APAC equity markets closed mixed, while all major European and the US equity indices closed lower. US government bonds closed almost flat and benchmark European bonds were higher on the day. CDX-NA closed wider across IG and high yield, while the equivalent European iTraxx indices ended the session almost unchanged. The US dollar, natural gas, and oil closed higher, copper was flat, and gold and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; S&P 500 -0.8%, Nasdaq -0.8%, DJIA -0.9%, and Russell 2000 -1.2%.

- 10yr US govt bonds closed -1bp/1.29% yield and 30yr bonds flat/1.92% yield.

- CDX-NAIG closed +1bp/50bps and CDX-NAHY +4bps/283bps, which is +2bps and +11bps week-over-week, respectively.

- DXY US dollar index closed +0.1%/92.69.

- Gold closed -0.8%/$1,815 per troy oz, silver -2.3%/$25.80 per troy oz, and copper flat/$4.32 per pound.

- Crude oil closed +0.2%/$71.81 per barrel and natural gas closed +1.7%/$3.67 per mmbtu.

- Total US retail trade and food services sales increased 0.6% in June. Excluding autos, retail sales increased 1.3%. Core retail sales were stronger than anticipated, implying more real personal consumption expenditures (PCE) in the middle two quarters of 2021. Our estimate for second-quarter growth in real PCE was revised up 0.6 percentage point to 11.1%, and our third-quarter growth estimate was revised up 0.6 percentage point to 2.8%. (IHS Markit Economists David Deull and James Bohnaker)

- Sales at motor vehicle and parts dealers were down 2.0% in June after a downwardly revised 4.6% decline in May. Still, sales in the category were a robust 25% higher than the level in February 2020, prior to the pandemic.

- Retail sales declined in several segments specializing in household and recreational goods. Sales at furniture and home furnishing stores declined 3.6%, building materials and garden supply store sales decreased 1.6%, and sporting goods store sales fell 1.7%. Further corrections are likely as consumers pivot toward service-oriented consumption.

- Nonstore retail sales increased 1.2% in June, thanks in large part to Amazon Prime Day, which took place over 21-22 June, instead of its traditional timeframe of mid-July. Nonstore sales remain elevated relative to the pre-pandemic trend and are likely to decline modestly in the next several months as shoppers engage in more in-person shopping.

- Sales at food services and drinking places increased 2.3% as warmer weather, looser restrictions, and more vaccinations encouraged dining out. June's increase propelled sales in this category to 6.6% above its pre-pandemic level and is consistent with recent OpenTable data showing that the number of seated diners has nearly fully recovered.

- The US University of Michigan Consumer Sentiment Index fell 4.7 points (5.5%) to 80.8 in the preliminary July reading, a five-month low. The reading suggests that concerns over recent price increases and the prospect of higher inflation are becoming increasingly salient for consumers. (IHS Markit Economist David Deull and James Bohnaker)

- The decline in consumer sentiment was split between expectations, the index for which fell 5.1 points to 78.4, and views on the present situation, which fell 4.1 points to 84.5.

- The decline was far more pronounced among upper-income households. The index of sentiment for households earning more than $100,000 a year fell 6.4 points to 85.3, while sentiment for households earning less than $100,000 a year fell 1.7 points to 78.6.

- The expected one-year inflation rate jumped 0.6 percentage point to 4.8%, the highest since the summer of 2008. Notably, however, consumers appear to regard inflation as principally a short-term phenomenon. The expected 5-to-10-year inflation rate rose only 0.1 percentage point to 2.9%.

- Press coverage of consumer price inflation has been unusually heavy in recent months, while gasoline pump prices (DOE all-grades), which are highly visible to consumers, were the highest in early July since 2014.

- Views on buying conditions for big-ticket items moved deeper into negative territory as the index of net negative references to rising prices for vehicles, houses, and household durable goods hit an all-time high. The index of buying conditions for large household durable goods fell 11 points to 101, while that of vehicles fell 7 points to 80, the lowest since 1981. The index of buying conditions for homes fell 11 points to 63, the lowest since 1982.

- Nevertheless, respondents remained sanguine about their own prospects. The mean expected probability of an increase in respondents' personal income rose 0.5 percentage point to 53.3%, the second-highest reading since the pandemic began.

- Eli Lilly (US) has purchased privately owned California-based biotech Protomer Technologies in a transaction that could be valued at more than USD1 billion, depending on whether future development and commercial milestones are met. The acquisition gives Lilly access to Protomer's proprietary chemical biology-based platform that can be used to develop therapeutic peptides and proteins with tunable activity than can be controlled using small molecules. Protomer has used the platform to develop various therapeutic candidates, including glucose-responsive insulins that are able to sense insulin levels in the blood and automatically activate in accordance with a person's needs. Lilly's acquisition of Protomer comes after it had purchased a 14% stake in the privately owned biotech in November last year. (IHS Markit Life Sciences' Milena Izmirlieva)

- Prysmian was awarded a contract worth USD900 million by SOO Green HVDC Link to supply high-voltage direct cable systems for a transmission project to be installed along existing railroad rights of in the United States (US). The 2,100-megawatt interregional project, considered the first link in US national clean energy grid, will connect the Midwest Independent System Operator (MISO) market to the eastern PJM Interconnection. Prysmian will be responsible for the full turnkey contract. It will provide 525 kV class HVDC cable to transmit renewable energy connecting SOO Green's converter station in northern Iowa to its Illinois converter station just west of Chicago. The total length of the project spans 350 miles and will require 700 miles of paired 525 kV cross-linked polyethylene class cables that will be installed underground along existing railroads. (IHS Markit Upstream Costs and Technology's Amey Khanzode)

- Aurora has confirmed a definitive agreement to go public through a merger with special-purpose acquisition company (SPAC) Reinvent, providing further details than were available in our earlier report, with an estimated equity value of USD11 billion, according to an Aurora statement. Aurora and partner Reinvent Technology Partners Y (Reinvent) have committed USD1 billion in private investment in public equity (PIPE). The company intends to be traded on the US Nasdaq stock exchange. Aurora is developing a Level 4 autonomous vehicle system aimed to operate multiple vehicle types without a human driver. It expects to enter the trucking industry first, in late 2023, and then rapidly expand into "adjacent verticals" of last-mile delivery and ride hailing. Aurora also notes its relationships with Volvo and PACCAR, which are both "long-term committed partners" who will help accelerate development, validations, and deployment of autonomous trucks. The company also has partnerships with Toyota and Uber relative to passenger mobility and ride hailing. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Audi has announced that it is expanding its traffic-light communications technology to three new US cities: New York City, Los Angeles, and San Francisco. The technology is based on vehicle-to-infrastructure technology and can tell drivers time to green light, provide green-light optimized speed advisories, and minimize stop-and-go traffic, potentially also improving fuel economy. Audi notes that by working with Traffic Technology Services, it has expanded the capability from a "handful" of connected signals to more than 22,000 connected intersections operated by more than 60 agencies in the United States, including these three new cities. The technology uses an LTE signal that comes with the Audi Prime or Plus connected-car subscription. A connected traffic signal communicates to servers that collect data and recognize patterns to make predictions about the signal, Audi said, and the servers send the info to the vehicle. Audi vehicles "only use data from signals found to have a high level of confidence", the company notes. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Building on the consumer announcement earlier in 2021, GM has announced a fleet variation on its EV charging support structure, called Ultium Charge 360 Fleet. BrightDrop also said that it plans to open its dealerships later in 2021. Speaking to reporters and analysts, including IHS Markit, BrightDrop vice-president of vehicle distribution Scott Young said that the company will consider dealers outside the current General Motors (GM) distribution network. "What we are looking at is the very best of the commercial dealers out there," Young said. The Ultium Charge 360 Fleet program's focus is on fleet and facility management tools, integrating with GM's take on fleet management services, called OnStar Vehicle Insights, and a BrightDrop fleet and asset management program. The company said that fleet companies are asking for help in transitioning their fleet from internal combustion engines (ICEs) to electric vehicles (EVs), with different concerns from private consumers and different use cases from one fleet customer to another. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Chevron, Cummins sign MOU for hydrogen collaboration framework for the two companies to work on opportunities for Cummins electrolyzer and fuel cell technologies to be used in Chevron refineries; developing infrastructure for the use of hydrogen as an energy source for transportation and industry; building market demand for hydrogen applications in commercial vehicles and industry; and advancing public policy promoting hydrogen as a decarbonized energy source. Cummins has "deployed more than 2,000 fuel cells and 600 electrolyzers around the world and are exploring other hydrogen alternatives including a hydrogen-fueled internal combustion engine as we continue to accelerate and harness hydrogen's powerful potential," says Amy Davis, president/new power at Cummins. (IHS Markit Chemical Advisory)

- SK Siltron to invest $300 million to build silicon carbide wafers plant in Michigan and the company currently operates a plant in Auburn. SK Siltron CSS manufactures specialty wafer made of SiC that can be used in the semiconductor power components of electric vehicles (EVs). "SiC wafers are more efficient at handling high powers and conducting heat than normal silicon," the company says. When used in EV system components, this characteristic can allow a more efficient transfer of electricity from the battery to the motor, increasing the driving range of an EV by 5% to 10%, it adds. The SK Siltron CSS expansion, pending state and local approvals, is part of a new domestic supply chain formed to provide the components required to support new environmentally friendly vehicles. SK Siltron in September 2019 acquired DuPont's Compound Semiconductor Solutions (CSS) business for $450 million. (IHS Markit Chemical Advisory)

- Canada's Housing starts decreased 1.5% month over month (m/m) to 282,070 units (annualized) in June. (IHS Markit Economist Chul-Woo Hong)

- Urban single starts fell 8.5% m/m while multifamily starts edged up 0.6% m/m. Rural starts increased 0.9% m/m.

- Regionally, the decrease was widespread as starts increased in only four provinces, led by British Columbia.

- Together with regional reopening, solid residential building activities will likely continue, firmly contributing to real GDP growth in the quarter.

- While total housing starts remained relatively strong in June, regional housing starts fluctuated. The gains were mainly concentrated in British Columbia as starts surged for a second month, up 43.1% m/m in June.

Europe/Middle East/Africa

- All major European equity indices markets closed lower; UK -0.1%, Spain -0.2%, Italy -0.3%, France -0.5%, and Germany -0.6%.

- 10yr European govt bonds closed sharply higher; UK -4bps, Italy/Spain -3bps, and France/Germany -2bps.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover +1bp/238bps, which is +1bp and +5bps week-over-week, respectively.

- Brent crude closed +0.2%/$73.59 per barrel.

- The European Central Bank (ECB) announced plans for a two-year project to consider the form and structure of a possible future digital Euro. On 14 July, Fabio Panetta, member of the ECB's Executive Board, announced the launch of a two-year project that will "commit the resources necessary to design a marketable product". Panetta reported that the Eurosystem's initial report on digital currency identified potential benefits on transactional costs, improved financial access, and the potential to make purchases across the Eurozone. He flagged that a digital Euro would be a direct claim on the ECB without credit or market risks, while having scope to apply adequate compliance mechanisms including AML/CFT. The pilot scheme will help to select the most suitable operational parameters for a future ECB-sponsored digital currency, considering how to ensure its use as a payment medium while restricting use for investment purposes (to avoid damaging existing deposit and savings arrangements) and whether to use a centralized or distributed ledger. Panetta's statement emphasizes that the project does not represent a commitment to create a Eurozone central bank digital currency, specifying that a decision "whether or not" to proceed "will only come at a later stage". (IHS Markit Economist Brian Lawson)

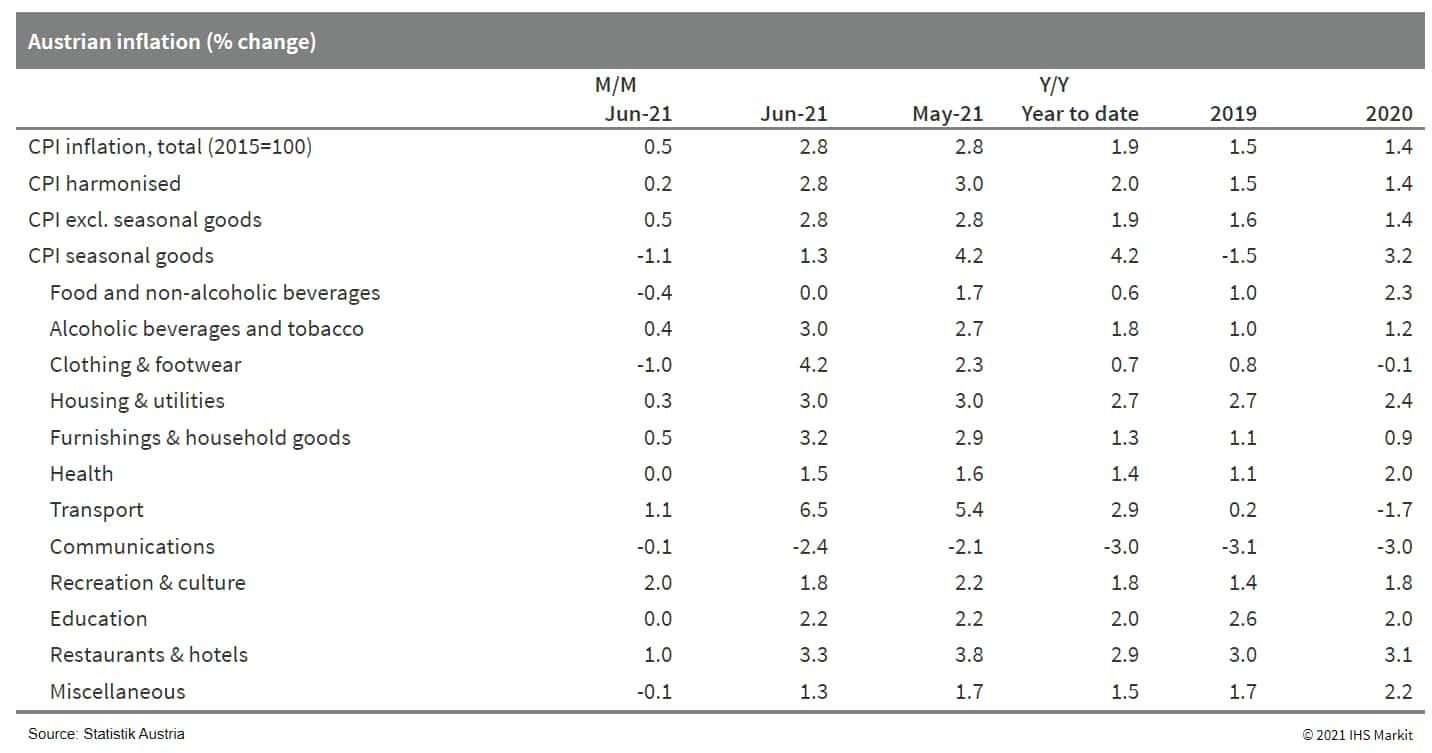

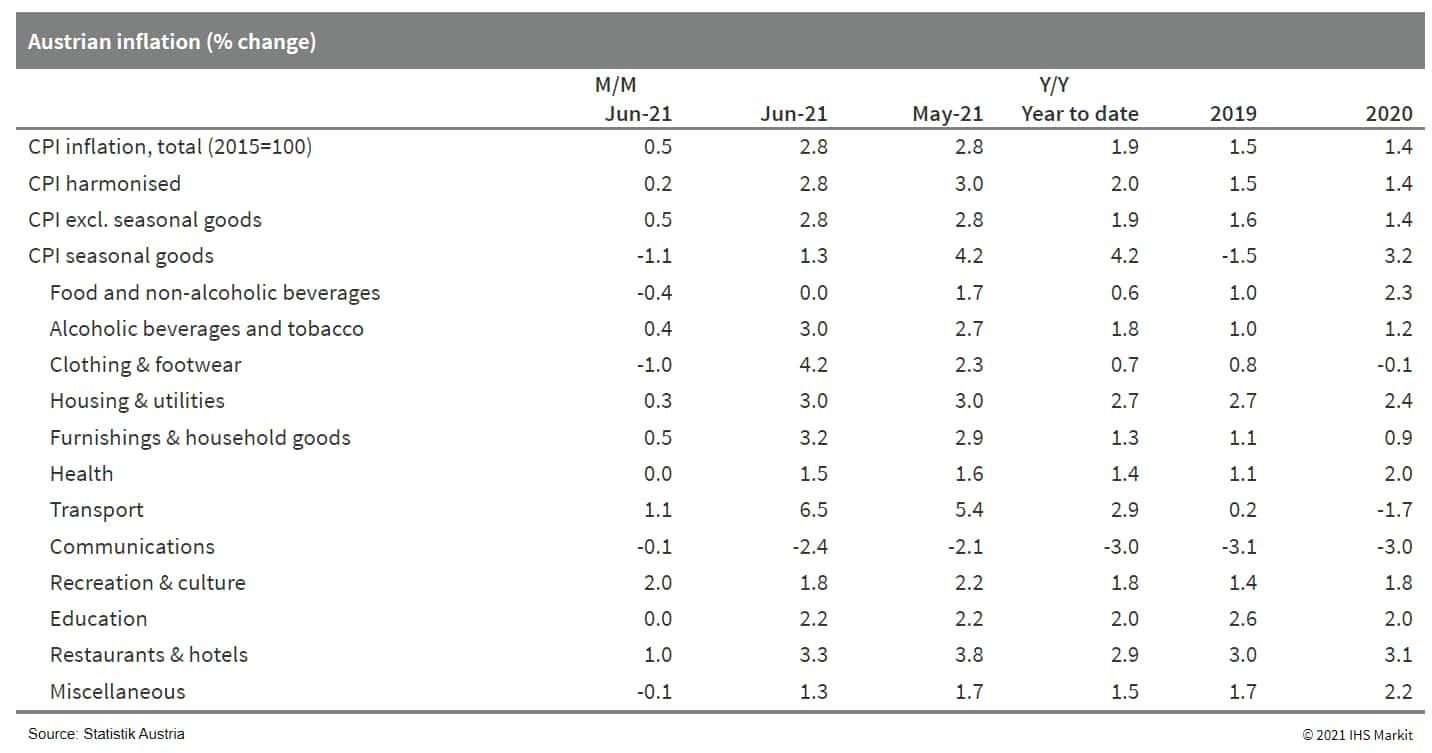

- Statistik Austria data reveal a 0.5% month-on-month (m/m) increase in June that exceeds the long-term average for the month by 0.3 percentage point. This was compensated with respect to the annual rate by large dampening base effects, however, given the price rebound in June 2020 when restrictions were loosened in the aftermath of the first wave of the pandemic. Thus, headline inflation according to the national measure held steady at 2.8% year on year (y/y). (IHS Markit Economist Timo Klein)

- The European Union-harmonised measure, which has a different weighting pattern (higher weights for fuel and restaurants and hotels and lower weights for insurance services and housing maintenance), increased by only 0.2% m/m. Its annual rate therefore softened from May's 3.0% y/y to 2.8% y/y, which nonetheless remains considerably above April's 1.9%. The gap with the eurozone average (1.9% in June) thus stays quite high at 0.9%, exceeding the 0.7-point long-term average observed during 2011-20.

- Energy prices continued to exert upward pressure, with their 0.9% monthly increase boosting their annual rate yet again from 11.8% to 12.4%.

- The Africa regional office for the WHO on Thursday (15 July) warned of a steep rise of COVID-19 fatalities in the region, with recorded deaths reaching 6,273 in the previous week. This represents a 43% week-on-week rise, with the figure just slightly lower than the 6,294 record reported in January this year. According to the WHO, the number of fatalities has been rising continuously over the past five weeks, while the number of documented cases has risen for eight consecutive weeks crossing the 6-million mark on Tuesday (13 July). The agency has attributed the increase to "public fatigue with key health measures and an increased spread of variants", including the Delta variant, which has now been detected in 21 African countries. The region's case-fatality rate currently stands at 2.6%, above the global average of 2.2%. The majority of recent deaths (83%) were concentrated in just a few countries, namely Namibia, South Africa, Tunisia, Uganda, and Zambia. The sharp rise in deaths was associated with shortages in oxygen, intensive care unit (ICU) beds, and other supplies and infrastructure faced by countries in the region, according to the WHO. WHO Regional Director for Africa Matshidiso Moeti said that hospitals in the most acutely impacted countries were "reaching a breaking point". At least six countries are reporting ICU bed shortages while demand for medical oxygen is estimated as 50% higher than this time last year, with boosting local oxygen production an immediate priority. (IHS Markit Life Sciences Ewa Oliveira da Silva)

- Social unrest broke out in South Africa during the week of 11 July 2021, resulting in mass looting of retail and warehouse stock, destruction of infrastructure and other assets (particularly heavy vehicles hauling cargo), and blocking of major logistics routes in the country. A state of emergency has been avoided following the deployment of 25,000 South African National Defense Force (SANDF) members to assist the police in ending the violence. (IHS Markit Economist Thea Fourie)

- The economic destruction of the past few days occurred during the third wave of the COVID-19-virus pandemic and attempts by the South African government to speed up the COVID-19 vaccine program in the country. Currently COVID-19-virus government restrictions include stricter curfew hours, school closures, and the temporary suspension of alcohol sales. Travelling across the Gauteng province border for leisure or non-commercial purposes is also prohibited.

- The impact on economic activity because of social unrest will be most visible in areas directly affected by the violence, namely KwaZulu-Natal (KZN) and certain parts of Gauteng. Temporary business closures to ensure workers' safety could continue to prevail over the short term, while the destruction of infrastructure, particularly retail stores in malls and warehouses, will prohibit the resumption of overall normal business activity for at least 6 to 18 months. Shortages of essential goods such as food and medicine in these areas pose a material short-term risk, while unemployment levels will inevitably rise further.

- The risk of supply-chain disruption to the rest of South Africa and neighboring countries also remains high, while key logistics routes such as the N2 and N3 highways continue to be closed and the risk of heavy vehicle arson along these routes continues to prevail. Initial reports suggest severe disruption in the transport of essential animal feedstock and the exports of perishable agricultural products such as citrus fruits.

Asia-Pacific

- APAC equity markets closed mixed; Australia +0.2%, Hong Kong/India flat, South Korea -0.3%, Mainland China -0.7%, and Japan -1.0%.

- The BOJ left its monetary policy unchanged at its 15 and 16 July monetary policy meeting (MPM). The bank will continue quantitative and qualitative monetary easing (QQE) with yield curve control (YCC). The BOJ also maintained its commitment to increase the monetary base until the year-on-year rate of increase in the observed consumer price index (CPI) exceeds 2% and stays above this target in a stable manner. (IHS Markit Economist Harumi Taguchi)

- The BOJ has revised down its real GDP growth outlook for fiscal year (FY) 2021/22 (starting from April 2021), reflecting the continued negative impact of the COVID-19-virus pandemic on private consumption, offsetting firm growth of exports and production. However, the BOJ revised up its outlook for FY 2022/23, anticipating a recovery in private consumption in line with the progress in vaccine rollouts. The bank also revised up its inflation outlook for FY2021/22 and FY2022/23, reflecting recent increases for oil prices and its outlook that the resumption of economic activity will support gradual moves to transfer costs to output prices.

- The BOJ also announced the preliminary outline of a fund-provisioning measure through which it will provide funds to financial institutions for investments or loans to address climate change issues, as it indicated with its decision to introduce the measure following the June MPM. Although the applied interest rate payable from the BOJ to counterparties will be 0% under the plan, double the amount outstanding of funds counterparties receive will be added to the Macro Add-on Balance in their current account at the BOJ for promoting the measure for incentives to financial institutions to utilize the measure.

- LG Chem intends to invest W3 trillion in sustainable businesses such as biomaterials, recycled materials, and renewable energy industry materials to build a platform for growth of its petrochemicals business, it says. It plans to begin full-scale production of the world's first bio-balanced superabsorbent polymer (SAP) product, which received International Sustainability & Carbon Certification (ISCC) Plus certification, and supply the product to clients in the US and Europe. ISCC provides standards of traceability and chain of custody in the operation of sustainable supply chains. (IHS Markit Chemical Advisory)

- In 2019 the company joined hands with Archer Daniels Midland (ADM) to jointly develop an economical biobased process for the commercial-scale production of acrylic acid, a key feedstock for SAP.

- LG Chem says it has received ISSC Plus certification for the entire value chain ranging from raw materials to production, purchasing, and sales for a total of nine bio-balanced products including SAP, polyolefins, and polycarbonate (PC).

- The company also intends to build facilities this year to produce polybutylene adipate terephthalate (PBAT).

- LG Chem says that the bioplastics market is expected to grow rapidly from W12 trillion in 2020 to W31 trillion by 2025. The company plans to form joint ventures (JVs) with domestic and overseas providers of raw materials, for stable sourcing of eco-friendly raw materials such as polylactic acid (PLA) made with plant-based ingredients such as corn and bio-naphtha.

- The company will also focus on enhancing its mechanical- and chemical-recycling capacities to build a circular economy for waste plastics. For mechanical recycling, plans are to strengthen the existing market for PC and acrylonitrile-butadiene-styrene (ABS), while expanding its product portfolio to include propylene oxide (PO) and polyvinyl chloride (PVC). The company aims to boost related product revenue by an annual average of more than 40% by 2025.

- In its 14 July meeting, the RBNZ's Monetary Policy Committee (MPC) announced the beginning of an unwinding of monetary stimulus measures, in line with new market expectations following similar announcements by other major central banks. The MPC considers that economic conditions have continued to improve globally since its May review and remain robust domestically amid mixed progress in the COVID-19-virus pandemic. (IHS Markit Economist Andrew Vogel)

- Most significantly, the MPC has decided to halt all new asset purchases under the Large Scale Asset Purchase (LSAP) program by 23 July 2021 as market conditions and functioning have improved considerably since its inception and the level of monetary stimulus could therefore be reduced to minimize the risk of not meeting the inflation and employment targets. The MPC noted that although further asset purchases were no longer necessary for monetary policy, the LSAP program remains an important tool for future monetary policy (if required), as well as for the efficient functioning of New Zealand's debt market.

- Despite the asset purchasing halt, the MPC left the OCR and FLP unchanged as the OCR remains the preferred tool for responding to economic conditions and the FLP provides a "useful means of transmitting monetary policy" given how its pricing moves in line with the OCR.

- New vehicle sales in the Philippines surged by 44.8% year on year (y/y) during June to 22,550 units, up from 15,578 units in June 2020, reports BusinessWorld, citing data released by the Chamber of Automotive Manufacturers of the Philippines Incorporated (CAMPI) and the Truck Manufacturers Association (TMA). Of this total, sales of passenger vehicles jumped by 56.7% y/y to 7,382 units during the month, while commercial vehicle (CV) sales went up by 39.6% y/y to 15,168 units. Toyota Motor Philippines continued to dominate the vehicle market in June with sales of 11,242 units or a 49.85% market share, followed by Mitsubishi Motors Philippines with sales of 2,933 units (a 13.01% market share) and Suzuki Philippines with sales of 1,795 units (a 7.96% market share). During the first half of 2021, the country's new vehicle market grew by 56.1% y/y to 132,767 units from 85,041 units in the same period last year. Sales of passenger cars grew by 77.3% y/y to 42,406 units during the period, while those of CVs increased by 47.8% y/y to 90,361 units. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 16 July 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.