Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Feb 13, 2025

By Matt Chessum

The rapid evolution of artificial intelligence (AI) has ushered in an era of heightened competition that is significantly influencing the volatility of technology stocks. The emergence of innovative companies, such as Deepseek, which have developed advanced AI tools at a fraction of the traditional cost, has intensified this competitive landscape. As a result, the dynamics of capital expenditure and investor sentiment within the U.S. technology industry are undergoing substantial shifts, contributing to increased stock volatility.

Deepseek's entry into the AI market exemplifies the disruptive potential of new players who leverage cutting-edge technology to deliver powerful solutions at reduced costs. This phenomenon challenges established firms, compelling them to reassess their capital expenditure strategies. Historically, tech giants have invested heavily in research and development to maintain their competitive edge. However, the rise of cost-effective alternatives raises questions about the sustainability of such investments. Companies may find themselves under pressure to justify their capital expenditures in an environment where cheaper, yet effective, solutions are readily available. This reassessment can lead to fluctuations in share prices as investors react to the perceived risk associated with these strategic shifts.

While the announcement of more cost-effective AI solutions initially sent shockwaves through the market, resulting in significant declines in the share prices of several technology stocks, the subsequent reaction from investors has shown a notable shift in sentiment. As the implications of these developments are digested, short interest across the sector has been decreasing, after an initial spike, indicating that investors are increasingly confident in the resilience and adaptability of established tech companies. This decline in short interest suggests that market participants are reassessing the potential for growth in the face of competition, viewing the emergence of cost-effective solutions not as a threat, but as an opportunity for innovation and market expansion. Short interest, which indicates the number of shares that investors have sold short in anticipation of a decline in stock price, can often serve as a barometer of market sentiment.

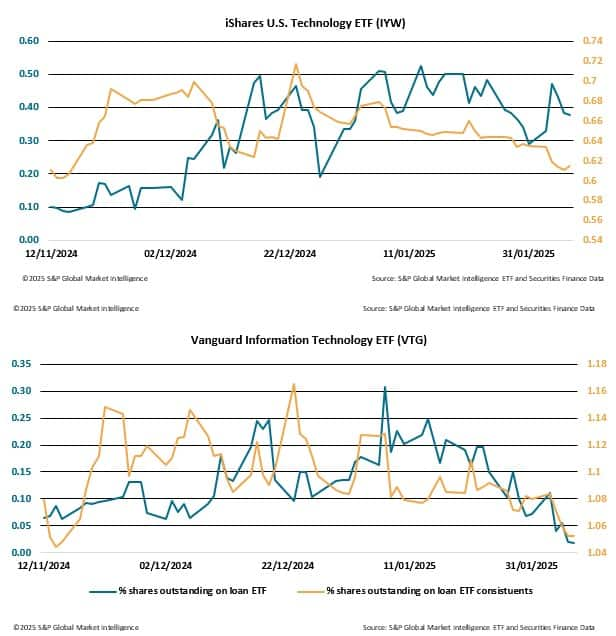

Furthermore, the volatility in technology stocks is reflected in the movements of short interest seen in the ETF market. Recent trends show a decrease in short interest among some of the largest U.S. tech stocks, both at the ETF level and across their individual constituents. This decline suggests a growing confidence among investors regarding the prospects of these companies, despite the intensifying competition that characterizes the AI landscape.

The reduction in short interest could imply that investors are increasingly optimistic about the ability of established firms to adapt to the competitive pressures posed by newcomers like Deepseek. The market may be signalling a belief that these companies will not only withstand the competition but also innovate and evolve to capture new opportunities. This sentiment is particularly noteworthy given the historical context of technology stocks, which have often been viewed with scepticism during periods of rapid change.

Moreover, the volatility in technology stocks can be attributed to the broader implications of AI advancements on various sectors. As AI continues to permeate industries ranging from finance to healthcare, the potential for transformative impacts can lead to both enthusiasm and apprehension among investors. The duality of opportunity and risk associated with AI developments contributes to the fluctuations in stock prices, as market participants weigh the potential for growth against the challenges of increased competition.

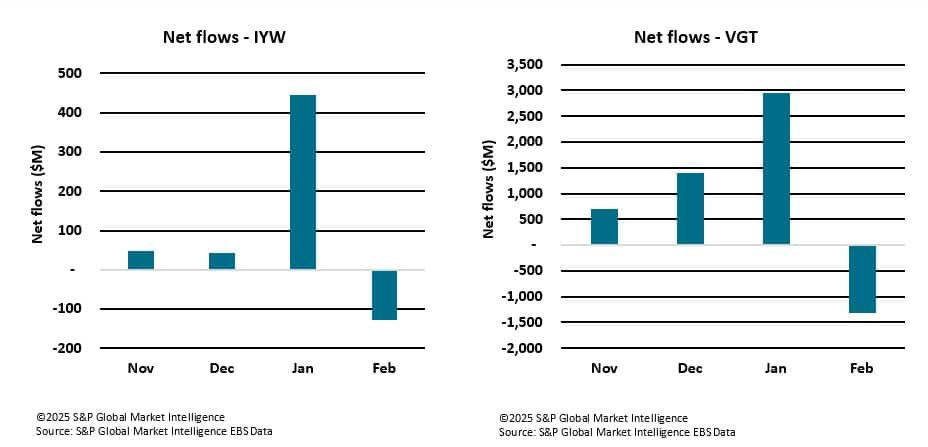

Despite the decline in short interest across the iShares U.S. Technology ETF (IYW) and the Vanguard Information Technology ETF (VTG), these products experienced a reversal in flows during February, turning negative after a robust combined inflow of $3.4 billion in January. This shift may be attributed to profit-taking by investors who capitalized on the strong performance of tech stocks in January, coupled with a cautious approach as the market digests the implications of increased competition and cost-effective AI solutions. However, the decreasing short interest suggests that overall sentiment remains positive, as investors are still optimistic about the long-term prospects of major tech companies, indicating that while some may be exiting positions for short-term gains, many others are likely holding onto their investments in anticipation of future growth.

The global competition in the artificial intelligence sector is undeniably making technology stocks more volatile. The emergence of companies like Deepseek has prompted established firms to reconsider their capital expenditures, influencing share prices and investor sentiment. The observed decrease in short interest across the U.S. tech sector, major U.S. ETFs and their constituents may indicate a shift towards a more positive outlook, suggesting that investors are less concerned about the competitive pressures within the industry. As the AI landscape continues to evolve, it will be essential for market participants to remain vigilant, monitoring the interplay between competition, innovation, and stock volatility in this dynamic sector.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.