Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Mar, 2022

By Asma Rafique

After enduring a rollercoaster ride for the last several weeks, insurance stocks and the broader equity markets had a much calmer and positive session.

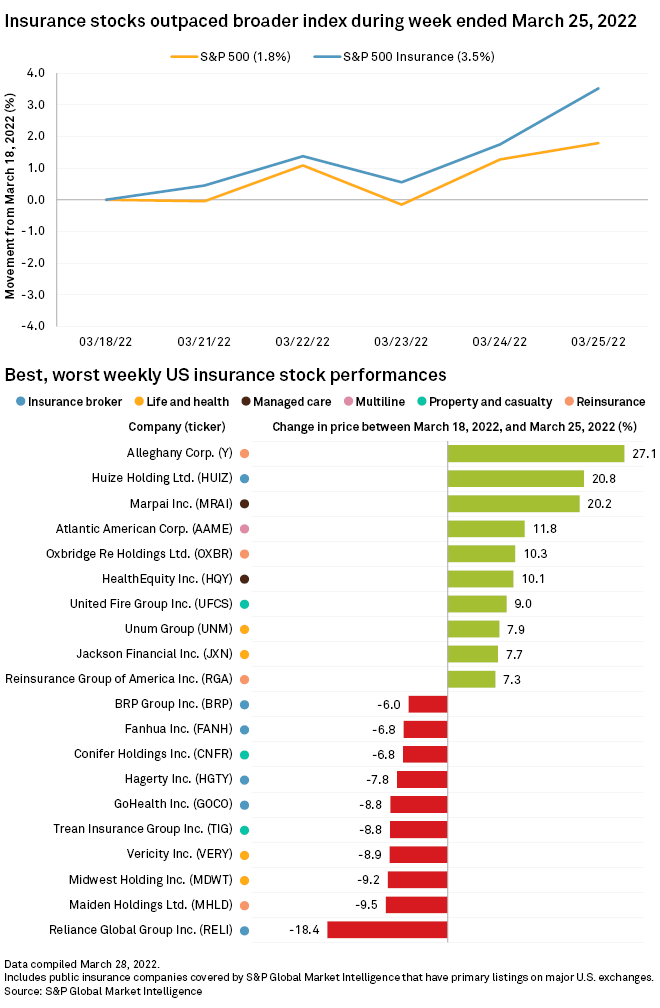

The S&P 500 finished the week ending March 25 up 1.79% at 4,543.06, while the S&P 500 Insurance index climbed 3.52% to 601.21.

Markets, economy remain

Investors have been wrestling with the effects of the war in Ukraine and this week managed to maintain optimism that the wider economy is on "solid footing" despite ongoing inflation and the prospect that the Federal Reserve will implement "supersized rate hikes" in future meetings, OANDA analyst Ed Moya said.

Confidence in the economy and its ability to withstand inflationary shocks is keeping stock prices up, according to Moya.

"We are still going to see a strong couple of quarters," the analyst said, though he did warn that the effects of inflation will be felt more significantly later in the year.

Even as inflation soars and geopolitics take center stage, another factor holding up equities are holding is that the labor market is not showing any signs of problems, Moya said. U.S. unemployment claims dropped to their lowest levels since 1969 last week.

Another big deal for Buffett

Headlines across the insurance space this week were dominated by Berkshire Hathaway Inc.'s major reinsurance deal. The Warren Buffett-led company announced it would buy all of Alleghany Corporation's outstanding shares in a deal worth approximately $11.6 billion.

Moya in an interview said the big reinsurance deal going forward despite heightened geopolitical risk shows that the economic impact of Russia's invasion of Ukraine is still widely expected to be temporary.

"Too many companies are holding too much cash and this geopolitical shock to Wall Street has sent many stock valuations deep into oversold territory," Moya said.

He expects financial conditions to further tighten in the coming years and suggested that companies seeking acquisitions follow Berkshire's footsteps and pull the trigger.

"This might be the perfect time," Moya said.

Berkshire's planned purchase of Alleghany is its second-largest insurance deal of all time, according to S&P Global Market Intelligence data. Only its purchase of General Re Corp., announced in June 1998, was larger. That deal was worth $24.59 billion at the time it was announced.

Alleghany closed the week up 27.08% at $860 per share, above Berkshire's takeout price of $848.02. Terms of the deal include a 25-day go-shop period and Barron's speculated that several big industry names could take a run at Alleghany, including Chubb Ltd., Markel Corp. and W. R. Berkley Corp. However, Keefe Bruyette & Woods analyst Meyer Shields said he does not expect any new bidders to enter the fray.

Berkshire's stock added 5.06% on the week. Chubb ticked up 2.96%, Markel rose 5.15% and W. R. Berkley climbed 3.09%.