Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 25, 2025

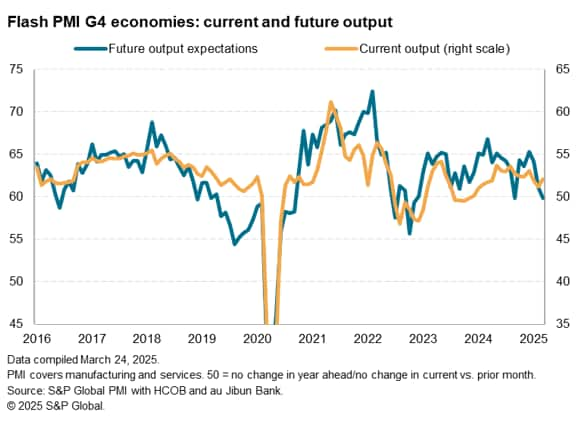

The flash PMI data compiled by S&P Global Market Intelligence indicated that business output among the G4 largest developed economies rose at a slightly increased rate in March, but growth was uneven and has remained modest so far this year by standards seen in 2024. The sustainability of any upturn is also questioned by business sentiment about prospects in the year ahead faltering to the lowest levels seen since November 2022.

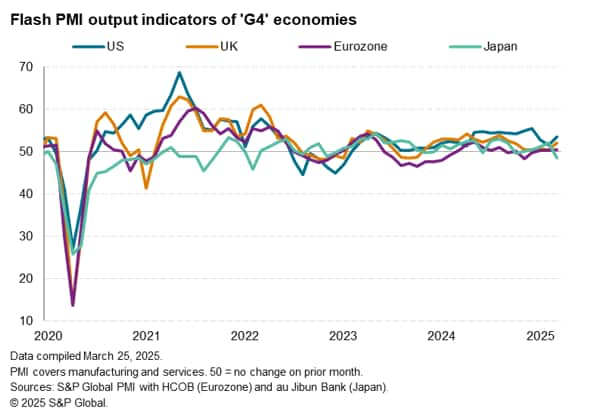

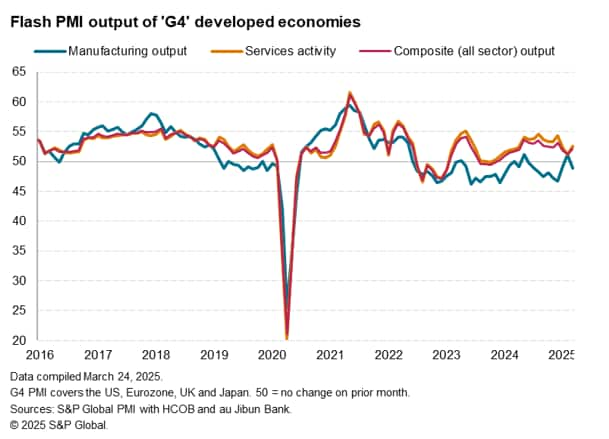

The Composite PMI Output Index from the G4 economies, covering both goods and services, lifted from 51.2 in February to 52.0 in March, according to the preliminary 'flash' reading. While the latest reading signalled the sharpest expansion of output for three months, the average reading for the first quarter as a whole is the lowest recorded since the first quarter of last year.

The US reported the strongest gain of the G4, regaining the top spot after falling behind Japan in February. Output growth across goods and services in the US was the strongest seen so far this year, albeit still lagging the robust pace seen throughout the second half of last year.

Growth also accelerated in the UK, attaining a six-month high, and edged higher in the eurozone. Although the latter's expansion was still only marginal, it was the best recorded for seven months, adding to tentative signs of a brightening picture across Europe.

In contrast, Japan bucked the improving trend, reporting the first fall in output since last October. The decline was also the sharpest recorded for just over three years.

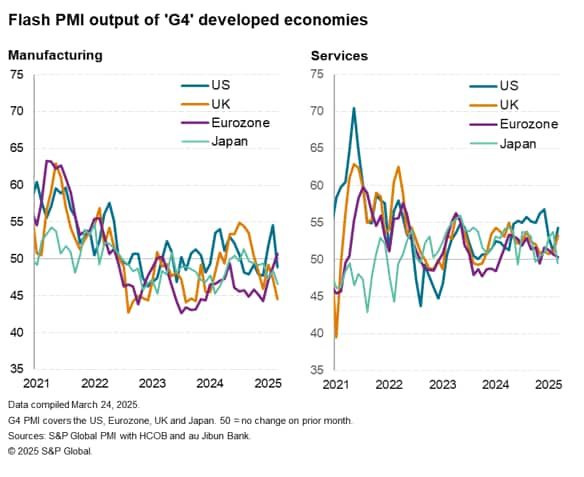

The current output divergences were driven largely by variations in service sector performance. Japan's services economy slipped back into decline for the first time in five months, albeit partly reflecting constraints due to labour supply problems. Eurozone services growth also slowed, coming close to stalling as firms reported a second month of falling inflows of new business. However, faster output growth was recorded in both the US and UK, reaching three- and seven-month highs respectively. Note though that some of this upturn in the US was attributed to improved weather after two harsh months at the start of the year, hinting that some of the revival may prove temporary.

Only the eurozone meanwhile reported an improvement in manufacturing output during March, enjoying its first upturn for two years and the largest (though still very modest) increase for nearly three years. Eurozone producers reported some advance shipping of goods to the US ahead of tariffs, but also indicated improved domestic demand. In contrast, UK and Japanese production fell at increased rates, the former dropping especially sharply, and US factory output slipped back into decline in March after two tariff-front-running related expansions in the opening months of the year.

Measured across the G4 economies, while services output growth accelerated, the rise was still among the weakest seen over the past year. Manufacturing meanwhile fell back into decline after having enjoyed a brief expansion for the first time in nine months during February.

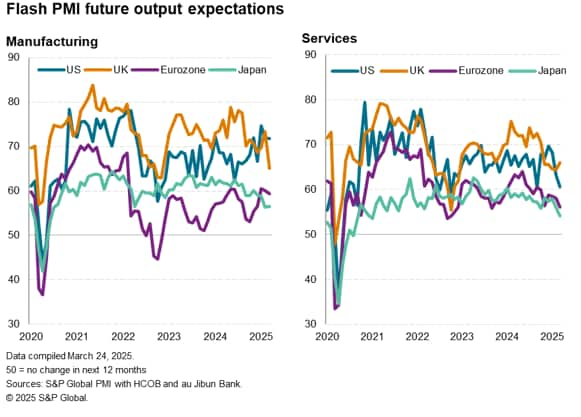

While the Output Index tracks monthly changes in actual factory production and equivalent gauges of service sector activity, the survey's Future Expectations Index provides a measure of business confidence. The latter asks companies where they think these activity levels will be in a year's time. Here the news was even less encouraging. Business expectations fell on average across the combined goods and services economies in the G4 economies to its lowest since November 2022.

Only the UK saw improved optimism in March, and even here the degree of sentiment remained among the lowest recorded over the past two years. Confidence in the country's manufacturing sector slumped to the lowest since late-2022 and service providers remained cautiously optimistic following the tax hikes seen in last year's Budget.

While US companies had been especially optimistic at the turn of the year, this confidence has faded, with March seeing sentiment drop to its second lowest since October 2022 (with only the lead up to last year's Presidential election seeing lower confidence). However, the drop in US confidence has been largely limited to the services sector, where government spending cuts have dampened optimism alongside worries over the uncertainty caused by tariff announcements. The latter has helped shore up sentiment in the US goods producing sector, with the promise of greater protectionism helping maintain confidence close to three-year highs in recent months.

Despite the eurozone seeing manufacturing sentiment run close to a three-year high, as companies anticipated higher government spending on defense and infrastructure, service providers in the single currency area were the gloomiest for 18 months on the back of concerns over the economic and geopolitical outlooks. Geopolitics also dominated in Japan, where manufacturing confidence hits the second-lowest in nearly three years, and service sector sentiment sank to the lowest for over four years.

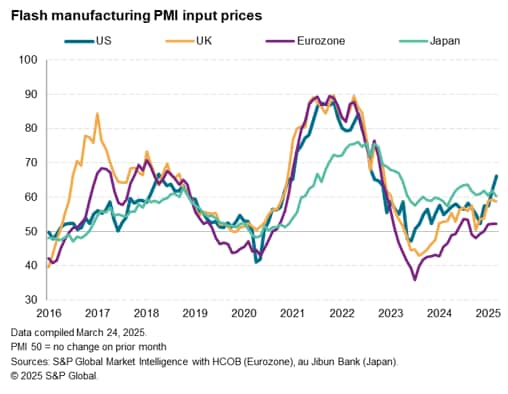

US manufacturers report tariff impact on prices

One final area to note was that the elevated level of confidence seen in the US manufacturing sector in recent months may be undermined if prices continue to rise at a pace witnessed in the sector during March. US factories reported the steepest rise in input costs for 31 months, causing the rate of inflation to far outpace equivalent rates reported in the other G4 economies. Producers commonly blamed these higher prices on tariffs. These higher costs were also passed through to customers, resulting in the highest rate of inflation for factory selling prices in the US for just over two years. Such high selling price inflation may dampen demand for US goods.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings