Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Nov, 2021

By Tim Zawacki and Jason Woleben

Stricter coverage eligibility requirements in Florida proposed by the residential property insurance units of The Progressive Corp. could help the company execute its plan to create a more geographically balanced portfolio.

Florida ranks as the largest state for Progressive's residential property insurance subsidiaries by a wide margin, and their presence in the catastrophe-prone Sunshine State has grown in recent years on both relative and absolute bases. With Progressive's property insurance combined ratio on a nationwide basis hitting 125.1% for the first three quarters of 2021, including 24 percentage points attributable to three natural catastrophes, the company's ability to reduce its business mix from states such as Florida, Texas and Louisiana will be key to its goal of producing less volatile and more profitable underwriting results. |

Progressive's ASI Preferred Insurance Corp. and American Strategic Insurance Corp. submitted rule revisions to the Florida Office of Insurance Regulation on Nov. 1 that include a requirement that roofs on underlying properties be 15 years and newer for both new and renewal business. Their existing rule manual only specifies that roofs needed to be in "good condition," meaning free of damage, creasing or heavy granular loss, and that composition shingle roofs must have been replaced within 15 years.

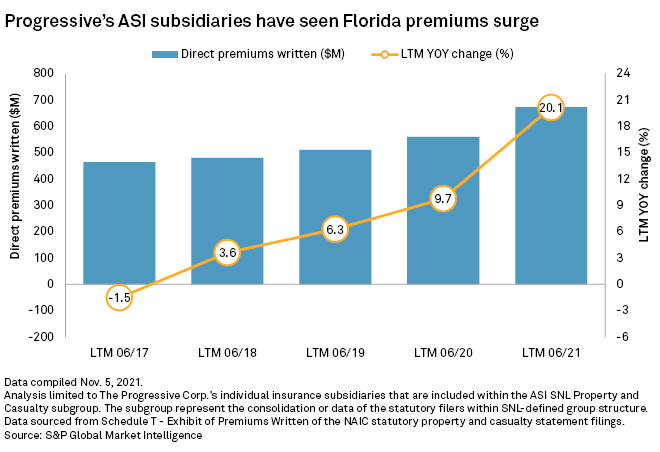

Progressive ranked as the No. 5 writer of homeowners business in Florida in 2020, trailing Universal Insurance Holdings Inc., the state-run Citizens Property Insurance Corp., State Farm Florida Insurance Co. and Tower Hill Signature Insurance Co. and its various affiliates. The group placed No. 10 as recently as 2018. The ASI subgroup, as consolidated by S&P Global Market Intelligence, generated 29.1% of its total direct premiums written for the first half of 2021 from Florida, up from 27.8% in the year-earlier period.

The trajectory of ASI's Florida growth on a year-over-year basis has been especially noteworthy. Its Florida direct premiums written have expanded at a faster pace over the last four quarters than at any point since Progressive first made a noncontrolling investment in the homeowners group in 2012.

The age of roofs is a particular concern in Florida due to the state's climate. The International Association of Certified Home Inspectors puts the estimated life expectancy of asphalt shingle roofs in the state at between 10 and 12 years as compared with 20 years elsewhere. More recently, insurers have also flagged an escalation in roofing contractor solicitations of policyholders for full roof replacements in the aftermath of hurricanes and other natural catastrophes. A Florida Office of Insurance Regulation data call found that the number of roof claims and the share of those claims that have been subject to litigation have increased in recent years.

The state regulator previously rejected stricter roofing criteria proposed by the ASI companies that would have applied only to new business. Homes in certain counties, including Palm Beach, Broward and Miami-Dade along south Florida's Atlantic coast, would have been required to have roofs that were five years old or newer; the threshold would have been set at 10 years in the counties not specified in the filing.

The ASI companies said that those rules were intended to manage catastrophe risk exposure, especially in counties where homes with older roofs had been generating higher loss ratios than other areas of the state. But the regulator disapproved the filing as it said the rules lacked support and were "unreasonable."

The November filing also seeks to tighten coverage restrictions on homes of unconventional construction beyond an existing limit on log homes to include do-it-yourself, dome, A-frame and shell homes, as well as properties that do not meet building codes. The revised rule manual would also insert new language that echoes a 2020 filing by FedNat Insurance Co. regarding potential exposure management efforts.

"From time to time based on [Office of Insurance Regulation] directives, preservation of policyholder surplus or exposure and risk management," the ASI filing states, "the Company may place limitations on exposures and/or coverage minimums in certain areas of the State. As a result, the Company may decline certain risks that would otherwise be eligible for the program."

Progressive's efforts to reduce residential property insurance exposure in what the company characterized as "more volatile states" is not limited to Florida, and they will employ a range of approaches that include higher deductibles, higher rates and targeted nonrenewals. President and CEO Tricia Griffith, speaking during a Nov. 3 conference call, said that the latter option is not Progressive's "preferred path." She said that "there are times where we need to use nontraditional methods to meet our targets." Management maintains a goal of an aggregate 96% combined ratio in all of the company's products.

ASI Lloyds, Progressive's Texas residential property insurance affiliate, produced a homeowners direct incurred loss ratio of 159.9% during the first half of 2021 due in large part to February winter storms and a late April hailstorm. The Florida-focused ASI Preferred fared better with a homeowners direct incurred loss ratio of 80.4% for the period, but that was still 11.7 percentage points above the U.S. P&C industry's result across all geographies and companies. Third-quarter losses for Progressive Property Insurance Co., the group's primary writer of Louisiana homeowners business, are likely to be inflated by Hurricane Ida. Progressive said that its losses and allocated loss adjustment expenses related to Ida exceeded the $200 million per-event retention under its property-catastrophe excess-of-loss reinsurance program.

The combination of Florida, Texas and Louisiana, all of which have experienced significant catastrophe activity in recent years, accounted for 47.4% of ASI's direct premiums written for the trailing-12-month period ended June 30.

Griffith said that Progressive is seeking to generate between 60% and 70% of its property insurance premiums from "nonvolatile states" within the "next couple of years."