Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Feb, 2021

By Abdullah Khan and David Hayes

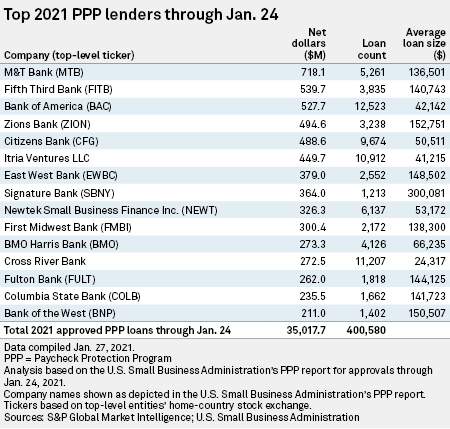

The leading lenders in the Paycheck Protection Program have changed in the early part of 2021 compared to 2020, and that could switch again as more of the COVID-19 relief loans are allocated.

|

M&T Bank Corp., which ranked 10th in 2020, is the top lender so far in 2021 with $718.1 million of PPP loans, according to data through Jan. 24 from the U.S. Small Business Administration. The SBA listed the leading 15 lenders, and JPMorgan Chase Bank NA, the top PPP lender in 2020, did not make the early 2021 ranking list.

However, the biggest banks did not initially have access to the program when it first reopened in January. The SBA had limited the program to certain lenders with $1 billion or less in assets in an effort to promote greater access to capital for underserved small businesses before opening to all lenders on Jan. 19.

Some large lenders are expecting to ramp up their PPP loan allocation. PNC Bank NA ranked third in 2020 but did not appear among the top 15 in the early days of the program in 2021. However, the company expects to originate $4 billion in PPP loans within the first quarter of the year, PNC Financial Services Group Inc. CFO Robert Reilly said according to a transcript of an earnings conference call.

Fifth Third Bancorp expects to originate $2 billion in new PPP loans in 2021, CFO James Leonard said according to a transcript of a company earnings call. Fifth Third Bank NA jumped to second place in 2021 — from 13th in 2020 — with $539.7 million of loans approved and an average loan size of $140,743.

Meanwhile, Signature Bank, which ranks as No. 8 in the latest round with $364 million in PPP loans, hopes to receive at least $1 billion in PPP loan applications in 2021, said President and CEO Joseph DePaolo during the company's fourth-quarter earnings call. "We've deployed a significant number of personnel [to] be ready to get the applications into the system and have the SBA give us an SBA number," DePaolo said, according to a transcript.

|

The PPP is part of the government's stimulus package and is designed to provide forgivable loans that help businesses keep workers employed during the COVID-19 crisis. The reopened program was given $284 billion as part of the stimulus plan signed into law in December 2020 and about 12.3%, or $35.02 billion, of the allocated funds had been approved in loans through Jan. 24, according to the SBA data.

According to the SBA's data, the accommodation and food services was the sector with the largest amount of net loans approved at $6.53 billion for 2021, compared to the $42.48 billion loan amount approved in 2020.

Social-distancing practices and government-mandated lockdowns due to the coronavirus pandemic, deeply impacted the sector. Since April 2020, the leisure and hospitality sector saw jobs drop by 498,000, led by a decline of 372,000 in food services and drinking places.

The construction sector started 2021 as the second largest with $4.95 billion in loans approved followed by manufacturing with $3.98 billion.