Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 22, 2024

By Jingyi Pan

Japan's private sector activity remained in slight contraction territory in the penultimate month of the year as new orders stagnated and external demand continued to worsen.

That said, business optimism about the year ahead improved, which led to the quickest increase in staffing levels since July. Selling price inflation also heightened on the back of still-elevated cost increases and as firms opted to share their rising cost burdens with clients amid greater optimism.

The slowdown in business activity and rising price pressures once again presented mixed signals for the Japanese central bank in their consideration of the timing for the next policy rate move.

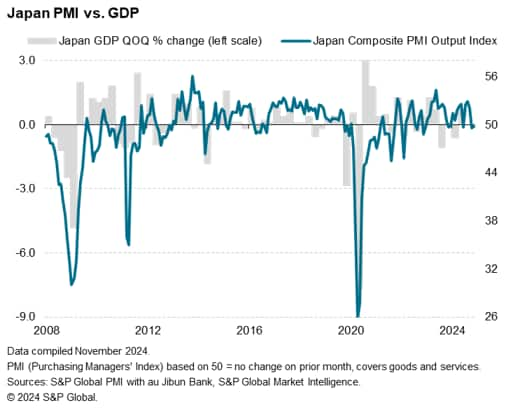

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, rose to 49.8 in November, edging up from a final reading of 49.6 in October. Posting below the 50.0 neutral mark for a second successive month, the latest reading signalled that Japan's private sector activity remained in decline, albeit only marginally. This is the first back-to-back reduction in business activity recorded since the start of 2023. The latest fractional decline in activity signalled another near-neutral GDP print midway through the final quarter of the year.

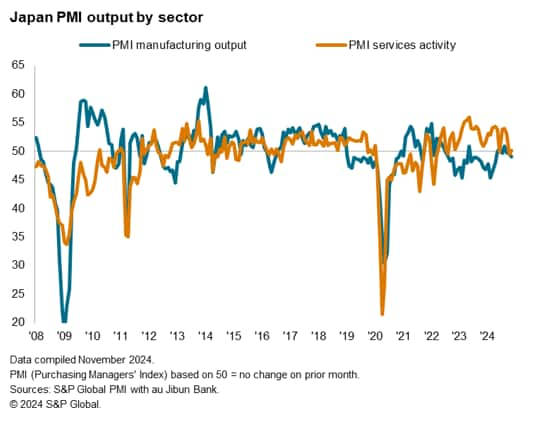

A sectoral divergence was observed in November as services activity returned to expansion after falling briefly in October. Absent the reductions in June and October, services activity would have expanded continuously since September 2022, though the latest November print is among the lowest seen over this period. The subdued activity was caused by the softening of new orders growth, whereby the rate of new business inflows was the least pronounced in the ongoing five-month sequence amidst another fall in export business. According to panellists, some service providers saw demand being negatively affected by sluggish economic conditions into the end of the year.

Meanwhile, manufacturing output fell for a third straight month in November. Moreover, the rate of reduction was the most pronounced since April, albeit still modest. Subdued conditions in the global manufacturing sector dampened demand according to panellists. This included key electronics and automotive sectors for Japan, thereby weighing on goods production in November. Export orders for goods fell for the thirty-third month in a row, though with nascent signs of improvement as the rate of reduction eased to be the least pronounced over this period.

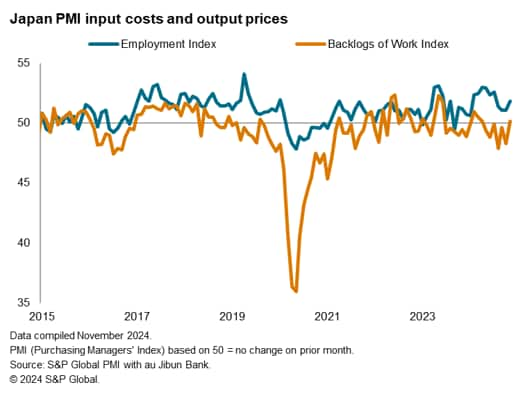

While overall business activity fell, staffing levels rose, extending the sequence of job creation to fourteen months. The rate of increase was the fastest in four months despite being modest overall. Sub-sector data revealed that employment rose mainly among service providers while manufacturing headcounts fell for the first time since February. Higher capacity pressure, as reflected by the fastest increase in unfinished business since March, led to higher services employment in November. Altogether, the latest data reflected above-average labour demand, albeit one that is uneven by sector.

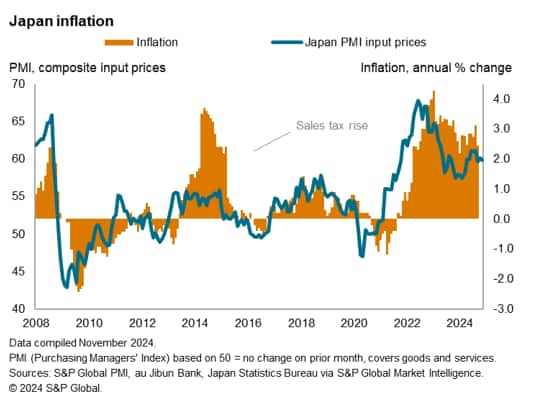

Price pressures meanwhile remained elevated. Average input prices rose at a softer, but still above-average, rate in November as cost inflation eased slightly in both the manufacturing and service sectors. Higher raw material, labour, energy and transport costs were often mentioned as reasons for the price increases while many private sector firms were also affected by the weakness of the Japanese yen.

The elevated cost increases resulted in another hike in selling prices. Output price inflation notably rose to the highest since May as both manufacturers and service providers raised charges at quicker paces. Anecdotal evidence suggested that firms lifted selling prices at a faster pace to reflect rising cost burdens.

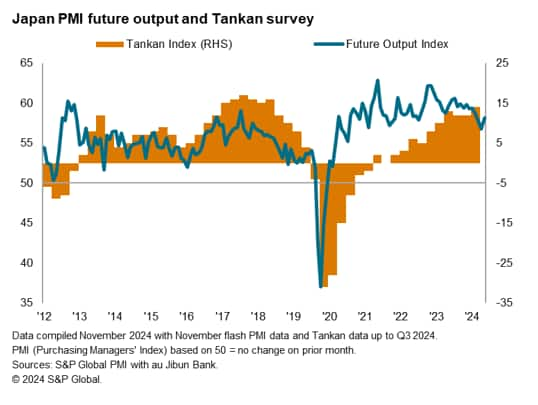

Finally, business confidence about prospects in the coming year broadly improved among Japanese private sector firms. The PMI Future Activity Index climbed to the highest level in three months, further indicating above-average optimism among businesses regarding output in the next 12 months.

The latest uptick in cost inflation indicates that Japan's inflation rate looks set to remain at around 2.0% in the coming months. While the inflation trend, alongside the tightness in labour market - particularly in the service sector - supports the Bank of Japan's (BOJ) hawkish bias, the weak business activity trend adds uncertainty to the timing of the next hike. However, the improvement in business confidence hints at the likelihood for higher activity in the year ahead, suggesting great potential for the BOJ to proceed in early 2025 instead of more imminently.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings