Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 15, 2019

UK job market shows signs of cooling as uncertainty hits demand for staff

- Strong headline labour market data mask weakening underlying trend

- Hiring slows as risk aversion drives shift from permanent staff

- Pay growth cools despite worsening staff availability

Weak labour market survey data have contrasted with encouragingly buoyant official data in recent months, but behind robust headline numbers the latest release of official data showed the gap narrowing.

Unemployment lowest since 1974

The headlines from the latest official job market data were undoubtedly positive: the unemployment rate fell to 3.8% in the three months to March, its lowest since 1974. The employment rate was meanwhile the joint-highest on record at 76.1%, with 99,000 extra people working during the first quarter. Wages also grew faster than inflation, up 3.2% on the year (including bonuses) putting annual real wage growth at 1.3%.

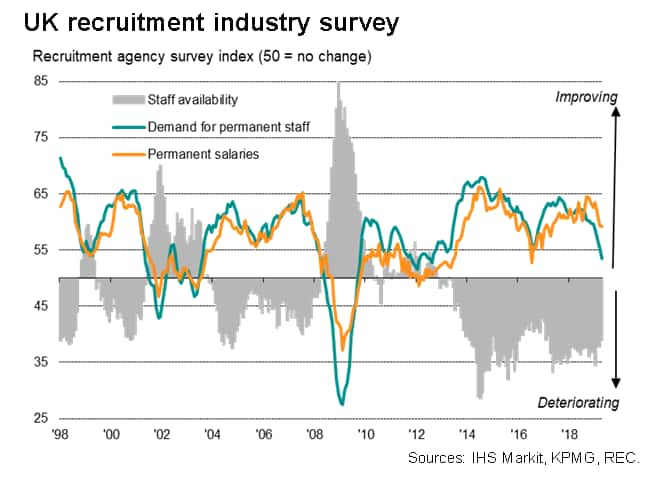

However, dig deeper and the data are less encouraging, hinting a slowdown in hiring which tallies with data from both the KMPG/REC recruitment agency survey and the IHS Markit/CIPS PMI. Heightened uncertainty has driven risk-aversion among employers, and encouraged a shift from taking on permanent staff. There are also signs that pay growth has begun to cool amid weaker growth of demand for staff.

Hiring slowdown

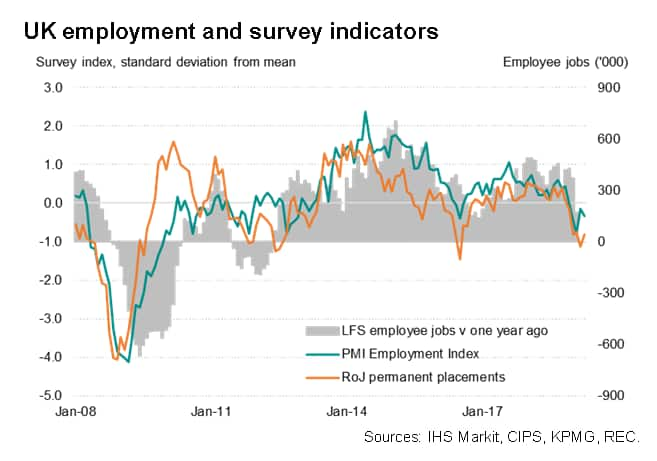

Both the PMI and recruitment industry surveys recorded a net fall in employee jobs for the third time in the past four months in April. Although the declines were only modest, the downturns represent a major turnaround from the strong hiring seen up to late last year and indicates the weakest hiring spell since the end of 2012.

The recruitment industry survey also showed demand for staff from employers to have grown in April at the weakest rate since August 2012.

The official labour market data have signalled a similar cooling of hiring so far this year.

First, employer vacancies fell, albeit marginally, for the third successive time in the three months to April to the lowest since the three months to September 2018.

Second, the number of employees in work rose by just 3,000 in the three months to March, down from 80,000 during the final three months of 2018 and a rise of 251,000 in the same quarter one year ago. The latest rise was in fact the smallest since the third quarter of 2017.

Risk aversion drives shift away from permanent staff

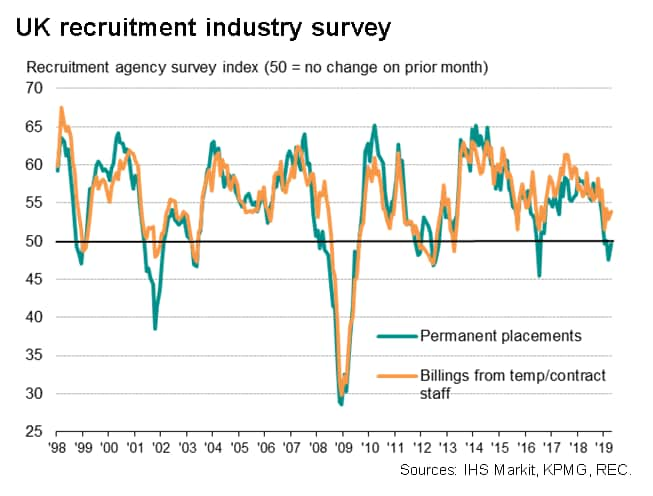

The headline employment numbers were buoyed, however, by a 90,000 increase in the number of people self-employed during the first quarter. While representing a welcome further improvement in the overall numbers of people in work, the near stagnation in employee numbers alongside the rise in self-employment adds weight to the argument that employers have become risk-averse in relation to adding to permanent payroll numbers. This suspicion is further fuelled by the continued rise in temporary and contract work recorded by the recruitment industry at a time of falling permanent placements. The gap between temporary and permanent staff demand signalled by the survey in April rose to the widest since May 2009.

Recruiters commonly reported that business uncertainty, often attributed to Brexit, caused employers to become increasing reticent to hire new staff. The PMI survey likewise shows business optimism to be running close to post-recession lows amid heightened anxiety over Brexit. Slower economic growth and a broader deterioration in confidence was also seen to have led to increased risk aversion.

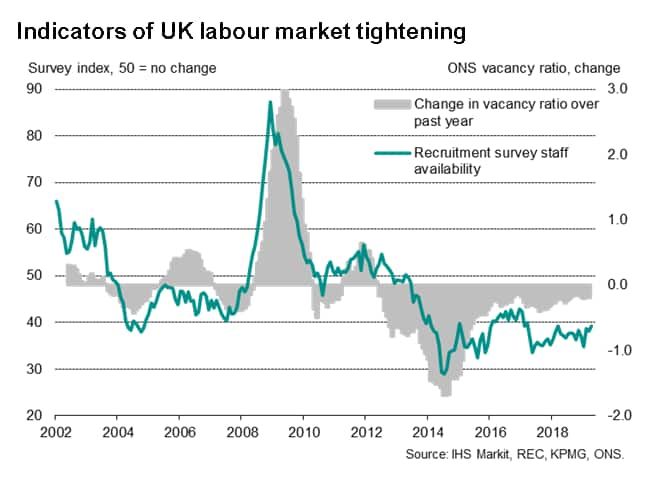

At the same time, a reluctance to change jobs due to heightened uncertainty has exacerbated skill shortages linked to the low level of unemployment, leading to a further drop in the availability of staff to fill vacancies. The number of vacancies per unemployed person has fallen to its lowest since data were first available in 2001, and the recruitment industry survey showed candidate supply problems worsening in April, continuing a remarkable run of deteriorating staff availability over the past five years.

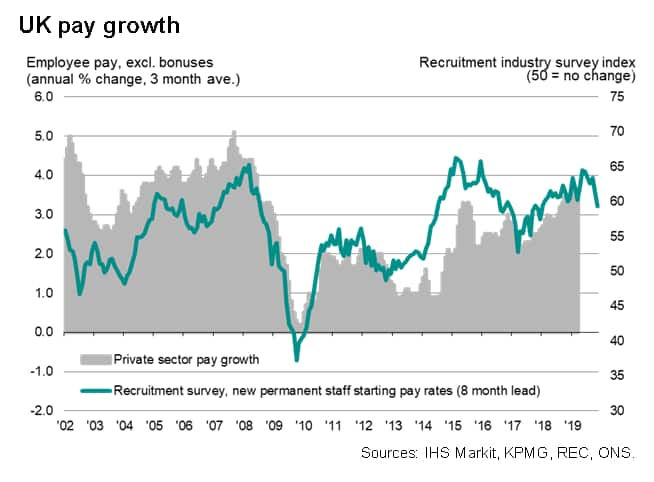

The combination of rising employment and falling candidate supply pushed pay up again in the three months to March, though there was evidence that the softening demand for staff indicated by the surveys has fed through to weaker pay growth.

Regular employee pay (excluding bonuses) rose 3.3% in the three months to March, with private sector pay up 3.5%. However, these rates were down from 3.4% and 3.6% respectively in the three months to February, providing a further indication that pay growth peaked at the start of the year. In March alone, regular pay growth was up just 2.9%, its weakest annual rise since last June.

This softening of pay growth was signalled in advance by the recruitment industry survey, which has recorded an easing in growth of pay awarded to people starting new permanent jobs in recent months. Having peaked in September of last year, the survey pay gauge indicated the slowest rise in salaries for two years in April, suggesting the official pay data will cool further at the start of the second quarter.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-job-market-shows-signs-of-cooling-as-uncertainty-hits-150519.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-job-market-shows-signs-of-cooling-as-uncertainty-hits-150519.html&text=UK+job+market+shows+signs+of+cooling+as+uncertainty+hits+demand+for+staff+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-job-market-shows-signs-of-cooling-as-uncertainty-hits-150519.html","enabled":true},{"name":"email","url":"?subject=UK job market shows signs of cooling as uncertainty hits demand for staff | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-job-market-shows-signs-of-cooling-as-uncertainty-hits-150519.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+job+market+shows+signs+of+cooling+as+uncertainty+hits+demand+for+staff+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-job-market-shows-signs-of-cooling-as-uncertainty-hits-150519.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}