Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 06, 2021

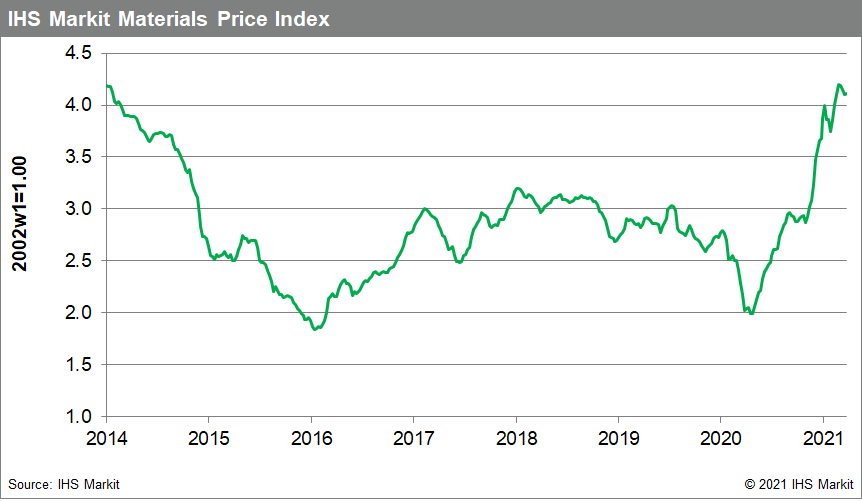

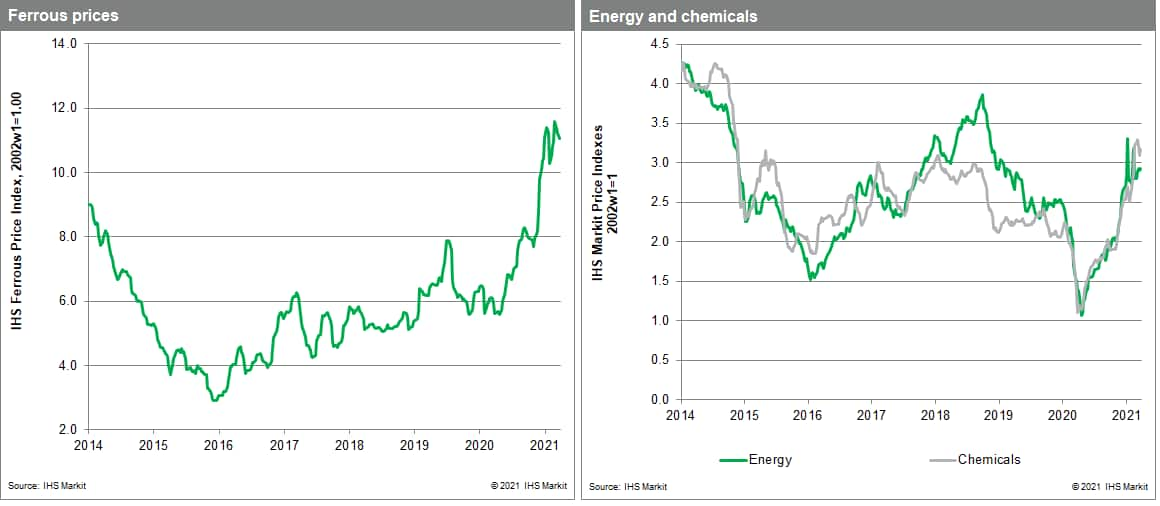

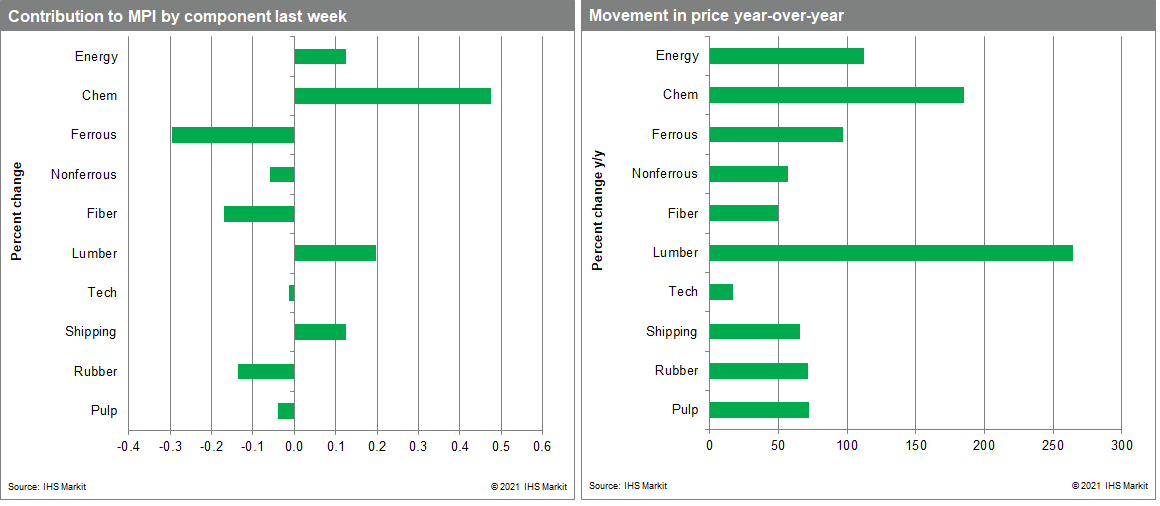

Our Materials Price Index (MPI) increased 0.2% last week, breaking a string of three consecutive weekly declines. The direction of price changes was mixed last week with five of the MPI's ten subcomponents increasing and five decreasing. Commodity prices as measured by the MPI are still up 12.5% year-to-date, though over the last four weeks the index has declined 2.1%.

Lumber and the freight rate saw the biggest increases last week. With a 4.8% increase building on the previous 10.3% climb, lumber prices have quickly reversed their 13% decline from two weeks ago. Availability remains an issue across North America with delivery times swelling. Similarly, freight rates jumped 4.2% last week on a combination of strong demand and tight supply. Although the blockage of the Suez Canal was resolved, the resulting backlog will continue to support higher pricing through at least early May. The largest declines recorded last week in the MPI were in fiber and rubber. Both cotton and polyester drove the fiber subcomponent lower last week. Cotton fell 2.4% with polyester dropping 3.8%. However, both fibers are far above year-ago levels with cotton up 66% year-over-year and polyester up 41%. Rubber prices fell 4.4% last week. The third decline in a row has returned prices to their late January level; prices are still 77% above year-ago levels.

Although the MPI posted just a 0.2% increase last week, commodity markets remain volatile. Six of the 10 subcomponents had week-to-week changes above 2%. As global demand improves, supply disruptions remain a source of upward price pressure. As measured by the IHS Markit Purchasing Managers Index (PMI), global manufacturing production is at its second-highest level since early 2018. Suppliers' delivery times have reached a level only exceeded one time in the survey's history: in April 2020 at the height of the shock from the pandemic. Long delivery times and rising backlogs of work suggest the current state of tight supply and improving demand may have some room left to run before we see a widespread pullback in prices.

Posted 06 April 2021 by Thomas McCartin, Senior Economist, Pricing & Purchasing, S&P Global Market Intelligence