Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Nov, 2023

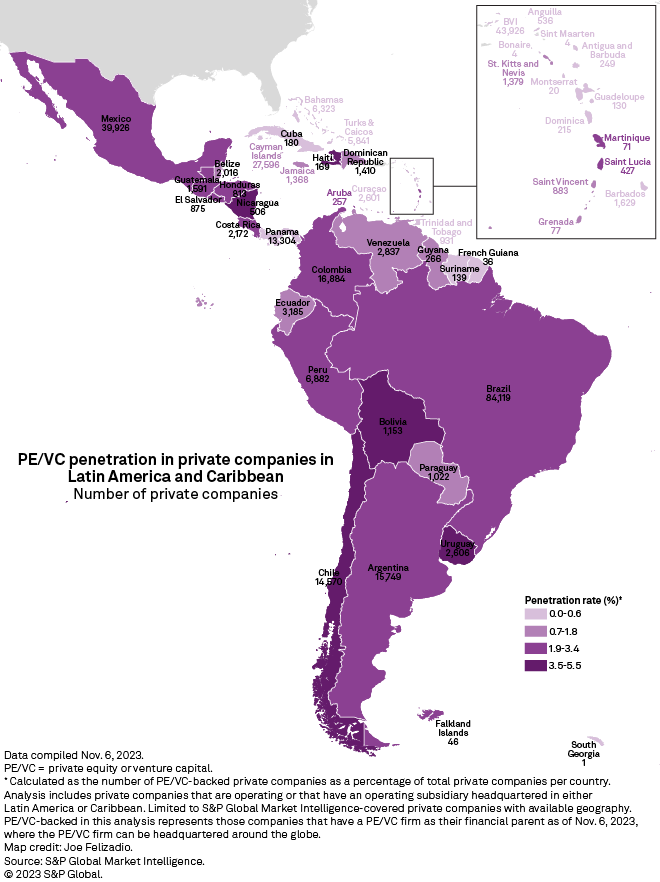

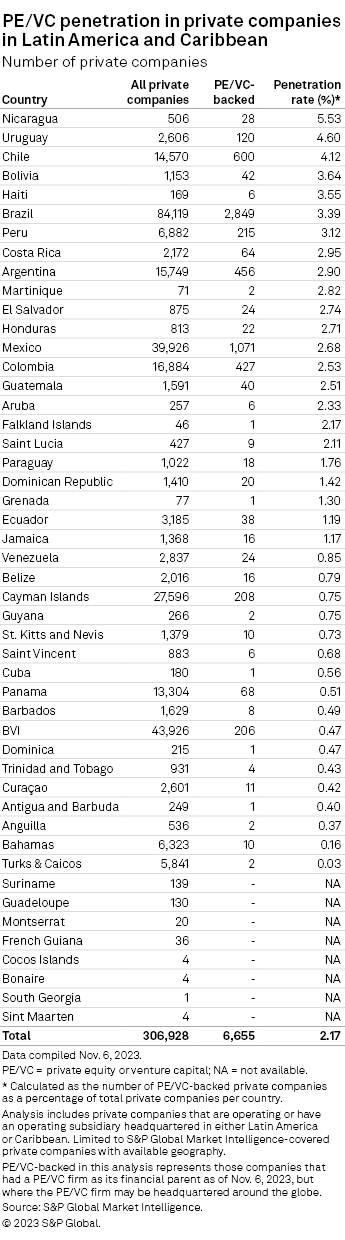

Brazil is home to 2,849 private companies backed by private equity or venture capital, the highest number across Latin America and the Caribbean, according to S&P Global Market Intelligence data.

As of Nov. 6, Brazil had a private equity penetration rate of 3.39%, the sixth highest in the region. The number of private companies operating in the country totals 84,119.

The private equity penetration rate measures the percentage of private companies in a market that has private equity or venture capital investment. A higher percentage implies a more attractive risk/reward proposition. In developed economies, it suggests conditions that support business growth, such as level of entrepreneurship and innovation, GDP growth and commercial maturity.

– Download a spreadsheet with data featured in the story.

– Read about private equity penetration in the Middle East and Africa, Asia-Pacific, Europe and the US.

– Explore more private equity coverage.

Among the top five countries in the region, Chile has 14,570 private companies and the third-highest private equity penetration rate, at 4.12%.

Mexico is also notable, with 1,071 private equity- or venture capital-backed companies, the second-highest number. Its private equity penetration stood at 2.68%, with 39,926 private companies operating in the country as of Nov. 6.

Nicaragua has the highest private equity penetration rate in Latin America and the Caribbean, at 5.53% as of Nov. 6, followed by Uruguay with 4.60%. Both countries have relatively modest private sectors and number of private equity investments.

Overall, the region has 306,928 private companies with a private equity penetration rate of 2.17%.

Most attractive investment sectors

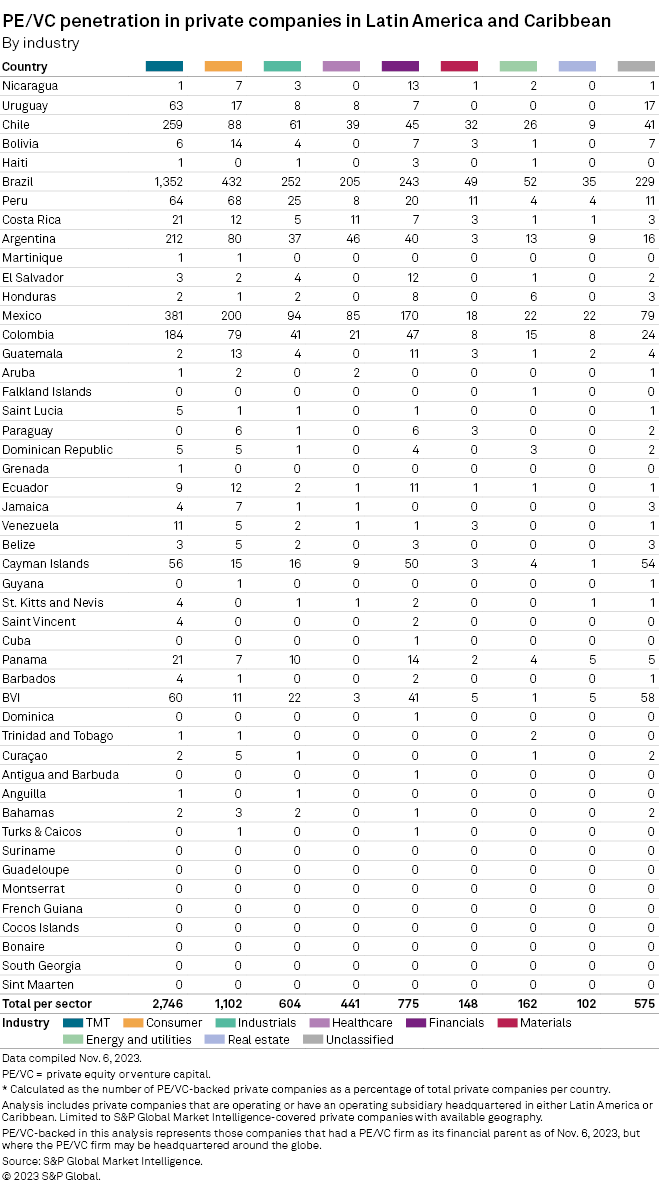

Technology, media and telecom (TMT) is private equity's most invested sector across the region, followed by the consumer sector with 1,102 companies, Market Intelligence data shows.

As of Nov. 6, there were 2,746 private TMT companies backed by private equity.

The year's largest announced private equity-backed transaction in Latin America and the Caribbean was in the sports industry. Splack Participações SA's pending acquisition of Brazilian sports franchise Coritiba Foot Ball Club em Recuperação Judicial is valued at $265.2 million.

São Paulo-based GPBR Participações Ltda., which operates an online platform for corporate employees to purchase gym passes, raised $85 million in series F financing, the largest private equity-sponsored funding round regionally in 2023. Investors in the round included EQT Partners AB, General Atlantic Service Co. LP, Moore Strategic Ventures LLC and Neuberger Berman Group LLC.