Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Aug, 2021

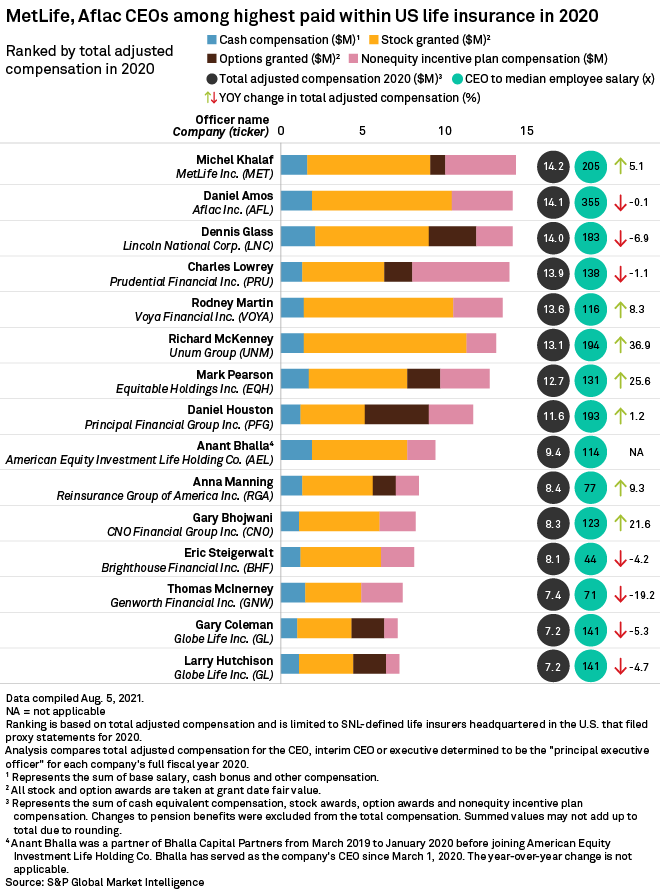

MetLife Inc.'s Michel Khalaf was the most highly compensated CEO of any U.S.-listed life insurer in 2020, according to an S&P Global Market Intelligence analysis.

Khalaf's compensation increased 5.1% year over year to $14.2 million. The compensation consists of $1.6 million in cash, $7.5 million in stocks, $900,000 in options and $4.3 million via a nonequity incentive plan. It is about 205x the median employee salary at MetLife.

Aflac Inc.'s Daniel Amos retained his position as the second-highest-paid CEO, earning about $14.1 million in 2020. Amos' compensation, which is about 355x the median employee salary at Aflac, consists of $1.9 million in cash, $8.5 million in shares and $3.7 million from a nonequity incentive plan.

Lincoln National Corp. CEO Dennis Glass, who was the most highly compensated CEO in 2019, dropped to the No. 3 spot in 2020. Glass' compensation decreased 6.9% year over year to $14.0 million, which is about 183x the median employee salary at the insurer. The package consists of $2.1 million in cash, $6.9 million in stocks, $2.9 million in options and $2.2 million via a nonequity incentive plan.

Rounding out the top five are Prudential Financial Inc.'s Charles Lowrey and Voya Financial Inc.'s Rodney Martin, with compensation of $13.9 million and $13.6 million, respectively.