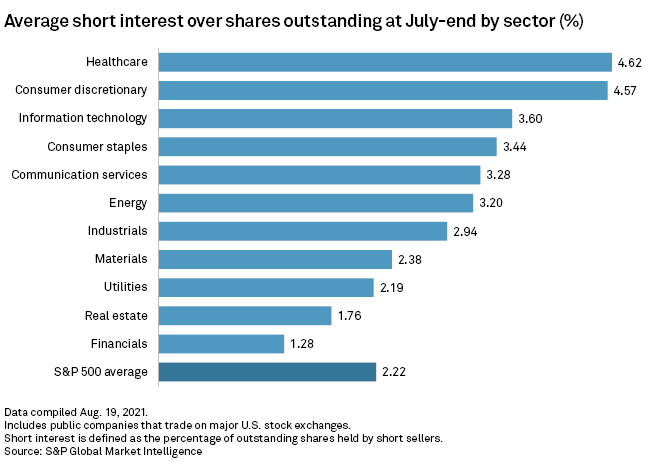

Short sellers held 4.57% of outstanding shares in the consumer discretionary sector at the end of July, according to the latest S&P Global Market Intelligence data tracking companies on major U.S. exchanges. The sector is the second-most shorted after healthcare. On average, short sellers held 2.22% of all S&P 500 stocks.

While the average short interest for consumer discretionary stocks has fallen from its 5.57% average at the end of December, it has risen significantly in recent months. Short interest grew from a low of 4.23% at the end of February to as high as 4.59% at the end of June.

Short-sellers borrow stock and sell it in anticipation that they can replace it at a later date at a lower cost if the share price falls. If their plays are successful, short-sellers profit from the difference between the price at which they sell the stock and the price at which they repurchase.

The strategy drew unprecedented attention earlier this year after retail traders caused GameStop Corp. shares to rise steeply in response to the heavy speculative betting on the retail game company's pending demise.

The recent increase comes amid disappointing data about consumers, a key driver of the U.S. economy. Last week, the University of Michigan's initial survey of consumer sentiment fell to its lowest point since 2011 as inflation rises and unemployment remains high. Retail spending in July was also worse than economists expected, largely due to supply constraints, possible fears of the delta variant and consumers switching from buying goods to services.

So far in 2021, S&P 500 consumer discretionary stocks have climbed about 8.4% on the year, trailing the 18.3% increase for the broader index. During the height of the pandemic, the sector jumped nearly 83% from its March 23, 2020, low to the end of the year.

Short sellers keep bets against biotech

The healthcare sector overtook the consumer discretionary sector at the end of January as the most-shorted sector, largely due to bets against biotechnology stocks.

"Biotechs almost always have high short interest as they typically trade on the pricey side with lots of hope," said Paul Schatz, president of Heritage Capital.

But the gap between the two most-shorted sectors appears to be closing as short-sellers see consumer spending without the benefit of government stimulus checks and prices heading higher into the holiday season.

"Concerns are growing that supply chain issues are keeping inventories low and that we may see some severe price increases heading into the holidays at the end of the year," Moya of OANDA said. "Given how the COVID story is unfolding, it seems that a complete return to normal for the U.S. consumer is not happening during the second half of the year."

John Stoltzfus, chief market strategist at Oppenheimer, said the bets against consumer discretionary may prove incorrect as the economy's post-pandemic path becomes clear.

"Normal recessions of course can be problematic for discretionary spending, but in our view the U.S. economy is moving not towards a recession but rather towards a more normal sustained economic expansion as it moves forward in this recovery period," Stoltzfus said.