Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 24, 2021

Calendar Week of 08/23/2021

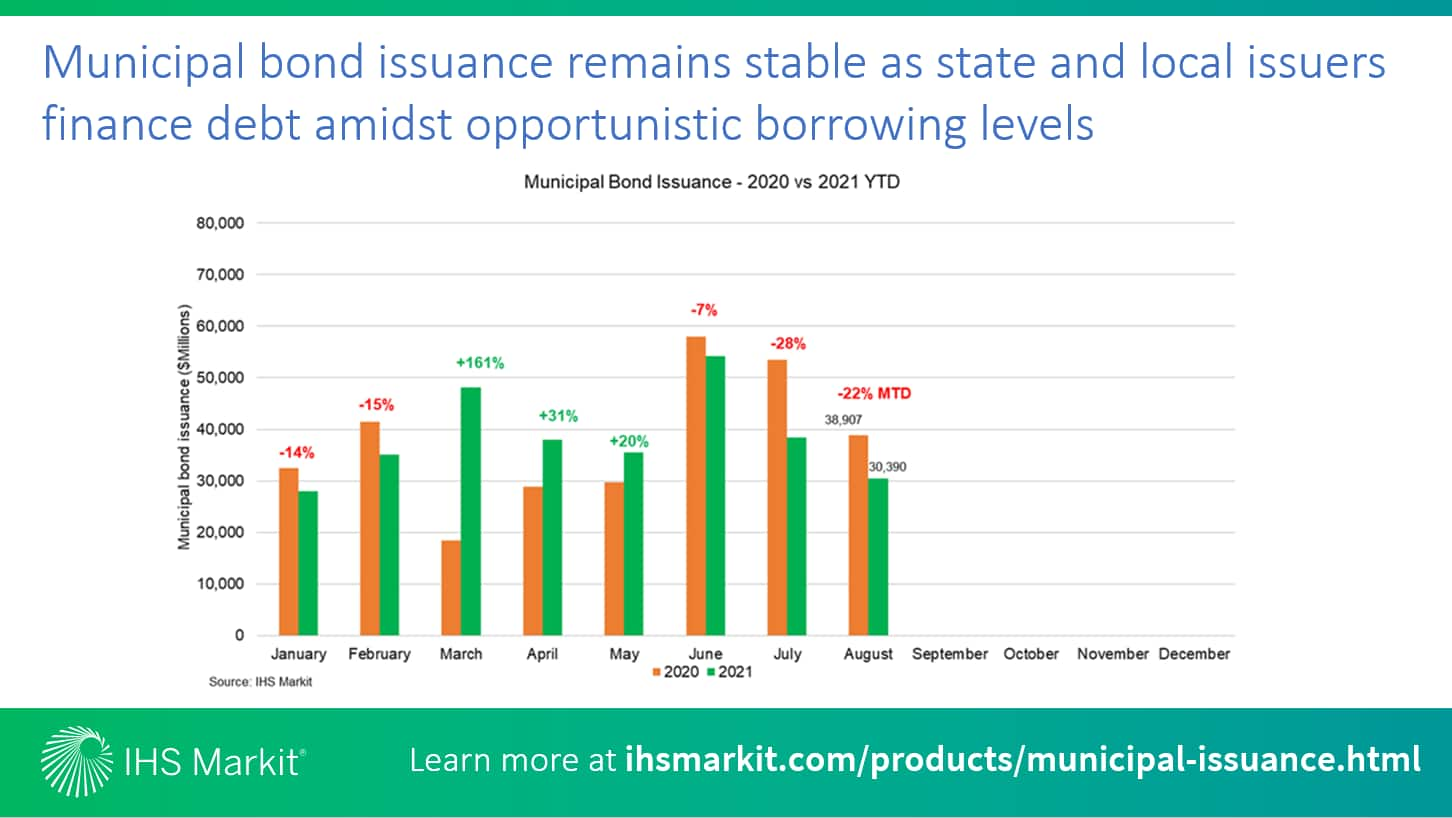

New issue activity remains steady as market participants step away from the desk for summer vacations, while state and local governments issue debt amidst surging investor demand and opportunistic borrowing levels. As the nation battles ongoing pandemic-related obstacles, market players continue to direct attention towards the pending national infrastructure bill after lengthy bipartisan discussions carry on, with a final vote forecasted to occur in the near future. Participants have closely analyzed evolving developments flowing from Washington, as increased federal support appropriated towards state and local municipalities throughout the course of the pandemic has triggered greater fluctuations in primary activity. Select issuers have remained on the sidelines, waiting to gain further clarity and direction surrounding additional federal assistance, playing a factor in trailing summer performance relative to the robust volumes registered over June-August of last year when issuers eagerly returned to market. As the summer redemption season triggers negative net supply levels, accounts actively strive to fill orders given strong buyside demand with a portion of new issue paper flowing into mutual funds which have witnessed inflows for half a year consecutively, placing greater pressure on new issue spreads. Despite political cross currents, muni benchmarks displayed mixed performance over the course of last week, with subtle cuts registered in the intermediate and long end of the curve, coupled with a one basis point bump noted in the 1YR tenor. As the market approaches the fall season, participants are forecasting an uptick in new issue activity as seasonal volume technicals point towards sustained issuance for the remainder of the year, placing the market on track to potentially surpass last year's total volume.

Muni bond financing activity over the month has remained on course after last week's calendar reached higher levels with $13.3Bn of muni paper successfully priced, outpacing the 2021 weekly average ($9.3Bn) by ~43% after several large-scale issuers tapped into the marketplace to take advantage of current market conditions. As institutions seek to put cash to work across ESG offerings, the New York Liberty Development Corporation (-/A/A-) witnessed healthy order flow across a $1.25Bn revenue refunding issue designated for the World Trade Center, with bumps of 5-10 basis points registered in the intermediate range given heavy market demand. The Puerto Rico Aqueduct and Sewer Authority also came to market last week, providing yield-focused investors greater opportunity by supplying $812mm of revenue refunding bonds across three series, with the greatest demand registered in the 2022A tax-exempt tranche, resulting in bumps of 5-12bps. This week's calendar is positioned to taper down to $9.2Bn, spanning across 236 deals with a greater presence of tax-exempt offerings geared towards retail investors. The Pennsylvania Turnpike Commission is slated to lead this week's calendar offering $600mm of oil franchise tax revenue bonds across two series spanning 12/2021-12/2053. The City of Santa Ana, CA will also come to market Wednesday, selling $426mm of pension obligation bonds on a taxable basis, led by Bank of America. This week's competitive calendar will include 121 issues for a total of $1.97Bn led by Montgomery County, MD (Aaa/AAA/AAA), auctioning $335mm of public improvement general obligation bonds tomorrow.

Posted 24 August 2021 by Matthew Gerstenfeld, Municipal Bond Business Development Specialist, IHS Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.