All major US equity indices closed higher after being sharply lower most of the day, while all APAC and European indices were lower on the day. US and benchmark European government bonds closed higher. European iTraxx closed wider across IG and high yield, while CDX-NA closed tighter despite opening significantly wider. The US dollar, oil, gold, and silver closed higher, while copper and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher despite being sharply lower most of the morning; Nasdaq +3.3%, Russell 2000 +2.7%, S&P 500 +1.5%, and DJIA +0.3%.

- 10yr US govt bonds closed -3bps/1.97% yield and 30yr bonds -2bps, which both closed well below the day's highs of -15bps and -14bps, respectively.

- CDX-NAIG closed -2bps/69bps and CDX-NAHY -10bps/369bps, but were as wide as +4bps and +20bps, respectively.

- DXY US dollar index closed +1.0%/97.14.

- Gold closed +0.8%/$1,926 per troy oz, silver +0.5%/$24.69 per troy oz, and copper -0.6%/$4.46 per pound.

- Crude oil closed +0.8%/$92.81 per barrel and natural gas closed -1.2%/$4.57 per mmbtu, with WTI trading as high as $100.47 per barrel at 5:30am ET.

- Russia and the West are now engaging in economic warfare following the 24 February Russian attacks on Ukraine. Stiffer Western sanctions are forthcoming and the details, once released, will be critical to a sharper understanding of how the conflict will impact energy markets—and supply chains globally. We will release more analysis after the sanctions are announced. Here is the context and what's at stake (IHS Markit Energy Advisory's Roger Diwan, Laurent Ruseckas, Karim Fawaz, Ian Stewart, and Sean Karst):

- The West—principally the United States and most of Europe—is engaged in economic warfare with Russia at the same time that war takes place between Russia and Ukraine. Economic difficulties will be felt by all sides. Cyberattacks—by both sides—will be part of this conflict as will Russian economic reprisals that remain to be seen.

- Energy and commodity markets will be ensnared in the web of sanctions and actions/reactions that unfold in the coming days and weeks, with far-reaching impacts across supply, demand, and global trade flows. A best-case scenario wherein energy flows remain largely shielded from ramifications is increasingly low likelihood.

- More severe Western sanctions will likely lead to some degree of disruptions in oil flows, even if the export of Russian crude oil and products is not targeted. Concern about running afoul of sanctions could lead to great caution on the part of financiers and buyers of oil. Independent of other factors, there will be transactional costs as traders and consumers reassess trade risks.

- Don't expect economic rationale to be the prime driver of events related to Ukraine. The stakes, as described by President Vladimir Putin in his 24 February address, go well beyond the economic realm but have the potential for enormous fallout.

- Russia sits at the heart of the global oil and gas markets and any disruption or large-scale rerouting of flows, whether intentional or sanctions-induced, would deeply destabilize physical markets.

- In 2021, Russia exported about 7.2 MMb/d of oil—4.4 MMb/d of crude oil and 2.8 MMb/d of refined products. Members of NATO accounted for more than half of all purchases of Russian oil exports. That same year, Russia exported about 141 Bcm (13.6 Bf/d) of pipeline natural gas to Europe (excluding Turkey), accounting for 29% of the European gas market.

- Russia will not sit still in terms of economic and cyberwarfare. The redirection of some energy flows is possible. This could fuel, at least for a time, panic and disruption—and lead to much higher prices.

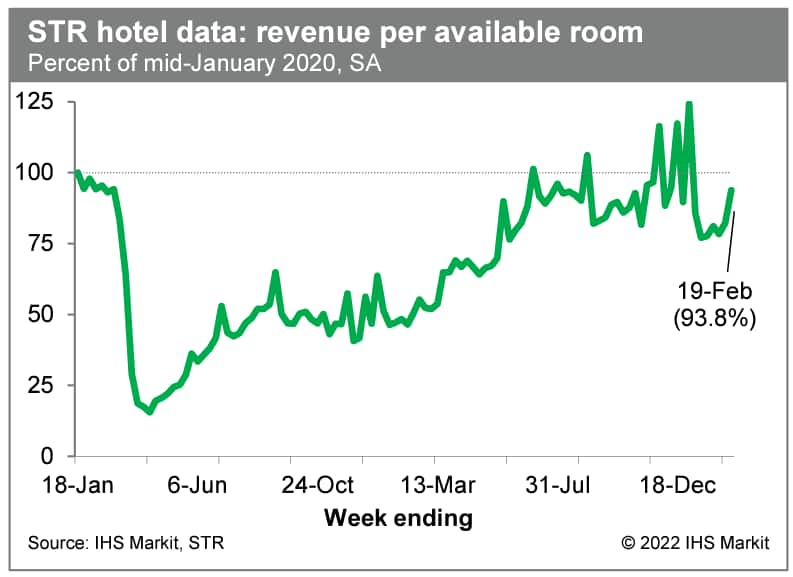

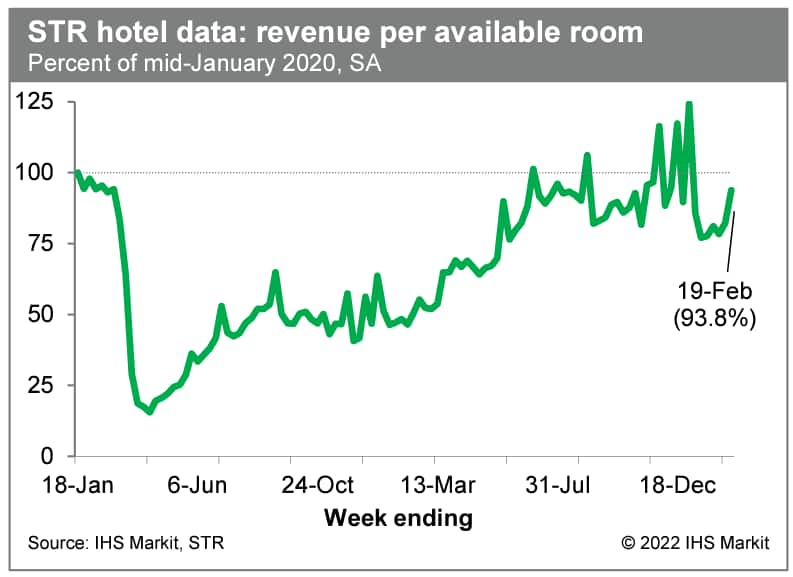

- Revenue per available room at US hotels last week, after seasonal adjustment, was 93.8% of the mid-January 2020 level (our estimate based on weekly data from STR). This is well above prior weeks' readings and consistent with other high-frequency indicators pointing to a rising level of comfort associated with in-person commerce as the spread of Omicron slows. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- US new home sales fell 4.5% (plus or minus 16.2%) in January to an 801,000 unit seasonally adjusted annual rate; the estimate was not statistically significant. Its three-month average—a better barometer of activity than the latest monthly estimate—has moved up from a 752,000 rate in December to a 796,000 rate in January. (IHS Markit Economist Patrick Newport)

- Sales for the previous three months were collectively revised up by 70,000 units.

- The average price of a new home first crossed the $400,000 threshold in September 2020; it is now $496,900, up 29% from February 2020 (the month before the pandemic struck); the median price has risen 28% since February 2020. From 2016 to just before the pandemic struck in early 2020, new home prices were about flat.

- Builders' costs have also soared. The Census's construction cost index for homes under construction that also came out today (24 February), has risen 24% since January 2020 and 17% since January 2021—which means that builders are not benefiting much from rising new home prices.

- Inventory—the number of homes for sale at the end of the month—increased by 12,000 in January to a 13-year-high of 406,000. Only 37,000 homes classified as inventory were completed; inventory units still in the planning stage were 106,000.

- The Census Bureau also released the monthly permits data for the states and—for the first time—for metropolitan areas. This data shows that six states—Arizona, California, Florida, Georgia, North Carolina, and Texas—account for about half of the increase in single-family permits since February 2020. Cities tabulating the largest number of single-family permits in January included Atlanta, Houston, Austin, Dallas, and Phoenix.

- Wheat futures settled to their highest since mid-2012 as Russia's invasion of Ukraine heightened concerns about global supplies from the major grain exporting region. (IHS Markit Food and Agricultural Commodities' Anamaria Martins)

- Futures were sharply higher with March and May Chicago contracts up their daily limit. May wheat was up 50 cents at $9.34 3/4 while Kansas City gained 48 cents at $9.66 and Minneapolis advanced 17 1/2 cents at $10.20 1/4.

- Spot basis bids for HRW wheat were unchanged at grain elevators across the Southern US Plains on Thursday, though farmers have taken advantage of high futures prices to lock in new-crop contracts, grain dealers said.

- Matif wheat settled record highs on Thursday as a Russian invasion of Ukraine fueled fears that massive exports through the Black Sea could be curtailed.

- In the tender market, Egypt's GASC had canceled an international purchasing tender for wheat while Jordan's state grain buyer has issued an international tender to buy 120,000 tons of milling wheat which can be sourced from optional origins.

- Expectations for US weekly wheat export sales range between 100,000 tons to 450,000 tons for 2021/22 the week ended February 17. Sales from zero to 100,000 tons are expected for 2022/23. The report is due out Friday, delayed a day by the Monday US holiday.

- The United States Postal Service (USPS) has announced a decision to maintain the current vehicle replacement deal with Oshkosh Defense, following criticism from the US presidential administration of Joe Biden for not purchasing electric vehicles (EVs) in its next contract. In a statement posted on its website, the USPS said that it has completed is environmental review of the Next Generation Delivery Vehicle (NGDV) program and will proceed with the next steps. Although most of the vehicles in the program are powered by ICEs, the USPS notes that the program will see the first 5,000 battery EVs (BEVs) in 2023. The USPS said that the program's flexibility "allows for an increase in the mix of BEVs should additional funding become available". Under the National Environmental Policy Act (NEPA), the USPS is required to evaluate potential environmental impacts of its new vehicles, although the act does not necessarily require purchases of EVs. In the statement, the Postmaster General and the USPS chief executive officer, Louis DeJoy, said, "As we have reiterated throughout this process, our commitment to an electric fleet remains ambitious given the pressing vehicle and safety needs of our aging fleet as well as our fragile financial condition. As our financial position improves with the ongoing implementation of our 10-year plan, Delivering for America, we will continue to pursue the acquisition of additional BEV as additional funding - from either internal or congressional sources - becomes available. But the process needs to keep moving forward. The men and women of the U.S. Postal Service have waited long enough for safer, cleaner vehicles to fulfill on our universal service obligation to deliver to 161 million addresses in all climates and topographies six days per-week." The USPS is to move forward with the preferred choice announced in January 2022. According to the USPS, the NDGV it has selected has a higher total cost of ownership than a BEV NDGV, although there is an opportunity to increase the BEV allocation if funding is generated. The agency's preferred alternative does include purchasing 50,000 to 165,000 purpose-built, right-hand-drive vehicles with a mix of ICE and BEV solutions, with at least 10% BEVs. The decision of the USPS was criticized by several US politicians as a lost opportunity to reduce its carbon footprint. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Tenneco has reached a definitive agreement for the company's acquisition by private asset manager Apollo Funds. In addition, Tenneco has released its financial results for the fourth quarter and full-year 2021. The acquisition of Tenneco by Apollo Funds is expected to close in the second half of 2022. According to a joint statement by the companies, the deal is an all-cash transaction with an approximate value of USD7.1 billion, including debt. Automotive News reports that, excluding debt, the acquisition is a USD1.6-billion deal. Under the agreement, Apollo Funds is to pay Tenneco shareholders USD20 per share, which is a 100.4% premium over Tenneco's closing share price of USD9.98 on 22 February 2022, according to Apollo Funds. Once the acquisition is completed, Tenneco is to become a private company and its shares will no longer be traded on the New York Stock Exchange. In the statement, Tenneco CEO Brian Kesseler said, "Over the last several years, Tenneco has transformed its business to succeed in today's environment. This transaction marks a significant milestone and will provide us with a new and exciting platform from which we can continue our global strategy in an evolving and dynamic mobility landscape... Specifically, this partnership will allow us to continue to invest in and grow Tenneco's multiple segments and global footprint. This transaction is also a testament to the achievements of our global team, whose commitment and focus during these extraordinary times have enabled our success." Separately, Tenneco reported its 2021 financial results, posting total revenue of USD18 billion, up 17% compared with 2020. With the improved revenue, Tenneco reported net income of USD35 million in 2021, versus a loss of USD1.5 billion in 2020. The company's adjusted net income was USD164 million last year, compared with a loss of USD36 million in 2020. (IHS Markit AutoIntelligence's Stephanie Brinley)

- BYD has won an order from Swedish freight technology company Einride for 200 Class 8 8TT battery-electric day-cab trucks, according to a company announcement. BYD says the electric vehicles (EVs) are to be assembled at the company's production facility in Lancaster, California, and deployed in the United States. In its statement, BYD says that it is to deliver the 200 vehicles in phases from February 2022 through the next 12 months. BYD states that most of the vehicles to be supplied are the company's third-generation extended-range 8TTs, and that these air-ride cabs offer improved aerodynamics and energy efficiency and have a spacious interior. The vehicles have as standard automatic emergency braking, adaptive cruise control, lane-departure warning, and blind-spot detection systems. The company says the trucks are powered by 563-kWh iron-phosphate battery packs, providing a "working range" of 200 miles per charge, and have 185-kW CCS1 charging capability. The trucks also have electronic parking brake, keyless entry, and push-to-start features. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric mobility startup Revel has raised USD126 million in a Series B funding round led by BlackRock Renewable Power, according to a company statement. Investors including Toyota Motor's venture capital firm Toyota Ventures, Goodyear Ventures, and Shell Ventures, among others, also participated in the financing round. As part of the deal, representatives from BlackRock and Toyota Ventures will join Revel's board of directors. The company plans to use the infused capital to expand its network of electric vehicle (EV) fast charging superhubs in New York City and other urban locations. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

- Major European equity markets closed sharply lower; Spain -2.9%, France -3.8%, UK -3.9%, Germany -4.0%, and Italy -4.1%.

- 10yr European govt bonds closed sharply higher; Italy -12bps, Spain -8bps, France -7bps, Germany -6bps, and UK -4bps.

- iTraxx-Europe closed +3bps/75bps and iTraxx-Xover +16bps/367bps.

- Brent crude closed +1.5%/$95.42 per barrel but was as high as $102.19 per barrel at 5:30am ET.

- Russian President Vladimir Putin announced this morning (24 February) the start of a military operation, allegedly "aiming to demilitarize and de-Nazify Ukraine". Soon thereafter, Russian armed forces initiated air and missile strikes on multiple military and dual-use strategic assets across Ukraine and began moving troops into the country across the border. Following this, Ukrainian President Volodymyr Zelenskyi announced martial law, formally putting Ukraine on a war footing. (IHS Markit Country Risk's Petya Barzilska, Alex Kokcharov, and John Raines)

- Russia's likely objective is to concentrate overwhelming military force in a 'blitzkrieg' campaign to coerce Ukraine into concessions over Crimea and the Donbas breakaway entities. Russia formally recognized the Donetsk People's Republic (DPR) and Luhansk People's Republic (LPR) in eastern Ukraine as independent states on 22 February.

- Russian forces will probably seek to avoid fighting in major Ukrainian cities as this would be likely to lead to protracted urban warfare resulting in heavy casualties, as well as severe destruction of property and infrastructure. We assess that Russian forces will most likely attempt to avoid being drawn into major cities such as Kyiv, Kharkiv, Odesa, Dnipro, Zaporizhzhia, and others but instead threaten them with capture, cutting off access, in a similar tactic to that used by Russian forces in Georgia in 2008. Even in this scenario, the use of artillery, tank, missile, aviation, and cyber strikes, primarily against military targets, would pose severe risks to individuals and assets, especially on the outskirts of these cities.

- Ukrainian armed forces are likely to resist advancing Russian forces, in contrast to the events of 2014, at least initially, but will most likely restrict fire to Ukrainian territory. There are reports of Ukrainian armed forces repelling Russian tank attacks this morning north of Kharkiv and near Shchastya, Luhansk region. Ukrainian attacks on targets within Russian territory are unlikely outside the immediate border area (5-10 km distance from the international border) so as not to provide further pretexts for Russian attacks. Given Russian air superiority, the most that the Ukrainian forces are likely to achieve is to delay the speed of the Russian advances, denying Putin the early victory (within days rather than weeks) that he seeks and buying time for international political and economic pressure to affect the Kremlin's calculus.

- Ukrainian airspace will remain closed to civilian aviation, with severe ground cargo risks, especially in eastern and southern regions, and severe marine cargo risks in the Black Sea and Sea of Azov. Ukraine's State Air Traffic Services Enterprise said that the country's airspace would be closed to civilian flights starting from 00:45 GMT on 24 February, with air traffic services suspended.

- Western sanctions against Russia and Belarus will almost certainly be expanded in the coming days. The United States is likely to initiate a sanctions response in the West, with others - the United Kingdom, Canada, and the European Union - following shortly thereafter. This is likely to result in either the listing of Russia's largest banks as specially designated nationals, thus fully blocking US entities from engaging in business with them, or the exclusion of designated Russian banks from using US dollars, producing knock-on effects for companies with existing relationships with these banks.

- Automakers with exposure to the Russian market are considering their next steps following recent events in Ukraine and the sanctions that have been applied against Russia. Earlier this week, prior to Russia entering the rebel-held regions of Donetsk and Luhansk on 22 February in what it referred to as a "peacekeeping" role after recognizing the Donetsk and Luhansk People's Republics (DPR and LPR) as independent states, Renault Group CEO Luca de Meo said that the automaker was monitoring the situation "carefully". Automotive News Europe (ANE) quoted the senior executive as stating that 90% of the Lada brand's sales were in Russia and that parts sourcing was highly localized, with a spokesperson telling Reuters that this stood at around 80%. (IHS Markit AutoIntelligence's Stephanie Brinley, Ian Fletcher, and Tim Urquhart)

- The chief executive of AvtoVAZ, Nicolas Maure, was quoted by Reuters as saying that his company was looking at how to source components that are localised, such as semiconductors. He told journalists earlier this week, "Of course we are also investigating possibilities to find alternatives in the case of sanctions."

- In addition, Renault chief financial officer Clotilde Delbos indicated that AvtoVAZ's debt and financing was held locally, without support from the Renault Group, further insulating the organization and containing risk exposure to the country as much as possible.

- Prior to Russia's move into Ukraine, Stellantis, which has a joint-venture (JV) plant in Kaluga with Mitsubishi, told Automotive News, "We are monitoring the situation closely and have no further comment at this stage." However, during a conference call yesterday (23 February) discussing the company's 2021 financial results, CEO Carlos Tavares said, "If we cannot supply the plant, if that is the reality, we have either to transfer that production to other plants, or just limit ourselves." He noted that the vehicles built at the site, some of which are being shipped to Western and Central Europe, are also built in France and the United Kingdom.

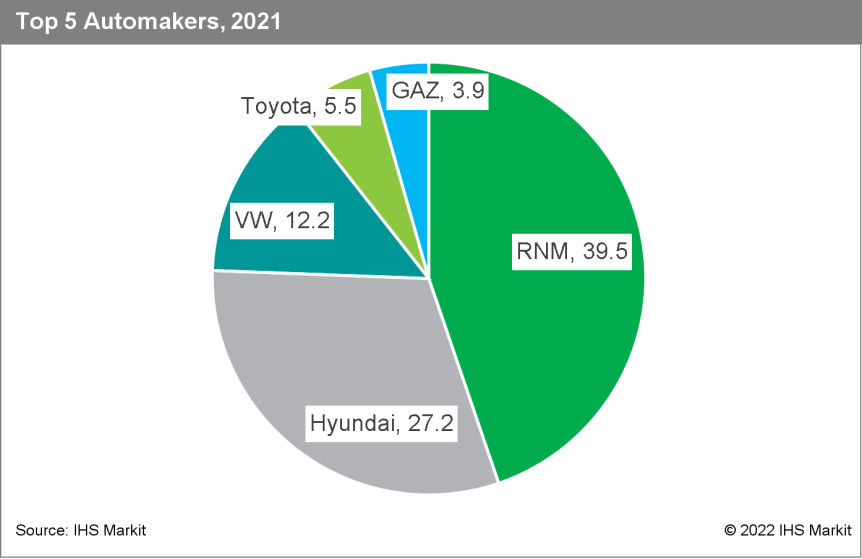

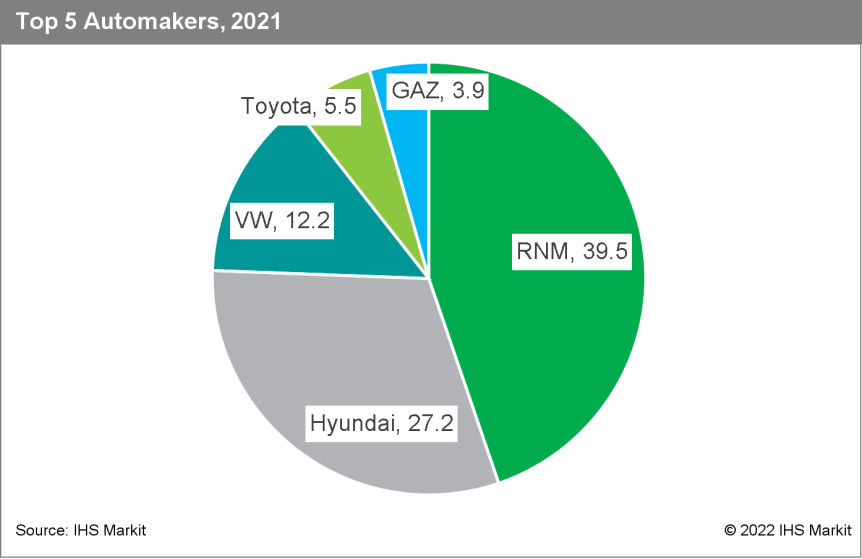

- These comments are likely to offer just a glimpse into the considerations currently being discussed at automakers with exposure to Russia as they watch the situation develop in Ukraine and await the response from other nations. According to IHS Markit light-vehicle production data, the Renault-Nissan-Mitsubishi Alliance has the greatest exposure to Russia through Renault Group's stake in AvtoVAZ, and it is forecast that its production in this market reached around 573,100 units last year. Other key producers include Hyundai, which is estimated to have built 394,400 units during 2021, while Volkswagen (VW) Group's estimated output that year was 176,900 units. Furthermore, the majority of light vehicles sold in Russia are locally sourced: of the 1.66 million vehicles that we forecast were sold in this market in 2021, around 81.7% were manufactured or assembled locally.

- Polestar has announced that it is to collaborate with a number of leading suppliers to develop a "truly climate-neutral car". The company said in a statement that it had signed letters of intent (LoI) to collaborate with "a selection of strategic partners in metals, safety, driving systems and electronics, on each area of focus on Polestar's Life Cycle Assessments (LCA) of its current vehicles' carbon footprints". The company said that steel and metals producer SSAB intended to collaborate with it on fossil-free steel, which could potentially replace not only conventional steel in a car but also other materials with significant carbon footprints. Norwegian aluminum and renewable energy company Hydro intends to collaborate with Polestar on zero-carbon aluminum, while automotive systems supplier ZF intends to explore with Polestar how it can eliminate carbon emissions and reduce the use of resources through electric powertrains and its overall systems competence. Automotive safety supplier Autoliv will also partner with Polestar on zero-emission safety equipment such as airbags and seatbelts, while automotive lighting manufacturer ZKW intends to support climate-neutral electrical control systems and wiring. (IHS Markit AutoIntelligence's Ian Fletcher)

- Italian researchers and market players have teamed up to develop a variety of industrial tomato that might guarantee high yields and good quality, while resistance to pest and disease will allow growers to scale down on fertilizers and pesticide use. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- The two-year project named VA.PO.RE, based in Emilia-Romagna, sees the participation of the regional innovation center Ri.Nova, seed producer Tera Seeds, tomato processor Conserve Italia, the research center CREA OF, growers cooperatives Irecoop Emilia-Romagna and FOR.B Onlus.

- "The goal of the project," explained Enrico Belfanti from Tera Seeds and Stefania Delvecchio from Ri.Nova, "is to supply processing companies with a high-quality tomato with excellent yields and resistant to downy mildew and Alternaria."

- Varieties resistance to some disease and pests is a key factor when climatic conditions do not allow plants' chemical treatments, but also for organic and integrated productions.

- Researchers reported that first results are very encouraging. About 20 different genotypes of industrial tomatoes, selected from hundreds, have been planted and the project is now focusing on four varieties which are particularly promising.

- Conserve Italia technicians will evaluate the qualitative results of the field tests and if those varieties are suitable for processing into paste, pulp and sauce.

- January inflation data for Sweden show an uptick in core inflation. However, their contribution to overall inflation should moderate in the second half of this year. (IHS Markit Economist Anja Heimann)

- In January, the consumer price index with a fixed interest rate (CPIF) - the Riksbank's target variable - rose by 3.9% year on year (y/y).

- While this rate was slightly below the 28-year high of 4.1% recorded in the month prior, on the back of a partial reversal of extremely high electricity prices, overall prices pressures remain strong in Sweden. The CPIF has continually exceeded the Riksbank's 2% target since August 2021.

- Electricity prices are the main contributor to above-target inflation. Despite a month-on-month (m/m) drop from December 2021 (-12.9%), they remain elevated at 23.1% above their January 2021 level.

- Over the past 12 months, motor cars, furniture, and housing have also recorded strong price rises, in the region of 5%-7%, respectively.

- However, these findings add to evidence that pressures from energy costs and supply chain disruptions have already resulted in a pass-through to consumers. Indeed, the CPIF excluding energy increased to 2.5% y/y in January this year, up from 1.7% y/y the month prior. This is its strongest rise since 2009 and has also been spurred on by a weaker krona.

- Nevertheless, Sweden has registered one of the lowest inflation rates compared with other European economies. The Swedish consumer price index (CPI) y/y change stood at 3.9%, the same as the CPIF, and thereby considerably lower than the eurozone's average of 5.1% y/y.

- Ghana's Vice-President Mahamudu Bawumia has announced the beginning of a campaign under the 'Moving Ghana towards a Net-Zero Future' theme promoting the use of electric- and compressed natural gas (CNG)-powered vehicles in the country, reports Daily Guide. The campaign is aligned with the country's efforts to end production of fossil-fuel-based vehicles by 2030 for net-zero carbon emissions. According to the source, the vice-president urged stakeholders to set a specific target and propose a plan towards the use of the aforementioned vehicles in Ghana. As part of the efforts, Kwaku Ofori Asiamah, Minister of Transport, will allocate approximately GHS10 million (USD1.5 million) for the purchase of gas and electricity-based buses. Bawumia said, "We have to be aware that this transition is going to take place over the next 30 years but the cost is being felt today. There is less and less funding available for oil exploration and exploitation and we have seen increase in oil prices globally. As this transition is talked about today and taking place, many of these developing countries are facing very high cost of petroleum prices resulting in economic impact such as high inflation in many countries as prices of goods increase to correspond with increase in petroleum prices. So we have to be very aware of where this is going. Many have said that petroleum price increase is going to remain at such high levels and we're not going to see any major decline." (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- Major APAC equity markets closed sharply lower; Mainland China -1.7%, Japan -1.8%, South Korea -2.6%, Australia -3.0%, Hong Kong -3.2%, and India -4.7%.

- Prices of pork and poultry have dropped again in China following this month's Spring Festival, when demand fell short of expectations. (IHS Markit Food and Agricultural Commodities' Max Green)

- Wholesale pork prices slumped to CNY18.92 per kg in the third week of February - down 11% in just two weeks. Prices are now at the lowest level since October last year, according to figures from the Chinese Commerce Ministry.

- Prices paid for imported pork have also fallen sharply as overseas suppliers compete to keep a slice of a shrinking market. As an example, average prices paid by China for frozen Brazilian pork slumped to just $2,108 per ton in January - down 15% y/y.

- Chinese hog prices have followed a similar downward trend, dropping 6% w/w to CNY13.93 in the third week of February, according to China's National Reform and Development Commission (NRDC). With pig prices low and feed costs high, producers are now estimated to be losing more than CNY150 per animal. Hog prices are now almost 60% down on year-ago levels.

- Adding to the gloom, live hog futures in Dalian this week fell below CNY12,500 per ton live weight (EUR1,650 per ton), not far off the record low set last September.

- With confidence low, many farmers have been offloading their animals below their optimum weights. Meanwhile, authorities in many provinces have started stockpiling pork in a bid to stabilize the market.

- Tesla plans to expand parts production at its Shanghai factory to meet growing demand for exports, reports Reuters, citing a document Tesla filed with the city government. The automaker will add production workshops, increase the number of workers, and lengthen the time that factory equipment is operational, the document stated. Exact figures were said to have been redacted from the document, which was filed on Tuesday. The document suggests that Tesla is pushing for higher output at its Giga Shanghai to meet rising demand for the Model 3 and Model Y. According to the China Association of Automobile Manufacturers (CAAM), vehicle output of the Giga Shanghai last year totaled 485,835 units, which already exceeded the facility's design capacity of 450,000 units. More than 163,000 vehicles made in Shanghai last year were exported to overseas markets. (IHS Markit AutoIntelligence's Abby Chun Tu)

- China's transport ministry has reportedly said that ride-hailing firms should disclose pricing details to the public. Wang Xiuchun, deputy director of the Department of Transport Services of the Ministry of Transport, also said that online ride-hailing companies should set reasonable upper limits on commissions and make them public, reports Reuters. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- South Korean President Moon Jae-in said earlier on 24 February that his government will "support and join the international community's efforts, including economic sanctions", against Russia following Russia's "use of force" in Ukraine, but has yet to announce details on what these measures would entail. Moon's statement follows Japanese Prime Minister Fumio Kishida announcing on 23 February that the government will ban exports and imports from the Donetsk People's Republic (DPR) and Luhansk People's Republic (LPR) regions in eastern Ukraine, suspend visa issuances for officials from those regions, and freeze their assets. Japan will also ban the issuance and transaction of new Russian sovereign debt in Japan and expand existing sanctions on bond issuance by designated Russian banks. Similar to Japan, South Korea's economic sanctions against Russian entities are likely to be limited to DPR and LPR and targeted individuals and assets at least in the initial round, and in co-ordination with sanctions implemented by EU countries, the United Kingdom, and the United States. IHS Markit assesses that Japanese government entities - namely, the Ministry of Economy, Trade and Industry (METI) and the Ministry of Finance - will probably implement further sets of sanctions following Russia's invasion of Ukraine, including export controls in concurrence with Western sanctions. Sectors that are most likely to be affected are exports of products that use advanced technologies, including semiconductors, robotics, and artificial intelligence (AI). The probability of such action would increase in the likely event of US and EU sanctions on high-technology. (IHS Markit Country Risk's Hannah Cotillon)

- Azerbaijani Economy Minister Mikayil Jabbarov, during a meeting with Isbrand Ho, Chinese automaker BYD's executive director for Europe, has discussed about a project to establish an assembly plant for electric buses, hybrid cars, and electric vehicles (EVs) in Azerbaijan, reports Abc.az. According to the source, the meeting covered issues around the country's economic priorities, the use of eco-friendly "green" technologies at the assembly plant, Azerbaijan's favorable business environment, as well as ways to use eco-friendly vehicles. (IHS Markit AutoIntelligence's Tarun Thakur)

- In 2021, Uzbekistan's GDP grew by 7.4% according to the Uzbek Committee of Statistics. The service sector made the strongest contribution to headline economic growth, rising by 9.2%. Within services, growth was particularly vigorous in the retail trade, transport and storage, and information and communication sectors. (IHS Markit Economist Andrew Birch)

- The industrial sector also contributed strongly to overall GDP growth in 2021, expanding by 8.7%. Vigorous gains in both natural gas mining and utilities contributed to the strong increase. Within the manufacturing sector, textile and clothing production rose robustly.

- Although consumer prices increased by 10.0% from end-2020 to end-2021, annual inflation rates were actually decelerating as the year came to a close. Annual consumer price growth peaked at just over 11% in July-August and slowly decelerated over the final four months of the year.

- Although balance-of-payments data are not yet complete for 2021, the Committee of Statistics did present full-year merchandise and service foreign trade figures (although these data do often differ greatly). In 2021, Uzbekistan exported USD16.610 billion of merchandise goods (including gold) and services. Exports increased by 10.0%. The country imported USD25.461 billion, up 20.4%.

- The resulting merchandise and service trade deficit soared to USD8.850 billion in 2021, up from a USD6.047-billion gap in 2020.

Posted 24 February 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.