Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 20, 2022

We see 10 major themes to watch for in Latin America in 2023, a year that will be marked by economic deceleration, the consolidation of the political left, higher fiscal burden, and greater business disruption risks.

1. The region's economy will grow more slowly in 2023; recession risks are increasing.

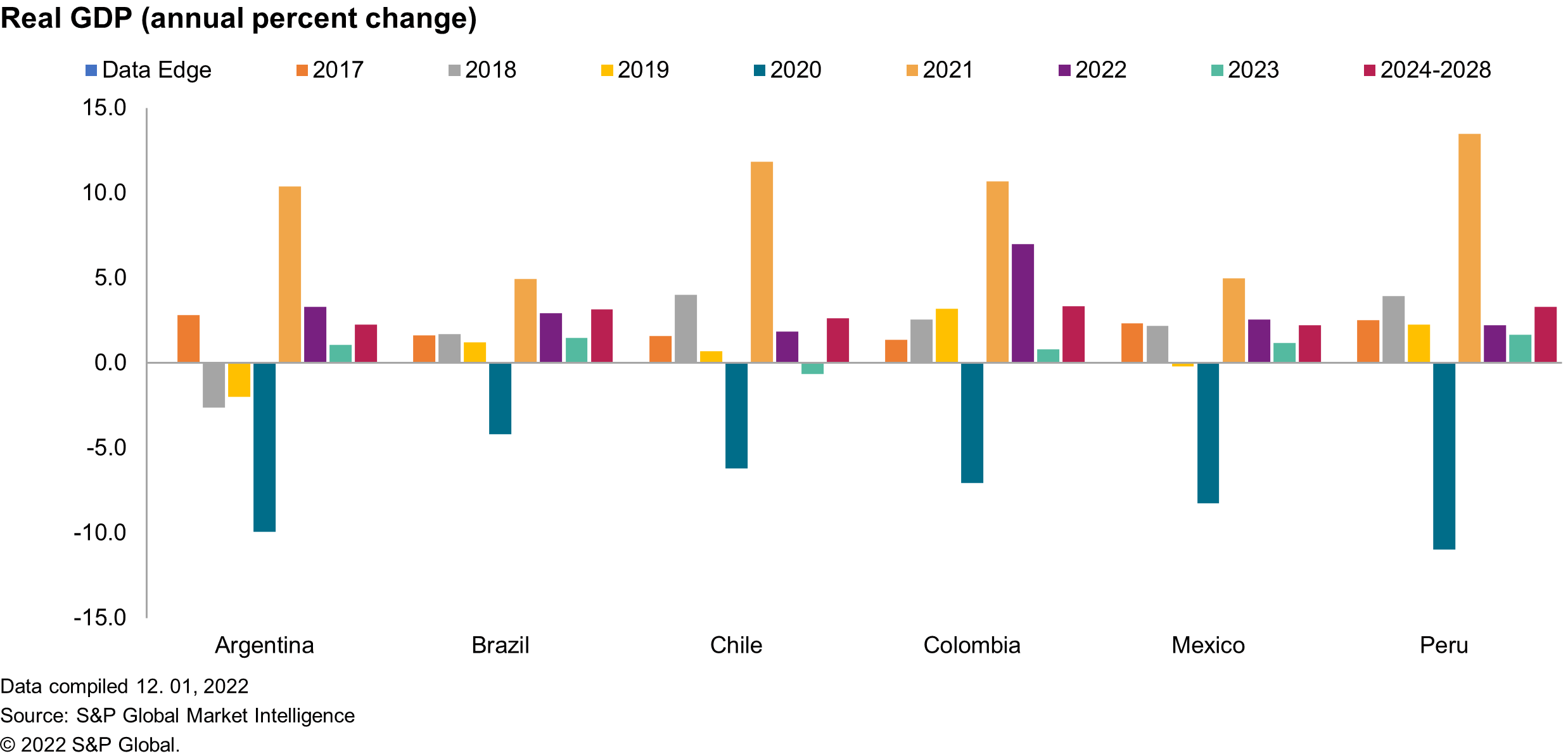

After estimated GDP growth of 3.3% in 2022, regional GDP is forecast to slow, to grow by only 1.5% in 2023. Deceleration will be driven by adverse external conditions and monetary tightening aimed at fighting high inflation.

S&P Global Market Intelligence's baseline reflects recessions in the United States and Europe leading to lower external demand. Higher interest rates will affect credit growth and discourage consumption and investment.

2. Lower inflation will allow central banks to begin easing monetary policy in the second half of the year.

Inflation has reached an inflection point in most countries in Latin America. Our forecast estimates inflation rates to fall below 10% for most countries in the region, apart from Suriname, Haiti, Cuba, Argentina, and Venezuela.

Central banks in Latin America have taken an aggressive stance against high inflation. Tighter monetary conditions, stabilizing or lower global prices for energy and food commodities, lower transportation costs, and the easing of supply chain disruption will help to slow inflation. We expect central banks in the region to start slashing rates relatively soon, provided inflation continues to decline.

3. Solid external positions will mitigate the risk of sharp currency depreciation.

Currency volatility will continue without sharp depreciations, with some exceptions such as Colombia, where market distrust has weakened support for the peso. Overall, the external scenario is adverse, reflecting recessions in the US and Europe, lower external demand, softer commodity prices, and tighter global financial conditions. For Latin American countries, this implies higher costs of borrowing, lower availability of credit, and a risk of capital outflows.

4. Banking liquidity levels will decline in 2023, particularly in Argentina, Bolivia, and El Salvador.

Given rising interest rates and lower deposit growth, some banks in Latin America are already experiencing significant declines in their liquidity. Banks are likely to place greater reliance on foreign funding or deleveraging to preserve their liquidity ratios. Tighter debt market conditions have also made governments more reliant on their banking sectors to fund their budget deficits.

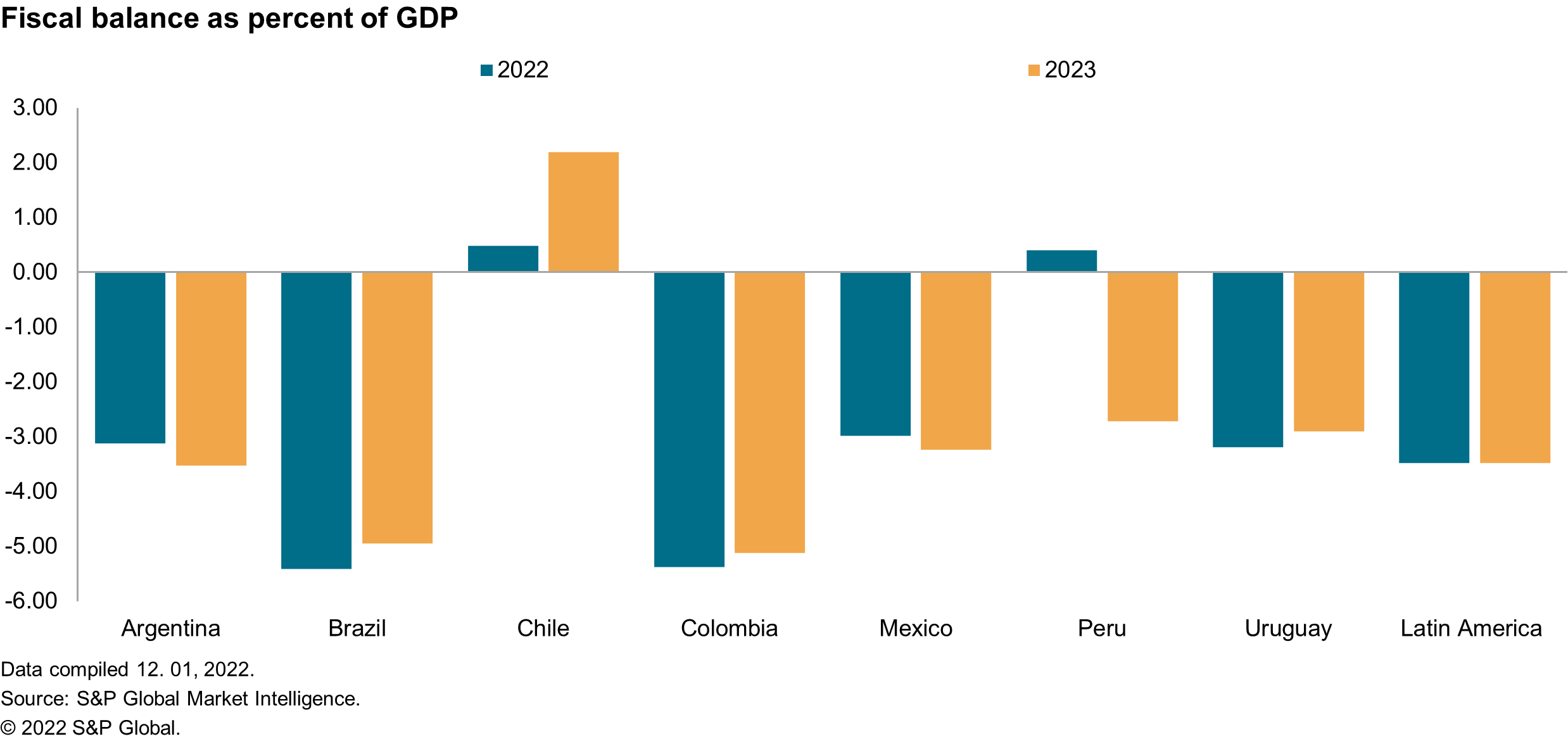

5. The resurgence of the political left will lead to higher tax burdens and expanded state-led development.

When Brazil's president-elect Luiz Inácio Lula da Silva takes office in January, most of the region's major economies will be governed by the political left. These governments are highly unlikely to re-activate the widespread expropriations and contract renegotiations conducted by their predecessors early this century.

Except for Mexico, most of the region's left-wing administrations will govern in 2023 without controlling their domestic Congresses, reducing scope for, and diluting anti-business policies. Without the control of Congress, however, the risk of policy gridlock will rise.

6. Left-wing administrations are appointing centrist finance and economy ministers, who are gaining increased influence that provides greater economic, financial, and political stability.

Most governments in Latin America are seeking to maintain or restore the trust of the private business sector and financial markets. To achieve this, presidents even from the left wing of the political spectrum are selecting pragmatic centrist individuals to lead their finance and economy ministries.

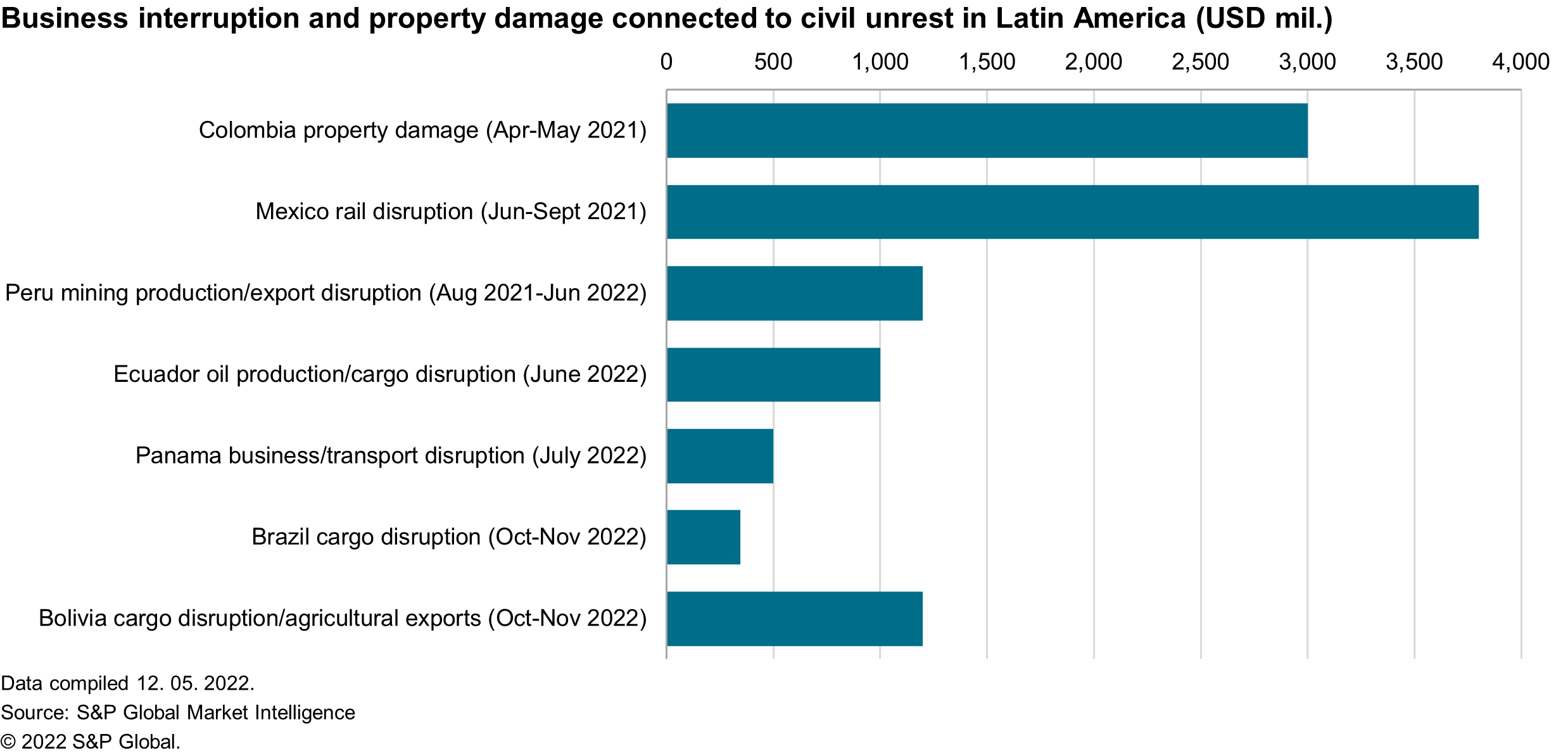

7. The cargo transport, extractive, and agricultural sectors face the highest disruption risks from social protests in 2023.

The combination of high inflation, rising unemployment, and sluggish economic growth in much of the region will worsen protest risks in 2023. Governments that reduce fuel, food or fertilizer subsidies, and social programs will face particularly high risk of protest, with other unrest triggers including police brutality, gender violence, environmental grievances, and inadequate infrastructure and public services. Pressure groups in the region are increasingly adopting tactics that generate economic costs, such as the blockade of key motorways, ports and project specific locations.

8. Counterparty risks will increase for companies doing business with Central America.

Growing corruption concerns are likely to drive implementation of additional sanctions by the US Department of State against government actors in El Salvador, Guatemala, Honduras, and Nicaragua during 2023. US sanctions on Venezuela will be reviewed in the first half of 2023 after temporary easing.

9. Efforts by multiple Latin American governments to prioritize investments in the renewable energy sector will face challenges.

Underdeveloped infrastructure (particularly for transmission lines), state interventionism, and social opposition exacerbate the risks of project delays and contract cancellation.

10. Within the process of geopolitically driven restructuring of global supply chains, Latin America presents investment opportunities.

Strategic competition between the US and mainland China and a renewed global push for energy transition are key potential drivers of new business opportunities in Latin America in the five to ten-year outlook. An S&P Global Market Intelligence open-source review of 141 investment pledges made by firms investing in the region during January-October 2022 highlights how firms from China, South Korea, Japan, and Australia are increasingly positioning themselves in the region.

Mining attracted most investment pledges, followed by hydrocarbons, automotive, and telecommunications. Over the five-year outlook, renewable energies, critical minerals, and advanced manufacturing should gain prominence.

-With contributions from Roger Padierna and Nicolas Suarez.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.