Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Oct, 2023

Short sellers have increased their bets against some oil and gas stocks as energy prices rose to their highest levels in nearly a year.

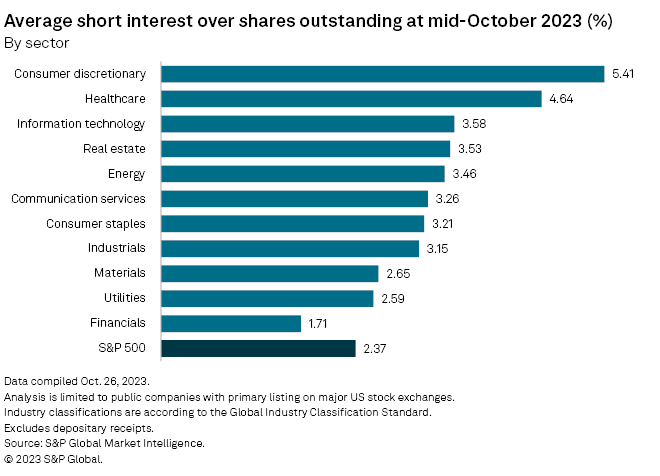

Short interest in the energy sector was at 3.46% in mid-October, up from 3.31% a month earlier, according to the latest S&P Global Market Intelligence data. Short interest in the sector jumped to 3.50% at the end of September when front-month Brent crude oil futures surged above $96 per barrel for the first time in about 11 months.

Consumer discretionary stocks continue to draw the highest amount of short interest, at 5.41% as of mid-October, as investors see persistently high inflation impacting consumer demand.

Short interest measures the percentage of outstanding shares of a given company or industry held by short sellers, who seek to profit from a stock's decline by borrowing shares to sell at a high price, then repurchasing them after a drop and pocketing the difference.

Energy sector in detail

Short interest in the energy sector has averaged 3.45% since the end of December 2022.

Short interest in oil and gas refining and marketing stocks jumped to 4.06% in mid-October from 3.66% in mid-September, the data shows.

Most shorted

Of the 10 most shorted energy stocks, half were oil and gas exploration and production companies, including Tellurian Inc., Vital Energy Inc., Permian Resources Corp., Callon Petroleum Co. and CNX Resources Corp.

The most-shorted energy stock as of mid-October was Vertex Energy Inc., with short interest of 20.17%.

Novavax Inc. remained the most shorted stock as of mid-October with short interest of 45.5%, down slightly from a month earlier when short interest in the stock was at 47.1%.