Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Feb, 2024

|

The UK's battery storage capacity now exceeds 3 GW, with ancillary service markets becoming saturated as a result. |

London-listed battery storage funds are seeing their stock prices slide amid a challenging revenue environment in Britain that has forced some investors to postpone shareholder dividends, restructure debt facilities and explore asset sales.

Harmony Energy Income Trust PLC and Gresham House Energy Storage Fund PLC both issued trading updates in recent days in which the companies outlined a series of headwinds in the UK battery storage market.

Wholesale power prices have fallen and become less volatile, though issues also persist in other revenue markets. That includes the Balancing Mechanism (BM), the market used to balance supply and demand in Britain, in which the companies said batteries are being underutilized.

"Whilst a reduction from the remarkable highs of 2022 was expected and built into third-party revenue forecasts, the scale and the speed of the reduction has exceeded market expectations," Harmony Energy Income Trust (HEIT) said Feb. 2.

HEIT, which has a 395.4-MW/790.8-MWh portfolio of operating and under-construction battery assets in the UK, said its revenues for the year ended Oct. 31, 2023, will be "markedly lower" than the same period in 2022.

The company also attributed the decrease to the saturation of ancillary service markets, such as frequency response, driven by the high build-out rate of battery assets.

The UK has more than 3 GW of battery storage in operation, but the requirement for frequency services is much less than that, according to George Hilton, batteries and energy storage research manager at S&P Global Commodity Insights. As a result, the market saturation is "here to stay and will likely worsen," Hilton said in an email.

Gresham House Energy Storage Fund (GRID), which has 740 MW of operating batteries in the UK, said Feb. 1 that a slower-than-expected pace of commissioning of new projects, due to elongated grid connection times, is another drag on revenues.

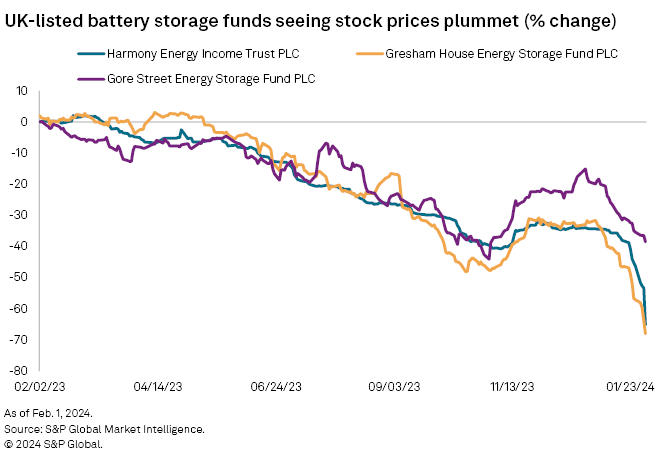

HEIT's and GRID's stock prices are down about 70% in the last 12 months. Another London-listed battery investor, Gore Street Energy Storage Fund PLC, is down 38% but has a more diversified geographical footprint.

'Far below its potential'

The challenges come as National Grid Electricity System Operator Ltd., which manages Britain's power grid, attempts to improve access to the BM.

The National Grid PLC unit launched its Open Balancing Platform (OBP) on Dec. 12, 2023, enabling smaller BM units, notably battery assets, to receive instructions from the grid operator's control room via "bulk dispatch."

However, the system was taken offline three days later to address technical issues and was relaunched Jan. 8. Since then, the system operator has only used the platform intermittently, with HEIT seeing some days of high BM volume and others of zero.

This creates uncertainty over how much capacity an asset can dedicate to other revenue markets since batteries use algorithms and AI software to execute revenue strategies, HEIT said.

GRID added that the volume of trades allocated to battery storage assets remains "far below its potential." It said the "skip rate" — the rate of battery assets not being dispatched under the BM — has remained high as a result.

"Intermittent use of the OBP has been frustrating and makes planning a trading strategy difficult," Berenberg analysts said in a Feb. 2 note. "We understand that on days when the OBP operates as expected, [battery storage] assets are achieving a healthy uplift in revenue: more consistent availability is expected during 2024."

Dividends postponed

Against a challenging market backdrop, both HEIT and GRID plan to postpone their next shareholder dividend payments. HEIT said it will distribute 8 pence per share to investors for fiscal 2023 but will delay declaring a first quarterly distribution for fiscal 2024.

"While the reasons for the recent low revenue environment are understood, and the market conditions are expected to improve, the short-term outlook remains uncertain," the company said. "It is well understood that [battery storage] revenues can vary across the course of a year and therefore prudent cash management is required."

HEIT also intends to restructure its debt facilities and explore "one or more" asset sales after last year selling a 99-MW project to Pulse Clean Energy Ltd. at a 1.5% premium to the asset's carrying value.

Cash proceeds from the sales will be used to reduce leverage and fund future dividend distributions, HEIT said, adding that any funds available after the dividend payments could be used to repurchase shares.

GRID similarly said it intends to commence a share buyback program, optimize its debt facilities and opt against declaring a dividend for the fourth quarter of 2023. It will also focus on completing a 332-MW project pipeline in 2024 that will help the company reach 1,072 MW of installed storage assets.