Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Apr, 2021

By Zack Hale

|

State policies within the New England region are poised to drive thousands of megawatts of offshore wind development over the next decade. |

A coalition of ISO New England stakeholders has filed a package of key tariff revisions with federal regulators aimed at boosting clean energy resource participation in the ISO-NE's forward capacity auctions.

Submitted by the New England Power Pool, or NEPOOL, the changes — which won nearly 73% support as part of the six-state grid operator's stakeholder process — were presented to the Federal Energy Regulatory Commission on April 7 as an alternative to a separate ISO-NE proposal that garnered just 19% support.

The joint submittal (ER21-1637), made under Section 205 of the Federal Power Act, is known as a "jump ball" filing under the ISO-NE's tariff provisions allowing FERC to choose between two competing proposals.

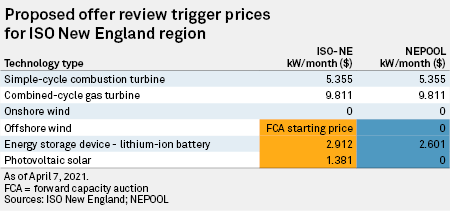

At issue are a set of proposed offer review trigger prices, or ORTPs, for the ISO-NE's 16th forward capacity auction, scheduled for February 2022, covering the 2025/2026 commitment period. The proposed ORTPs would also apply to the ISO-NE's 17th and 18th forward capacity auctions.

With auctions held three years in advance, the ISO-NE's capacity market is designed to ensure grid reliability at all times and allow generating resources to make up any shortfalls in revenue they earn in the grid operator's energy and ancillary services markets.

The ISO-NE's market mitigation rules subject all new capacity auction participants to ORTPs to ensure that uneconomically low-priced offers do not distort the auction's clearing price. However, new resources can avoid ORTPs through a unit-specific offer review process in which they are required to demonstrate to the ISO-NE's independent market monitor that the unit's actual costs are lower than the grid operators' administratively set floor price.

The ISO-NE's tariff requires the grid operator to recalculate the values it uses to set ORTPs on at least a triennial basis using the latest data available.

Two proposals

The dueling proposals submitted to FERC on April 7 differ in several key respects. Notably, NEPOOL's alternative proposal assumes an average useful life of 25 years for onshore and offshore wind and 30 years for solar. In contrast, the ISO-NE's proposal assumes a 20-year economic life for all generation technology types.

By modeling cash flows over a longer time horizon, the ORTPs for offshore wind and solar under NEPOOL's alternative are lower because those resources realize additional revenues beyond the ISO-NE's 20-year assumption.

"The more net revenue the resource receives outside of capacity payments, the lower the capacity payments will need to be to make the resource whole," Abigail Krich, president of Boreas Renewables, LLC, explained in supporting testimony.

Krich also argued that an analysis by Daymark Energy Advisors demonstrates the ISO-NE's proposed capital cost assumption of $5,358/kW for offshore wind resources "is entirely outside the range of supportable costs."

According to the April 7 filing, Daymark Energy-based its analysis on power purchase agreements for three offshore wind projects in New England: the 800-MW Vineyard Offshore Wind Project, 704-MW Revolution Wind Offshore Project, and 804-MW Mayflower Wind Offshore Project.

Using those power purchase agreements, Daymark Energy calculated a range of supportable costs between $2,486/kW and $2,809/kW for the three projects.

"If the developers behind these projects expected capital costs equal to the ISO proposal, the contracts they signed would have locked them into expected losses of approximately $1.3 billion each, on average, per 800 MW project," Krich said.

All three eastern grid operators with mandatory capacity markets — the ISO-NE, PJM Interconnection, and New York ISO — have traditionally used ORTP values that reflect a 20-year economic life under financing assumptions for natural gas-fired units.

In justifying the ISO-NE's assumed 20-year assumed economic life for offshore wind resources, Concentric Energy Advisors Senior Vice President Danielle Powers argued in supporting testimony that the assumption is consistent with 20-year power purchase agreements for the region's offshore wind projects currently under development.

NEPOOL's alternative also included a different dispatch methodology for energy storage resources that lowered their ORTP relative to the ISO-NE's proposal.

The joint filing comes as the ISO-NE faces heightened pressure to find a way to accommodate state-supported clean energy resources such as offshore wind in its capacity market. In October 2020, five out of six governors within the ISO-NE's footprint signed a letter calling on the grid operator to proactively develop market-based mechanisms that facilitate the growth of clean energy resources in line with their states' climate and energy policies.

To meet the region's net-zero-by-2050 emission reduction goals, a November 2020 study produced by the Energy Futures Initiative and clean energy analysis firm Energy and Environmental Economics estimated that New England will eventually need to add 22 GW of offshore wind capacity, 22 GW of utility-scale solar, 13 GW of distributed solar, and 13 GW of battery storage.

During a FERC-hosted technical conference last month on the need for capacity market reforms, ISO-NE President and CEO Gordon van Welie said making the necessary changes to all of the grid operator's major market components, including capacity, ancillary services, and energy, will likely be a five- to 10-year journey.