Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Oct, 2021

By Michael Rae

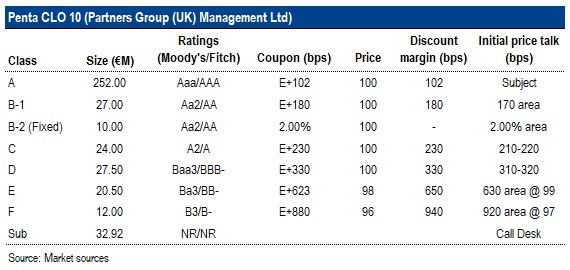

BNP Paribas on Oct. 20 priced the €405.92 million Penta CLO 10 for Partners Group.

Details are as follows:

The deal, which is expected to settle Nov. 30, has a non-call period ending Feb. 29, 2024, and a reinvestment period that runs off on Nov. 20, 2026. The weighted average life test is nine years, while the legal final maturity is Nov. 20, 2034.

Provisions for environmental, social and corporate governance elements include both an exclusion list and ESG scoring, encompassing an ESG monthly report that includes the portfolio's average ESG score and distribution.

The retention holder, PGGLF 2 DAC, is expected to retain a horizontal strip to comply with EU/U.K. risk-retention requirements. The manager is relying on Foreign Safe Harbor exemption for U.S. risk retention.

Partners Group most recently placed the €353.5 million Penta CLO 2021-2 via Morgan Stanley, which priced at 101/180/230/320/640/935 basis points across the floating-rate triple-A to single-B notes on a discount-margin basis.

This latest print takes year-to-date new-issue European CLO volume to €29.07 billion from 71 deals, versus €16.82 billion from 50 deals in the same period in 2020, according to LCD data.