Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Dec, 2024

|

At 65 MW, Scout Moor in Lancashire is one of England's largest onshore wind farms. Plans for a 100-MW second phase are now underway. |

Onshore wind developers in the UK are in mobilization mode as part of a government effort to double installed capacity by 2030. But ambitions for a new wave of project development could be thwarted due to ongoing discussion over power market reform.

The Labour Party's election victory in July brought with it a shift in sentiment in favor of onshore wind, installations of which had fallen behind other renewable technologies under the UK's previous Conservative government.

Offshore wind and solar are still expected to grow at a faster rate than onshore wind under Labour's Clean Power 2030 plan. But the renewed political support for the technology — in particular the government's effort to boost development in England — has already sent a vote of confidence to the industry.

Labour moved quickly to end the effective ban on onshore wind in England and more recently said it would bring the largest projects back under the national planning regime to secure approvals faster.

"For the first time, we have a supportive UK government to help unblock pipeline in Scotland, England and Wales together," James Robottom, head of policy at trade group RenewableUK, said in an interview.

At the same time, however, wind developers face an uncertain future amid debate about replacing the UK's national power price with a zonal pricing system to help incentivize more generation closer to demand hubs.

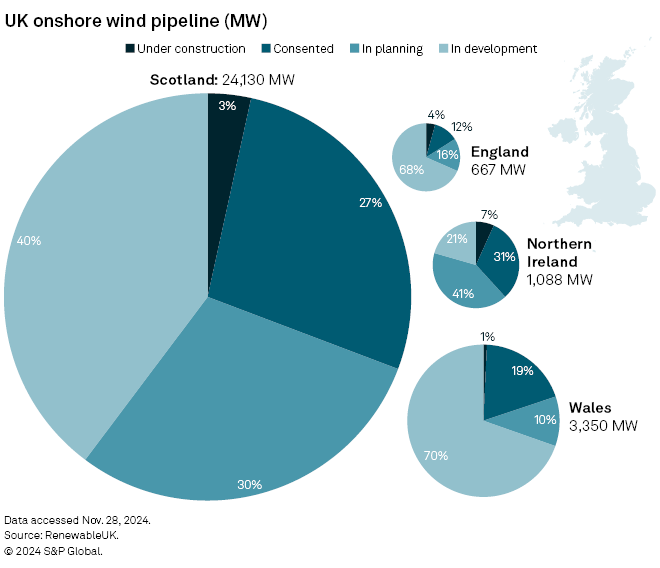

Transmission grid bottlenecks in sparsely populated northern regions such as Scotland — where the onshore wind development pipeline is nearly five times the rest of the UK combined — are already impeding the flow of power to demand centers in the south.

"The big unknown is the doubt [that zonal pricing] would create on the investment side," said Anthony Doherty, chief investment officer at Ireland-headquartered NTR PLC. "As an investor, I can 100% see that. Investors like certainty."

Zonal pricing creates divisions

With a development pipeline exceeding 24 GW, Scotland is expected to do most of the heavy lifting in the UK's pursuit of between 27 GW and 29 GW of onshore wind installed by 2030.

But the realization of that pipeline comes with challenges. Certain Scottish wind projects are already paid to switch off at times of low demand, with gas-fired generation ramping up in their place.

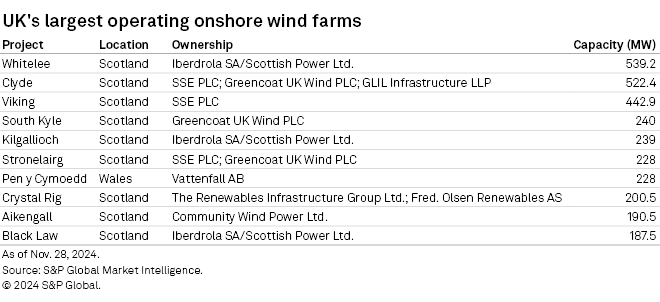

One of the UK's newly added onshore wind assets in 2024, SSE PLC's 443-MW Viking wind farm on Scotland's northerly Shetland Islands, has been paid more than £9 million this year to curtail its production after having only become fully operational in late August, according to data from GB Renewables Map.

The issue is spurring calls for the UK to move to zonal power pricing, under which areas with high renewables generation and low demand, such as Scotland, would see lower prices.

A decision on whether to pursue that model or reform the current national pricing regime will be made as part of the Review of Electricity Market Arrangements (REMA) in mid-2025.

The debate has already created major divisions within the industry. RenewableUK and its counterpart Solar Energy UK argue that a zonal pricing system would create uncertainty in the market, potentially raising the cost of capital for renewables and making it harder for installation targets to be reached.

Other organizations, such as the Association for Decentralized Energy (ADE), highlight that zonal pricing would mean lower energy bills for consumers.

"If we don't act, grid congestion could cost us £3 billion a year by the end of the decade — this is utterly unsustainable," Sarah Honan, ADE's head of policy, said in a statement, adding that views differ among ADE's membership base.

Investor uncertainty

In the investor community, opinions on zonal pricing typically come back to the issue of market uncertainty.

"If you were starting from scratch ... it makes sense to have locational pricing," NTR's Doherty said in an interview. "It's retrofitting that to an existing system where it becomes a much bigger challenge."

By the time a decision is made on REMA, the review will have been in process for three years, with less than five years left to meet 2030 targets.

"We're a bit late for it," said James Pinney, head of northern Europe at Cubico Sustainable Investments Ltd. A zonal pricing system will take time to design and implement, which could negatively impact the availability and cost of capital.

"None of those are good for costs to end consumers in the near run or the government's ambition to deliver clean power by 2030," Pinney said in an interview.

Doherty acknowledged the need for more investment into transmission infrastructure, "but that can't just happen overnight." Instead, a combination of greater interconnection with other European nations, new long-duration energy storage and incremental transmission investment would help ease constraints, the executive said.

Pinney also pointed to potential reforms to the UK's Transmission Network Use of System (TNUoS) charges — the fees paid by electricity suppliers and generators to use the transmission network. Charges are higher, and rising, in more remote locations such as Scotland, and lower for generators in England and Wales.

In its Clean Power 2030 plan, the government said it needs to address the "volatility and long-term uncertainty" arising from TNUoS charges, adding that energy regulator Ofgem has proposed a temporary cap-and-floor regime to alleviate these concerns.

TNUoS reform might be "easier for investors to swallow," Pinney said. "That could start to significantly impact the economics of certain projects."

Projects emerging in England

England's onshore wind pipeline stood at just 667 MW in late November, with no significant projects receiving approval in the decade before Labour lifted the effective ban.

The industry hopes the loosened planning restrictions will lead to a flurry of new projects. In November, Cubico unveiled plans to build the 100-MW Scout Moor II wind farm in Lancashire — the first new onshore project to be announced in England under the new government.

Early development of the wind farm got underway before the election. Pinney said Cubico took a "calculated risk" to progress with the project given its strong capacity factors and proximity to load in Greater Manchester — even if the likelihood of securing planning approval "would have been lower under a Conservative government."

Scout Moor II is expected to enter the planning system in 2025 with a view to winning consent and being built out before 2030.

For now, the RenewableUK database shows just one other full-scale onshore wind farm in development in England — Worldwide Renewable Energy's 302-MW Calderdale wind farm in Yorkshire — but more are expected to be added now that the ban has been lifted.

"We are starting to see projects coming out of the woodwork," RenewableUK's Robottom said. "It's been encouraging to see that there are definitely developers out there interested in onshore wind in England."