Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Feb, 2021

By David Feliba

|

People using protective masks wait in line outside a Caixa Economica Federal bank branch in São Gonçalo, Brazil, to receive urgent government aid amidst the COVID-19 pandemic in May 2020. |

Fintechs and banks have set their sights on Brazil's newly expanded payments market as a huge mass of previously unbanked citizens have accessed digital banking services for the first time.

The lockdown measures and emergency aid resulting from the pandemic have ushered some 13.3 million Brazilians into the financial system between March and December of 2020, according to central bank data. The figure is higher than that of the whole two previous years combined.

A study by MasterCard is even more optimistic and claims that an estimated 36 million users opened an account during 2020 to collect the so-called corona voucher, a welfare installment that was mostly distributed through state-run bank Caixa Econômica Federal.

"In a matter of months, more than 17% of Latin America's unbanked population was brought into the financial system," the report by MasterCard stated.

This mass of newcomers into the financial system is increasingly becoming a target for Brazilian fintechs and banks in a new landscape forged by the pandemic, which has accelerated financial inclusion efforts. Caixa has been the government's preferred channel for distributing aid, but customer retention will be a tall order for the state-run bank as competition steps up.

To disburse funds, Caixa built up mobile system Caixa Tem. The app saw some 274 million downloads and had paid benefits to 35 million beneficiaries by the end of the third quarter. According to the bank, it represented the "largest social inclusion program" in the history of Brazil.

As a result, analysts claim that the state-run lender is now in pole position to tap this newly banked segment. The bank has built new features for its app such as virtual debit cards, QR payments, cashback and utilities bills.

"Caixa was able to benefit from being the main provider of [government] funds," Guilherme Machado, a bank director with S&P Global Ratings, said in an interview. "It was a huge system that had to be developed and that now reaches 70% of the Brazilian population."

CEO Pedro Guimarães recently signaled the bank intends to spin off its digital banking unit through an IPO in U.S. markets.

|

Competition in the sector

But despite Caixa's success, the public behemoth will not absorb the market expansion alone. Analysts argue there is enough room for other players to lay their bets as well, and that Caixa could struggle to preserve such a massive audience.

"Even though Caixa has the advantage, they are not necessarily going to retain all clients and monetize," Machado said. In many cases, users would just forward the collected funds through Caixa to their own accounts in other banks. "It was simply more money flowing through the economy," he added.

The surge in customer accounts has extended to fintech players as well. Digital bank Nu Pagamentos SA saw an increase of 7 million accounts during early 2020, while fintech firm PicPay Serviços Ltda., a digital wallet partially owned by Banco Original SA, more than doubled its user base from 14 million reported in 2019 to 38.8 million by the end of last year.

"Fintechs have managed to stand out in the market," Anderson Chamon, PicPay's co-founder, told S&P Global Market Intelligence over email. A third-party report suggested that the fintech firm was considering an IPO operation later this year.

Even non-financial companies such as Via Varejo and Magazine Luiza, large retail chains in Brazil, are powering up their own wallets.

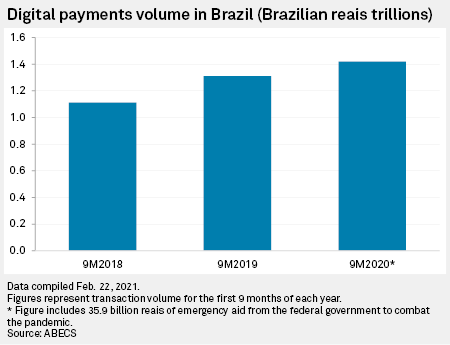

Regulators have accompanied the rise in digital financial services through initiatives such as open banking and the recently launched PIX instant payment system, which have enhanced the prospects for the broad financial system. Even before PIX was launched, digital payments as a whole had risen to 1.416 trillion Brazilian reais in the 9 months up to Sep. 2020, up 8.1% year over year.

For their part, big banks have laid out their own strategies as well. Both Banco Bradesco SA and Itaú Unibanco Holding SA have launched their own wallets. Bitz was marketed in late 2020 and had 218,000 users as of year-end, while Iti, which was launched by Itaú in 2019, garnered 3 million accounts through 2020.

Even so, their efforts might prove insufficient in targeting the recently banked segment.

"In this low-income segment, banks are under tremendous pressure from emerging players," João Bragança, a senior manager with Roland Berger consultancy firm, said. "They are providing digital wallets that are very driven to the segment, whereas banks are old fashioned and, oftentimes, even require the customer to go to the branch.

"In this segment, clients are sort of afraid of branches," he added.

A payments operation

Whether the newly banked will continue to demand financial services once the pandemic blows over will depend entirely upon the quality of the services provided, PicPay's Chamon said. "Many of them are probably still within the ecosystem, depending on the experience they have had."

However, opportunities to offer more complex, profitable products such as credit have so far been limited. Almost 15% of Nubank's customers above the age of 55 have reportedly never had a credit card.

"The credit quality of that segment is very poor and very risky to actually provide credit to," Bragança said. The business opportunity with the newly banked, experts argue, leans toward payments and merchant operations.

"Users want to have more control over their financial data and access the best benefits in the market in terms of promotions and discounts," Chamon said. According to Bragança, client data makes way for a "massive opportunity" to tackle this specific segment by way of striking deals with merchant shops and stores that usually serve them.