Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 05, 2022

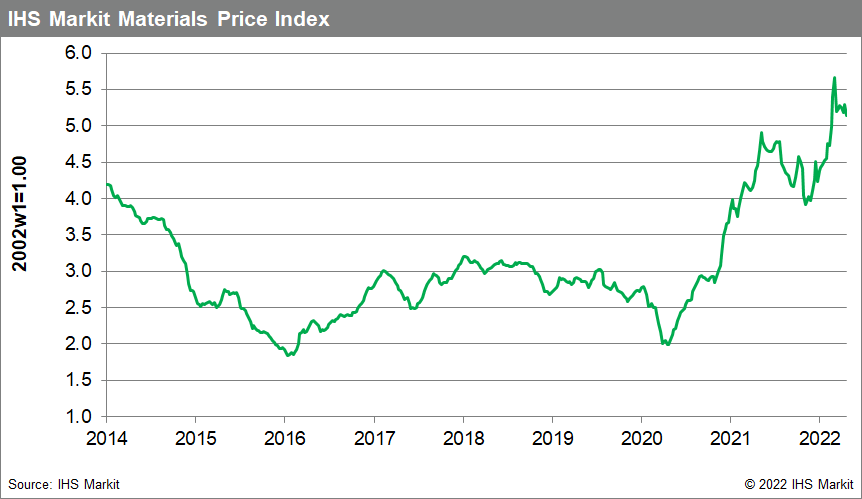

Our Materials Price Index (MPI) fell 2.7% last week, with eight of the index's 10 subcomponents posting declines. The slowdown in mainland Chinese growth tied to widening COVID lockdowns has weighed on sentiment in multiple commodity markets in recent weeks. The 2.7% decline offset the 2% increase in the previous week, but commodity prices generally remain elevated, with the MPI currently sitting 10% above its 26-week moving average.

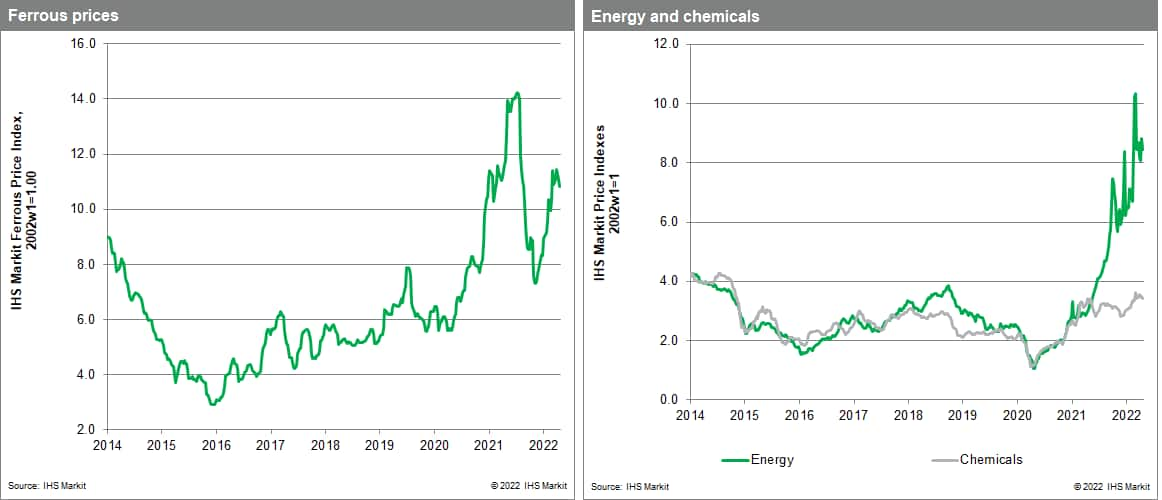

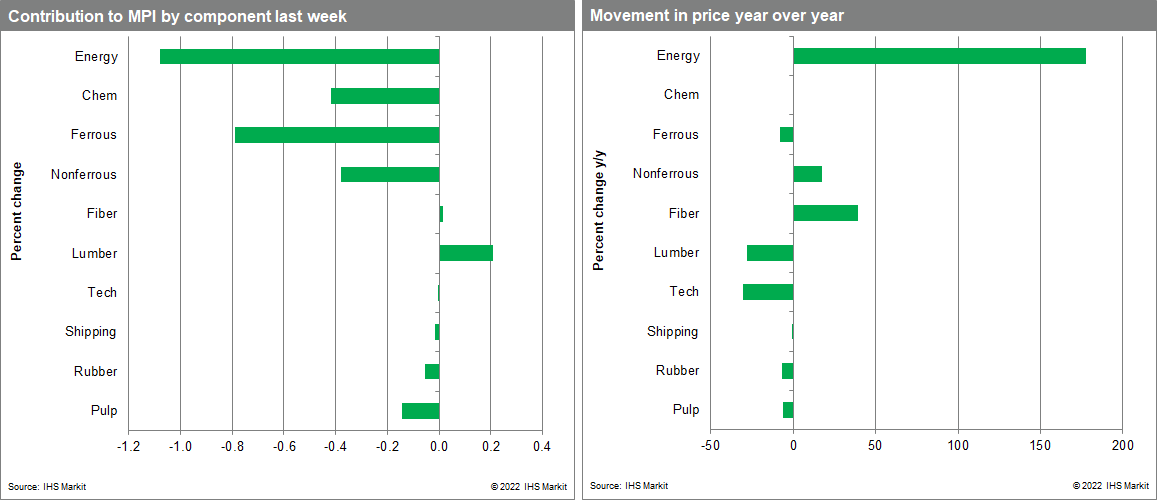

Lumber prices were the biggest mover last week with a 6.2% increase building off the previous week's 10.5% climb. Prices have gotten support in the last two weeks from logistics issues moving lumber out of Canada and buyers replenishing inventories. Prices below $900 looked attractive in an environment where prices were as high as $1400 in March. Nonferrous metals and energy products saw the largest declines in the index last week. The nonferrous metals index retreated 4.7% with all six base metals in red. Aluminum saw the biggest drop at 5.7%. Base metals prices were impacted by the slowdown in mainland Chinese growth, flat or falling orders from car makers, higher interest rates and a stronger US dollar. The MPI's energy subcomponent posted a 4.4% decline, with nearly flat natural gas prices, a 3.8% decline in oil, and coal sliding 7.3%. The coal index was driven lower by US and European prices, which both shed more than 10% last week as the near-term outlook on European supply improved.

Last week we had mentioned that widening COVID-19 lockdowns in mainland China were now drawing attention in markets. Indeed sentiment worsened last week on news that other large cities in China may soon face lockdowns similar to what is now happening in Shanghai. This week sees the US Federal Reserve Open Market Committee meet with markets widely expecting both a 50-basis point interest rate hike and an announcement that the central bank will also begin to shrink its balance sheet, moves that will reduce liquidity and potentially add volatility to commodity markets.

Posted 05 May 2022 by Thomas McCartin, Senior Economist, Pricing & Purchasing, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.