Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Nov, 2021

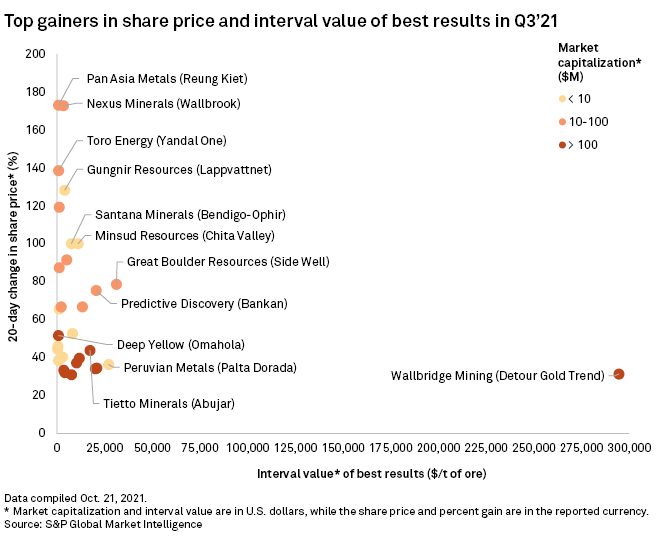

Lithium, nickel and uranium exploration targets helped drive the biggest share price gains among smaller cap mineral resource companies in the third quarter, according to a recent screener on S&P Global Market Intelligence's online platform. The share price moves came amid strong base and energy metals markets, with prices for industrial metals on the climb in recent months.

Among very small market cap companies, which have a market cap of under US$10 million, the share prices of Canada-based Gungnir Resources Inc., TSX Venture Exchange-listed Minsud Resources Corp. and ASX-listed Santana Minerals Ltd. surged the most, up 128.2%, 100.0% and 100.0%, respectively.

Nickel exploration results on the Lappvattnet nickel project in Sweden drove Gungnir's gains. On Aug. 31, it reported drilling as much as 4.3 meters grading 3.19% nickel in a broader intercept with 10.4 meters grading 1.51% nickel. In describing the assay results, the company noted that the intercept came outside nickel resources at Lappvattnet and that they were close to the surface.

Targeting base and precious metals in South America, Minsud said Aug. 26 that it drilled as much as 202 meters grading 0.13% copper, 0.77% zinc and 22 grams per tonne of silver on its Chita Valley project in Argentina. The explorer cast the drilling results as supporting the "potential for a large porphyry copper-molybdenum system" in the area. Porphyry deposits are key exploration targets in the copper sector.

Rounding out the top three gainers in the very small market cap category, Santana Minerals' share price jumped after it released drilling results from the Bendigo-Ophir gold project in New Zealand. It intercepted as much as 5.7 meters grading 11.19 g/t gold. The explorer said the drilling confirmed the extension of gold mineralization about 100 meters deeper in the deposit.

As for small market cap companies, which have a market cap between US$10 million and US$100 million, Pan Asia Metals Ltd. and Nexus Minerals Ltd. gained the most, up 173.0% and 172.7%, respectively. Pan Asia's gains came on the heels of drilling at its Reung Kiet lithium project in Thailand, with the company reporting as much as 18 meters grading 0.62% lithium oxide. Nexus Minerals' share price increase followed the release of drilling results from its Wallbrook gold project in Australia. It reported hitting as much as 10 meters grading 5.49 grams per tonne of gold, with the company saying exploration extended mineralization at the project.

And among the large market cap companies, which have market caps in excess of US$100 million,