Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jan, 2021

By Fatima Aitizaz and Zuhaib Gull

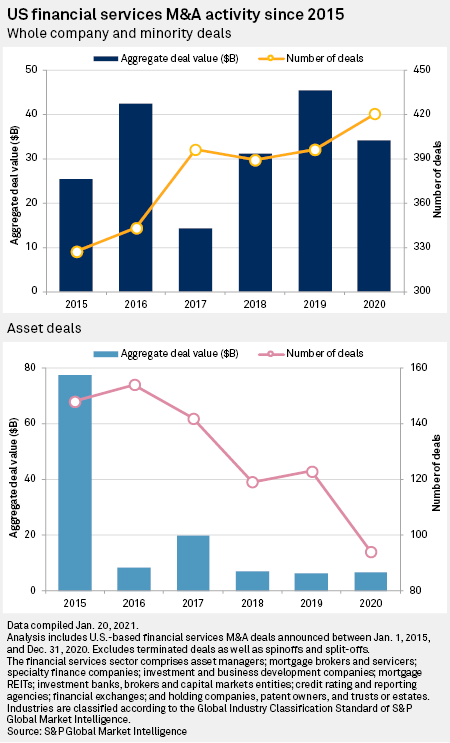

U.S. financial services M&A activity managed to pick up in 2020 in terms of whole-company and minority deal volume, despite the macroeconomic uncertainty caused by the coronavirus pandemic. However, the total value of those M&A transactions was lower than in 2019.

According to S&P Global Market Intelligence data, there were 420 whole-company and minority stake deals announced in 2020, with an aggregate deal value of $34.15 billion, compared to 396 deals worth $45.33 billion in 2019.

Meanwhile, there were 94 asset deals announced in 2020 compared to 123 deals in the prior year, but deal value rose year over year to $6.72 billion from $6.43 billion.

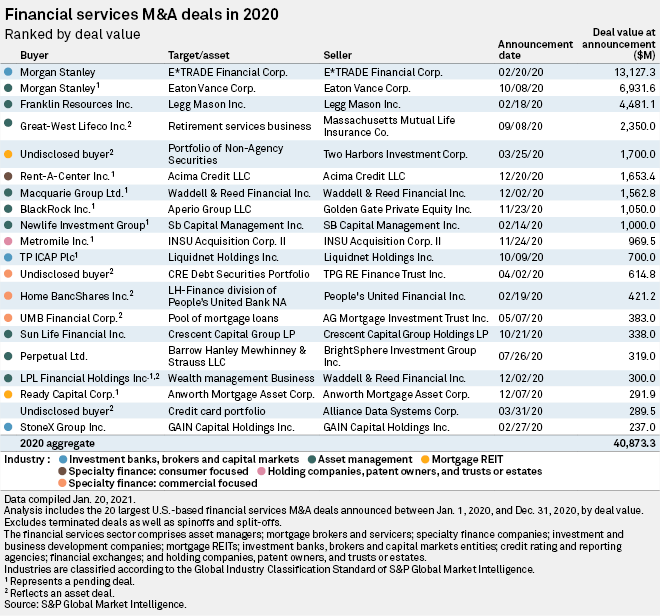

Morgan Stanley was responsible for both of the largest acquisitions of 2020: its $13.13 billion deal for E*TRADE Financial Corp. and its $6.93 billion purchase of Eaton Vance Corp.