Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 13, 2019

Inverting the alternative data pyramid

Integrating alternative data into the investment process is the future of portfolio management, yet the practice of identifying valuable, non-traditional data sets is age old. Some call it fundamental analysis, like interviewing customers about a company's product. Others call it plain smarts, like using satellite imagery to measure crop yields or revenue at the mall. For all the attention it gets, alternative data remains remarkably undefined — and that's ok. What qualifies as alternative data is not the important question. The real question is how do you turn such information into insight?

Technology, of course, is the key to finding insight and the value of such insights in the investment process will only improve as tools to aggregate and interpret data, especially unstructured data, improve. Similarly, backtesting new datasets is becoming faster and cheaper and is a critical component in validating the value derived from any alternative data set.

The Demystifying Alternative Data study by Greenwich Associates found that 71% of asset managers believe that using alternative data gives them an investing edge over competitors. Around half of the investment managers surveyed by Greenwich are currently using alternative data, with another quarter planning to do so within a year. In short, alternative data is big and it's not going away.

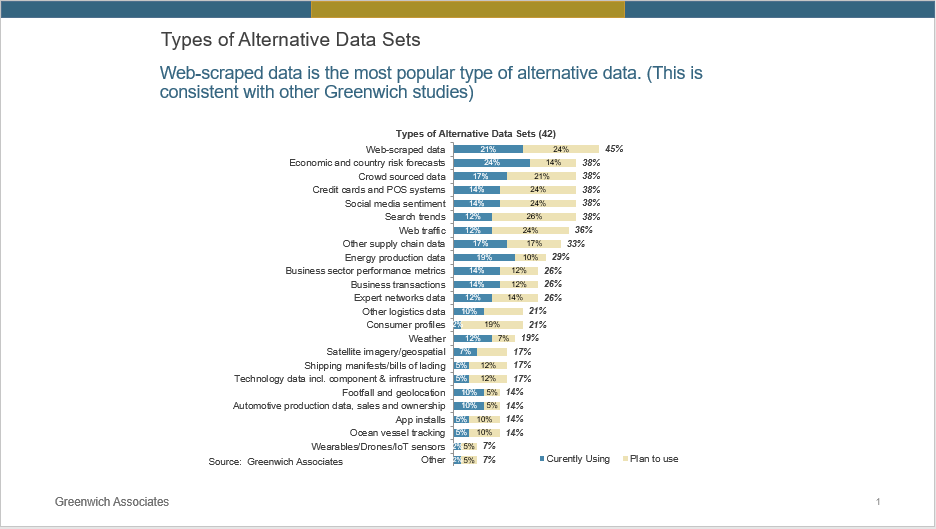

The survey found that the most commonly used forms of alternative data include web-scraped data, social media sentiment, web traffic and search trends. Certainly, there is a lot of value in those areas. Our testing of our social media sentiment signal shows significant alpha in analyzing Twitter activity.

Yet, web-sourced data are just the starting point on the alternative data spectrum. Since this information is natively digital, it's easier to aggregate, analyze and pipe into algorithms. We are still in the early stages of a profound shift in the types of data investment firms consume and how they consume it.

<span/>The most sophisticated asset managers are beginning to test more direct and more granular indicators of supply and demand. Examples include bills of lading data from cargo ships, energy production and distribution, automobile registrations, technology component cost, political risk and ESG metrics. The list goes on and on.

There is no doubt this information is typically harder to normalize and analyze, but it's definitely worth the effort. According to Greenwich, 42% of all asset managers believe the alpha edge they achieve by using alternative data lasts for at least four years. That edge is probably even more pronounced for supply chain metrics and our research shows that information like import volumes have strong predictive power [add link to maritime case study].

At the same time, we should realize that many types of capital markets data can be alternative to the equity investor. The CDS market, for example, can be a leading indicator for equities markets. Short squeezes are very clearly linked to movement in equity. A strong ESG focus has also been correlated to a company's stock outperformance. Ultimately, investors are likely to use a combination of alternative data factors and even blend prepackaged models with proprietary analytics.

When it comes to alternative data, it is important to understand that data alone are not the answer for most firms. 83% of asset managers in the Greenwich survey want some assistance in understanding alternative data, ingesting it and processing it. We believe a collaborative service model is essential to bring the benefits of alternative data to the majority of investors. Of course, the big quants have the horsepower to find hidden value in the raw data, but most firms need supplemental expertise —and we have experts at IHS Markit who can help. We can consult with firms about our data sources, methodologies and prepackaged analytics for a growing number of alternative data factors. We also have a growing, world class data science team that partners with clients to design and test advanced data models.

Making it easy for firms to access alternative data spanning the real economy and the derived economy was a major driver of the merger between IHS and Markit in 2016. Not only is the firm unique for the scope of information we can provide (we are sitting on 25 petabytes of data at our last count), but very few can see the world through a lens like ours. We are an information company at our core. We understand the nuances of ingesting data, packaging data for customers and deriving new insights from multiple data sources.

What is alternative data? The better question might be what isn't alternative data? Don't be bound by where the crowd is focusing—imagery, web data, geo location and credit card transactions. Those are important, but a more interesting challenge, and perhaps a greater source of alpha, is out there for people and firms that are willing to look beyond the herd. Be creative and get excited. Engage with your data partners. If you have a hypothesis, there's a high likelihood the data exist and experts are there to help you test and discover new relationships between supply, demand, price and profit.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finverting-the-alternative-data-pyramid.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finverting-the-alternative-data-pyramid.html&text=Inverting+the+alternative+data+pyramid+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finverting-the-alternative-data-pyramid.html","enabled":true},{"name":"email","url":"?subject=Inverting the alternative data pyramid | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finverting-the-alternative-data-pyramid.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Inverting+the+alternative+data+pyramid+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2finverting-the-alternative-data-pyramid.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}