Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Oct 08, 2021

By Alex Cotter

It's always good to take a look backward for lessons learned before moving forward to set new strategies and goals. Utilizing our residential construction outlook through 2025, here are the five things you need to know.

1. The housing market's return to pre-COVID normalcy is already underway.

The pandemic caused housing markets to behave strangely, with surging prices and relatively few mortgage defaults, even as the global economy tumbled. Now with markets at all-time highs, we see the buying frenzy is finally waning.

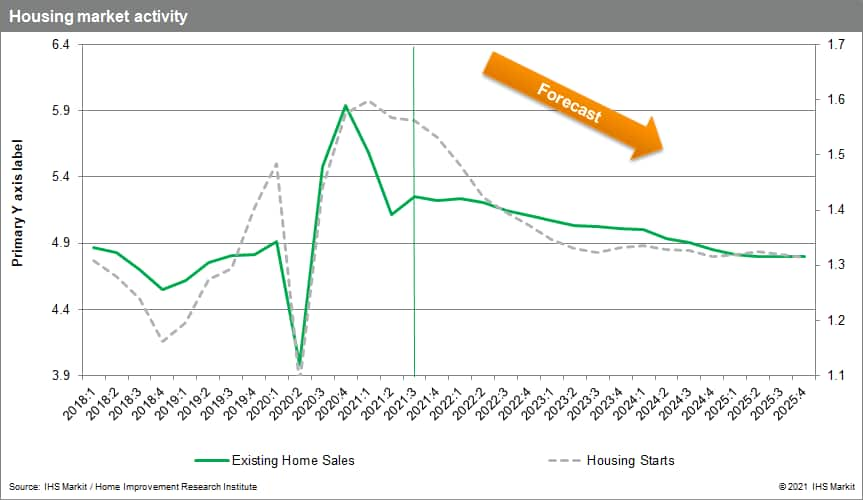

We project 1.4 million homes to be built in the US in 2022 versus 1.54 million new homes in 2021. Single-family housing permits, a directional indicator on housing starts, have shown depressed numbers for the past four months, down 17% since January. Soaring home prices, low supply, and the end of forbearance protection will bring new sellers to the market. For the time being, existing home sales remain above pre-pandemic levels, but we anticipate a cooling-off period for the remainder of 2021.

New and existing home sales through 2025 are charted below. COVID caused home sales to surge. Trends are expected to return to pre-2020 levels by 2022.

2. If you are a retailer or vendor, home improvement professionals might become your best customer.

COVID forced the consumer to stay home, often with idle time, and kicked off a DIY home improvement trend; however, we see the future of home improvement shifting more toward professional services. One reason for the shift is the surge in home prices and home equity available to finance projects. Another reason for the upward trend is existing home sales will outpace sales of new homes which typically do not require improvement.

Though 2025, we project that nearly 60% of the growth in the home improvement market will come from professionals (e.g., contractors). Retailers and vendors in this space should prepare to spend more resources catering to the professional customer, such as professional-grade equipment sales and rentals.

Professional and consumer home improvement spend in billions are charted below. Through 2025, the entire segment will grow 12%. Market share of professionals will drive most of this growth.

3. Outfitting your smart home may have to wait until 2022.

Voice-activated lightbulbs, robot vacuums, camera doorbells, and Wi-Fi-connected laundry machines are the new modern conveniences. Stay-at-home orders and fiscal stimulus drove broad demand for household electronics in 2020 and the smart home trend got a boost.

The unexpected side effect of this surge in demand, however, is that it has contributed to a shortage of parts for many of these products. For example, the supply of semiconductors has been depleted and new production is still struggling to meet demand because of factory closures and supply chain disruptions. Consumers experienced steep price increases and a low supply of smart home products, a problem that will linger through at least the end of the year.

On a positive note, we have observed that component inventories have improved, though unevenly. By the second half of 2022, we anticipate supply and prices to approach pre-COVID levels.

4. For many Americans, it's time to renovate the kitchen.

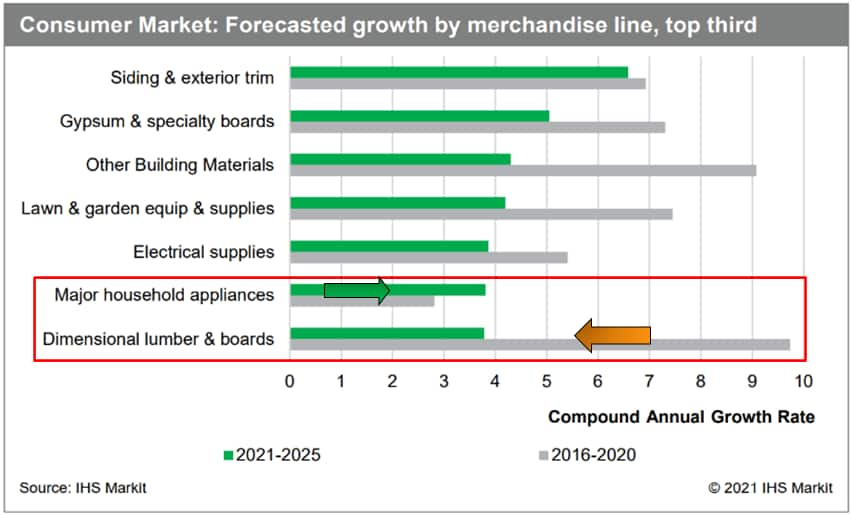

It's everything AND the kitchen sink with the renovation market shifting toward kitchens. The data suggest that lumber-intensive renovations such as home offices or bedroom additions are a trend that has seen its peak. Our forecast for lumber sales through 2025 is 60% lower than the previous five years.

We forecast roughly a 30% increase in appliance and cabinet sales through 2025. Consumers are seeing that "eating-in" is going to be a longer-term necessity.

Spend on appliances and lumber through 2025 is charted below. Major household appliance sales are set to increase roughly 30%. Lumber and board sales are set to decrease 60%.

5. The era of ultra-low mortgage rates is ending.

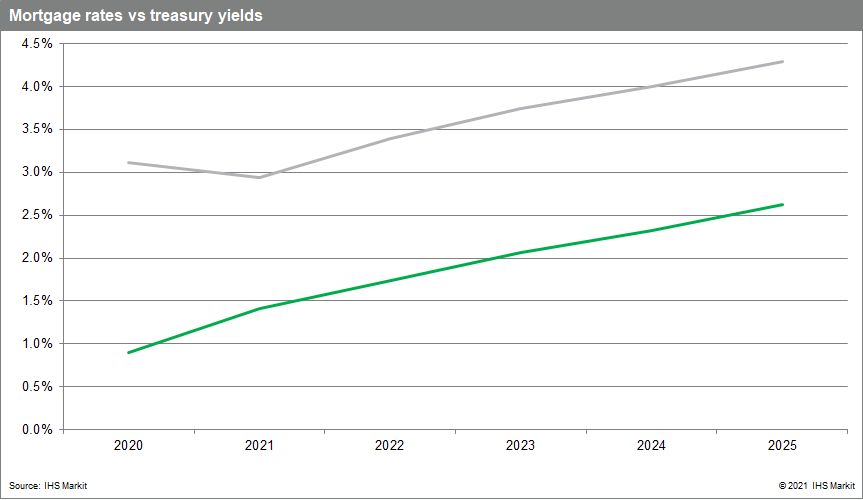

Mortgage rates are a key factor in the cost of owning a home, and ultra-low rates during the pandemic will not be around forever. To understand where mortgage rates are headed (and when), we need to consider the broader economic outlook. There are tight correlations between the 30-year fixed conventional mortgage rate and Treasury bond yields. And the Treasury yield outlook is closely linked to the Federal Reserve's interest rate policy, which is dependent on its stated objectives for maximum employment and inflation at around 2%.

Currently, the economy is still at the mercy of distortions caused by the pandemic, and our forecast expects that the Fed's objectives will not be satisfied for a couple of years. As such, we expect an initial interest rate hike to occur in 2023 with additional rate increases in subsequent years. By Q4 2024, we expect to see 10-year treasuries at 2.45%, and conventional 30-year mortgages 1.55% higher at 4.0%.

Posted 08 October 2021 by Alex Cotter, Consulting Director, Consumer goods, manufacturing and financial services, Economics & Country Risk, S&P Global Market Intelligence