Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Jul, 2021

By Bill Holland

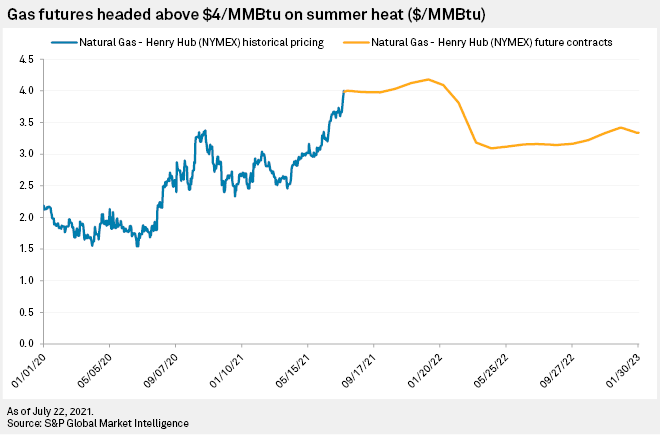

NYMEX natural gas futures prices went above $4/MMBtu for the first time in more than two years and kept climbing July 23, as gas kept its market share for power generation while North America ran its air conditioners against higher-than-normal heat.

Future contracts for delivery in the winter months of 2022 also stayed above $4/MMBtu, according to S&P Global Market Intelligence data.

"NYMEX [gas contract for August delivery] is up 0.27% versus 4.014 as of 7:17 a.m. and traded to a two and a half year high of 4.024 at 3:00 a.m. versus the seven-year high of 4.929 from November 2018," Mizuho Securities USA LLC Director of Energy Futures Robert Yawger said in his morning note July 23.

According to gas analysts at energy investment bank Tudor Pickering Holt & Co., demand for gas from power producers will stay high as the heat wave continues. "Prices rallied to end [July 22] near a $4 handle as warmer-than-average weather continues to bolster the setup for balances through summer," Tudor Pickering Holt said in its July 23 note.

"In the coming weeks, with warmer-than-average temperatures expected to trickle back in, should forecasts hold, we'd expect power gen demand to again breach the 40 Bcf/d level versus a five-year average of 42 Bcf/d in the next two weeks as coal generation has failed to pick up materially and gas' share of the thermal stack has remained resilient at roughly 60%," Tudor Pickering Holt said.

S&P Global Platts pegged next week's Monday-to-Friday power demand at 42.4 Bcf, up from this week's 40 Bcf, according to a July 23 note.

Pure-play shale gas producers have waited more than a year for prices to climb above $4/MMBtu, but their share prices showed little reaction to the $4/MMBtu price point. Analysts said investors moving into gas have already accounted for higher commodity prices after the near-record lows seen in 2020.

S&P Global Platts and S&P Global Market Intelligence are both owned by S&P Global Inc.