US and European equity markets closed higher, while APAC was mixed. US government bonds continued to selloff, with yields on most benchmark European bonds also higher on the day. European iTraxx closed close to flat, while CDX-NA was tighter on the day across IG and high yield. The US dollar, oil, gold, silver, and copper were all higher on the day. Tomorrow's US non-farm payroll report will be watched closely to quantify the impact of the second wave of COVID-19 infections on the US labor market recovery.

Americas

- US equity markets closed higher; Nasdaq +2.6%, Russell 2000 +1.9%, S&P 500 +1.5%, and DJIA +0.7%.

- 10yr US govt bonds closed +4bps/1.08% yield and 30yr bonds +4bps/1.86% yield.

- The average for a 30-year, fixed loan fell to 2.65%, down from 2.67% last week and the lowest in data going back 50 years, Freddie Mac said in a statement Thursday. It was the 17th record low since the coronavirus started roiling financial markets last March. (Bloomberg)

- CDX-NAIG closed -2bps/50bps and CDX-NAIG -8bps/294bps.

- DXY US dollar index closed +0.3%/89.83.

- Gold closed +0.3%/$1,914 per ounce and silver +0.8%/$27.26 per ounce.

- Copper closed +1.4%/$3.70 per pound, which is the highest close since February 2013.

- Crude oil closed +0.4%/$50.83 per barrel.

- Seasonally adjusted (SA) US initial claims for unemployment insurance fell by 3,000 to 787,000 in the week ended 2 January. The not seasonally adjusted (NSA) tally of initial claims rose by 77,400 to 922,072. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 126,000 to 5,072,000 in the week ended 26 December. Prior to seasonal adjustment, continuing claims rose by 145,444 to 5,382,459. The insured unemployment rate in the week ended 26 December was unchanged at 3.5%.

- There were 161,460 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 2 January, the lowest since the program started. In the week ended 19 December, continuing claims for PUA fell by 70,553 to 8,383,387.

- In the week ended 19 December, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 293,434 to 4,516,900. With the latest extension to 24 weeks for PEUC, eligible recipients can receive up to 50 weeks of unemployment benefits between the regular state programs and PEUC.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 19 December, the unadjusted total fell by 419,228 to 19,176,857.

- US employers announced 77,030 planned layoffs in December, according to Challenger, Gray & Christmas—up 18.9% from November's 64,797. December's total was 134.5% higher than the number of cuts announced in December 2020. (IHS Markit Economist Juan Turcios)

- December was the 10th month to report job-cut announcements specifically because of the COVID-19 pandemic, which totaled 4,057 for the month. Employers cited other reasons including a downturn in demand and market conditions more frequently than COVID-19 as causes of job-cut announcements in December.

- For the year, 2,304,755 job cuts were announced in 2020, 289% higher than in 2019. The yearly total is the highest on record and surpassed the previous annual record of 1,956,876 announced job cuts in 2001 by 17.8% (Challenger began tracking job-cut announcements in January 1993).

- Of the 2,304,755 total job cuts announced over 2020, nearly half (1,109,656) were because of COVID-19, according to employers.

- According to Andrew Challenger, senior VP of Challenger, Gray & Christmas, "In the final months of the year, companies that may have survived the initial impact of the pandemic in March and April determined staffing adjustments based on increasingly difficult market conditions. While some segments were up, such as warehousing, shipping, financial, and some manufacturing segments, many others were hurt considerably, chief among them Hospitality, Entertainment, and Leisure."

- Unsurprisingly, the hardest-hit sector and recipient of the lion's share of coronavirus-related cuts in 2020 was the entertainment/leisure sector, which encompasses bars, restaurants, hotels, and amusement parks. Over 2020, companies in the entertainment/leisure sector announced 866,046 cuts, a whopping 851,083 higher than during 2019.

- Transportation companies announced the second-highest number of job cuts in 2020 as air travel plummeted over most of last year. The transportation sector announced 29,430 cuts in December, the highest number of announced cuts for the month. Transportation companies announced 199,559 job cuts in 2020 compared to 30,560 job cut announcements in 2019.

- Rounding out the top five most adversely affected sectors over 2020 were retail (184,886 job cuts), services (159,234 job cuts), and automotive (87,191 job cuts).

- The nominal US trade deficit widened by $5.0 billion to $68.1 billion in November. The overall widening reflected a 2.9% increase in imports and a 1.2% increase in exports, both gains somewhat above our estimates. (IHS Markit Economist Kathleen Navin)

- In response to the details of today's trade report, we lowered our estimate of fourth-quarter GDP growth 0.1 percentage point to 2.9% and maintained our forecast of first-quarter GDP growth of 2.4%.

- Both exports and imports continued to recover from pandemic-driven lows reached in May 2020; from February to May, exports fell 31.3%, and imports declined 19.1%.

- Through November, exports have reversed nearly two-thirds of their decline, while imports have reversed all of their decline.

- Fairly robust domestic demand for goods continues to support the relatively strong comeback for imports. Indeed, real goods imports in November were nearly 10% above their February 2020 level.

- Meanwhile, lagging foreign demand provides relatively less support for exports, as the recovery overseas has trailed that in the United States. As of the third quarter of 2020, real US GDP was down 3.4% from the fourth quarter of 2019, while our estimate of trade-weighted foreign GDP was down 4.5% over the same period.

- We look for both exports and imports to continue their recoveries in the coming quarters.

- AmerisourceBergen Corporation (US) has signed an agreement with Walgreens Boots Alliance (WBA; US) whereby AmerisourceBergen will acquire the majority of WBA's wholesale pharmacy businesses (Alliance Healthcare) for approximately USD6.5 billion, including USD6.275 billion in cash and 2 million shares of AmerisourceBergen's common stock. (WBA's business operations in China, Italy, and Germany are excluded from this transaction.) In addition to the acquisition, the two companies have strengthened and expanded their commercial agreements, with a three-year extension to their US distribution agreement until 2029 with a commitment to partner on additional opportunities in sourcing and distribution. Alliance Healthcare UK will remain the distribution partner for UK retail pharmacy Boots (part of WBA) until 2031. The acquisition of Alliance Healthcare will notably expand AmerisourceBergen's operations to Europe with the acquisition of Alliance Healthcare, one of Europe's largest pharmaceutical wholesalers. (IHS Markit Life Sciences Margaret Labban)

- Healthcare services company Optum (part of UnitedHealth Group, US) has announced an agreement to acquire healthcare technology company Change Healthcare (US) for USD25.75 per share in cash (or an estimated value of USD7.84 billion, according to the Financial Times (FT), representing a 41% premium). The transaction value amounts to USD13 billion when accounting for the USD5 billion in debt owed by Change, according to Bloomberg. Optum operates three core businesses: OptumHealth, which provides supportive care to about 98 million consumers; OptumInsight, which offers data, analytics, research, consulting, technology, and managed services solutions to hospitals, physicians, health plans, governments, and life sciences companies; and OptumRx, its pharmacy benefit management business. The Change Healthcare business will merge with OptumInsight, with the aim of providing software and data analytics - as well as technology-based research and consulting services - to improve healthcare processes. According to UnitedHealth, the merged entity will "simplify clinical, administrative and payment processes - resulting in better health outcomes and experiences for everyone, at lower cost." Optum already has several analytical and technological tools for improving operational and clinical performance, and the acquisition will further leverage Change's own technologies, connections, and capabilities. (IHS Markit Life Sciences Margaret Labban)

- After enduring a projected 10.6% year-on-year (y/y) drop in demand for new commercial vehicles during the 2020 pandemic year, the global market for new trucks and buses with a GVW of above 6 tons may decline by more than 9% y/y in 2021, Divis has written. IHS Markit forecasts that demand will fall to 2.9 million new vehicles in 2021, from an estimated 3.2 million in 2020. This is also the lowest level globally since 2016. The decline is largely expected from weakness in the world's heavy-truck segment, which represented 58% of the world's commercial-vehicle demand, and mainland China is the largest global market for the segment. In 2020, mainland China accounted for 54% of global heavy-truck segment sales, and the forecast drop of 37% for the segment in mainland China in 2021 for the largest market is not recoverable by gains in other markets. IHS Markit forecasts lost momentum for the segment as mainland China's market normalizes from the blistering selling rates of mid-2020. IHS Markit forecasts gains in heavy-duty demand elsewhere around the world, but the overall volume of the mainland China market means those gains will be too small to offset the anticipated slippage in mainland China. The decline in mainland China brings global segment demand down by nearly 22% y/y in 2021. North America is the second-largest heavy-truck market, accounting for 15% of global sales in 2020 and sales there are forecast to rise by about 7.4% y/y in 2021. The MHCV market's overall performance is heavily tied to both mainland China and to the heavy-duty truck segment. In 2020, the heavy-duty truck segment in China bucked the global trend of declining demand and grew an estimated 21% y/y, although the global MHCV market is estimated to have fallen by 10.6% y/y in 2020. However, the decline in the heavy-duty truck segment forecast for mainland China in 2021 will have the effect of muting MHCV market performance globally in the next several years. (IHS Markit AutoIntelligence's Stephanie Brinley)

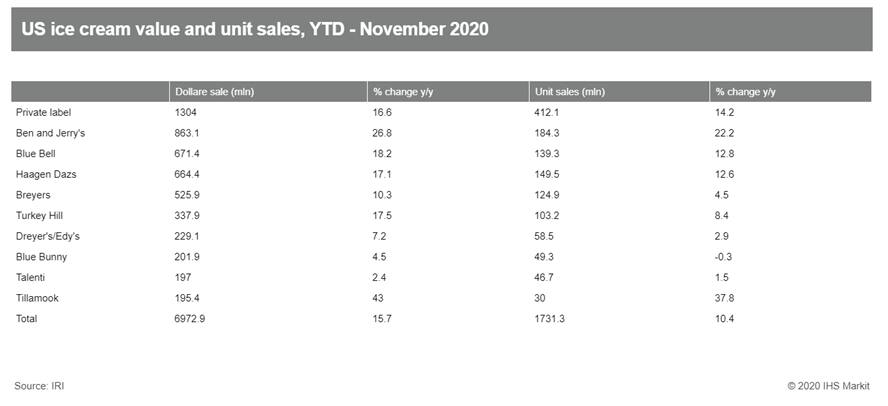

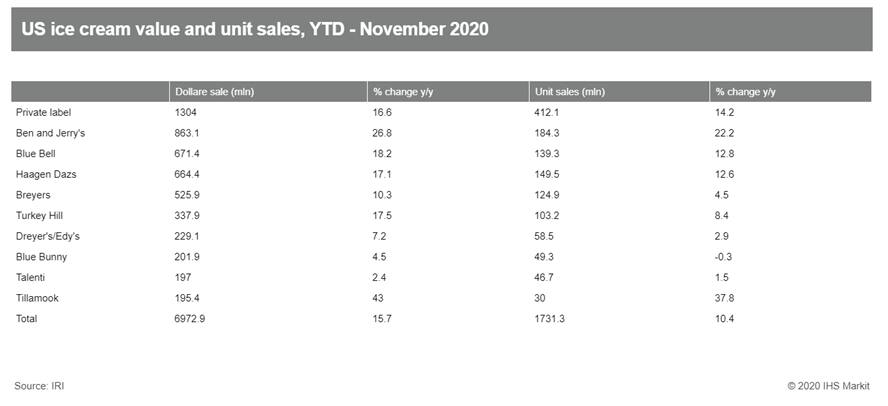

- Value sales of ice cream and sorbets in the US rose by 15.5% to USD7.8 billion during the 52 weeks ending 1 November 2020, Dairy Food reported, quoting data released by the market research firm IRI. Sales volume rose by 10% to 1.7 billion units as consumers seem to have turned to comfort food during the ongoing pandemic. The ice cream subcategory slightly outperformed the total ice cream/sherbet category. Dollar sales jumped 15.7% to USD7.0 billion, while unit sales rose 10% to 1.73 billion. Among the top 10 brands, Tillamook was the standout. The brand's value sales increased 43%; its unit sales improved 37%. Ben & Jerry's came in second in terms of performance. The brand's value and unit sales were up 26% and 22%, respectively. None of the top 10 brands posted a decrease in dollar sales with only Blue Bunny recording a slight falloff (0.3%) in unit sales, while Halo Top did not make into the top 10 brands. Private label sold the most in both value (USD1.3 billion) and volume (412 million units), followed by Ben and Jerry's (USD863 million and 184 million units), Blue Bell (USD672 million and 140 million units) and Haagen Dazs (USD664 million and 150 million units). However, looking at percentage growth, brands gained to a larger extent than private labels. According to a recent report published by IRI, this is because consumers are seeking for indoor dine-out-like experiences and - even low-income consumers - are indulging in premium category products, including ice cream. Frozen yogurt sales rose by 9.6% toUSD337.5 million. Unit sales rose 4.9% to 76.3 million. Within this category the Oatly dairy-free brand recorded the most impressive growth among the top 10 brands. Its dollar sales skyrocketed 1,600%, and its unit sales shot up by over 1,70%. The frozen dessert and sorbet/ices subcategories performed well. The first saw a 27% increase in value and 19.0% in volume, while the latter gained 8% in value and 4% in unit sales. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

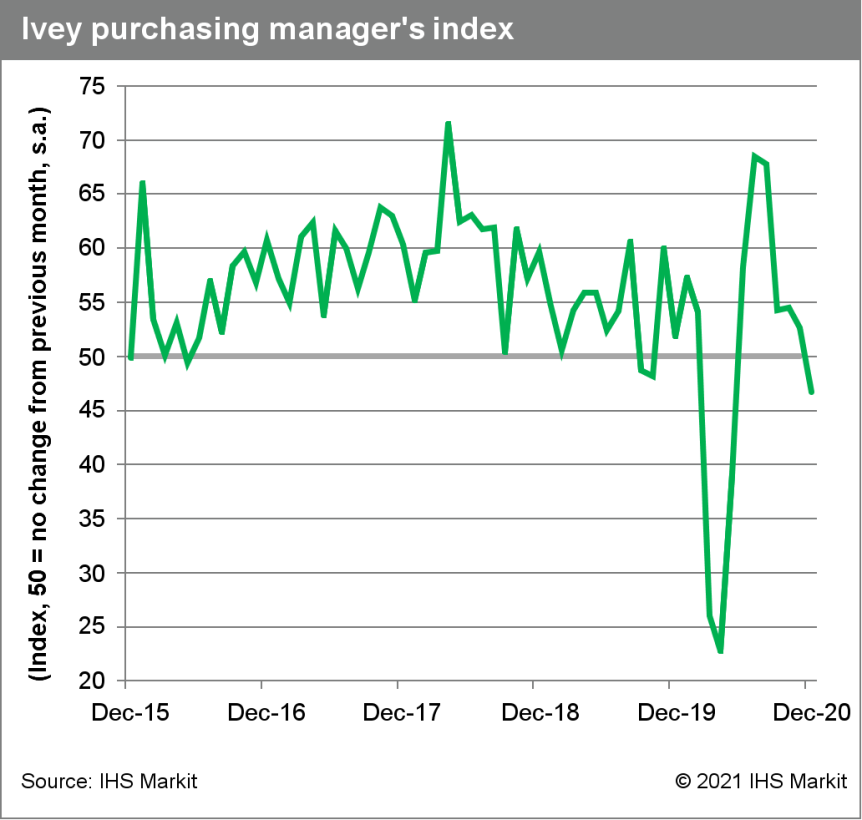

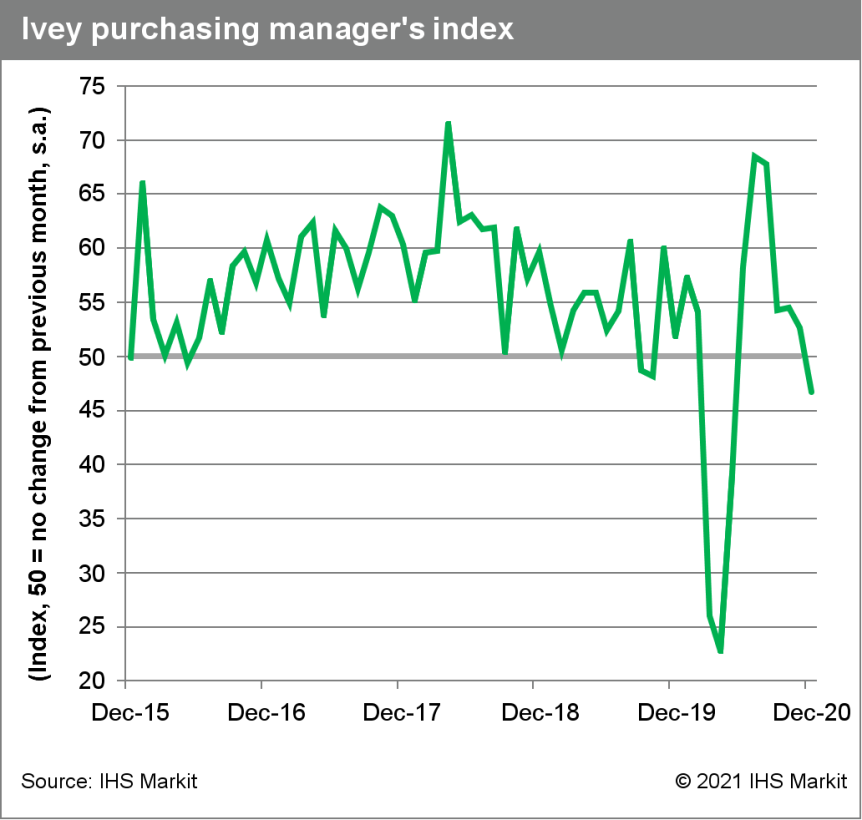

- Following the decrease in the previous month, Canada's Ivey Purchasing Managers' Index (PMI) declined 6.0 points to 46.7 in December. The Ivey PMI has trended lower over the past five months, but it dipped into contraction mode for the first time since May 2020, reflecting worsening business conditions owing to the re-imposed restrictions in several major regions. (IHS Markit Economist Chul-Woo Hong)

- All sub-indexes decreased in the month except the prices index, which inched up to the highest level since October 2018.

- Together with the surging new COVID-19 cases, stricter restrictions heavily weighed on overall business conditions.

- The employment (down 2.3 points to 45.8) and suppliers deliveries (down 4.2 points) indexes declined for two consecutive months. The inventories index (down 5.5 points) fell the most among the sub-indexes, suggesting ongoing severe supply-chain pressures. The prices index continued its four-month rising streak, up 0.8 point to 66.9. Together with the intense supply-chain pressure, inflation pressure keeps modestly rising.

- The decrease in overall purchasing managers' spending activity will weigh on real GDP growth in the month. The latest reading of the CFIB small business short-term outlook (down 4.0 points) showed a similar pattern. Meanwhile, the slowdown in economic activities will likely vary among industries as manufacturing business conditions solidly improved given the strong increase in IHS Markit manufacturing PMI in December.

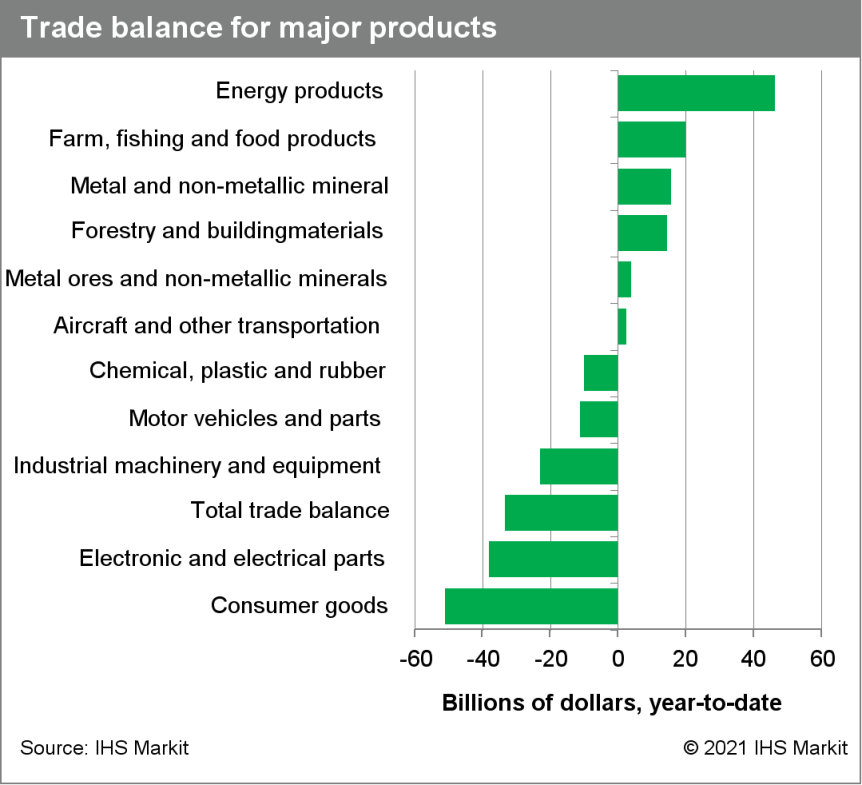

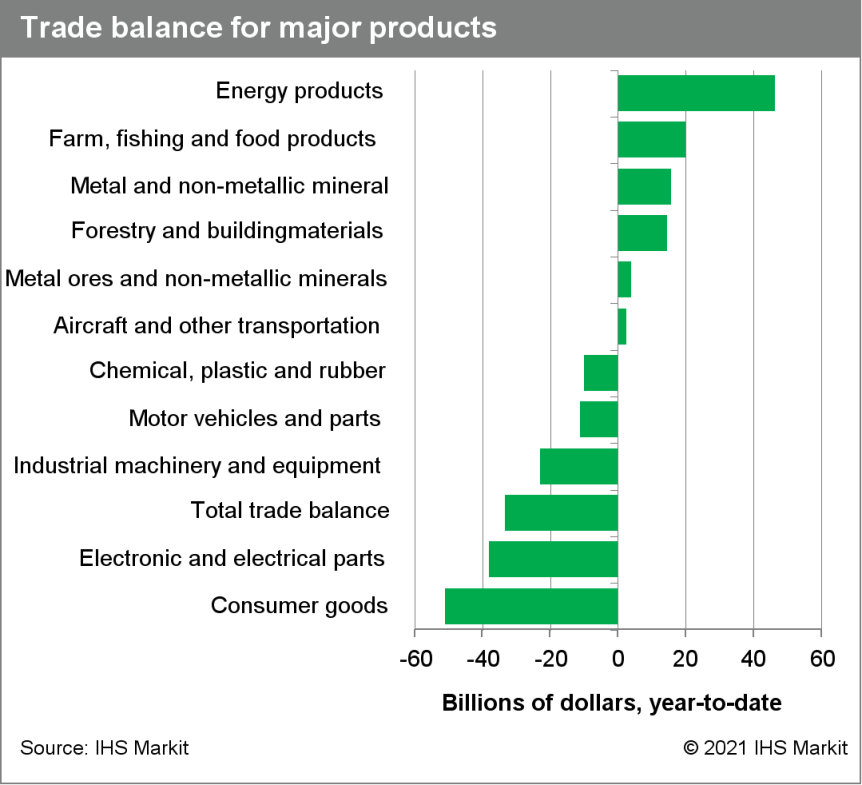

- The Canadian merchandise trade deficit narrowed by $0.4 billion to $3.3 billion in November. Canada's trade surplus with the United States shrank by $0.8 billion to $2.3 billion. Total trade (i.e., exports plus imports) with the United States decreased 1.0% to $63.8 billion—the lowest level since June—while total trade with countries other than the United States climbed 2.1% in November to a record-high $33.1 billion. The trade deficit with the rest of the world narrowed by $1.2 billion to $5.7 billion. (IHS Markit Economist Patrick Newport)

- Nominal imports inched down 0.3% month on month (m/m) to $50.1 billion on fewer imports of industrial machinery, equipment, and parts; real imports fell 0.4% m/m. November's small decline in nominal imports was the first in five months and imports now stand a whisker above February's pre-pandemic level. Industrial machinery, equipment, and parts decreased 3.9% in November, with other general-purpose machinery and equipment accounting for the lion's share of its decline. Two new airliners imported from Ireland were behind the 16.2% increase in imports of aircraft and other transportation equipment and parts.

- Exports increased $0.2 billion to $46.8 billion (still $1.5 billion below the February pre-pandemic level), largely owing to the surge in gold exports to the United Kingdom. Real exports increased 0.6%. Exports remained energetic, with the sixth increase in seven months. Exports of metal and non-metallic mineral products increased $0.7 billion—more than total exports' gain—largely on a surge in exports of refined gold to the United Kingdom because of strong increases in cast gold bullion bars sales and gold transfers within the banking system. Metal ores and non-metallic minerals, copper ores, and iron ores all posted double-digit monthly growth; exports of both copper and iron ores have already surpassed their 2019 totals. Exports of motor vehicles and parts were down for the second straight month; lumber exports were also down as lumber prices fell.

- Argentina's central bank has announced the imposition of a new rule limiting imports of luxury goods to preserve the country's currency reserves, reports Reuters. In the automotive industry, the luxury goods affected by the new rule include high-end automobiles and sports cars. According to a statement by the central bank, "The Board of Directors of the Central Bank of the Republic of Argentina established that importers of luxury goods and a specific set of final goods must obtain financing before entering the official market to cancel payments." The report added, "The measure covers luxury products such as high-end automobiles and motorcycles; private jets with a value of more than one million dollars; recreational use boats; drinks like champagne, whiskey, liqueurs and other spirits priced over USD50 a liter; caviar; pearls, diamonds and other precious stones, among other products." Under the rule, importers of luxury goods will not have free access to the purchase of US dollars in the official market to finance the entry of products into the country, and will have to seek foreign-exchange (forex) financing privately or will have to wait for year to make payments to an overseas supplier. It is not clear at the moment what threshold of dollar values this rule applies to in the case of high-end vehicles. The rule has been introduced to slow the outflow of the central bank's dollar reserves. The measure comes into effect on 7 January and will affect products that have already been shipped from their ports of origin but will not affect products in transit. According to IHS Markit's global economic report, Argentina had USD42.19 billion in forex reserves in 2019 and USD36.2 billion in 2020, and this is forecasted to decrease further to USD35.9 billion in 2021. (IHS Markit AutoIntelligence's Tarun Thakur)

- Agribusiness associations Argentine Rural Confederations (Confederaciones Rurales Argentinas: CRA), the Argentine Agrarian Federation (Federación Agraria Argentina: FAA), and the Argentine Rural Society (Sociedad Rural Argentina: SRA) on 5 January announced protest action against the government's decision taken on 31 December to freeze corn exports until 1 March 2021 to prioritize supply to the domestic market. The associations announced that they will halt sales on 11-13 January to protest against the measure, claiming that there are no supply problems for the domestic market. Government officials said they would not review the decision, despite President Alberto Fernández's prior efforts to promote export-oriented sectors to expand Argentina's export earnings. Corn is the second source of foreign currency in Argentina (USD5 billion in 2020), after soya bean and by-products. According to private estimates quoted by local media, the measure would cost USD810 million in lost exports. The export freeze represents an additional burden for the agricultural sector, which is already subject to high export taxes or "retenciones", at 12% for corn, and strict capital controls. The measure, which was unexpected by agribusiness producers who have been discussing policies for the sector with government officials, signals the government's discretion in policy-making and the increasing influence of the more radical Kirchnerist faction of the ruling Everybody's Front. (IHS Markit Country Risk's Carla Selman)

Europe/Middle East/Africa

- European equity markets closed higher; France +0.7%, Germany +0.6%, Spain +0.4%, UK +0.2%, and Italy +0.1%.

- 10yr European govt bonds closed mixed; Italy -1bp, France/Germany flat, Spain +1bp, and UK +4bps.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover +1bp/248bps.

- Brent crude closed +0.1%/$54.38 per barrel.

- Economic sentiment improved in December 2020, in line with IHS Markit's prior PMI release, but November's retail sales plunged amid tighter COVID-19 virus containment measures. (IHS Markit Economist Ken Wattret)

- The eurozone's economic sentiment indicator (ESI) rebounded in December, although the 2.7-point increase failed to compensate fully for the somewhat larger decline in November.

- The ESI is now nine points below its long-run average since 2000 and 13 points below its pre-COVID-19 level back in February 2020.

- By sector, the best performers in December were industrial and consumer sentiment. The rise in the former echoed the relatively strong performance already evident in IHS Markit's manufacturing PMIs for December. Export orders have been a notable bright spot in recent months.

- Sentiment also improved in December in the construction sector, which remains the only key sector where the sentiment index is above its long-run average. In contrast, services sentiment again underperformed in December, reflecting the nature of the COVID-19 shock, and is now almost 24 points below its average since 2000.

- Eurozone retail sales fell off a cliff in November. Sales volumes plunged by more than 6% month on month (m/m), the biggest drop since April, and well below market consensus expectations (of -3.4% m/m, according to Reuters' survey). More stringent COVID-19 virus containment measures in many member states was the key factor behind the magnitude of the drop.

- In level terms, retail sales volumes are now around 3% below where they were back in February 2020. Prior to November, retail sales growth had been comfortably outperforming consumer sentiment.

- As in prior months, November's breakdown of eurozone retail sales by type of product shows significant variations:

- Mail-order and internet sales continued to outperform, unsurprisingly, rising by 1.8% m/m in November. The level of sales was more than 28% above its February 2020 level.

- In contrast, sales of textiles, clothing, and footwear continued to underperform, plunging by more than 17% m/m in November. In level terms, sales in this area were 24% below their February level.

- Differences in COVID-19 virus-related restrictions were reflected in eurozone member states' m/m changes in retail sales. The largest decreases were in France (-18.0%), Belgium (-15.9%), and Austria (-9.9%). The highest increases, albeit much smaller, were in the Netherlands (+2.6%) and Germany (+1.9%).

- Eurozone survey data to December suggest that the 2%-plus quarter-on-quarter (q/q) decline in fourth-quarter 2020 GDP projected in our baseline forecast may be too weak. That said, available "hard" activity data are limited at this point and the figures available to November have been less encouraging than the surveys.

- The December 2020 "flash" Harmonized Index of Consumer Prices (HICP) data for the eurozone show that the headline inflation rate was unchanged at -0.3% for the fourth straight month (see first chart below), slightly weaker than expected (consensus: -0.2%), and below zero for the fifth month in a row. (IHS Markit Economist Ken Wattret)

- The headline inflation rate was stable despite upward pressure on the energy rate (-8.3 to -6.9% year on year) due to prior gains in crude oil prices.

- The core inflation rate excluding food, energy, alcohol, and tobacco prices was unchanged for the fourth straight month at just 0.2%, matching its record low.

- Looking at the two key sub-components of the core rate, the most important, inflation for services, partly rebounded in December (0.7%) but remained very low by historical standards. In December 2019, the rate was 1.8%.

- In contrast, inflation for non-energy industrial goods slipped further into negative territory (-0.5%), although the signs from factory-gate prices suggest some modest upward drift going forward.

- While producer price index (PPI) inflation was negative in November 2020 for the 16th straight month, the headline rate of change (-1.9%) was up by around three percentage points compared with May 2020's cycle trough.

- The PPI rate excluding energy also edged higher, in line with the signals from surveys of industrial firms' pricing intentions (see second chart below). Still, at zero in November, the rate of increase remained consistent with negligible price pressures for core goods.

- Headline and core eurozone inflation rates will rise in January 2021 given the end of reduced value-added tax (VAT) rates in Germany, which we expect to push up headline inflation in Germany by around three-quarters of a percentage point (with the eurozone headline rate to rise by around one-third of this magnitude).

- The German Federal Motor Transport Authority, the KBA, has released data on the country's electrified vehicle market in 2020 with combined alternative drives (battery-electric, hybrid, plug-in, fuel cell, gas, hydrogen) taking up 22% of the overall market during the year. The KBA's data also stated that the number of registered passenger cars that were pure battery electric vehicles (BEVs) rose by 206% year on year (y/y) to 194,163 units. A total of 394,940 new BEVs and plug-in hybrids (PHEVs) cars were registered in 2020. (IHS Markit AutoIntelligence's Tim Urquhart)

- Looking at the brand-by-brand market share of the overall plug-in market, the Volkswagen (VW) passenger car brand achieved the highest share of 17.4%, up 608.6% y/y.

- It was followed by Mercedes-Benz with a share of 14.9%, and an increase of 499.8% y/y in volumes. Audi (9.0% share/+607.9%). In terms of the pure BEV market passenger cars, the VW passenger car brand had the largest share of new registrations, at 23.8%.

- VW was followed by Renault (16.2%/+233.8%) and Tesla (8.6%/+55.9%). Private registrations took a 48.8% share of the BEV market, in comparison to around 37% almost half of all new registrations.

- In terms of the overall market picture, the share of passenger cars with alternative drives increased from 2.4% in 2019 to a share of 3.6% in 2020, which was an increase of 54.0%. For pure BEVs, this trend was even more pronounced, with market share rising from 0.5% in 2019 to 1.2% in 2020, an increase of 147.1%. The combined 2020 market share for cars with an electric drive (battery-electric, plug-in, fuel cell) in Germany stood at a record high of 13.5%.

- The obstacles to accelerated BEV and PHEV take up are becoming fewer and fewer, although there are still doubts about the ramp-up in public charging infrastructure provision. Therefore it will be interesting to see how the market develops in 2021, especially now many early adopters have made the switch to electrified vehicles and the OEMs will be faced with persuading a more conservative category of consumer out of their ICEs and into BEVs and PHEVs.

- Autonomous technology provider EasyMile has expanded its partnership with intelligent processors supplier Kalray to develop intelligent systems. Kalray will supply its SuperECU, based on MPPA Intelligent Processor, to help EasyMile build safe autonomous systems. Benoit Perrin, managing director of EasyMile, said, "Safety and performance reliability are key to embedded systems. This collaboration with Kalray, which started with the ES3CAP program, matches the high criteria we expect of our partners and we are delighted to be working with them." The companies collaborated in 2019 for the ES3CAP program, which aims to build a hardware and software platform requiring high computing capacity in the fields of aeronautics, defense, and autonomous vehicles. EasyMile has developed autonomous mobility solutions and has built the EZ10, a fully electric shuttle bus that is capable of Level 4 autonomous operation. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Following the announcement in December of an asset purchase agreement between Janssen Pharmaceutica NV (the Belgium-based subsidiary of Janssen, the pharmaceutical division of Johnson & Johnson, US) and Gedeon Richter (Hungary) involving Janssen's Evra transdermal contraceptive patch assets in markets outside the United States, the completion of the agreement has been confirmed. The total paid by Richter is reported to be over HUF78 billion (USD267.7 million), according to Hungarian pharmaceutical news source Pharmaonline, which quotes the website of the Budapest stock exchange as its original source. Under the terms of the agreement concluded in December, Janssen will provide support to Richter to help with the transfer of marketing authorizations outside the US. Richter chair Erik Bogsch stated that the acquisition of the rights to the transdermal contraceptive patch will help the company achieve its aim of increasing sales of its women's health division by 60% by 2030. Evra is a once-weekly contraceptive for women, which is described as the first transdermal hormonal patch to receive approval, and the first non-invasive form of birth control that provides almost total effectiveness, when used as intended. (IHS Markit Life Sciences' Brendan Melck)

- Swedish passenger car registrations dropped by 18.1% year on year (y/y) during 2020, according to data published by the Swedish trade association Bilindustrieföreningen (BIL Sweden). Sales contracted from 356,036 units in 2019 to 291,664 units in 2020, with a fall of 28.7% y/y to 34,302 units in December. During the year, Volvo was the biggest-selling brand in Sweden with sales of 52,691 units, but this was a decline of 19.3% y/y, while Volkswagen (VW), in second place, sold 42,809 units, down by 12.5% y/y. However, Kia managed to record a fall of just 1% y/y to 25,191 units, taking third place. In the commercial vehicle category, registrations of light commercial vehicles (LCVs) with a gross vehicle weight (GVW) of less than 3.5 tons decreased by 42.4% y/y in 2020, and suffered a 64% y/y decline in December to 3,985 units. Sales of heavy commercial vehicles (HCVs) with a GVW of more than 16 tons also decreased by 25.5% y/y to 4,959 units in 2020, with a fall of 18.4% y/y to 431 units in December. Like many vehicle markets in Europe and around the world, 2020 registration volumes will be influenced by the impact of the COVID-19 virus pandemic. However, this was not the only factor influencing the Swedish market last year, with demand for light vehicles affected by the changes to the bonus-malus tax, which were made at the beginning of the year. This caused registrations to be pulled forward to the final months of 2019, as customers and dealers sought to avoid changes; this high base has resulted in the steep decline in December 2020. (IHS Markit AutoIntelligence's Ian Fletcher)

- The Byumba (Gicumbi district) based milk powder plant, that was scheduled to start construction towards the end of 2020, has been put on hold due to the project financing problems. On 5 January 2021, Antoine Juru Munyakazi, executive chairman of TRIOMF East Africa told The New Times, that plans to construct the plant have not been cancelled but indicated that the problem has been its financing. "The financing that we were seeking in Rwanda was not possible owing to the Covid-19 problem …the factory requires a lot of money as it is a big project. Because of the Covid-19 impact, our banks are not interested in taking risk on big projects." He added: "So, the investors for the factory are now mainly trying to source financing from outside the country." Pierre-Célestin Hakizimana, the president of IAKIB - a dairy farmers' cooperative in Gicumbi District, said that the cooperatives had already mobilized RWF360 million from their savings and allocated to that activity. "The investor [TRIOMF] told us that we should put the money we had raised into increasing milk production so as to ensure sustainability of milk supply that the factory will need," he said. The factory, the plans for which were announced in January 2020, is a RWF37 billion (USD37.4 million) joint venture investment between South Africa's TRIOMF East Africa and Rwandan investors. According to information from the Ministry of Trade and Industry, the factory will process 252,000 liters of milk per day. The cooperatives in Gicumbi District collect about 95,000 liters of milk per day and were planning to increase production thanks to the availability of the factory. The factory would not only source milk from Gicumbi dairy farmers, but also those from the neighboring districts in the Northern and Eastern Province of the country. Only about 10% of the country's total milk production gets processed into different dairy products, according to data from the Ministry of Agriculture and Animal Resources. In 2019, Rwanda has spent USD10.7 million on milk powder exports, which is 26% up on 2018. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

Asia-Pacific

- APAC equity markets closed mixed; South Korea +2.1%, Australia/Japan +1.6%, Mainland China +0.7%, India -0.2%, and Hong Kong -0.5%.

- Unlike in the national 14th Five-Year Plan, Shenzhen continues to set explicit growth targets to guide regional development. Slower growth rates implied by the targets appear reasonable as homegrown technology cannot provide an immediate solution to the US blockade. (IHS Markit Economist Lei Yi)

- Shenzhen released an outline of the city's 14th Five-Year Plan and 2035 outlook on 31 December 2020. With Shenzhen's full-year GDP expected to reach CNY2.8 trillion (USD433.7 billion) in 2020, the unveiled plan sets a target of expanding regional GDP to over CNY4 trillion by 2025. Furthermore, according to the plan, both the size of the economy and GDP per capita should double by 2035 from 2020 levels.

- Unsurprisingly, core technology innovation topped the development agenda. Research and development (R&D) expenditure should reach about 5% of local GDP in 2025, compared with 4.93% in 2020. Strengthening fundamental research capabilities was specifically emphasized, and major breakthroughs should be achieved in key technologies employed in areas including integrated circuits, artificial technology, biomedicine, and new materials.

- In terms of financial sector reforms, on top of further promoting the IPO registration system for the ChiNext board, the local government is also encouraging development of stock index futures for the Shenzhen Stock Exchange, exploring the setting up of an international board (known as "Silk Road Board") to facilitate the listing of companies involved in the Belt and Road Initiative as well as the usage of digital currency.

- Shenzhen's growth targets imply a compound annual growth rate (CAGR) of 4.7% over the next 15 years (2021-35). Although this growth rate is significantly lower than that registered for the past 15 years, as Shenzhen's economy expanded fivefold from CNY495 billion in 2005 (translating to a CAGR of about 12%), the targets appear rather reasonable given rising external growth headwinds from geopolitical tensions and the pivot towards technological independence prompted by the US blockade.

- Domestic corn prices rose from CNY1,700-1,800 per ton (USD243-257/ton) at the end of 2019 to CNY2,500-2,600/ton in 2020, an increase of over 40%. On 7 January 2021, the highest price is CNY3,050 at Yunnan province. Trade data shows that China's November corn imports were a record-breaking 1.2 million tons, up 7% over October. The average import price was USD234/ton cost, insurance, and freight (CIF) in November, about USD148 lesser than domestic produce. In January-November 2020, total corn imports were 9.0 million tons, up 89% from this time of the previous year. Ukraine and the US are the two major suppliers, with 5.2 million tons and 3.3 million tons, respectively. Industry sources expect the 2021 full-year imports to increase to 10.0 million tons. The recovery of the pig industry following two years' slow consumption contributed to the strong demand for feed raw material. The poor weather conditions also impacted grain harvests in 2020. China's yearly corn demand is forecast to be 300 million tons in 2030; with 25 million tons in short, which have to rely on imports to fill the gap; or corn substitutes (both domestic and imports). In October, a grain purchasing manager at Guangdong province said: "Given corn price hikes, I have placed orders for corn substitutes such as barley, sorghum and wheat from producing countries for processing for January-June 2021. " Chinese buyers' huge appetite could potentially push up the world's prices in 2021. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- The CAAM's full-year 2020 data are not available at the time of writing; however, from the data for January to November 2020, Chinese brands are dominant players in the SUV market with a share of 49.1%, while Japanese and German brands trail behind with market shares of 19.9% and 19.0% respectively. IHS Markit data indicate SUVs had a 39% share of the Chinese light-vehicle market in 2019. By 2021, the market share of SUVs is expected to increase to 41%, with their sales volumes increasing from around 9.71 million units in 2019 to 10.24 million units in 2021. (IHS Markit AutoIntelligence's Abby Chun Tu)

- GAC NIO, a joint venture (JV) established by GAC Group and NIO, has secured CNY2.4 billion (USD372.3 million) in investment to develop smart connected cars, reports Yicai Global. Guangdong Zhutou Intelligent Technology Investment will infuse about CNY1.9 billion into GAC NIO New Energy Automotive Technology, while GAC Group's wholly owned GAC AION New Energy Vehicle unit will contribute the remaining CNY482 million. Upon completion of the capital increase, GAC Group and GAC Aion will jointly hold a 25% equity stake in GAC NIO. The project is expected to involve initial investment of about CNY3 billion and the next round of investment will exceed CNY10 billion. In addition, GAC NIO will co-operate with Guangdong Yuanzhi Technology Group to develop a new generation of smart cars. The GAC NIO JV was founded in April 2018 with registered capital of CNY500 million. The JV announced earlier in 2020 that it is working on developing a new vehicle platform based on Level 4 autonomous vehicle technology. GAC NIO currently only has the Hycan 007, a mid-size electric sport utility vehicle, on the market. It shares the same platform as GAC's Aion LX and is positioned in the same segment. With the Hycan brand, GAC is eager to explore a new business model under its partnership with NIO. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- smart Automobile, the joint venture (JV) between Chinese automaker Zhejiang Geely Holding Group and Mercedes-Benz, is expected to introduce an all-electric sport utility vehicle (SUV) based on Geely's SEA electric vehicle (EV) platform. According to Daniel Lescow, the smart brand's vice-president of sales, marketing, and after-sales, the first prototypes have already been built. Mercedes-Benz will continue to be responsible for the design of future smart models under the partnership with Geely. The first electric cars introduced by the JV will be produced in China and will hit the market in 2022. (IHS Markit AutoIntelligence's Abby Chun Tu)

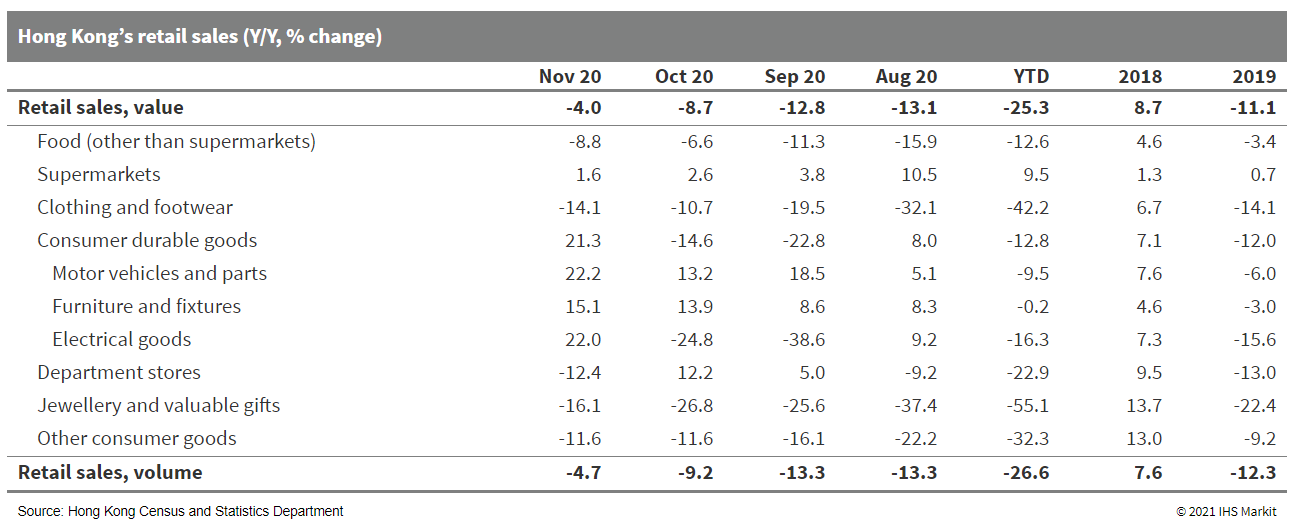

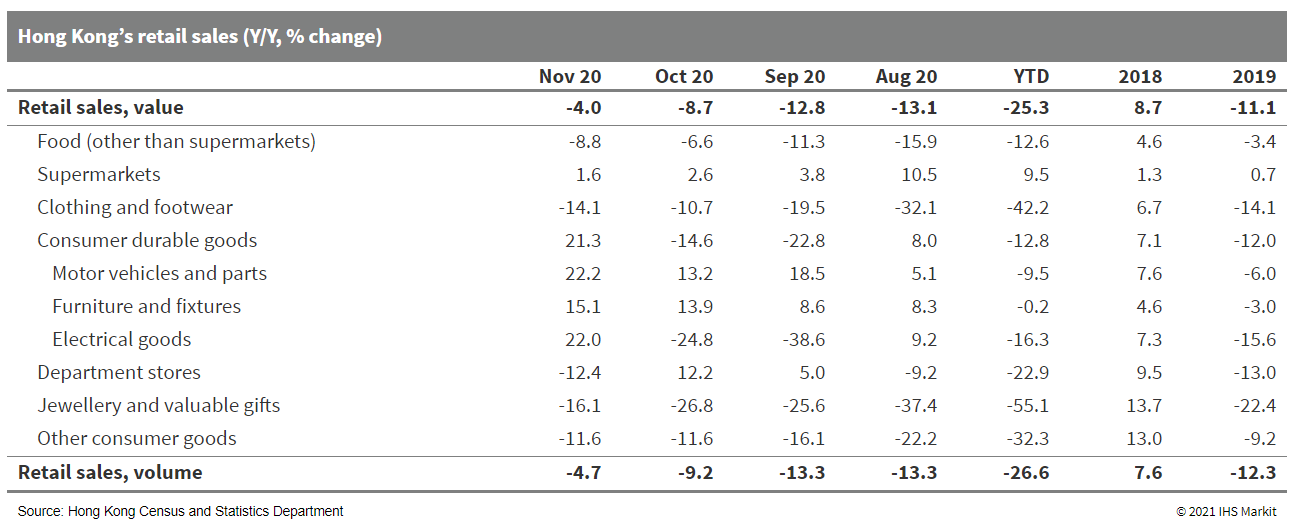

- Hong Kong SAR's economy improved further in November as demand at home and abroad turned stronger. Retail sales fell at the slowest pace in 17 months in November, while merchandise exports returned to growth. That said, the new wave of local COVID-19 infections and the worsening pandemic in other parts of the world have once again dampened the short-term prospects. The government is eyeing to commence mass vaccinations as early as the first quarter of 2021 to revive the hard-hit economy. (IHS Markit Economist Ling-Wei Chung)

- Retail sales contracted further in November but at a slower pace. Retail sales in value terms fell 4.0% year on year (y/y) in November, narrowing from an 8.7% y/y drop in October. The rate of fall also marked the smallest since May 2019. Sales in volume terms - stripping out price effects - fell 4.7% y/y in November, slowing from a 9.2% y/y decline in October.

- The improvement in retail sales in November was driven chiefly by a jump in local consumer spending as sales of consumer durable goods surged 21.3% y/y, reversing a 14.6% y/y drop in October. It also marked the biggest increase since February 2018. Within that, sales of vehicles and furniture continued to climb at a double-digit pace, accelerating to the 22.2% and 15.1% surges in November, respectively. Sales of electrical goods and other consumer durable goods also jumped 22.0% y/y, reversing a 24.8% y/y slump in October.

- Tourist-related spending remained weak as the tourism sector stayed at a standstill. Total tourist arrivals plunged 99.8% y/y in November, marking the eighth straight month of slumping more than 99.6% y/y since April. It was mainly driven by a similar 99.8% y/y slump in tourists from mainland China. Due to the outbreak, tightening social distancing measures, and travel restrictions, tourist arrivals started to plunge in February by more than 96% y/y since then.

- As a result, sales of luxury items continued the double-digit slump in November, down 16.1% y/y, although the decline narrowed from a 26.8% y/y drop in October. It was also the smallest fall since May 2019. Other tourist-related spending, such as sales of medicines and cosmetics, continued to fall, plunging 35.0% y/y after slumping 39.4% y/y in October.

- A separate report shows that merchandise exports improved in November as well, expanding 5.6% y/y and reversing a 1.1% fall in October. An 8% y/y expansion in shipments to mainland China provided the main support to the November export performance as the economic recovery there continued to gain momentum.

- The economy improved further in November as demand at home and abroad turned stronger. This came after the economy bottomed out in the third quarter of 2020 from the longest recession since the 1998 Asian financial crisis. However, the short-term outlook has been clouded by the new wave of local COVID-19 infections and the worsening pandemic in other parts of the world.

- These factors will weigh on consumer and business sentiment and restrain related activities in December 2020 and further into early 2021, dampening hopes for possible pick-ups in demand boosted by the Lunar New Year holidays. Along with the renewed lockdown measures in Europe and other parts of the world, these factors will increase downside risks to the economy's short-term prospects.

- BASF and Eramet have entered into an agreement to jointly assess the development of a nickel and cobalt hydrometallurgical refining complex in Indonesia, BASF has announced in a press release. The plan includes a high-pressure acid leaching (HPAL) plant and a base metal refinery (BMR). The HPAL would be located in Weda Bay (Indonesia), while the location of the BMR will be determined during the feasibility study. "With Eramet, we have a responsible and experienced partner to supply raw materials for our battery materials production. As a global supplier, BASF offers a full solution from metals to innovative CAM [cathode active material] products in support of our battery materials customers around the world," said Dr Peter Schuhmacher, president of the Catalysts division at BASF. The HPAL plant would process locally secured mining ore from the Weda Bay deposit to produce a nickel and cobalt intermediate. The BMR would supply nickel and cobalt to produce precursor cathode active materials (PCAM) and then CAM for lithium-ion (Li-ion) batteries in electric vehicles (EVs). BASF says that Eramet has carried out extensive geological work since the acquisition of Weda Bay in 2007 and confirmed the potential of this deposit, whose mining operations started at the end of 2019. The two companies also partnered to develop an innovative closed-loop process for the recycling of Li-ion batteries in 2019. "The share of high nickel CAM is rising to meet the demand for higher energy density batteries and reduce overall battery costs, and Weda Bay's resources rank among the most competitive globally for addressing this demand. The planned development will provide BASF access to an additional secure source of 42,000 metric tons of nickel and 5,000 metric tons of cobalt annually from mines operating according to internationally recognized sustainability standards," said BASF. (IHS Markit AutoIntelligence's Jamal Amir)

- As per the Ministry of Energy and Mineral Resources of Indonesia, the monthly benchmark coal price (HBA) basis, 6300 GAR for January 2021 was announced at $75.84/t, up 27% m/m. There has been a significant surge in the HBA price due to strong demand for Indonesian coal for the 2nd consecutive month from Chinese buyers. Chinese buyers increased intake of Indonesian coal amidst a severe tightness in domestic supply and strong winter demand. Many domestic coal mines in China had announced plans to cut production at the end of December month to ensure safety at the end of the year which was in addition to the ongoing crackdown on illegal mines. As per the National Development and Reform Commission (NDRC), electricity consumption in China (Mainland) during December 2020 was 11% higher y/y. As per IHS Markit Commodities at Sea, Indonesian coal shipments during December 2020 stood at 40.1mt, up 20% y/y. Out of total Indonesian coal shipments, around 42% were destined to China (Mainland). On average Indonesia, shipments to China (Mainland) were 30% of their total loadings. During November 2020, Indonesian shipments to China (Mainland) were quite strong to North China ports (4.5mt versus 0.5mt during November 2019). The shipments were high cv coal cargoes for steel mills which were running on tighter inventory ever since there has been an unofficial ban on discharge of Australian coal cargoes. During December 2020, Indonesian shipments to China (Mainland) slowed to North China (1.3mt) but increased significantly to South China (8.1mt, up 89% y/y) and East China ports (8mt, up 123%). These cargoes are reportedly going to the power plants as coastal utilities are running low on thermal coal stockpiles. (IHS Markit Maritime and Trade's Pranay Shukla)

Posted 07 January 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.