Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 16 Apr, 2021

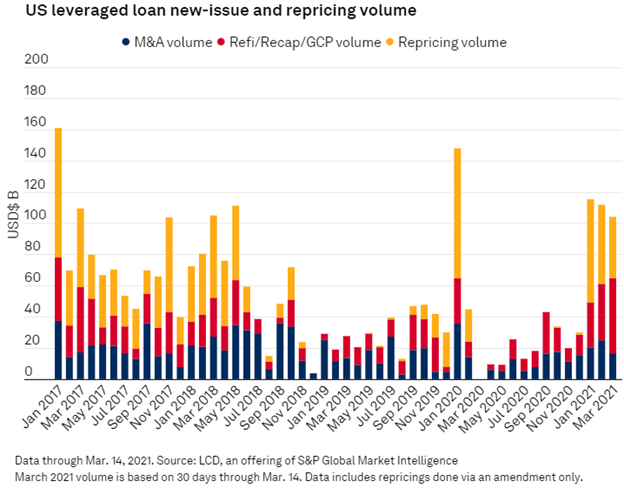

March 23 marked the trough of a historic collapse across the global financial markets, after the COVID-19 pandemic spurred the steepest monthly decline in the 23-year history of the S&P/LSTA Leveraged Loan Index. One year later, LCD takes a look at where the leveraged loan asset class stands today.

Download Infographic

Theme

Products & Offerings