Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Mar, 2023

By Eri Silva

| An empty electric vehicle charging station in a parking lot. EV sales across top markets declined 55.8% month over month in January. Source: sinology/Moment via Getty Images |

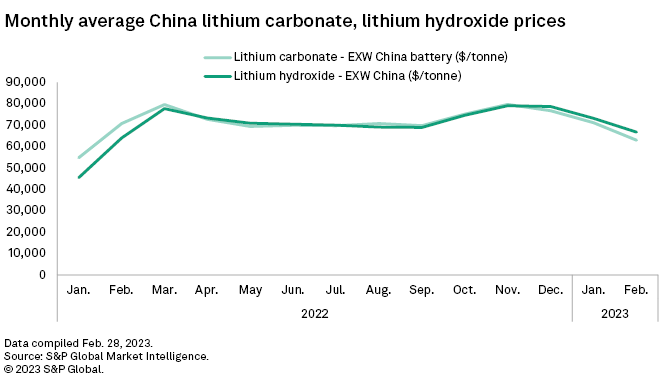

Lithium prices have plummeted 21% since a November 2022 peak amid declining electric vehicle demand, according to S&P Global Market Intelligence data.

The spot price for lithium carbonate, EXW China battery grade, fell to around $62,925 per tonne on Feb. 22 from a peak of $79,650/t on Nov. 30, 2022, Market Intelligence data shows.

Declining January

"We're seeing the historic cyclicality of demand in China slowing in January and February, just as we did last year," Austin Devaney, chief commercial officer of U.S.-based lithium explorer Piedmont Lithium Inc., told Commodity Insights. "We believe the medium- and long- term forecasts for the market will remain strong and undeterred by minor variations in growth patterns."

In China, EV sales have run into headwinds with the phase-out of subsidies amid a weak macroeconomic outlook, Alice Yu, senior analyst of Commodity Insights, said in a February report.

Sales across top markets slowed 55.8% month over month in January and contributed to declining lithium prices, Yu wrote. Still, global EV sales are expected to grow by 35.4% in 2023 to 14.3 million units, increasing the appetite for lithium.

"Despite the price correction, we still expect lithium prices to remain [many times] above cost and historical levels to continue incentivizing project development," Yu said in an email, adding that the market is forecast to move back into a deficit in 2024.

Benchmark Mineral Intelligence projected that prices will begin picking up again in the second or third quarter, Cameron Perks, the company's principal lithium analyst, told Commodity insights. Perks expects any unanticipated production increases from miners such as Wodgina Lithium Pty. Ltd. and Sociedad Química y Minera de Chile SA to be absorbed by the market.

"Keep in mind that the price 'slump' is still orders of magnitudes higher than the previous cycle," Perks said.

Commodity Insights projected that lithium prices will remain around the $42,000 mark from 2024 through 2026, before jumping above $45,000 in 2027 as demand overtakes supply even further.

"The Chinese are the modern-day lithium OPEC and control enough of the supply and demand that the price of lithium can be what they want it to be," said Will McDonough, CEO of asset manager EMG Advisors. "Over the course of the next 12 months, there will continue to be new demand drivers, and [we'll] continue to see supply disruptions, which sets up for interesting price activity."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.