Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Aug, 2021

By Zoe Sagalow

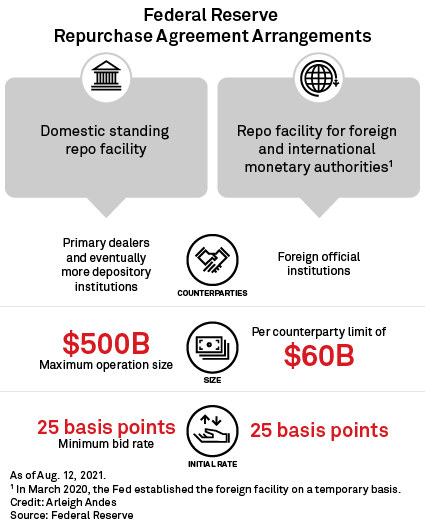

Two years after the repurchase agreement market experienced significant turmoil, the Federal Reserve established two standing facilities that experts say should help limit episodes of extreme volatility in a critical corner of financial markets.

Repo markets allow financial institutions to engage in short-term transactions — often overnight — wherein a borrower can exchange low-risk assets like Treasury securities for cash to meet certain obligations. The market plays a critical role in the transmission of monetary policy, and it provides a key source of financing for nonbank financial firms.

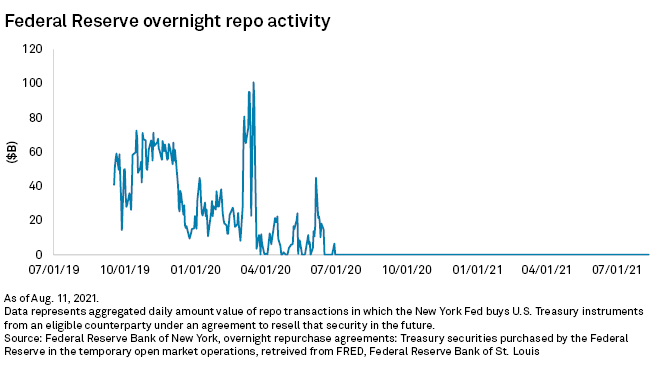

Normally, financial institutions conduct these transactions with each other without incident, but in September 2019, several factors led to cash shortages across the financial system, a significant jump in demand in overnight borrowing markets and a corresponding jump in interest rates. Consequently, the New York Fed stepped in to make billions of dollars in repo purchases and supply much-needed liquidity to the market.

The repo incident had knock-on effects for the Fed's benchmark federal funds rate as well, forcing it to breach its 25-basis-point target range, undermining the effectiveness of monetary policy.

|

At present, the situation in short-term funding markets is much different than it was nearly two years ago. In response to the COVID-19 pandemic, the Fed has been purchasing $120 billion in Treasury and mortgage-backed securities per month from primary dealers and crediting their reserve accounts at the Fed, meaning cash is in ample supply.

Michael Pugliese, a vice president and economist at Wells Fargo & Co., said the Fed is establishing the two standing facilities as backstops in money markets now so that participants can access them when they are needed.

"I think the idea is, it's better to act at a time when you don't need them," Pugliese said in an interview. "A good analogy would be: You want to put smoke detectors or sprinklers into your house before the fire ... as opposed to waiting until disaster had struck."

Members of the Fed's Federal Open Market Committee have discussed the possibility of introducing a standing repo facility since September 2019, according to meeting minutes.

Having a backstop in place will give market participants confidence to stay engaged, according to Christopher Russo, a post-graduate research fellow at the Mercatus Center at George Mason University who formerly advised policymakers in the Federal Reserve System.

"Most of the time, it will do its job without actually having any take-up," Russo said in an interview. "I think there is additional benefit to formalizing that the Fed is there and will act as a lender of last resort."

Upsides vs. downsides

Kathy Bostjancic, chief U.S. financial economist at Oxford Economics, said downside risks will likely be outweighed by the benefits of the repo facilities. They will help keep "the plumbing of the financial markets" running, she added.

Mark Cabana, head of U.S. rates strategy for Bank of America Corp., also said the benefits outweigh the costs. A disadvantage could be a misperception that the Fed is providing too much leverage to the banking system, but he thinks that is not a concern now because the facility is priced as a backstop.

Mercatus Center's Russo highlighted similar concerns, saying there is a risk this is "a venue for the Fed to take an even larger role in the repo market."

With its expansion of the balance sheet, "the Fed made the overnight bank market less competitive," Russo added. "There's a concern that by taking further steps in the repo market, like the standing repo facility," the market could similarly become less competitive.

George Selgin, senior fellow and director of the Center for Monetary and Financial Alternatives at the libertarian Cato Institute, said he does not see much downside because the facility is limited, only dealing in low-risk securities.

But Selgin said that if the Fed replaced its current system, which he described as complicated and inefficient, some of the other monetary policy tools the Fed uses would be unnecessary.

"We would need a facility like the standing repo facility for an alternative system, but we could have things be a lot simpler in many other respects if we had such a system," he added.

Selgin proposes a "tiered" version of a "corridor" system in which reserves are scarce, and interest on reserves is set below the policy target rate. Under the tiered modification, some reserves would have a low rate while others would be "grandfathered" in, perhaps at the target rate.